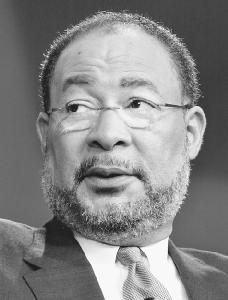

Richard D. Parsons

1948–

Chairman and chief executive officer, Time Warner

Nationality: American.

Born: April 4, 1948, in New York City, New York.

Education: Bachelor's degree, University of Hawaii; Albany Law School, JD.

Family: Son of Lorenzo L. Parsons (electronics technician) and Isabelle J. Parsons (homemaker); married Laura Bush (child psychologist); children: three.

Career: Governor Nelson Rockefeller (New York), 1974–1976, counsel; President Gerald R. Ford's domestic policy office, 1974–1976, senior White House aide; Patterson Belknap Webb & Tyler, 1977–1988, managing partner; Dime Savings Bank, 1988–1995, chairman and chief executive officer; Time Warner, 1995–?, president; ?–2002, co-chief operating officer; 2002–, chief executive officer; 2003–, chairman.

Address: Time Warner, 75 Rockefeller Plaza, New York, New York 10019; http://www.timewarner.com.

■ Richard Parsons was one of four African American CEOs of a Fortune 500 company in 2004. He led Time Warner, a media company that was facing some of its most challenging times in its history, struggling to overcome a $165 billion failed merger with America Online (AOL) in 2001. Parsons established himself as a skilled conciliator who could mend rifts and rally forces. Parsons was also a reluctant symbol of the positive changes transforming corporate America.

As of 2004 Time Warner had five basic divisions: cable networks, publishing, music, filmed entertainment, and cable. Its movie, publishing, music, and cable television portfolio included Time, the number one U.S. magazine publisher; Warner Brothers, a producer and distributor of movies, television programs, and videos; Warner Music Group; Home Box Office, the number one paid cable network; Time Warner Cable, the number one cable delivery system; Warner Books; and the Book-of-the-Month Club. Time Warner also owned cable

television networks (CNN, TBS, and TNT), the WB Television Network, and properties ranging from Mad magazine to the Atlanta Braves. Its struggling AOL unit continued to hurt the bottom line. The unit has suffered from drastically lower advertising revenues and slowing subscriber growth. AOL lost 2.2 million subscribers in 2003 as customers defected to rival high-speed and discount Internet services.

LAYING THE FOUNDATION

Parsons surfaced from the hardscrabble Bedford-Stuyvesant section of Brooklyn, New York, to earn the top score among all 3,600 law school graduates who took the New York State Bar exam with him. He earned his degree while working nights as a janitor. Early in his career, Parsons worked as an assistant counsel to Governor Nelson Rockefeller (New York). He later moved to Washington, D.C., and worked for the then vice president Rockefeller and President Gerald R. Ford's domestic policy office, traveling in circles that would come in handy later in his corporate life. Next Parsons practiced law for Patterson Belknap Webb & Tyler from 1977 to 1988 in New York, handling free speech, product liability, and banking cases.

By 1988 Parsons had become CEO of Dime Savings Bank, just as the Northeast's real estate market collapsed. He engineered a massive restructuring, unloading $1 billion in bad loans while cutting the workforce from 3,500 to 2,000. The bank stayed afloat. Parsons kept employees informed, creating quarterly videotapes to discuss earnings and the restructuring process.

A LIKABLE MANAGER

While leading Dime Savings Bank, Parsons assumed several corporate and civic directorships, including joining the board of Time Warner in 1991. This move would be pivotal to his career. In February 1995 Parsons joined Time Warner as the company's president. He worked closely with the former chairman and CEO Gerald Levin, cleaning up the company's balance sheet and doggedly driving the Time Warner message to Wall Street.

Over time Parsons developed a reputation as the best executive to resolve sticky situations. When controversy erupted in the media community following Time Warner's refusal to carry the Fox News Channel and the Disney Channel on its cable system, it was Parsons who diplomatically settled the disputes. Time Warner understood the value that Parsons's skills conveyed to the investment community and played upon it. Said David Joyce, an equity analyst at Guzman & Company, "My sense is that Parsons is truly a statesman. He's got a really even keeled, witty temperament about him" ( Black Enterprise , February 2002).

Unlike CEO Gerald Levin, who was seen as reluctant media mogul, Parsons was viewed entirely differently by the Time Warner family. Known to mingle easily with employees, Parsons once flew to Barcelona, Spain, for a record industry bash. Recalls Roger Ames, chairman and CEO of Warner Music Group, "Dick was still dancing when I left at 6 in the morning. Yet he was there when the plane left at 7." ( BusinessWeek , May 19, 2003).

THE MERGER THAT MADE HISTORY

In January 2000 the announcement of a merger between AOL and Time Warner made headlines. With the specter of the 1999 failure of a similar proposed merger between USA Networks and Lycos hanging over them, AOL and Time Warner worked diligently to reassure investors that the companies' combination made strategic sense, meeting with top shareholders, extolling the virtues of the deal to the press, and promising more details about linkups between the two companies soon.

