Gift Store

BUSINESS PLAN

CRYSTAL CREEK GIFTS

1329 Thompson Blvd.

Charlevoix, MI 49625

This gift and clothing store is located in a thriving tourist location. The summer season's influx of travelers will make up the bulk of this store's clientele, which has prepared carefully for it's market by choosing affordable and attractive products with wide appeal. This business plan is thorough in it's analysis of patrons and financing.

- STATEMENT OF PURPOSE

- BASIC BUSINESS DEFINITION

- MARKET ANALYSIS

- MARKETING PLAN

- ORGANIZATION AND MANAGEMENT

- MANAGEMENT

- SUMMARY OF SOURCES AND USE OF FUNDS

- CAPITAL EQUIPMENT

- START-UP COSTS

- WORKING CAPITAL

STATEMENT OF PURPOSE

This business Plan has been developed as a planning, operating, and policy guide for the owners of Crystal Creek and as a financing proposal to submit to local financial institutions.

Mike and Hannah Taylor are requesting a loan of $70,000 and a credit line of $25,000. This sum will be sufficient to purchase capital equipment and beginning inventory to cover start-up costs and to provide adequate working capital to successfully initiate this new business. The legal structure will be set up as a proprietorship. The anticipated opening date is April 1, 1997.

BASIC BUSINESS DEFINITION

The Crystal Creek Gifts is a year-round retail clothing store, located at 1329 Thompson Blvd. in Charlevoix, Michigan. It will service the summer tourist trade (80% of business between May-October). The merchandise carried will be men's sportswear (20%), ladies' sportswear (50%) with accessories at (10%), and gift items (20%). We aim to carry unique products and high quality apparel.

MARKET ANALYSIS

The target market for Crystal Creek is concentrated on the tourist to our area. He/she is a professional, well-educated, up-scale clientele who's taste in clothing and gifts reflect an unique, active, lifestyle. The target market income is $25,000 and higher. Crystal Creek will focus on these individuals during the tourist season, May through October.

Downtown Charlevoix attracts tourists who are walking up and down Thompson looking for items which they don't find at big city malls and an item which will remind them of their trip to Charlevoix.Thompson Boulevard also attracts a local or seasonal resident who enjoys the amenities of downtown. These include personal service, holiday shopping nights, "Friday Night Live," and the friendly atmosphere.

MARKETING PLAN: PRODUCT DIFFERENTIATION STRATEGY

To offer products that are different from competition in ways other than price.

Products and Services

Ladies apparel will consist of "groupings" of clothing which coordinate and sell each other. An example of this would be shorts, tees, and sweaters in sporty colors; cotton and twill bottoms, funembroidered sweatshirts. Menswear includes Rugby-stripe golf shirts, cotton sweaters, golf caps, and nautical and golf-embroidered sweatshirts. Brand names will be recognizable for their quality. Gift items will be moderately prices items: flowerpots, calendars, frames, birdhouses, many impulse items which will intrigue customers from the front display window.

Pricing

Crystal Creek will use a 50% mark-up for fashion goods. A 60% mark-up for fleece embroidered goods will compensate for seasonal markdowns. Gift items will be evaluated for quality and priced accordingly.

Promotion

The promotional budget for Crystal Creek is approximately $200 a month in the off-season, which would cover the cost of small newspaper ads. During the season, in addition to newspaper ads, the store plans to run ads in up-scale local magazines, possibly do a postcard mailing to customers.

Location

The advantage for Crystal Creek's to be on Thompson Boulevard is tremendous. Not only does Thompson Boulevard have the best walking traffic, but being in an area of other successful stores attracts people to the area. Other advantages to downtown include participation in the Downtown Development Authority which promotes downtown throughout the year via craft shows, "Friday Night Live," holiday shopping nights, etc.

ORGANIZATION AND MANAGEMENT

Attorney : David Stanford, Esq., 410 S. North Street, Charlevoix, MI 49625

Accountant : Linda Persimmons, 346 E. Thompson Boulevard, P.O. Box 2050, Charlevoix, MI 49625

Insurance Agent : Jerry Smith 515 Baylor Street, Charlevoix, MI 49625

Other : Rick Bameldi, Economic Development Contact for Northwest Michigan Council of Governments, P.O. Box 67809, Charlevoix, MI 49625

MANAGEMENT

Mike and Hannah Taylor, the owners of Crystal Creek, will be responsible for ordering inventory, merchandising, maintaining accounting and inventory records, supervising dayto-day records operations and hiring, training, and scheduling employees other than part-time help in the busiest part of the season. Mike and Hannah will be responsible for the majority of working hours.

Mike Taylor has a marketing degree from Ferris State University. He also has 15 years' experiencein merchandising day-to-day operations of a business in addition to experience in hiring, training employees.

Hannah Taylor is a graduate of Michigan State University's merchandising program and has many years experience as a buyer and shop manager at private golf clubs, resorts, and retail stores.

Mike and Hannah Taylor have owned their own shop before. In 1989, they secured a loan from Second National Bank in Newton, Michigan, to operate the ProShop Express at Wanatchee Country Club. The loan was paid back, on time, over the course of the golf season. The following year, 1990, a loan was also taken out and paid back on time.

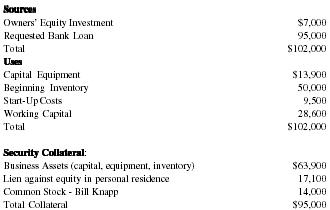

SUMMARY OF SOURCES AND USE OF FUNDS

| Sources | |

| Owners' Equity Investment | $7,000 |

| Requested Bank Loan | 95,000 |

| Total | $102,000 |

| Uses | |

| Capital Equipment | $13,900 |

| Beginning Inventory | 50,000 |

| Start-Up Costs | 9,500 |

| Working Capital | 28,600 |

| Total | $102,000 |

| Security Collateral : | |

| Business Assets (capital, equipment, inventory) | $63,900 |

| Lien against equity in personal residence | 17,100 |

| Common Stock - Bill Knapp | 14,000 |

| Total Collateral | $95,000 |

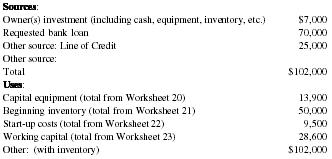

Summary of Sources and Uses of Funds

| Sources | |

| Owner(s) investment (including cash, equipment, inventory, etc.) | $7,000 |

| Requested bank loan | 70,000 |

| Other source: Line of Credit | 25,000 |

| Other source: | |

| Total | $102,000 |

| Uses | |

| Capital equipment (total from Worksheet 20) | 13,900 |

| Beginning inventory (total from Worksheet 21) | 50,000 |

| Start-up costs (total from Worksheet 22) | 9,500 |

| Working capital (total from Worksheet 23) | 28,600 |

| Other: (with inventory) | $102,000 |

CAPITAL EQUIPMENT

Office furniture, business machines (computer equipment, copier, FAX machine, cashregister, typewriter), store fixtures (display cases, shelves, stands, counters), delivery equipment, air conditioners, production machinery and construction equipment

List of only the equipment needed to start business, not what is already owned:

| Equipment Cost | |

| Fixtures | $9,000 |

| Computer | 3,000 |

| Copier | 600 |

| Fax | 500 |

| Cash Register | 500 |

| Stereo | 500 |

| Television | 300 |

| Total | $13,900 |

BEGINNING INVENTORY

| Products Cost | |

| Merchandise & Gifts | $50,000 |

| Total | $50,000 |

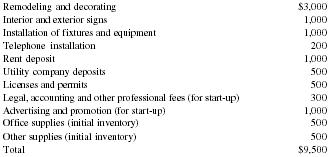

START-UP COSTS

Start-up costs are one-time expenses that are incurred prior to opening our business. Some of these expense categories, such as professional services and advertising, also may be on-going expenses. Therefore, they may be part of your working capital estimate for the first six months of operation.

| Remodeling and decorating | $3,000 |

| Interior and exterior signs | 1,000 |

| Installation of fixtures and equipment | 1,000 |

| Telephone installation | 200 |

| Rent deposit | 1,000 |

| Utility company deposits | 500 |

| Licenses and permits | 500 |

| Legal, accounting and other professional fees (for start-up) | 300 |

| Advertising and promotion (for start-up) | 1,000 |

| Office supplies (initial inventory) | 500 |

| Other supplies (initial inventory) | 500 |

| Total | $9,500 |

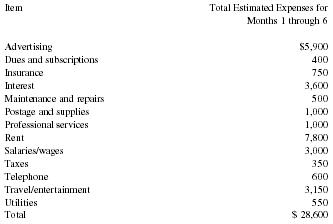

WORKING CAPITAL

Minimum working capital requirements should be estimated by totaling projected expenses for the first six months of Year 1.

| Item | Total Estimated Expenses for Months 1 through 6 |

| Advertising | $5,900 |

| Dues and subscriptions | 400 |

| Insurance | 750 |

| Interest | 3,600 |

| Maintenance and repairs | 500 |

| Postage and supplies | 1,000 |

| Professional services | 1,000 |

| Rent | 7,800 |

| Salaries/wages | 3,000 |

| Taxes | 350 |

| Telephone | 600 |

| Travel/entertainment | 3,150 |

| Utilities | 550 |

| Total | $ 28,600 |

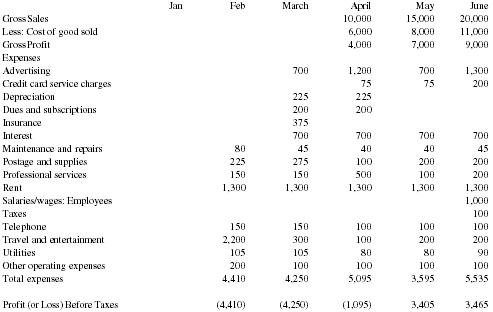

Projected Income Statement: Detail by Month

| Jan | Feb | March | April | May | June | |

| Gross Sales | 10,000 | 15,000 | 20,000 | |||

| Less: Cost of good sold | 6,000 | 8,000 | 11,000 | |||

| Gross Profit | 4,000 | 7,000 | 9,000 | |||

| Expenses | ||||||

| Advertising | 700 | 1,200 | 700 | 1,300 | ||

| Credit card service charges | 75 | 75 | 200 | |||

| Depreciation | 225 | 225 | ||||

| Dues and subscriptions | 200 | 200 | ||||

| Insurance | 375 | |||||

| Interest | 700 | 700 | 700 | 700 | ||

| Maintenance and repairs | 80 | 45 | 40 | 40 | 45 | |

| Postage and supplies | 225 | 275 | 100 | 200 | 200 | |

| Professional services | 150 | 150 | 500 | 100 | 200 | |

| Rent | 1,300 | 1,300 | 1,300 | 1,300 | 1,300 | |

| Salaries/wages: Employees | 1,000 | |||||

| Taxes | 100 | |||||

| Telephone | 150 | 150 | 100 | 100 | 100 | |

| Travel and entertainment | 2,200 | 300 | 100 | 200 | 200 | |

| Utilities | 105 | 105 | 80 | 80 | 90 | |

| Other operating expenses | 200 | 100 | 100 | 100 | 100 | |

| Total expenses | 4,410 | 4,250 | 5,095 | 3,595 | 5,535 | |

| Profit (or Loss) Before Taxes | (4,410) | (4,250) | (1,095) | 3,405 | 3,465 |

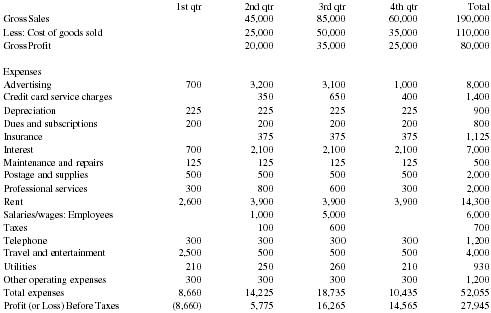

Projected Income Statement: Detail by Quarter Year 1

| 1st qtr | 2nd qtr | 3rd qtr | 4th qtr | Total | |

| Gross Sales | 45,000 | 85,000 | 60,000 | 190,000 | |

| Less: Cost of goods sold | 25,000 | 50,000 | 35,000 | 110,000 | |

| Gross Profit | 20,000 | 35,000 | 25,000 | 80,000 | |

| Expenses | |||||

| Advertising | 700 | 3,200 | 3,100 | 1,000 | 8,000 |

| Credit card service charges | 350 | 650 | 400 | 1,400 | |

| Depreciation | 225 | 225 | 225 | 225 | 900 |

| Dues and subscriptions | 200 | 200 | 200 | 200 | 800 |

| Insurance | 375 | 375 | 375 | 1,125 | |

| Interest | 700 | 2,100 | 2,100 | 2,100 | 7,000 |

| Maintenance and repairs | 125 | 125 | 125 | 125 | 500 |

| Postage and supplies | 500 | 500 | 500 | 500 | 2,000 |

| Professional services | 300 | 800 | 600 | 300 | 2,000 |

| Rent | 2,600 | 3,900 | 3,900 | 3,900 | 14,300 |

| Salaries/wages: Employees | 1,000 | 5,000 | 6,000 | ||

| Taxes | 100 | 600 | 700 | ||

| Telephone | 300 | 300 | 300 | 300 | 1,200 |

| Travel and entertainment | 2,500 | 500 | 500 | 500 | 4,000 |

| Utilities | 210 | 250 | 260 | 210 | 930 |

| Other operating expenses | 300 | 300 | 300 | 300 | 1,200 |

| Total expenses | 8,660 | 14,225 | 18,735 | 10,435 | 52,055 |

| Profit (or Loss) Before Taxes | (8,660) | 5,775 | 16,265 | 14,565 | 27,945 |

| July | August | Sept. | Oct. | Nov. | Dec. | Total |

| 32,500 | 30,000 | 22,500 | 18,000 | 16,000 | 26,000 | 190,000 |

| 19,000 | 18,000 | 13,000 | 11,000 | 10,000 | 14,000 | 110,000 |

| 13,500 | 12,000 | 9,500 | 7,000 | 6,000 | 12,000 | 80,000 |

| 1,400 | 1,300 | 400 | 400 | 200 | 400 | 8,000 |

| 200 | 250 | 200 | 100 | 100 | 200 | 1,400 |

| 225 | 225 | 900 | ||||

| 200 | 200 | 800 | ||||

| 375 | 375 | 1,125 | ||||

| 700 | 700 | 700 | 700 | 700 | 700 | 7,000 |

| 40 | 45 | 40 | 40 | 45 | 40 | 500 |

| 200 | 200 | 100 | 100 | 100 | 300 | 2,000 |

| 200 | 200 | 200 | 100 | 100 | 100 | 2,000 |

| 1,300 | 1,300 | 1,300 | 1,300 | 1,300 | 1,300 | 14,300 |

| 2,000 | 2,000 | 1,000 | 6,000 | |||

| 250 | 250 | 100 | 700 | |||

| 100 | 100 | 100 | 100 | 100 | 100 | 1,200 |

| 150 | 150 | 200 | 150 | 150 | 200 | 4,000 |

| 90 | 90 | 80 | 70 | 70 | 70 | 930 |

| 100 | 100 | 100 | 100 | 100 | 100 | 1,200 |

| 7,530 | 6,685 | 4,520 | 3,960 | 2,965 | 3,510 | 52,055 |

| 5,970 | 5,315 | 4,980 | 3,040 | 3,035 | 8,490 | 28,945 |

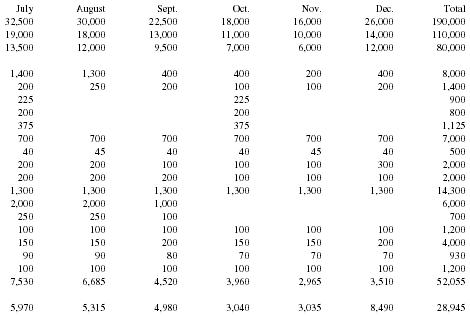

Projected Income Statement: Detail by Quarter Year 2

| 1st qtr | 2nd qtr | 3rd qtr | 4th qtr | Total | |

| Gross Sales | $20,000 | 50,000 | 90,000 | 65,000 | 225,000 |

| Less: Cost of goods sold | 13,000 | 28,000 | 53,000 | 37,000 | 131,000 |

| Gross Profit | 7,000 | 22,000 | 37,000 | 28,000 | 94,000 |

| Expenses | |||||

| Advertising | 600 | 1,800 | 2,400 | 1,200 | 6,000 |

| Credit card service charges | 150 | 400 | 700 | 450 | 1,700 |

| Depreciation | 450 | 450 | 450 | 450 | 1,800 |

| Dues and subscriptions | 250 | 250 | 250 | 250 | 1,000 |

| Insurance | 200 | 200 | 200 | 200 | 800 |

| Interest | 1,800 | 1,800 | 1,800 | 1,800 | 7,200 |

| Maintenance and repairs | 125 | 125 | 125 | 125 | 500 |

| Postage and supplies | 500 | 500 | 500 | 500 | 2,000 |

| Professional services | 300 | 800 | 600 | 300 | 2,000 |

| Rent | 4,050 | 4,050 | 4,050 | 4,050 | 16,200 |

| Salaries/wages: Employees | 1,100 | 5,500 | 6,600 | ||

| Taxes | 120 | 730 | 850 | ||

| Telephone | 300 | 300 | 300 | 300 | 1,200 |

| Travel and entertainment | 2,500 | 500 | 500 | 500 | 4,000 |

| Utilities | 225 | 240 | 255 | 225 | 945 |

| Other operating expenses | 350 | 350 | 350 | 350 | 1,400 |

| Total Expenses | $11,800 | 12,985 | 18,710 | 10,700 | 54,195 |

| Profit (or Loss) Before Taxes | ($4,800) | 9,015 | 18,290 | 17,300 | 39,805 |

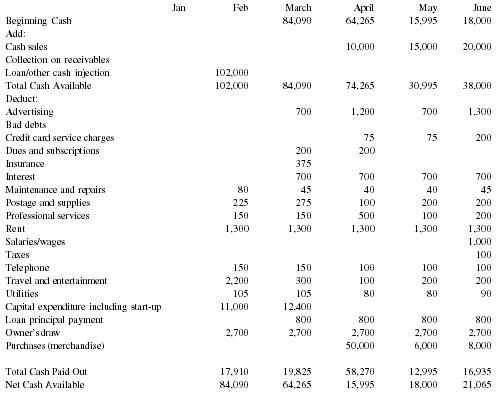

Projected Cash Flow Statement: Detail by Month

| Jan | Feb | March | April | May | June | |

| Beginning Cash | 84,090 | 64,265 | 15,995 | 18,000 | ||

| Add: | ||||||

| Cash sales | 10,000 | 15,000 | 20,000 | |||

| Collection on receivables | ||||||

| Loan/other cash injection | 102,000 | |||||

| Total Cash Available | 102,000 | 84,090 | 74,265 | 30,995 | 38,000 | |

| Deduct: | ||||||

| Advertising | 700 | 1,200 | 700 | 1,300 | ||

| Bad debts | ||||||

| Credit card service charges | 75 | 75 | 200 | |||

| Dues and subscriptions | 200 | 200 | ||||

| Insurance | 375 | |||||

| Interest | 700 | 700 | 700 | 700 | ||

| Maintenance and repairs | 80 | 45 | 40 | 40 | 45 | |

| Postage and supplies | 225 | 275 | 100 | 200 | 200 | |

| Professional services | 150 | 150 | 500 | 100 | 200 | |

| Rent | 1,300 | 1,300 | 1,300 | 1,300 | 1,300 | |

| Salaries/wages | 1,000 | |||||

| Taxes | 100 | |||||

| Telephone | 150 | 150 | 100 | 100 | 100 | |

| Travel and entertainment | 2,200 | 300 | 100 | 200 | 200 | |

| Utilities | 105 | 105 | 80 | 80 | 90 | |

| Capital expenditure including start-up | 11,000 | 12,400 | ||||

| Loan principal payment | 800 | 800 | 800 | 800 | ||

| Owner's draw | 2,700 | 2,700 | 2,700 | 2,700 | 2,700 | |

| Purchases (merchandise) | 50,000 | 6,000 | 8,000 | |||

| Total Cash Paid Out | 17,910 | 19,825 | 58,270 | 12,995 | 16,935 | |

| Net Cash Available | 84,090 | 64,265 | 15,995 | 18,000 | 21,065 |

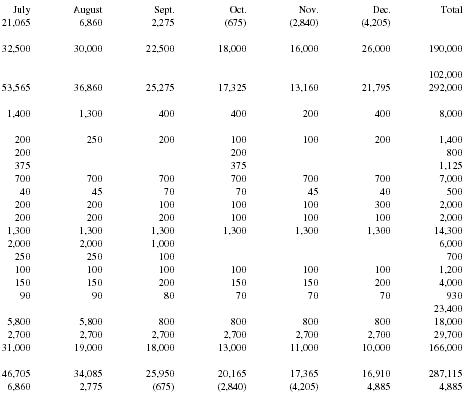

| July | August | Sept. | Oct. | Nov. | Dec. | Total |

| 21,065 | 6,860 | 2,275 | (675) | (2,840) | (4,205) | |

| 32,500 | 30,000 | 22,500 | 18,000 | 16,000 | 26,000 | 190,000 |

| 102,000 | ||||||

| 53,565 | 36,860 | 25,275 | 17,325 | 13,160 | 21,795 | 292,000 |

| 1,400 | 1,300 | 400 | 400 | 200 | 400 | 8,000 |

| 200 | 250 | 200 | 100 | 100 | 200 | 1,400 |

| 200 | 200 | 800 | ||||

| 375 | 375 | 1,125 | ||||

| 700 | 700 | 700 | 700 | 700 | 700 | 7,000 |

| 40 | 45 | 70 | 70 | 45 | 40 | 500 |

| 200 | 200 | 100 | 100 | 100 | 300 | 2,000 |

| 200 | 200 | 200 | 100 | 100 | 100 | 2,000 |

| 1,300 | 1,300 | 1,300 | 1,300 | 1,300 | 1,300 | 14,300 |

| 2,000 | 2,000 | 1,000 | 6,000 | |||

| 250 | 250 | 100 | 700 | |||

| 100 | 100 | 100 | 100 | 100 | 100 | 1,200 |

| 150 | 150 | 200 | 150 | 150 | 200 | 4,000 |

| 90 | 90 | 80 | 70 | 70 | 70 | 930 |

| 23,400 | ||||||

| 5,800 | 5,800 | 800 | 800 | 800 | 800 | 18,000 |

| 2,700 | 2,700 | 2,700 | 2,700 | 2,700 | 2,700 | 29,700 |

| 31,000 | 19,000 | 18,000 | 13,000 | 11,000 | 10,000 | 166,000 |

| 46,705 | 34,085 | 25,950 | 20,165 | 17,365 | 16,910 | 287,115 |

| 6,860 | 2,775 | (675) | (2,840) | (4,205) | 4,885 | 4,885 |

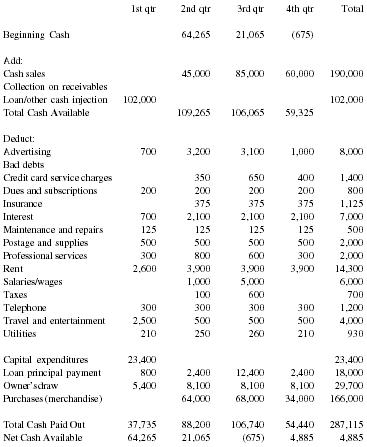

Projected Cash Flow: Detail by Quarter Year 1

| 1st qtr | 2nd qtr | 3rd qtr | 4th qtr | Total | |

| Beginning Cash | 64,265 | 21,065 | (675) | ||

| Add: | |||||

| Cash sales | 45,000 | 85,000 | 60,000 | 190,000 | |

| Collection on receivables | |||||

| Loan/other cash injection | 102,000 | 102,000 | |||

| Total Cash Available | 109,265 | 106,065 | 59,325 | ||

| Deduct: | |||||

| Advertising | 700 | 3,200 | 3,100 | 1,000 | 8,000 |

| Bad debts | |||||

| Credit card service charges | 350 | 650 | 400 | 1,400 | |

| Dues and subscriptions | 200 | 200 | 200 | 200 | 800 |

| Insurance | 375 | 375 | 375 | 1,125 | |

| Interest | 700 | 2,100 | 2,100 | 2,100 | 7,000 |

| Maintenance and repairs | 125 | 125 | 125 | 125 | 500 |

| Postage and supplies | 500 | 500 | 500 | 500 | 2,000 |

| Professional services | 300 | 800 | 600 | 300 | 2,000 |

| Rent | 2,600 | 3,900 | 3,900 | 3,900 | 14,300 |

| Salaries/wages | 1,000 | 5,000 | 6,000 | ||

| Taxes | 100 | 600 | 700 | ||

| Telephone | 300 | 300 | 300 | 300 | 1,200 |

| Travel and entertainment | 2,500 | 500 | 500 | 500 | 4,000 |

| Utilities | 210 | 250 | 260 | 210 | 930 |

| Capital expenditures | 23,400 | 23,400 | |||

| Loan principal payment | 800 | 2,400 | 12,400 | 2,400 | 18,000 |

| Owner's draw | 5,400 | 8,100 | 8,100 | 8,100 | 29,700 |

| Purchases (merchandise) | 64,000 | 68,000 | 34,000 | 166,000 | |

| Total Cash Paid Out | 37,735 | 88,200 | 106,740 | 54,440 | 287,115 |

| Net Cash Available | 64,265 | 21,065 | (675) | 4,885 | 4,885 |

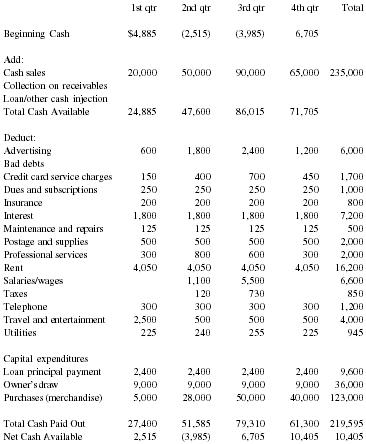

Projected Cash Flow: Detail by Quarter Year 2

| 1st qtr | 2nd qtr | 3rd qtr | 4th qtr | Total | |

| Beginning Cash | $4,885 | (2,515) | (3,985) | 6,705 | |

| Add: | |||||

| Cash sales | 20,000 | 50,000 | 90,000 | 65,000 | 235,000 |

| Collection on receivables | |||||

| Loan/other cash injection | |||||

| Total Cash Available | 24,885 | 47,600 | 86,015 | 71,705 | |

| Deduct: | |||||

| Advertising | 600 | 1,800 | 2,400 | 1,200 | 6,000 |

| Bad debts | |||||

| Credit card service charges | 150 | 400 | 700 | 450 | 1,700 |

| Dues and subscriptions | 250 | 250 | 250 | 250 | 1,000 |

| Insurance | 200 | 200 | 200 | 200 | 800 |

| Interest | 1,800 | 1,800 | 1,800 | 1,800 | 7,200 |

| Maintenance and repairs | 125 | 125 | 125 | 125 | 500 |

| Postage and supplies | 500 | 500 | 500 | 500 | 2,000 |

| Professional services | 300 | 800 | 600 | 300 | 2,000 |

| Rent | 4,050 | 4,050 | 4,050 | 4,050 | 16,200 |

| Salaries/wages | 1,100 | 5,500 | 6,600 | ||

| Taxes | 120 | 730 | 850 | ||

| Telephone | 300 | 300 | 300 | 300 | 1,200 |

| Travel and entertainment | 2,500 | 500 | 500 | 500 | 4,000 |

| Utilities | 225 | 240 | 255 | 225 | 945 |

| Capital expenditures | |||||

| Loan principal payment | 2,400 | 2,400 | 2,400 | 2,400 | 9,600 |

| Owner's draw | 9,000 | 9,000 | 9,000 | 9,000 | 36,000 |

| Purchases (merchandise) | 5,000 | 28,000 | 50,000 | 40,000 | 123,000 |

| Total Cash Paid Out | 27,400 | 51,585 | 79,310 | 61,300 | 219,595 |

| Net Cash Available | 2,515 | (3,985) | 6,705 | 10,405 | 10,405 |

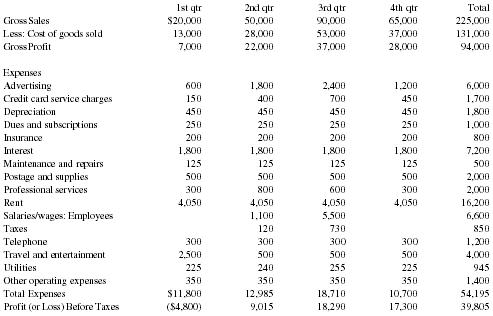

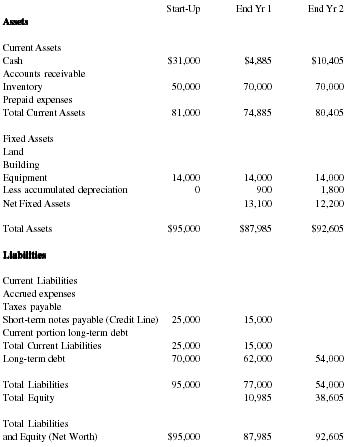

Projected Balance Sheets

| Start-Up | End Yr 1 | End Yr 2 | |

|

Assets

|

|||

| Current Assets | |||

| Cash | $31,000 | $4,885 | $10,405 |

| Accounts receivable | |||

| Inventory | 50,000 | 70,000 | 70,000 |

| Prepaid expenses | |||

| Total Current Assets | 81,000 | 74,885 | 80,405 |

| Fixed Assets | |||

| Land | |||

| Building | |||

| Equipment | 14,000 | 14,000 | 14,000 |

| Less accumulated depreciation | 0 | 900 | 1,800 |

| Net Fixed Assets | 13,100 | 12,200 | |

| Total Assets | $95,000 | $87,985 | $92,605 |

| Liabilities | |||

| Current Liabilities | |||

| Accrued expenses | |||

| Taxes payable | |||

| Short-term notes payable (Credit Line) | 25,000 | 15,000 | |

| Current portion long-term debt | |||

| Total Current Liabilities | 25,000 | 15,000 | |

| Long-term debt | 70,000 | 62,000 | 54,000 |

| Total Liabilities | 95,000 | 77,000 | 54,000 |

| Total Equity | 10,985 | 38,605 | |

| Total Liabilities | |||

| and Equity (Net Worth) | $95,000 | 87,985 | 92,605 |