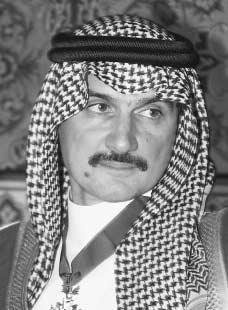

Alwaleed Bin Talal

1957(?)–

Entrepreneur, investor

Nationality: Saudi Arabian.

Born: July 9, 1957(?), in Riyadh, Saudi Arabia.

Education: Menlo College, BA, 1979; Syracuse University, MA.

Family: Son of Prince Talal; married Princess Kholood; divorced twice; children: two (previous marriage).

Career: Kingdom Establishment for Trading and Contracting, 1979–, owner; Kingdom Holding Company and Kingdom Hotel Investment Group, owner.

Address: Kingdom Holding Company, Takhassussi Road, PO Box 2, Riyadh, Saudi Arabia 11321.

■ Prince Alwaleed bin Talal bin Abdulaziz al-Saud was an internationally renowned businessman and investor who became a self-made billionaire at the age of 31. He was ranked the fourth-wealthiest person in the world by Forbes magazine in 2004. Although he started investing in businesses in Saudi Arabia, Bin Talal amassed his large fortune by investing in companies around the world in a variety of industries, including construction, banking, media, hotels, and technology.

ROYAL BEGINNINGS

Bin Talal was born in Saudi Arabia. His paternal grandfather, Abdulaziz ibn Saud, united the Arabian peninsula and formed the kingdom of Saudi Arabia, while his maternal grandfather, Riad al-Solh, was the first prime minister of the Republic of Lebanon. His father, Prince Talal, was the brother of the king of Saudi Arabia. Despite his influential and wealthy family tree, Bin Talal was proud of the fact that he earned his fortune through his own hard work.

Bin Talal's parents divorced when he was a young child, and he spent part of his childhood in Beirut. In order to instill more discipline in the young Bin Talal, his father made him return to Riyadh to attend the King Abdul Aziz Military Academy.

Like many other members of the royal family, he pursued his college education in the United States. He earned a business administration degree from Menlo College in California and later finished a master's degree in political science from Syracuse University.

To start his business career, Bin Talal's father gave him $15,000 cash and a house. Bin Talal invested this money in construction. The initial cash investment was quickly spent, but his father refused to lend him any more money. Bin Talal mortgaged his house to support his fledgling business. Just one year later he got his first big break when he joined two other small companies to win a contract for a $16 million military academy. By 1981 Kingdom Establishment had over $1.5 billion in revenues. Bin Talal expanded his construction business to maintaining and operating existing buildings in Saudi Arabia.

INTERNATIONAL SUCCESSES

Bin Talal made his mark on the international scene in 1990 when he bought almost 5 percent of Citicorp's shares. At that time the company was on the verge of bankruptcy, but in only a couple of years it turned around, and Bin Talal profited billions. In subsequent years Bin Talal bought minority stakes in numerous foreign companies, including some of America's largest firms. In 2003 he owned small percentages of stock in Amazon.com, eBay, AOL Time Warner, Ford Motor Company, Hewlett-Packard, Motorola, Pepsi, and the Walt Disney Company, among others.

Although this investment strategy was successful for Bin Talal, he had very diverse business interests. He partnered with other investors to purchase large shares of hotel stocks, such as the Four Seasons and the Fairmont Hotels. He also invested heavily in Saudi Arabia and other Arab countries, particularly in media and technology. For example, Bin Talal owned part of Arab Radio and Television, Lebanese Broadcasting Centre, and the Palestine Development and Investment Company. Aside from Kingdom Holding Company, which was largely responsible for his international business activities, Bin Talal also owned several other companies in Saudi Arabia, including Kingdom Hotel Investment Group, Kingdom Centre, Kingdom City, Kingdom Hospital, and Kingdom Schools.

Not all of Bin Talal's investments were successful. For example, EuroDisney, Planet Hollywood, and Motorola continued to struggle even after Bin Talal's stock purchases. While he was praised for knowing when to make wise acquisitions, he was also criticized for not recognizing when to sell bad stocks.

LEADERSHIP AND BUSINESS STRATEGIES

Bin Talal owed his success as an investor to his practices of diversifying successfully and refusing to be limited by national borders. He invested primarily for long-term gains and had a good track record for selecting undervalued companies. He was also cautious and searched continually for bargains. Bin Talal had a sharp mind and was an excellent deal maker, conducting negotiations in Arabic, English, and French.

Reputed to be an extremely hard worker, Bin Talal surrounded himself with a staff that shared this value. He was a direct communicator and a demanding leader. Addicted to news, he traveled with a technology crew who kept him in touch with global developments no matter where he happened to be. Bin Talal also moved easily between the traditional Arab world and Western cultures. He lived primarily in Saudi Arabia, wore traditional Arab garb while he was there, and observed cultural and religious practices according to the laws and customs of the kingdom. At the same time, he traveled extensively across the globe, spoke American slang, and dressed in stylish business suits while working in the West.

CHANGING PERCEPTIONS OF SAUDI ARABIA

Not only did Bin Talal become a successful businessman, but he also helped to change international perceptions of the kingdom of Saudi Arabia. While the business world in the early 21st century tended to think of Saudi Arabia as traditional and private, Bin Talal was an example of a very modern businessman who was open to the media and the public. "I want my voice to be heard," Bin Talal told Forbes magazine (August 8, 1988). "I would love to be a corporate leader."

Bin Talal was also a very generous businessman. In a country that did not have income taxes, he donated considerable amounts of money to charitable causes. "It is my responsibility to take advantage of my position to make the world a better place," Bin Talal told the Middle East Economic Digest (May 3, 2003). In 2001 he donated $10 million to New York City to help with the recovery after the September 11 terrorist attacks. However, Mayor Rudolph Giuliani refused to accept the donation because Bin Talal also made some controversial political remarks about America's policies in the Middle East.

By 2004 Bin Talal had established himself as a successful international investor and one of the wealthiest businessmen in the world. He continued to look for new bargain investments both in Saudi Arabia and around the world. In 2004 he was also entertaining the idea of publicly trading the $21 billion Kingdom Holding Company.

sources for further information

Barrett, William P., "'I'm Not Finished Yet.' (Saudi Arabia's Prince Bin Talal Bin Abdulaziz Al Saud Self-Made Billionaire at 33)," Forbes , August 8, 1988, pp. 86–87.

MacLeod, Scott, "The Prince and the Portfolio," Time , December 1, 1997, pp. 62–68.

"The Mystery of the World's Second-Richest Businessman," The Economist , February 27, 1999, p. 67.

"A Prince with Divided Loyalties," BusinessWeek , October 15, 2001, p. 64.

Rossant, John, and Stephen Baker, "The Prince and the Public," BusinessWeek , April 26, 2004, p. 13.

Serwer, Andrew, "The Prince: His Royal Highness Prince Bin Talal Bin Abdulaziz al-Saud," Money , October 1988, pp. 108–110.

"The View from the Top," Middle East Economic Digest , May 2, 2003, pp. 4–6.

—Janet P. Stamatel