Following the merger, Parsons and Robert Pittman became co-COOs at AOL Time Warner. Parsons was given responsibility for overseeing Time Warner's filmed entertainment and music businesses as well as all corporate staff functions, including financial activities, legal affairs, public affairs, and administration. He was also the principal executive responsible for supervising the interaction and coordination of the company's operating divisions. He oversaw Time Warner's efforts in New York City to rescue Harlem's financially troubled Apollo Theater. From the beginning the merger seemed destined for failure, and Parsons spent much of his early tenure allaying the concerns of angry shareholders. Ultimately every executive who led AOL Time Warner, other than Parsons, was forced out as the merger failed. In 2001, with the media industry hurting from a slump in advertising spending, AOL Time Warner suffered financially after the terrorist attacks of September 11. In December 2001 Gerald Levin abruptly retired, and Pittman resigned his post at AOL Time Warner in late July 2002.

MEDIA EXECUTIVE SURVIVES AS NEW MEDIA FAIL

Although Parsons was part of the team that orchestrated the AOL merger with Time Warner, the reality was that once AOL Time Warner's board made the decision to distance itself from the merger, it needed a senior executive from the original Time Warner to run the company. Parsons was named CEO in May 2002, and at that time his in-the-trenches managerial style, along with a track record running a global business and contacts in Washington, D.C., drove his ascension. Parsons described the differences between his predecessor and himself: "I'm kind of a lunch-pail manager. Where Jerry Levin was more cerebral and strategically focused as a CEO, I will tend to demonstrate more of an in-the-trenches style of leadership. I like to be with the troops" ( Black Enterprise , February 2002).

The 2002 fiscal year was rough for the company, with its stock price falling to around $9 per share—a record low—and the price of its bonds falling to the levels of junk. One of Parsons's early struggles came in June 2002, when the Securities and Exchange Commission (SEC) alleged that AOL had inflated its premerger revenues. Parsons defended the company before CFO Wayne H. Pace had completed his investigation. In August, AOL Time Warner embarrassingly disclosed dubious transactions totaling $49 million. An additional disclosure of $190 million followed. (As of early 2004 the company had yet to settle with the SEC.) What is more, the investigation hampered the company's ability to spin off its cable division as a separate business. "This is an overhang on the company," Parsons conceded ( Washington Post , January 7, 2004).

AN AFRICAN AMERICAN TRAILBLAZER

Parsons's CEO appointment placed him in the spotlight for more reasons than his company's immense power. He had also become one of the top African Americans in Corporate America. He said of the distinction, "It's an annoyance. Of course your priority is the shareholders and 90,000 employees. But there are also countless numbers of people outside who, for whatever reason—race being the biggest—are rooting for you. And not" ( Fortune , July 22, 2002). However, Parsons did not turn his back on the African American community. He said that one of his objectives was to transform his workforce, to better reflect the customers and community it serves. "We need to make more progress in our senior management ranks" ( Black Enterprise , February 2002).

ORCHESTRATING A TURNAROUND

Effective September 2003 AOL Time Warner's directors voted to rename the company Time Warner, marking a symbolic end to the ambitions of the Internet boom. The name change process—including the adoption of the "TWX" ticker symbol on the New York Stock Exchange—was completed in late 2003. Also during 2003 Parsons proved willing to make tough moves. Time Warner sold a controlling interest in its principal music operation, Warner Music Group, for $2.6 billion to an investor group led by Thomas H. Lee Partners and Edgar Bronfman Jr. This sale was expected to reduce Time Warner's reported net debt by approximately $2.6 billion. Parsons said, "I'm very pleased that we are putting our music company in such capable hands. Despite my personal fondness for the music business as well as for all of our wonderful managers and music group employees, I believe that this transaction is clearly in the best interests of our company's shareholders. Not only will it greatly enhance our financial flexibility, it also will enable us to pursue higher growth opportunities in our other lines of business" Business Wire , November 24, 2003).

By the end of 2003 Parsons had managed to elevate both his company's stock and his reputation. His strategy was to understate the goals of a company that had been crippled by hype. For the nine months that ended September 30, 2003, the company's revenues rose 5 percent to $31.15 billion. Net income from continuing operations and before accounting changes totaled $2.01 billion, up from $331 million, reflecting growth in the company's cable subscriptions and increased gross profit margins.

Once Parsons had turned the company around, he began looking for possible new merger partners. "We're now in a position to play," said Parsons ( Newsweek , December 22, 2003). He added that the company could pay for a deal worth up to $8 billion in cash, with the goal to expand Time Warner's cable operations.

See also entries on Dime Savings Bank of New York, F.S.B. and Time Warner Inc. in International Directory of Company Histories.

sources for further information

Bianco, Anthony, and Tom Lowry, "Can Dick Parsons Rescue AOL Time Warner?" BusinessWeek , May 19, 2003, p. 86.

Daniels, Cora, "Most Powerful Black Executives in America," Fortune , July 22, 2002, p. 60.

Dingle, Derek, and Alan Hughes, "A Time for Bold Leadership," Black Enterprise , February 2002, p. 76.

Roberts, Johnnie, "Prime Time for Parsons," Newsweek , December 22, 2003, p. 4.

Time Warner, "Investor Group Led by Thomas H. Lee Partners, Edgar Bronfman Jr., Bain Capital, and Providence Equity Partners to Purchase Warner Music Group," Business Wire , November 24, 2003.

Vise, David, "Time Warner Is Ready To Grow, Parsons Says" Washington Post , January 7, 2004.

—Tim Halpern

Comment about this article, ask questions, or add new information about this topic: