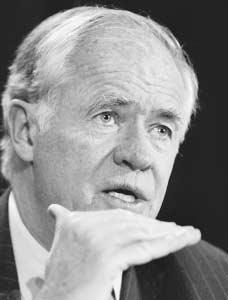

Charles K. Gifford

1942–

Chairman, Bank of America

Nationality: American.

Born: November 8, 1942, in Providence, Rhode Island.

Education: Princeton University, BA, 1964.

Family: Son of Clarence H. (banker) and Priscilla Kilvert; married Anne Dewing, 1964; children: four.

Career: Chase Manhattan, 1964–1966, position unknown; Bank of Boston, 1966, loan officer; 1967–1987, successively higher vice president positions; 1987–1989, vice chairman; 1989–1995, president; 1993–1995, chief operating officer; 1995, president and chief executive officer; BankBoston, 1995–1996, president, chairman, and chief executive officer; 1996–1999, chief executive officer; 1997–1999, chairman; FleetBoston Financial Corporation, 1999–2001, president and chief operating officer; 2001–2004, chief executive officer; 2002–2004, chairman; Bank of America, 2004–, chairman.

Address: Bank of America, 100 Federal Street, Boston, Massachusetts 02110-2003; http://www.bankofamerica.com.

■ Throughout more than 40 years as a bank executive, Charles "Chad" Gifford showed a capacity to make decisions that fit the requirements of the economic and business environment of the time. Whether the situation demanded attention to the needs of customers, management reorganization, or negotiation of substantial merger agreements, Gifford displayed an openness to change. His interpersonal skills and genuine liking for people fostered success as well. Though he grew up in a wealthy New England family, he conducted himself with understanding and concern for associates and customers from all social backgrounds.

BANKING BECOMES HIS PROFESSION

The son of banker Clarence H. Gifford, former chief executive officer of Rhode Island Hospital Trust National Bank,

Gifford did not have aspirations to become a banker himself. A New England blue blood, he spent summers in Nantucket and earned a BA in history at Princeton University in 1964. Gifford chose banking as a profession only after he fell in love with Anne Dewing and wanted to marry. He began his banking career in New York City, where many companies provided graduate school-like training. He worked at Chase Manhattan from 1964 to 1966 before joining Bank of Boston, where he cultivated a career.

At Bank of Boston Gifford worked in commercial lending, first as a loan officer in 1967, then in various vice president positions. From 1975 to 1977 he headed corporate lending at the London, England, office. In Boston he became the executive of the Corporate Banking Group in 1984. After two years as vice chairman, the company promoted him to president in 1989, with Ira Stephanian as chief executive officer.

CHANGING BANK OF BOSTON TRADITIONS

After Bank of Boston overextended itself in real estate and other investments during the 1980s, Gifford and Stephanian were responsible for returning the company to solvency. More than 200 years old, Bank of Boston needed to discard its pompous, conservative image, and the executive team provided complementary and practical qualities for accomplishing this goal. Stephanian, a middle-class son of Armenian immigrants, brought awareness of the needs of average Americans, while Gifford's elite connections were balanced with a common touch. Friendly and outgoing, Gifford remembered everyone's name, including those of the bank's cafeteria employees and security guards. Gifford and Stephanian changed basic traditions at Bank of Boston by hiring executives from outside the usual pool of elite candidates, promoting minorities, and seeking business from average corporations and average consumers, rather than only the wealthiest. A booster of the local economy, Gifford took pride in the First Community Bank, a subsidiary that offered banking services to poor- and moderate-income people through 14 branches in inner-city neighborhoods.

In 1993 Gifford and Stephanian restructured Bank of Boston's management to eliminate bureaucracy, flatten a longstanding hierarchy, and transfer decision making to employees close to the customer. By these actions they sought to provide better service and create more efficient operations. They visited several companies, such as General Electric, and noted best practices in this trend toward decentralization. While Gifford viewed reorganization as essential to Bank of Boston's long-term prosperity, he expressed distress at having to fire executives whom he considered friends. Given his additional title of chief operating officer, Gifford's responsibilities shifted away from management and toward determining general strategy, institutionalizing the new corporate culture, and supporting individual and team success. Gifford responded to an employee's inquiry about what decisions he wanted the employee to make by saying, essentially, you decide how to run your business.

NEGOTIATING MAJOR MERGERS

Gifford became chief executive officer of Bank of Boston in 1995 after Stephanian had failed to find a merger partner, as the board of directors had demanded. After informally meeting William Crozier, BayBanks's chairman, Gifford negotiated for a merger that paired Bank of Boston's strengths in corporate and international banking with BayBanks's strengths in technology and regional retail banking. When discussing the $2 billion deal, Gifford tended to speak of the rapport and trust he found with Crozier, rather than about financial details, while Crozier emphasized the excellent timing. Gifford succeeded where Stephanian had failed partly because the latter sought a merger of equals. Gifford, however, wanted Bank of Boston to lead, allowing the company room to compromise certain issues in negotiation. That BayBanks graciously conceded to BankBoston as the simplest and strongest name for the merged company demonstrated a good relationship.

As chief executive and chairman of BankBoston, Gifford negotiated a second major merger with Fleet Financial Corporation in 1999, forming FleetBoston Financial Corporation, a $187 billion financial services institution and the eighth-largest bank holding company in the United States. Gifford took the positions of president and chief operating officer with the understanding that he would become chief executive in two years.

When he became chief executive of FleetBoston in December 2001, Gifford inherited a company in disarray. He faced problems in Brazil and currency devaluation in Argentina. A loan sale in January 2001 heightened losses when Enron, Kmart, and other large public corporations defaulted; the stock market collapse created losses in private equity and investment banking operations. All these issues negatively affected the company's share value as well.

Gifford responded to these challenges by addressing select problems in consumer banking and financial products. His biggest hurdle involved correcting FleetBoston's poor customer service image, a reputation inherited from Fleet Financial, by renewing consumer trust. Beginning in late 2001, the company hired 500 tellers, opened 26 branches, added 126 automated teller machines (ATMs), and then eliminated certain fees for ATM transactions and checking accounts. Gifford changed his perspective on profit and loss by reorganizing departments and financial statements to reflect customer affluence instead of product line and distribution. He refocused marketing to target banking products and services—such as checking and savings accounts, mortgages, insurance, mutual funds, and estate planning—to the customers most likely to use them. The emphasis on consumer products suited the requirements of a weak economy and investor distrust, as the public preferred to secure their savings in banks rather than stocks; savings deposits increased throughout the banking industry at this time. In a reflection of the era, FleetBoston closed its investment bank, Robertson Stephens, as well as other unprofitable operations.

In 2003 FleetBoston and Bank of America announced a merger agreement that created the second largest bank in the United States, with 33 million customers. Gifford's interpersonal style fostered the agreement, as he and Bank of America's CEO Ken Lewis casually began discussions of a merger. Under the terms of the agreement, Bank of America acquired Fleet-Boston in a $47 billion stock transaction, with FleetBoston shareholders receiving $45 per share, a premium over the $32 per share value when the merger was announced. Gifford became chairman of Bank of America in March 2004, and the transaction was completed in April.

See also entries on Bank of America Corporation, Chase Manhattan Corporation, and FleetBoston Financial Corporation in International Directory of Company Histories .

sources for further information

Browning, Lynnley, "Laid Back in a Tight Banking Spot," New York Times , February 10, 2002.

"Gifford Banks on Merger," Sunday Republican , July 28, 1996.

Kantrow, Yvette D., "Q&A: Bank of Boston Sees 'Reengineering' as Tough Medicine to Gain Efficiency," The American Banker , December 10, 1993, p. 4.

—Mary Tradii

Comment about this article, ask questions, or add new information about this topic: