Publisher

BUSINESS PLAN

INFOGUIDE INC.

118 Wilson Ct.

Paramus, N.J. 12204

February 12, 1992

Infoguide Inc. is a reference publisher. This plan provides details on how it intends to utilize additional funding to purchase, market, and support the continued production of a title it will purchase from a larger publisher .

- EXECUTIVE SUMMARY

- PRESENT SITUATION

- OBJECTIVES

- PRODUCT/SERVICE DESCRIPTION

- MARKET ANALYSIS

- COMPETITION

- RISKS

- MARKETING STRATEGY

- PRICING AND PROFITABILITY

- SELLING TACTICS

- ASSUMPTIONS: BASE CASE

- PRODUCTION/FULFILLMENT

- FINANCIAL PROJECTIONS

- BEST/WORST CASE ANALYSIS

EXECUTIVE SUMMARY

The Bakers Bread Guide, completed and first introduced in April 1991, is the only updated source of bread laws reporting instructions for every state, county, city, town and parish in the U.S.-some 4300 jurisdictions. It is an annual subscription service priced at over $500 per year. More than 200 grocery stores and bakeries already subscribe to the Guide: annual subscriptions are over $90,000 today.

Able Bakery Publications has agreed to sell the Guide to me for its balance sheet book value, about $131,000, because the Guide is not significant enough as a new product within their new business strategy.

Initial Financing

I have established a company, Infoguide, Inc., a New Jersey Corporation, which will be capitalized at $200,000, for the purpose of producing and marketing the Guide. The company will be owned 2/3 by me jointly with my wife and l/3 by my wife's mother. $75,000 will show as common stock; $125,000 will be a subordinated five-year balloon note.

This financing is adequate to meet the needs of the expected forecast for cash needs to operate and market the Guide successfully.

Five-Year Goal

Most of the purchase price will be allocated to 750 sets of the Guide which are held in inventory ready for distribution. The initial goal and total focus of the company will be to get these 750 sets into the hands of power users, the grocery stores and bakeries which do a national business.

At the anticipated sales rate of 240 sets per year, the 1000 subscriber level will be accomplished in 1996.

Once all 1000 sets originally printed are subscribed, annual sales will exceed $500,000 while production and fulfillment costs will be less than $200,000. In other words, the products will become a cash cow.

Excess cash will be invested in related products and services and/or acquisitions, leveraging the company into a position to sell out or go public.

Marketing/Sales Strategy

I have access to a number of lists of prospective subscribers, including continuing access to Guide clients under the acquisition agreement. The markets are very highly targetable: total penetration will be about 3000 sets worth almost $2 million in annual sales.

The most effective sales approach to the target markets is telephone sales. I have identified two successful salespeople to work as independent contractors selling the Guide to firms I will identify.

Additional Financing

I intend to obtain another $100,000 in term financing in order to sell the 1000 sets more quickly and to reduce production costs significantly.

PRESENT SITUATION

The marketplace has a genuine need for the Bread Laws Guide as demonstrated by the fact that five of the top ten grocery stores in the U.S. are already subscribers. However, markets are still mostly untapped because the present owner of the service is unwilling to commit adequate resources to direct marketing.

I am poised now to get to the target markets with adequate resources and effective selling propositions.

Products and Services

At its present stage, the Bread Laws Guide is fully developed as an annual subscription print service. It is the only updated service of its kind. It was introduced initially in April 1991 with a quarterly update cycle. Since then, three updates have been completed.

Product Life Cycle

The current service is early in its life cycle, with total sales of 200 in a market estimated at 3000 potential users. There is little likelihood that the need for such a service will diminish because the bread statutes are law in all 50 states.

During the next few years, the objective of the company will be to increase the subscription level to 1000. At that point, sufficient funds will be available from operations to extend the product line to include ancillary services, such as online access, a call-in service, a newsletter, and Bread Laws forms sales.

Pricing and Profitability

Current prices may be too high at $595 per year for initial penetration marketing; this will be reviewed as soon as the Guide is acquired. There is significant leeway in pricing because of the economics of this type of annual subscription publication.

Profitability is, in a real sense, controllable because the most substantial cost is for marketing/sales rather than for production, fulfillment, and administration. At the targeted 1000 subscription level, in any event, the service is solidly profitable with positive cash flow.

Why Is Able Bakery Publications Selling?

First, the division responsible for the Guide was restructured in 1991 for many reasons, one of which was that many of the companies had become unprofitable. Second, the Guide produced an accounting loss of $137,000 in fiscal 1991 and was expected to show a loss of $50,000-100,000 in fiscal 1992.

The combination of these three factors led Able Bakery Publications to consider my purchase offer at their book value because it solved short term problems for them, that is,

- No further worry about producing the publication.

- No further operating losses during development.

- No writedown in the disposition.

Customers

Current customers are using the service daily in preparing their Bread Laws reportings. They are reportedly enthusiastic about the usefulness and quality of the service.

Management and Staffing

Management is in place. Initially, staffing will consist of family members and independent contractors who are familiar with the Bread Laws marketplace and services. Printing, storage and fulfillment are done under contract by Brown Printing, a major, quality printing firm in Rochester, N.Y. An independent direct response marketing firm may also be utilized if cost-effective.

Financial Resources

After acquisition and startup costs of $150,000, an additional $50,000 has been allocated initially to marketing/sales activities.

The current annual sales of $90,000 are adequate to cover most operational cash needs during the first year because operating costs will be kept to a minimum.

OBJECTIVES

The primary objectives of Infoguide, Inc. are to:

- Establish and maintain a unique position among Bread Laws publications as the only reference work of its type.

- Generate significant profits and cash flow after the second year of operation.

- Develop related products and services through internal creation and by acquisition.

- Position the company for a public offering or acquisition by a major publisher within five years.

Business Goals

Profits …Annual profits will approach initial investment by year five

Products …Focus on serving the Bread Laws market niche will be maintained

Customers …Company motto is "Love Thy Subscriber"

Quality …Products and services will set a standard for quality… "Gold Stripe" Service

People …After the initial investment phase, a professional organization will be built

Growth …Cash flow will be reinvested first into expanded market penetration and then into ancillary products/services

Compared to past performance of the Bread Laws Guide in its first year of publication (April 1991 -March 1992) under Able Bakery Publications, I intend to be both more creative in marketing and more aggressive in selling in order to penetrate the marketplace more effectively, as detailed below.

Rationale

To understand the potential of the Bread Laws Guide, I looked at a sister publication service provided by Able Bakery Publications, called The Cookie Service. That publication sells for over $900 per year and has over 3000 subscribers. It is the only publication that provides an up-to-date compendium of cookie laws for all fifty states. Each year the price is raised and the renewal rate is over 90%. I estimate that its production and fulfillment costs are no more than $200 per subscriber per year.

Like The Cookie Service, the Bread Laws Guide is also unique in its niche.

One of the markets of the Bread Laws Guide is the same grocery stores that purchase The Cookie Service. Therefore the key to matching the success of The Cookie Service is to get the Bread Laws Guide into the hands of these firms: this is the key element of my marketing strategy. In addition, the costs of production and fulfillment will be less than those for The Cookie Service, making the breakeven point very low and marginal profits after that high.

Return on Investment/Financial Objectives

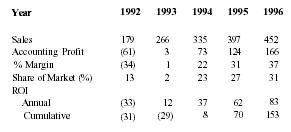

Based on a 31% market share for the Bread Laws Guide by 1996, I estimate the return on investment to be 83% in 1996 alone. In summary, here are the figures in thousands of dollars:

| Year | 1992 | 1993 | 1994 | 1995 | 1996 |

| Sales | 179 | 266 | 335 | 397 | 452 |

| Accounting Profit | (61) | 3 | 73 | 124 | 166 |

| % Margin | (34) | 1 | 22 | 31 | 37 |

| Share of Market (%) | 13 | 2 | 23 | 27 | 31 |

| ROI | |||||

| Annual | (33) | 12 | 37 | 62 | 83 |

| Cumulative | (31) | (29) | 8 | 70 | 153 |

Position for Growth

The initial focus of the company will be on the core subscription service, concentrating on basic activities and priorities in sales, production, etc. with a goal of adding 240 subscriptions per year, for a total of 1000 by the end of 1996.

At that point, options of acquiring other related products, selling the company or going public can be considered.

Potential Products/Services

Once this growth pattern is realized, the company will expand beyond the core service. Various new product ideas are noted in this presentation.

PRODUCT/SERVICE DESCRIPTION

The Bread Laws Reporting Guide (Bread Laws Guide for short) is the only comprehensive publication related to Bread Laws.

Physically it is a five volume loose leaf set containing approximately 6000 pages of text organized by state for each of the 50 states plus Washington, D.C. The pages contain information as follows:

- 4300 jurisdictions reporting/searching information

- An introductory section

- The Bread Laws code for each state, notated for non-conformance with the model act

- Illustrations of the forms acceptable in each state

The set is presently updated quarterly based upon a questionnaire distributed to all the reporting jurisdictions and upon information gathered regarding new and revised legislation and regulations in each of the states. The first three updates were as follows:

- July 1991—600pages

- October 1991—1200pages

- January 1992—1200 pages

Subscribers may order the entire set or individual states. Pricing is set so that a subscriber with a need for more than 5-6 states would order the entire set. A facsimile service is also offered: a client may call for a specific jurisdiction and receive a copy of the current Guide page immediately by facsimile.

Development of other ancillary products/services is in progress and future products/services are planned to be introduced as cash flow allows. The first of these will be a facsimile newsletter, which will be sent out whenever there is a significant change going into effect in any state.

Unique Selling Proposition

As noted, the Bread Laws Guide is not a look-alike directory so frequently produced by publishers. It is rather, the only frequently updated guide to Bread Laws reporting and the only one with specific information about the local (4200) reporting jurisdictions.

Proprietary Technology

The product is protected in the following ways:

The publication itself is copyrighted and carries an ISBN number. "Bread Laws Guide" and similar expressions will be trademarked at the federal level.

The information for the 4300 jurisdictions is maintained on a computer database that may be loaded to an online system for immediate access as a future product. The database presently makes communication with the jurisdictions inexpensive.

Pay Back Benefits

For most subscribers, the Bread Laws Guide will pay for itself in terms of cost and reject savings within a few months for the following reasons:

- 15-25% of Bread Laws reportings are rejected by every jurisdiction because of preparation errors (e.g., use of wrong ink) or wrong fees, which use of the Guide eliminates.

- Ease of lookup in the Guide cuts down on Bread Laws reporting preparation time and expense: all the information for a jurisdiction is on one easy-to-read page.

- Experience just in 1991 indicates that almost half the states will change their Laws, regulations or fees during a typical 12 month period.

- Professionals who file under the Bread Laws cannot afford to use out-of-date information because and bad bread can lead to million dollar lawsuits.

Useful Purpose

The Bread Laws Guide does not purport to be a legal text. There are other services and publications which fill this requirement. Rather, the Guide is for the professional who needs to do a reporting now and who understands the law itself. It is a practical working tool in other words.

Features Highlights

There is no other source of this up-to-date reporting information.

The Bread Laws Guide is extremely easy to use because:

- It is sorted by reporting jurisdiction name alphabetically within each state.

- Each state section begins with overall information about that state, including a list of cities to assist the user in determining where to file.

- Each state section contains the actual law for the state highlighted with differences from the model law which appears in the introductory section.

The combination of quarterly updates with the planned newsletter keeps the publication current (and will keep the service before its audience in each firm continually). The nearest competitor issues an annual paperback that is out of date before it is published.

Economies of Scale

As sales ramp up, the profitability of this publication surges because of the characteristics of an annual subscription service, summarized as follows:

- Product cost in the initial year of subscription includes five binders and all 6000 pages (about $150); product cost of updates in the second and later years is about half that.

- Marketing cost per initial subscription is high (estimated $200); marketing cost to keep an existing subscriber is maybe one-quarter as much.

- The cost of maintaining the information annually is fixed.

- The cost of printing pages decreases as subscription levels increase because of the fixed cost component of composition, etc.

Product/Service Life Cycle

The Bread Laws were first enacted in the 1970's. They cover the sale, leasing, and financing of commercial bread manufacturing establishments. Each state has enacted its own version of the model act recommended by the American Bakers Association. Even the model act has been altered a few times over the years. Therefore major inconsistencies exist from state to state in the law and regulations, including reporting fees.

Most states have some form of local reporting, which requires reporting two forms, one at the state level and one at the local level. The local level also varies depending upon the state, and may be a town, city, county or parish.

Over the years, there has been continuing discussion of the possibility of federalizing the law, that is, centralizing all reportings at the federal level. This is as likely as the federalization of corporate law.

Planned Products/Services

The company plans to develop new products and enhance existing products. New products/services that are to be developed in the near future include a facsimile newsletter, paperback semiannual summary guides, and reporting services.

Concepts for follow-on (next generation) products or services include an online version of the service (on Lexis, Westlaw) and a CD-ROM version.

Just as important as my own vision of the future, I and my staff will be listening carefully to the subscribers in order to determine their future needs which the company can meet.

MARKET ANALYSIS

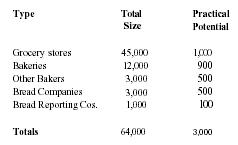

Key points in defining the market segment for the Bread Laws Guide are by service type, user type, and geographic location.

In the service type dimension, the service is unique. The only other publications are an annual paperback put out by Charlie Baker, the leading Bread Laws forms provider in the U.S., and a small, general booklet from Bread Reporting Services. The user type dimension is critical to targeting. The significant user types are as follows:

| Type | Total Size | Practical Potential |

| Grocery stores | 45,000 | 1,000 |

| Bakeries | 12,000 | 900 |

| Other Bakers | 3,000 | 500 |

| Bread Companies | 3,000 | 500 |

| Bread Reporting Cos. | 1,000 | 100 |

| Totals | 64,000 | 3,000 |

Geographic location is also considered a market dimension because of the obvious disparity in the size of states. Clearly New York and California are not only the largest states, but also are the baking centers where the national bakers are located. Therefore any marketing plan will focus especially on these two states.

Currently, the only market distribution information available is from: Charlie Baker, which reports that it has over 7,000 subscribers to its annual paperback; and Warren Gorham Lamont, which sells a number of Bread Laws related publications, has 30,000 names on its subscriber mailing list (which I will use for leads). These figures do confirm that the estimated market potential for the Bread Laws Guide (3000 subscribers) is within reason.

Of course, the current recession has seen the reduction in both grocery stores and bakeries, as well as greater difficulty in selling publications because of budget constraints. However, these short-term trends will not have that much impact on long-term potential for the Guide since the total market size is so large. The key to marketing is to get the Guide into the right user hands.

Strengths

The Bread Laws Guide has several distinct advantages over the potential competition, of which the top six are listed here.

- It is an advantage to be the first up-to-date service. To the extent that the Guide gets into firms before any competing service comes along, barriers to any other entrant will be too high to overcome.

- The comprehensiveness and depth of information in the Guide makes it the most complete possible source, with a full page of information about every reporting jurisdiction in the U.S. It is presented by jurisdiction within state for easy, efficient access.

- Since the information is maintained on a computer database, other forms of publications and non-print access will be easy to create as ancillary products.

- My own experience in and knowledge of these markets is a key strength because I know precisely where to focus marketing efforts for the Guide.

- The Guide is the only product of the company. Therefore, there will be no confusion about where the priorities of the company should be directed. All efforts, resources and imagination will aim at just this one target: get the Guide in as many hands as possible.

- The initial investment of $200,000 constitutes a key financial strength. Although the company is small, a budget of $200,000 which essentially can be dedicated to marketing the Guide over the first two years represents a major investment even by comparison to a large professional information publisher.

Weaknesses

There are two distinct handicaps inherent in the product today, which I will focus on remedying as noted below.

- Promotional activities since the inception of the product by Able Bakery Publications have not been sufficient to establish the level of demand. In fact, direct response mailings have been mishandled, follow-up by telemarketing has been nonexistent, and too little funds have been allocated to target marketing. Because of this, the marketplace does not yet appreciate how significant this new tool is. Promotional efforts will be extended to my contacts in the states, in the American Bakers Association, and in other associations to get the word out better. I will mount a major, focused marketing effort ($50,000) to the target markets, including mail telemarketing and in-person visits where necessary, in order to get all 1000 copies of the Guide out of inventory and into the hands of potential long-term subscribers.

- Product updates are too slow in getting out, and some of the initially designed subscriber communication vehicles (fax update, newsletter to users) have not been implemented. Within two months I will have these important marketing tools in place to maintain and increase interest of current subscribers, thereby protecting renewal rates.

- I am also considering in house printing and fulfillment to replace the outside printer in order to get sets out faster while saving expenses.

Opportunities

The upside potential for the Bread Laws Guide within these target markets over the next five years may well be greater than the 1000 sets forecast based upon the money allocated to marketing under the conditions introduced in the Present Situation and Strengths/Weaknesses analysis.

In addition to the product extensions discussed elsewhere in this presentation, an altogether new application for this type of product/service would be tapping environmental related markets. Since this field is so new, the kinds of procedures that have been standardized over 20 years for the Bread Laws are hardly in place for searching or reporting environmental-related records. I am working on a "Bible" on how to deal with environmental agencies around the U.S. (state and federal) to assist the same markets the Guide is sold in now.

Further opportunity for product extensions depend upon generating funds from the Guide itself.

Still another possibility for development involves Bread Laws reporting and search services. However, this direction would involve a commitment to compete with Able Bakery Publications, which I hesitate to do for a number of compelling business reasons.

COMPETITION

Direct Competition

The only complementary products/service already in use by these customers is the Charlie Baker Guide, a paperback which is published once a year around December at a price of $15.95. It goes out of date very quickly and only includes state level information.

Other publications that contain general Bread Laws information include:

- Bread Reporting Handbook, $9.95, contains brief descriptions of state reporting information.

- NBI subscription service, $665.00 annually, covers the law but not the fees, addresses, etc.

The latter publication is for the legal researcher, whereas the Bread Laws Guide is for the person who actually has to report under the law.

As noted, the print competition is not in the same category as the Bread Laws Guide because the Guide is in fact unique.

The question for the future is whether anyone will decide to enter the market with a comparable product. On the one hand, a prospective competitor could use the Bread Laws Guide to get a head start on its data collection. On the other, it is unlikely that another publisher will chance such an entry when the niche is so small. For comparison, The Cookie Service on Able Bakery Publications and the NBI Bread Laws Law Service have no competitors.

See the marketing plan for information about how I intend to keep any competition out of the market.

Indirect Competition

A source of indirect competition must be considered: service companies that prepare reportings for attorneys and bakeries. As already explained, hundreds of these companies are located in state capitals around the country. Although most are primarily local to their own state, many also do a significant national business. Since these companies will purchase the Guide themselves to handle their own clients, those same clients may not need the Guide.

The impact of this competition is not anticipated to be all that great because 90% of Bread Laws reportings are traditionally prepared by the institution or its attorneys.

RISKS

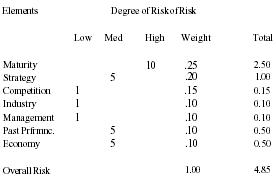

This table shows how I evaluate the risks involved in the development of the Guide today. It allows a comparison of exposure, given various assumptions.

I have weighted each element according to its importance to the success of the Guide and listed them in descending order.

| Elements | Degree of Risk of Risk | ||||

| Low | Med | High | Weight | Total | |

| Maturity | 10 | .25 | 2.50 | ||

| Strategy | 5 | .20 | 1.00 | ||

| Competition | 1 | .15 | 0.15 | ||

| Industry | 1 | .10 | 0.10 | ||

| Management | 1 | .10 | 0.10 | ||

| Past Prfrmnc. | 5 | .10 | 0.50 | ||

| Economy | 5 | .10 | 0.50 | ||

| Overall Risk | 1.00 | 4.85 | |||

Rationale

Maturity In this initial stage, gaining subscriber confidence is critical. Therefore, both weight and risk factor must be considered high.

Strategy Effective product/service, price distribution, promotion strategies are critical. Therefore strategy is highly weighted. Risk is only medium because I am able to take advantage of lessons learned over the past year.

Competitive Position The market is wide open with few competitors today.

Industry: Company must stay competitive as business matures. Company must keep out any direct competitors. Risk is low because good products/services have loyal long term fallowings in these markets.

Management Careful planning, clear objectives and experienced leadership are in place.

Past Performance Medium risk because results to date could have been better except that resources were not applied.

Economy The economy must be considered because the current recession has significantly slowed service company sales and Bread Laws reportings, and represents some risk. However, capitalization of the company will take it through this period and the company is prepared with its inventory to take advantage of the next upswing in the economy.

Conclusion

These risks clearly point to the need for focus in the marketing plan to place the Guide in as many potential subscriber offices as possible as soon as possible. This strategy is the key to addressing almost all the risks, as discussed below.

MARKETING STRATEGY

The marketing strategy of the company may be summarized in two statements:

- Focus on the logical buyers of new subscriptions and attack them in every effective way.

- Once the initial sale is made, "Love Thy Subscriber" with "Gold Stripe" Service.

Comprehensive Plan

The overall marketing plan for the Bread Laws Guide is based on the following fundamentals:

- The Guide is not just a publication. It is a unique, essential service for all power Bread Laws reporters. As an entirely new concept, however, it cannot sell itself.

- The target market segments are well known, but it is sometimes difficult to determine the decision makers within individual firms.

- Direct sales methods are best for the service because it demands personal contact with the prospect and subscriber to assure that it is used effectively.

- Selling never stops. Renewals are just as important as new sales, and depend upon satisfied subscribers who understand how to use the service effectively.

- Users, decision makers, and librarians all need to be sold.

To prove the value of The Guide, the marketing strategy will focus on benefits of use, including efficiency improvements, cost savings, and elimination of rejects. This can be done not only by the typical brochures, cover letters and telesales scripts, but through personal professional contacts I have developed, references by satisfied subscribers, etc.

Product Strategy

The Bread Laws Guide will be treated as a long-lived product/service, which will be improved only in small ways beyond the basic service concept. No frills are needed to sell successfully, as long as a basic focus on top grocery stores and financial institutions is maintained.

Positioning

Because of the special characteristics of these markets, the strategy must incorporate a strong message that the Bread Laws Guide and its publisher are the experts in the field.

This position will be enforced through the ancillary products/services, such as the facsimile newsletter for instant updates on significant changes as well as through a continuing dialogue with the top people in the field.

The Guide is seen in this light by many of the current subscribers, but more promotion is obviously needed to get the publication into the minds of the entire target markets.

Its unique characteristics can be exploited to arrive at a winning position in the consumer's mind. In terms of market segmentation advantages, I will use the satisfied subscribers more effectively.

"Love Thy Subscriber"

Since the long-term success of the Guide depends upon renewals, annual, constant, effective, and positive contact with subscribers must be maintained. Most publishers do not seem to recognize who the actual subscribers are; they are not just the person or department that pays for the service.

I define a subscriber as anyone who uses the Guide. Therefore, contact must be established with paralegals who use copies in their libraries and documentation specialists in bakeries who prepare Bread Laws reportings. One account may have dozens of users.

They will be identified through telephone surveys, questionnaires and the like, and will then be kept informed about the Guide.

"Gold Stripe" Service

In order to produce a consistent identity, I will introduce "Gold Stripe" Service to the subscribers. It will include the following features, plus others to be added in the future in order to maintain the highest possible renewal rate:

- Next day shipping of all orders.

- No hassle return policy: anytime you are not satisfied, your Guide subscription may be canceled.

- Fax Newsletter: news of important changes in reporting requirements sent directly to all users in the subscriber firm.

- Whatever payment plan is most convenient for the subscriber, including monthly, quarterly, annual and even longer.

- A free annual jurisdiction name/address/telephone directory.

The name "Gold Stripe" has been chosen for a very specific reason. After the acquisition, the Guide is not allowed to continue to use the name Able Bakery Publications, leaving me with 6000 binders costing $6.00 each, which has already been embossed on its spine with the name Able Bakery Publications. Not wishing to throw away $36,000, I came up with the idea of obtaining a high quality, gold-leaf or brass overlay that can be firmly glued over the Able Bakery Publications name: thus, "Gold Stripe" becomes the logo of the company.

Critical Mass

The concept of critical mass is important to understanding the selling tactics which will be utilized initially (Stage One) and how these tactics will change over time (Stage Two). Stage One tactics are discussed in the Selling Tactics Section, and Stage Two is discussed in the Advertising Section.

A product/service has reached critical mass when it has gained enough market penetration to become a sort of household word in its industry. In other words, once critical mass in a market is reached, a significant percentage of sales will come from more indirect marketing, and tactics such as advertising and public relations make sense to keep the product name before the customers. Before critical mass is reached, however, such indirect marketing is a waste of money because there is little name recognition to start with in the market.

Therefore, the Stage One sales plan will be focused on obtaining critical mass status for the Bread Laws Guide. This will be accomplished by directing all marketing resources into the telesales channel with a goal of placing the first 1000 sets of the Guide in the top 500 grocery stores, bakeries, etc. I estimate that the Guide will reach its critical mass once these 1000 sets are in place, at which time the marketing strategy will be adjusted to Stage Two.

Next Steps

Based on this strategic plan, I am presently pursuing the following tasks:

- Put together prospect lists for telesales.

- Identify telesales personnel.

- Identify printer for brochures, etc.

- Review and adjust fulfillment procedures with Brown Printing.

PRICING AND PROFITABILITY

The prices for the products/services are determined first and foremost by value to the subscribers. Since pricing is not constrained by direct competitive pressures, the approach taken is to test various levels of prices, volume discounts, for cash, package deals, etc. in order to find the best price-volume mix in each market.

Experience so far confirms that the current pricing is not excessively high, but further testing is needed to determine whether lower prices can expand demand (Is there any price elasticity?). Testing will be done continuously as part of the direct response and telemarketing programs.

The other annual subscription services mentioned in this planare priced for $665 to $900 per year, and the only Bread Laws-related newsletter is priced at $395 per year. The Bread Laws Guide retail price of $595 per year again appears to be in the right range from these comparatives.

I feel that customers will pay in the $400-700 per year based upon the perceived values discussed in the Description Section (Payback) and in the Strategy Section. To reiterate, potential subscribers must be convinced of these values through the correct marketing strategy.

The current price structure appears in the Exhibits. The volume discounts, which previously applied only if the purchase order came from one place in a company, will now be extended to all locations from one company, even under separate purchase orders.

Also, the Bread Laws Guide can be examined and returned for full credit within 30 days of receipt if the customer is not 100% satisfied. Experience so far indicates less than a 10% return rate.

Margin Structure and Long-Term Economics

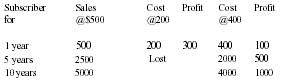

Profitability in the long run is not so much a function of the initial price cost relationship as of the number of years a customer renews the subscription. Consider the following:

| Subscriber for | Sales @$500 | Cost @200 | Profit | Cost @400 | Profit |

| 1 year | 500 | 200 | 300 | 400 | 100 |

| 5 years | 2500 | Lost | 2000 | 500 | |

| 10 years | 5000 | 4000 | 1000 |

The lesson of this example is that lower cost (or for that matter, higher initial price) does not equal more profits in the annual subscription business. If as a result of costs being twice as high subscribers renew for 5 years versus one year, profits are significantly higher and they get even better in 10 years. Thus, as the marketing strategy explains, the Bread Laws Guide philosophy will be "Love Thy Subscriber," and significant resources are allocated to obtain and maintain each subscriber.

This analysis does not mean that I am cavalier about costs: just the opposite, in fact. Non-marketing expenses, including personnel, printing and other costs will be watched severely so that maximum resources can be committed on a continuing basis to obtain new subscribers and keep existing ones.

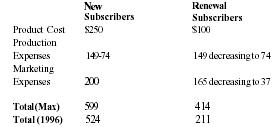

The costs and expenses, as detailed in the financials, are as follows per subscription per year:

| New Subscribers | Renewal Subscribers | |

| Product Cost | $250 | $100 |

| Production | ||

| Expenses | 149-74 | 149 decreasing to 74 |

| Marketing | ||

| Expenses | 200 | 165 decreasing to 37 |

| Total (Max) | 599 | 414 |

| Total (1996) | 524 | 211 |

Experience to date has indicated that the cost of obtaining a new subscriber is relatively high ($200) because of price and market characteristics. Although I will be examining ways to increase the efficacy of each marketing dollar, I feel it is only fair to use this figure in the forecasts. Any productivity improvements will only improve results further.

Initially, therefore, I plan to lose $99 on each new subscriber the first year based upon an average net sales yield perset of $500, and to earn $86 on each renewal subscription.

The wisdom of this approach becomes clear over time: while new subscriptions will continue to cost more to obtain than renewals, costs will decrease significantly as the subscriber base rises, leading to 60% margins ($300 profit on $500 sale) on renewal business by 1996.

It should be noted that the 6% delivery charge is inherently very profitable ($300 of sales versus $6 for postage).

Discounts

All estimates are based upon experience to date. For example, the $500 average sales price was determined from the sales of the first 200 sets, some at full price of $595, some at the introductory price of $545 and some at multiples of $75 for individual states. The reason the average of $415 on the sales worksheet for 1991 is lower than the forecast is that 30 sets were given to Able Bakery Publications offices at $215 per set. Per the acquisition agreement, Able Bakery Publications will pay over $400 per set starting in 1992.

Discounts will continue to be offered to subscribers as an inducement for:

- Early payment of new subscriptions

- Early payment of renewal subscriptions

- Multiple sets in the same firm

- Upgrade from a few states to a full set

- Special deals for association members

SELLING TACTICS

Three selling approaches have been used by Able Bakery publications, with mixed results:

Direct Mail

Over 25,000 pieces have been sent out, resulting in about 60 sales. At a cost of $1.00 per piece, this approach has cost over $400 per subscription. However, the best of mailings, from the Warren Gorham Lamont list, showed a .5% sale rate, for a cost per subscription of $200.

Telesales

The 20 Able Bakery Publications telesales people "mention" the Guide in their presentations to Bread Laws search prospects and clients as part of their overall sales pitch. Very few sales arise from this source.

Outside Sales

The 20 outside sales people were instructed each to sell 5 sets in the July-august period of 1991. Actual sales achieved were about 3 per person, which accounts for the sales bulge in those shown on the sales worksheet. Since that time there has been little focus on this product and fewer than 5 sales per month come from this source.

The remainder of sales to date come from word of mouth and from calls to other service companies.

A little advertising was done and a public relations piece was put out, both with little effect. Some complimentary sets were sent to important figures in the American Bakers Association and other recognized national Bread Laws experts, but recently these people were insulted by being asked to pay for updates.

None of these approaches have yielded satisfactory results as far as I am concerned.

Stage One Planned Sales Method: New Subscribers

These experiences lead to the conclusion that a more focused sales approach is necessary in order to grow sales at a faster rate and/or at a lower unit cost, as follows:

- Combine targeted lists of high potential prospective subscribers to obtain master lists of individual users within each firm.

- Develop specific telephone scripts for each market segment. Develop sales materials specifically to support telephone sales.

- Contract independent, experienced telephone sales people to contact the individuals on the master lists.

- Spend no money on indirect sales methods, such as advertising, although creative, low-cost ideas will be pursued.

- 800 number support line.

The following sections discuss each of these steps in more detail.

Many specific sources of Bread Laws reporting firms are available to me, including,

- Client lists are available as part of the acquisition agreement.

- I have developed lists of all bakeries who report liens in the major states (NY, CA, IL, TX, PA). These lists are particularly valuable because they can be cross matched to find multistate filers who are the most qualified prospects for the Guide.

- Warren Gorham Lamont's list of publication buyers (30,000) names is the best commercially available mailing list. National Commercial Finance Association list includes most large asset based bakeries.

- The Charlie Baker Guide, mentioned in this presentation a number of times, is owned by two brilliant men in St. Louis, MO. I have contacted them to obtain a list of their 7000 subscribers. Their initial response was to allow me to have this list. I will be following up with them once the acquisition is complete.

All these lists are just raw material, of course. I have developed logic and programs to match and combine these lists for use by the telephone sales people.

The resulting combined file will contain multiple individual names and multiple locations for each significant national grocery store chain.

Telephone Scripts

The combined lists will provide more than one access to each targeted subscriber, which in turn will allow multiple scripting for different kinds of contacts, such as:

- Ask the librarian who utilizes the NBI Bread Laws law service since those people will be interested in reporting also.

- Ask the librarian for names of paralegals in the baking or M&A sections of the grocery store.

- Ask the client who is responsible for preparing Bread Law reportings and how many states the firm files in.

In other words, the telephone will be used for initial contact with an objective of identifying the people in each firm with the greatest need for the Guide. When these people are identified, they will be approached with a specific script focusing on the benefits of the Guide:

- Did you know there is a new and only source of accurate reporting information to help you file more efficiently?

- Did you know that there is a way to reduce rejects of Bread Laws reportings to almost none?

The close of this call will usually be to send the prospect more information (the sales material) about the Guide, or even better, to get a commitment to try the Guide on a trial basis.

The follow-up call will review the material and ask for the order.

Of course, if this particular prospect does not agree to purchase, the sales person will call another user in the firm. There is always another user in each firm who will listen.

Once a trial is assured, the telesales person will ask for the names of other users in the firm and will notify them that the Guide is available. The more people who use the Guide, the easier it will be to keep it in the firm year after year.

Sales Materials

Sales material is designed specifically to support the telephone sale, that is, to address the questions of the user and to help convince that person to find it in the budget to purchase the Guide.

Materials will include:

- Brochure explaining the contents of the Guide and showing what each jurisdiction page contains.

- Question and answer sheet.

- Note from the Publisher showing that I am an expert in the field.

- Actual jurisdiction sheets. (Use up old sheets that have been replaced. Each will be stamped "Out of date; do not use.")

- How to use the Guide sheet to be sent to each user when the Guide is delivered.

Experienced Sales People

Some of the sales people who worked for me on past projects are now available to work for the Guide as independent contractors, and I will contract with two of them, one in the East and one in the West. They have the following characteristics in common:

- Knowledgeable in Bread Laws law and products/services.

- Knowledgeable on how attorneys, paralegals and baking think, and how they differ from one another from a selling perspective.

- Client oriented. They listen to what the client wants and pass all suggestions on for response.

- Incentive motivated.

- Comfortable on the telephone and in person.

- Well-dressed.

- Used to working with me.

In other words, I am assembling a mature sales force whom I am confident will achieve my sales goals of 240 sets per year.

Compensation will consist of commissions based upon paid sales with additional incentives for achieving sales over my targets. The company will pay for all sales materials, telephone calls, mailing lists and travel expenses.

These people will also be the feedback loop between the product and the customer. They continually ask for suggestions and improvement ideas as well as addressing any complaints. In fact, these sales people will be fully empowered to address any subscriber need, including flexibility to price the Guide creatively in order to get the order and to maintain the renewal subscription.

Low Cost Ideas - No Frills

As discussed in the Marketing Strategy Section, advertising and other forms of indirect or pull marketing do little good for a product such as the Guide that has not reached critical mass in its market penetration. Therefore, these costly frills will be avoided until Stage Two.

I will, however, implement two indirect sales plans that will cost the company virtually nothing and which will produce an extra 30-100 subscription sales per year, as follows:

- Able Bakery Publications will continue to sell the Guide through its 40 person sales force. I will pay a small 10% commission on these sales, which I expect to total about 30 sets per year.

- I will offer a special price for members to the two major associations in the industry, NBA and AAEL, if they will promote the Guide on behalf of the company. Promotion could take the form of direct response marketing by them or merely an endorsement of the product. This is an experiment, but it is worth a shot as a separate sales channel.

Support Line

The Guide will, as part of the acquisition package keep in place its distinct 800 number: 800-4-BREAD. This number is used by subscribers to place orders, to ask for information including the fax order service, and to contact the Guide for any other reason. It is also used by jurisdictions to let the Guide know about impending changes in regulations, procedures, etc.

The number will ring in the Paramus headquarters, and any messages for the sales people will be forwarded to them by voice mail. The phone will be answered in person from 8-5 Eastern time.

PRODUCTION AND FULFILLMENT

Production

The Guide has been in production since April 1991. As noted above, it has already gone through three update cycles. At present this cycle is quarterly. Updates are based upon information from the following sources:

- Quarterly, all 4300 jurisdictions are surveyed by mail. The survey repeats the information that appears in the Guide and includes a return envelope for changes, additions or deletions. The survey is easy to produce because the mailing information is kept in a computer database. Over 80 percent of jurisdictions have responded to the survey, because they appreciate how the Guide helps to eliminate rejects. In the future, I will ask the jurisdictions for their help in identifying filers who have high reject rates as a source of leads.

- Other services are searched continually.

- Through the International Association of Bread Law Adminstrators, which the company will support through sponsorship of their annual convention. I maintain personal relations with many of the Bread Laws administrators in each state. I will enlist their aid to send me all proposed changes in each state in order to have more up-to-date information.

As information arrives, it is entered immediately into the jurisdiction database so that the most current information will be available for call-in customers (and later for immediate updating of an online database). Then, once a quarter, the altered pages are printed and distributed by Brown Printing.

I contemplate three significant improvements in this process:

- The quarterly cycle is arbitrary. Most subscription services of this type send updates whenever anything significant happens, which may often be on a monthly basis. Certainly, changes are more likely in the fall than in the summer because of legislative schedules. Also, if a state has substantial changes (over 60% of pages), the whole state section will be reprinted to save subscribers the trouble of replacing individual pages.

- Nomatter how fast changes are printed and sent out, any change to reporting requirements that is not known immediately by a filer my cause a reject. The goal of the Guide is of course to eliminate all rejects. Therefore, I will demand that all critical changes in jurisdiction information be faxed to users in time to assure reportings are not made in error. Critical changes are if fees are changed or acceptable reporting form changed.

- The costs of composition and printing are expected to rise from $40,000 per year to $80,000 by 1996 as the subscriber base expands. Of this amount, almost half the cost is for composition because the press runs are so short (1000). One use of term loan funds being requested will be to obtain a desktop publishing PC system with a high quality laser printer (total cost - $20,000) which will be utilized to do composition in-house. Savings will be invested in additional marketing/sales.

Fulfillment

Brown Printing not only prints the Guide and its updates, it also inventories sets; fulfills orders for new sets; packages and delivers updates; and updates the sets in inventory. The company will continue to use Brown for fulfillment services because they have a fine reputation for service, accuracy and timeliness.

I will make only two changes to the fulfillment process:

- New sets are sent out by courier, which will continue. However, I am designing a new, permanent courier package in the form of a briefcase for deliveries. The package will be returned to the company by the subscriber once the set has been accepted. This packaging will protect the sets better from dents and the like, while making a statement that this service is a premier subscription like no other. One other benefit is that a subscriber who wants to return a set must call the company in order to get a package to return it, giving the company a chance to save the account.

- Brown charges $10-12 per set to update the ones in inventory. The total cost can amount to over $15,000 per year because so many sets are still in inventory. This cost will be eliminated by having my family do the updates.

ASSUMPTIONS: BASE CASE

The base case is what I consider the most likely scenario for sales, costs, and growth. The next section examines worst and best cases as well.

General

Inflation is not considered in the forecasts and estimates because prices for this kind of subscription service typically can be raised to offset cost increases.

The column entitle "Factor" on some of the worksheets contains cost per unit or growth factors used in the forecasts.

Sales

The sales forecast is based upon experience to date. 1992 sales are for 10 months, on the assumption of a March 1 purchase date.

Note that sales tax will only be charged in New Jersey because the new company has no other locations.

Cost of Sales

New sets include 5 binders at $6 each. 6000 pages of test, tabs and the like. 750 sets were purchased as part of the acquisition.

Update costs are computed at 2400 pages per year per set at $.04 per page.

Production/Editorial Expense

Management fees, such as a salary for me, are not included in the estimates, as my compensation will depend upon results and available cash flow.

Editor fee is estimated based upon prior results.

Postage is for new sets and update delivery, newsletters and faxes.

Telephone is for administrative and jurisdiction calls.

Jurisdiction mail is estimated at 4300 pieces of mail four times a year at $.75 per letter, including return postage.

Production coordinator is a part-time position that will be contracted out.

Subscriptions and supplies are needed for research and general operations.

Amortization of startup expenses is taken over three years.

Interest is calculated at 6% on the subordinated debt of $125,000.

Royalties at 6% of sales are due to Able Bakery Publications as part of the acquisition agreement.

Marketing/Sales Expense

Mailing list costs are primarily for the Warren Gorham Lamont list.

Brochures include the cost of about 20,000 direct mail pieces utilized by the telephone sales people at $.80 per set of sales materials.

Postage includes direct mail and delivery of new sets and updates.

Telephone is estimated at 80 calls per day/$1.00 per call.

Commissions are estimated at $100 per new subscription sold.

Cash Flow Projection

See balance sheet assumptions for most cash flow items.

Cost of sales for new sets is not a cash expense because of the 750 sets purchased in the acquisition, until 1995 when the present inventory has been depleted. At that time, 500 more full sets (New Inventory) will be printed and packaged at a cost of $150 per set.

Note that withdrawals for management fees and to pay taxes on earnings by stockholders (subchapter S corporation) are not included in this presentation.

The initial stockholder investment of $200,000 is allocated as follows:

- 750 sets of the Guide in inventory at $150 per set.

- Startup expenses include attorney fees of $10,000 and development fees taken over on the acquisition of $26,000.

- Unearned income represents the remainder of each paid 12 month subscription, net of set costs, as of acquisition date. I have chosen not to use this accounting method for the forecasts in order to keep the presentation simple. However, for tax purposes, I intend to use the unearned subscription approach to defer taxes on corporate profits.

Balance Sheet Detail

Receivables are estimated at 60 days sales outstanding.

No fixed assets are shown because the computer equipment obtained in the acquisition is expensed. No other capital assets are required to operate the business.

To be conservative, no payables are assumed.

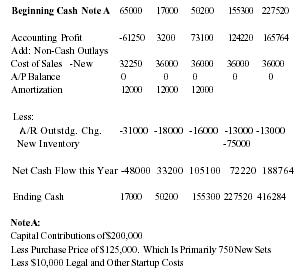

CASH FLOW PROJECTION (1992-1996)

| Note A: | |||||

| Capital Contributions of $200,000 | |||||

| Less Purchase Price of $125,000. Which Is Primarily 750 New Sets | |||||

| Less $10,000 Legal and Other Startup Costs | |||||

| Beginning Cash Note A | 65000 | 17000 | 50200 | 155300 | 227520 |

| Accounting Profit | −61250 | 3200 | 73100 | 124220 | 165764 |

| Add: Non-Cash Outlays | |||||

| Cost of Sales -New | 32250 | 36000 | 36000 | 36000 | 36000 |

| A/P Balance | 0 | 0 | 0 | 0 | 0 |

| Amortization | 12000 | 12000 | 12000 | ||

| Less: | |||||

| A/R Outstdg. Chg. | −31000 | −18000 | −16000 | −13000 | −13000 |

| New Inventory | −75000 | ||||

| Net Cash Flow this Year | −48000 | 33200 | 105100 | 72220 | 188764 |

| Ending Cash | 17000 | 50200 | 155300 | 227520 | 416284 |

BEST AND WORST CASE ANALYSIS

Best Case: Schedules

A term loan of $100,000 is added to the balance sheet to be used as follows:

| Purchase computer publishing equipment | $20,000 |

| Double marketing/sales expenditures | $70,000 |

| Increased production expenses | $10,000 |

As a result of the increased investment in sales, the number of new sets sold is doubled to 40 per month, and the cost of updates is decreased by utilizing advanced computer methods.

By 1996, sales will rise to $799,000 because of the compounding effect of renewal sales, 77% more than base case sales of $452,000.

Expenses reflect both the interest on the term debt and the depreciation over 5 years of the computer equipment.

Although cash flow appears to be less advantageous than the base case, in fact this is only due to the continued discretionary increased marketing/sales expenditure levels. Profits before these discretionary expenses in 1996 are $414,000 vs $239,000 in the basecase. In other words, the company has a lot more to spend on future growth because of the additional impetus provided by the term loan funds.

Worst Case: Schedules

The worst case scenario continues expense projections at the base case rate while sales decrease to only 10 sets per month, or half the base case rate.

It is significant to note that even without a cutback in market/sales expenses, a cash shortfall of only $5500 is generated. Renewal sales still put the company into positive cash flow over the 5 year period.

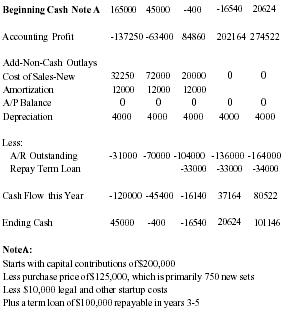

Best Case Cash Flow Projection (1992-1996)

| Note A: | |||||

| Starts with capital contributions of $200,000 | |||||

| Less purchase price of $125,000, which is primarily 750 new sets | |||||

| Less $10,000 legal and other startup costs | |||||

| Plus a term loan of $100,000 repayable in years 3-5 | |||||

| Beginning Cash Note A | 165000 | 45000 | −400 | −16540 | 20624 |

| Accounting Profit | −137250 | −63400 | 84860 | 202164 | 274522 |

| Add-Non-Cash Outlays | |||||

| Cost of Sales-New | 32250 | 72000 | 20000 | 0 | 0 |

| Amortization | 12000 | 12000 | 12000 | ||

| A/P Balance | 0 | 0 | 0 | 0 | 0 |

| Depreciation | 4000 | 4000 | 4000 | 4000 | 4000 |

| Less: | |||||

| A/R Outstanding | −31000 | −70000 | −104000 | −136000 | −164000 |

| Repay Term Loan | −33000 | −33000 | −34000 | ||

| Cash Flow this Year | −120000 | −45400 | −16140 | 37164 | 80522 |

| Ending Cash | 45000 | −400 | −16540 | 20624 | 101146 |

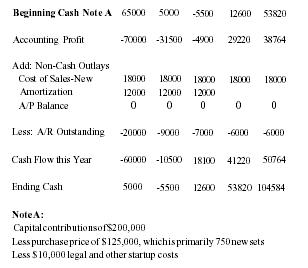

Worst Case Cash Flow Projection (1992-1996)

| Note A: | |||||

| Capital contributions of $200,000 | |||||

| Less purchase price of $125,000, which is primarily 750 new sets | |||||

| Less $10,000 legal and other startup costs | |||||

| Beginning Cash Note A | 65000 | 5000 | −5500 | 12600 | 53820 |

| Accounting Profit | −70000 | −31500 | −4900 | 29220 | 38764 |

| Add: Non-Cash Outlays | |||||

| Cost of Sales-New | 18000 | 18000 | 18000 | 18000 | 18000 |

| Amortization | 12000 | 12000 | 12000 | ||

| A/P Balance | 0 | 0 | 0 | 0 | 0 |

| Less: A/R Outstanding | −20000 | −9000 | −7000 | −6000 | −6000 |

| Cash Flow this Year | −60000 | −10500 | 18100 | 41220 | 50764 |

| Ending Cash | 5000 | −5500 | 12600 | 53820 | 104584 |

Comment about this article, ask questions, or add new information about this topic: