Bistro and Wine Bar

BUSINESS PLAN

THE WINE BISTRO

3700 Johnston Boulevard

Springfield, Missouri 65804

Thanks to this plan, the restaurant owner received $35,000 in an operating loan and $30,000 in a term loan. The business is a bistro and wine bar offering customers first-rate food and wines along with a comfortable, elegant atmosphere in which to dine, meet friends, or have a drink after work.

- EXECUTIVE SUMMARY

- THE BUSINESS

- THE MARKET

- MARKET STRATEGY

- OPERATIONS PLAN

- FINANCIAL PLAN

EXECUTIVE SUMMARY

We are seeking $35,000 in an operating loan and $30,000 in a term loan. The owner will provide $15,000 in equity.

After almost 15 years in the restaurant business, Mr. Roberts is looking to open a conveniently located bistro and wine bar that will offer its lucky customers first-rate food and wines along with a comfortable yet elegant atmosphere in which to dine, meet friends, or have a drink after work.

Mr. Roberts has found an excellent spot strategically located in downtown Springfield. The restaurant will be within walking distance of two courthouses, several large office buildings, as well as many downtown businesses. Two up-scale hotels are located nearby: one with 198 rooms is located one half block away while the Best Western Hotel is only a block and a half away.

Mr. Roberts plans to take over a location that was previously a restaurant. The owner of the building will sell the equipment and furnishings at a discount. The previous business closed due to a change of priorities of the previous owner. The restaurant has been closed for three months.

The restaurant is projected to generate $100,000 in profits before taxes in the first year, after owner's draw.

THE BUSINESS

Mission Statement

Our goal at the Wine Bistro is to bring to the Springfield area a restaurant that will provide excellent food and wine at a reasonable price in a comfortable but refined atmosphere. In the summertime, patrons can dine outside in one of two patios—either the all non-smoking patio, or downwind in the cigar lounge.

Customers will find the bistro conveniently located in the center of the downtown area near two courthouses. It will be an excellent place for business people and lawyers located nearby to come for a delicious lunch and a good quality glass of wine. It will be an appropriate place to take clients: the perfect place for a lunch meeting.

Description

The Business at a Glance

Legal Name: The Wine Bistro

Type: Service

Product/Service: Restaurant and wine bar

Form: Corporation, not yet registered

Status: Start-up

Ownership: 100% by Mr. Roberts

Facility: 12,000 square feet on two floors plus patio in the summertime

The Products and Services

The Wine Bistro will offer clients high-end dining at a reasonable price. We will have 40 seats, plus two patios in the summertime with up to 50 more seats.

When customers enter the restaurant in the foyer, there will be a comfortable couch and coffee table where people can wait for a table or for their friends. Once inside the restaurant there is a bar with a large picture window and ten bar stools where patrons can also wait for a table or just have a drink after work. On the main level past the bar there is room for ten seats at three or four tables. Upstairs there is an "L" shaped dining area, with two sections. One section has five tables, while the other has four to five tables, for a total of 40 seats. The restaurant is broken up into smaller areas that allow the customer more intimate dining and chatting with friends.

Unique Selling Proposition

Our first priority is quality and presentation of the food. We will use the freshest local ingredients. For example, many of our cheeses will come from the local dairy, while we shop at the local Farmer's Market for fresh produce.

In the summer we will operate two patios. It will be the only place in Springfield with a non-smoking patio and also an outdoor cigar lounge.

Strategy

Our strategy will rely on the experience and proven track record of Mr. Roberts. We will take over a location where previously a restaurant was operated. Unlike the previous owner of the restaurant, we will bring to the venture experience, commitment, a sufficient amount of capital, and local goodwill.

The owner of the building bought the restaurant equipment and the fixtures from the previous tenant. We will be able to purchase these at a discount. The owner is interested in finding a new tenant for the location and has committed to waiving the first month's rent and will contribute to initial advertising.

Regulations

We will need a liquor license. There is already an existing license from the previous owners. We can use the old license for 90 days. We will be able to get our own license during this time. There will be no interruption in coverage.

THE MARKET

Market Overview

Though there are three other restaurants in Springfield that offer high-end dining, the Springfield area is large enough to comfortably support another restaurant offering high-quality food and service.

A key way we will reach our market is through our excellent location. There are two courthouses nearby; one is two blocks away while the other is three blocks away. Within walking distance is a regional building, the Centre (a large theatre), a new theatre soon to be opened called the Theatre, and a Mutual Life branch with about 100 employees. The Sheridan, a 198-room hotel, is only half a block away, while the Best Western Hotel is only one-and-a-half blocks away. There are many local shops nearby. The Farmer's Market is close by, and also a small mall and fitness center.

Key Market Trends

As the baby boom generation continues to age, and their children grow up, baby boomers have more free time and money to go out to dinner. Fast-food restaurants, the domain of young families, have fallen out of favor as many boomers now demand more nutritional, higher-quality food. Fine dining allows people to socialize and relax as they meet friends over excellent food and a fine glass of wine.

Competition

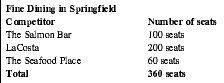

Our direct competitors consist of the following:

- The Salmon Bar serves nouveau cuisine with low prices but very small portions. They have only been open 8 months but people haven't been very receptive to it.

- LaCosta is part of a chain of restaurants. They have reasonable prices and serve reasonable food. They have close to 200 seats in a Mediterranean-style dining room. They offer a fair wine list that is relatively expensive. The food is consistently middle-of-the-road while the service isn't very consistent.

- The Seafood Place is a well-known restaurant with a good reputation. It's been in business for 15 years. It's located right downtown. It offers good food at about the same price that we will have. They have a small wine list. They only have 60 seats.

| Competitor | Number of seats |

| The Salmon Bar | 100 seats |

| LaCosta | 200 seats |

| The Seafood Place | 60 seats |

| Total | 360 seats |

Competitive Analysis

The Wine Bistro will offer its clients consistently excellent food and service, along with an exceptional wine list. The staff will be knowledgeable about wines and be able to suggest the best wines to go with a particular meal. Unlike the Salmon Bar where servings are artistic but meager, we will offer our clients the aesthetics of food as well as high-quality taste and reasonable portioning.

LaCosta, which is part of a chain of restaurants, is less able to control the quality of food and service. As owner/operator, Mr. Roberts will be able to monitor all aspects of the restaurant and ensure high quality. Regulars of our establishment will get to know him and the staff and will enjoy a friendly atmosphere that may be missing from a chain restaurant.

The Seafood Place is an example of a successful Springfield restaurant. However, it can only offer 60 seats. We can benefit from the Seafood Place clients who may be looking for variety in their dining experience.

MARKET STRATEGY

Marketing Plan

The Wine Bistro will look to a particular segment of the community for customers. Perhaps our strongest advantage is our location in the business area of Springfield. We will build on the customers that Mr. Roberts has developed over many years in the business. For new customers our food and service will speak for itself; people will return based on the quality of experience of their first meal at the Wine Bistro.

We intend to become a recognized and active participant in the local community. Already, from working and living in the area, Mr. Roberts is well known in the community. The Wine Bistro will build on this and take an active part in promoting the well being of the area by hiring locally trained chefs, graduates from local colleges, and by buying locally. There is a strong sense of community in Springfield from which we can all benefit.

Market Positioning

Our position in the market will be entry-level fine dining. The atmosphere will be a casual yet refined atmosphere. People will feel comfortable coming for dinner but they will also feel that they are going somewhere special. Though there will be no dress code, no one will feel overdressed if they decide to dress for a special occasion.

Pricing Strategy

In the Springfield area we will lean towards a higher end price. Though we will be less expensive than LaCosta, we will be positioned in the mid to high-end range. However, customers will be able to taste the value in each dish we serve. We will use only premium ingredients. Food costs will be a third of the price of each plate.

Advertising and Promotion

We will have a grand opening party to promote the opening of the restaurant. We will do a direct mailing of 1,000 names, addresses, and e-mails that Mr. Roberts has collected from previous customers. We will also contact lawyers from offices located around the courthouses, as well as local businesses. We have allocated $1,500 for the Grand Opening Party and mailing. The Grand Opening will consist of an open house where people will be invited to visit the restaurant, meet Mr. Roberts, and the chef. During this event, hors d'oeuvres and wine and beer will be served.

The owner of the building has committed to doing some advertising for the Grand Opening as well.

Also, as an annual event we will be holding the Big Brothers Gala Event. This is a fundraiser for the organization with contributors paying $200 a plate. This gives us a chance to support an important organization, as well as giving the restaurant high exposure in the community. The dinner takes place in late February giving us a boost during the slow season.

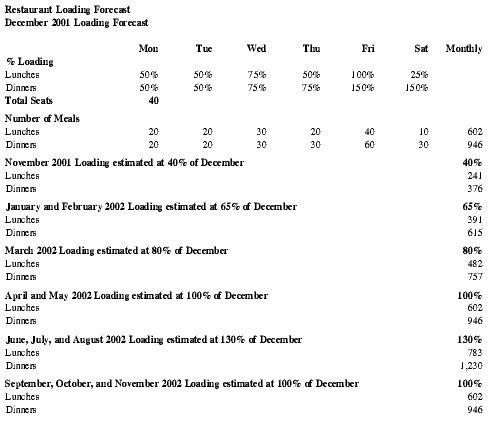

| Mon | Tue | Wed | Thu | Fri | Sat | Monthly | |

| % Loading | |||||||

| Lunches | 50% | 50% | 75% | 50% | 100% | 25% | |

| Dinners | 50% | 50% | 75% | 75% | 150% | 150% | |

| Total Seats | 40 | ||||||

| Number of Meals | |||||||

| Lunches | 20 | 20 | 30 | 20 | 40 | 10 | 602 |

| Dinners | 20 | 20 | 30 | 30 | 60 | 30 | 946 |

| November 2001 Loading estimated at 40% of December | 40% | ||||||

| Lunches | 241 | ||||||

| Dinners | 376 | ||||||

| January and February 2002 Loading estimated at 65% of December | 65% | ||||||

| Lunches | 391 | ||||||

| Dinners | 615 | ||||||

| March 2002 Loading estimated at 80% of December | 80% | ||||||

| Lunches | 482 | ||||||

| Dinners | 757 | ||||||

| April and May 2002 Loading estimated at 100% of December | 100% | ||||||

| Lunches | 602 | ||||||

| Dinners | 946 | ||||||

| June, July, and August 2002 Loading estimated at 130% of December | 130% | ||||||

| Lunches | 783 | ||||||

| Dinners | 1,230 | ||||||

| September, October, and November 2002 Loading estimated at 100% of December | 100% | ||||||

| Lunches | 602 | ||||||

| Dinners | 946 | ||||||

Risks

There are three basic reasons why a restaurant fails. They are:

- Lack of management skills of the owner. Many new restaurant owners don't have a good understanding of or experience in restaurant business. Mr. Roberts has worked almost 15 years in the industry and worked for a range of restaurant types from start-up restaurants to established restaurants. During the past three years he has been the General Manager of Rosa's Place Restaurant in Springfield.

- The menu and atmosphere don't match. We will match up-scale atmosphere with fine food and wine.

- Under capitalization. Many restaurant owners forget about the need for working capital. They overestimate how busy they will be and end up going out of business in the first six months.

- Poor location. We have a great location, especially for lunch. We feel confident that lunch will bring dinner. Many people will come for lunch because lunch is cheaper then decide to come back with their wife or husband for dinner.

Rewards and Opportunities

OPERATIONS PLAN

This represents an excellent opportunity to open a restaurant in a previously successful location with experienced and seasoned management.

Management

Mr. Roberts, Owner/Operator—Mr. Roberts has almost 15 years of experience in the restaurant business. Over the past three years he has been the manager of the award-winning restaurant Rosa's Place. From his many years of experience working in many different establishments he has gained a wealth of knowledge managing a successful restaurant.

Advisors

- Lawyer: Mr. Dave Smith, Springfield

- Accountant: GH Accounting Services, Springfield

- Bank: CitiBank, Springfield

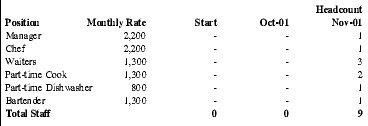

Personnel Plan

The core staff is the manager and the chef. Other staff will be added based on actual customer requirements. The plan below is based on supporting the sales plan forecasted in the previous section.

| Position | Monthly Rate | Start | Oct-01 | Headcount Nov-01 |

| Manager | 2,200 | - | - | 1 |

| Chef | 2,200 | - | - | 1 |

| Waiters | 1,300 | - | - | 3 |

| Part-time Cook | 1,300 | - | - | 2 |

| Part-time Dishwasher | 800 | - | - | 1 |

| Bartender | 1,300 | - | - | 1 |

| Total Staff | 0 | 0 | 9 |

Location and Facilities

The Wine Bistro will be located at 3700 Johnston Boulevard as part of the Market Village, a six-unit complex. This location has 12,000 square feet plus another 12,000 square feet of patio in the summertime. It is an excellent location in the middle of downtown Springfield, close to two courthouses, many office buildings, and other local businesses, as well as two high-end hotels and the farmer's market.

Implementation Schedule

We hope to have the money in place by October 1 so we can open the restaurant by November 1. We will need one month to get things up and started. The owner of the building will waive the rent for the first month. We plan to have the Grand Opening during the second Sunday in November. We will be open for business during the previous week at a lower level. We can use this time to make sure everything is in working order.

November 1 is the latest we can open for this year and still benefit from the busy Christmas season. If there is a delay we will need to wait until next spring to avoid the slow winter season.

FINANCIAL PLAN

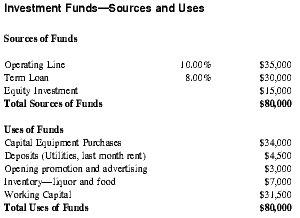

| Investment Funds—Sources and Uses | ||

| Sources of Funds | ||

| Operating Line | 10.00% | $35,000 |

| Term Loan | 8.00% | $30,000 |

| Equity Investment | $15,000 | |

| Total Sources of Funds | $80,000 | |

| Uses of Funds | ||

| Capital Equipment Purchases | $34,000 | |

| Deposits (Utilities, last month rent) | $4,500 | |

| Opening promotion and advertising | $3,000 | |

| Inventory—liquor and food | $7,000 | |

| Working Capital | $31,500 | |

| Total Uses of Funds | $80,000 | |

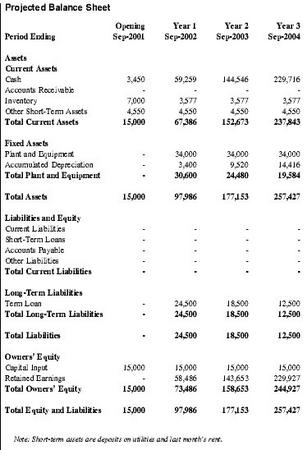

| Period Ending | Opening Sep-2001 | Year 1 Sep-2002 | Year 2 Sep-2003 | Year 3 Sep-2004 |

| Note: Short-term assets are deposits on utilities and last month's rent. | ||||

| Assets | ||||

| Current Assets | ||||

| Cash | 3,450 | 59,259 | 144,546 | 229,716 |

| Accounts Receivable | - | - | - | - |

| Inventory | 7,000 | 3,577 | 3,577 | 3,577 |

| Other Short-Term Assets | 4,550 | 4,550 | 4,550 | 4,550 |

| Total Current Assets | 15,000 | 67,386 | 152,673 | 237,843 |

| Fixed Assets | ||||

| Plant and Equipment | - | 34,000 | 34,000 | 34,000 |

| Accumulated Depreciation | - | 3,400 | 9,520 | 14,416 |

| Total Plant and Equipment | - | 30,600 | 24,480 | 19,584 |

| Total Assets | 15,000 | 97,986 | 177,153 | 257,427 |

| Liabilities and Equity | ||||

| Current Liabilities | - | - | - | - |

| Short-Term Loans | - | - | - | - |

| Accounts Payable | - | - | - | - |

| Other Liabilities | - | - | - | - |

| Total Current Liabilities | - | - | - | - |

| Long-Term Liabilities | ||||

| Term Loan | - | 24,500 | 18,500 | 12,500 |

| Total Long-Term Liabilities | - | 24,500 | 18,500 | 12,500 |

| Total Liabilities | - | 24,500 | 18,500 | 12,500 |

| Owners' Equity | ||||

| Capital Input | 15,000 | 15,000 | 15,000 | 15,000 |

| Retained Earnings | - | 58,486 | 143,653 | 229,927 |

| Total Owners' Equity | 15,000 | 73,486 | 158,653 | 244,927 |

| Total Equity and Liabilities | 15,000 | 97,986 | 177,153 | 257,427 |

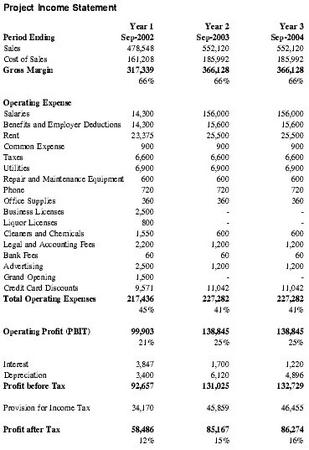

| Period Ending | Year 1 Sep-2002 | Year 2 Sep-2003 | Year 3 Sep-2004 |

| Sales | 478,548 | 552,120 | 552,120 |

| Cost of Sales | 161,208 | 185,992 | 185,992 |

| Gross Margin | 317,339 | 366,128 | 366,128 |

| 66% | 66% | 66% | |

| Operating Expense | |||

| Salaries | 14,300 | 156,000 | 156,000 |

| Benefits and Employer Deductions | 14,300 | 15,600 | 15,600 |

| Rent | 23,375 | 25,500 | 25,500 |

| Common Expense | 900 | 900 | 900 |

| Taxes | 6,600 | 6,600 | 6,600 |

| Utilities | 6,900 | 6,900 | 6,900 |

| Repair and Maintenance Equipment | 600 | 600 | 600 |

| Phone | 720 | 720 | 720 |

| Office Supplies | 360 | 360 | 360 |

| Business Licenses | 2,500 | - | - |

| Liquor Licenses | 800 | - | - |

| Cleaners and Chemicals | 1,550 | 600 | 600 |

| Legal and Accounting Fees | 2,200 | 1,200 | 1,200 |

| Bank Fees | 60 | 60 | 60 |

| Advertising | 2,500 | 1,200 | 1,200 |

| Grand Opening | 1,500 | - | - |

| Credit Card Discounts | 9,571 | 11,042 | 11,042 |

| Total Operating Expenses | 217,436 | 227,282 | 227,282 |

| 45% | 41% | 41% | |

| Operating Profit (PBIT) | 99,903 | 138,845 | 138,845 |

| 21% | 25% | 25% | |

| Interest | 3,847 | 1,700 | 1,220 |

| Depreciation | 3,400 | 6,120 | 4,896 |

| Profit before Tax | 92,657 | 131,025 | 132,729 |

| Provision for Income Tax | 34,170 | 45,859 | 46,455 |

| Profit after Tax | 58,486 | 85,167 | 86,274 |

| 12% | 15% | 16% | |

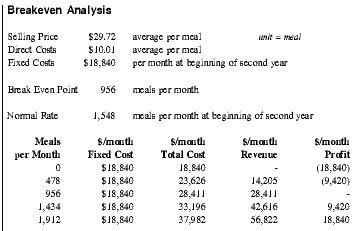

| Selling Price | $29.72 | average per meal | unit = meal | |

| Direct Costs | $10.01 | average per meal | ||

| Fixed Costs | $18,840 | per month at beginning of second year | ||

| Break Even Point | 956 | meals per month | ||

| Normal Rate | 1,548 | meals per month at beginning of second year | ||

| Meals per Month | $/month Fixed Cost | $/month Total Cost | $/month Revenue | $/month Profit |

| 0 | $18,840 | 18,840 | - | (18,840) |

| 478 | $18,840 | 23,626 | 14,205 | (9,420) |

| 956 | $18,840 | 28,411 | 28,411 | - |

| 1,434 | $18,840 | 33,196 | 42,616 | 9,420 |

| 1,912 | $18,840 | 37,982 | 56,822 | 18,840 |

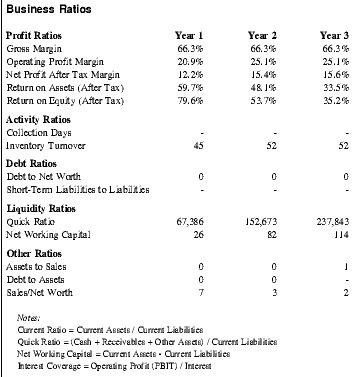

| Profit Ratios | Year 1 | Year 2 | Year 3 |

| Notes: | |||

| Current Ratio = Current Assets / Current Liabilities | |||

| Quick Ratio = (Cash + Receivables + Other Assets) / Current Liabilities | |||

| Net Working Capital = Current Assets - Current Liabilities | |||

| Interest Coverage = Operating Profit (PBIT) / Interest | |||

| Gross Margin | 66.3% | 66.3% | 66.3% |

| Operating Profit Margin | 20.9% | 25.1% | 25.1% |

| Net Profit After Tax Margin | 12.2% | 15.4% | 15.6% |

| Return on Assets (After Tax) | 59.7% | 48.1% | 33.5% |

| Return on Equity (After Tax) | 79.6% | 53.7% | 35.2% |

| Activity Ratios | |||

| Collection Days | - | - | - |

| Inventory Turnover | 45 | 52 | 52 |

| Debt Ratios | |||

| Debt to Net Worth | 0 | 0 | 0 |

| Short-Term Liabilities to Liabilities | - | - | - |

| Liquidity Ratios | |||

| Quick Ratio | 67,386 | 152,673 | 237,843 |

| Net Working Capital | 26 | 82 | 114 |

| Other Ratios | |||

| Assets to Sales | 0 | 0 | 1 |

| Debt to Assets | 0 | 0 | - |

| Sales/Net Worth | 7 | 3 | 2 |

The page left intentionally blank to accommodate tabular matter following.

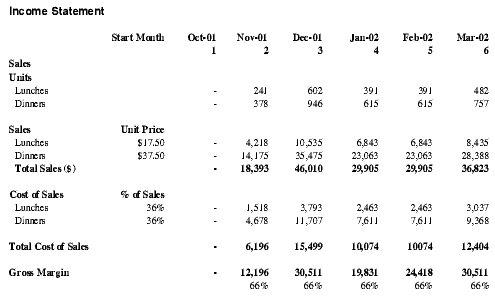

| Start Month | Oct-01 | Nov-01 | Dec-01 | Jan-02 | Feb-02 | Mar-02 | |

| 1 | 2 | 3 | 4 | 5 | 6 | ||

| Sales Units | |||||||

| Lunches | - | 241 | 602 | 391 | 391 | 482 | |

| Dinners | - | 378 | 946 | 615 | 615 | 757 | |

| Sales | Unit Price | ||||||

| Lunches | $17.50 | - | 4,218 | 10,535 | 6,843 | 6,843 | 8,435 |

| Dinners | $37.50 | - | 14,175 | 35,475 | 23,063 | 23,063 | 28,388 |

| Total Sales ($) | - | 18,393 | 46,010 | 29,905 | 29,905 | 36,823 | |

| Cost of Sales | % of Sales | ||||||

| Lunches | 36% | - | 1,518 | 3,793 | 2,463 | 2,463 | 3,037 |

| Dinners | 36% | - | 4,678 | 11,707 | 7,611 | 7,611 | 9,368 |

| Total Cost of Sales | - | 6,196 | 15,499 | 10,074 | 10074 | 12,404 | |

| Gross Margin | - | 12,196 | 30,511 | 19,831 | 24,418 | 30,511 | |

| 66% | 66% | 66% | 66% | 66% |

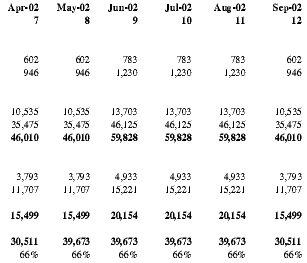

| Apr-02 | May-02 | Jun-02 | Jul-02 | Aug-02 | Sep-02 |

| 7 | 8 | 9 | 10 | 11 | 12 |

| 602 | 602 | 783 | 783 | 783 | 602 |

| 946 | 946 | 1,230 | 1,230 | 1,230 | 946 |

| 10,535 | 10,535 | 13,703 | 13,703 | 13,703 | 10,535 |

| 35,475 | 35,475 | 46,125 | 46,125 | 46,125 | 35,475 |

| 46,010 | 46,010 | 59,828 | 59,828 | 59,828 | 46,010 |

| 3,793 | 3,793 | 4,933 | 4,933 | 4,933 | 3,793 |

| 11,707 | 11,707 | 15,221 | 15,221 | 15,221 | 11,707 |

| 15,499 | 15,499 | 20,154 | 20,154 | 20,154 | 15,499 |

| 30,511 | 39,673 | 39,673 | 39,673 | 39,673 | 30,511 |

| 66% | 66% | 66% | 66% | 66% | 66% |

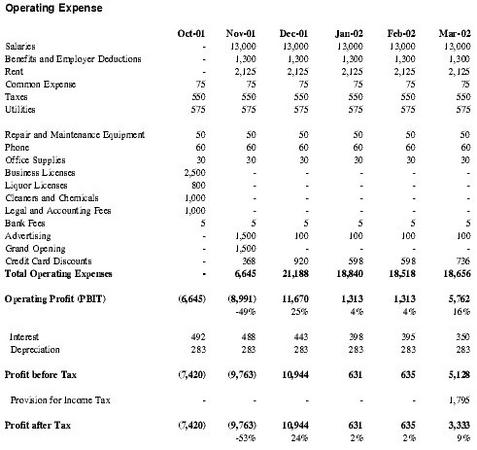

| Oct-01 | Nov-01 | Dec-01 | Jan-02 | Feb-02 | Mar-02 | |

| Salaries | - | 13,000 | 13,000 | 13,000 | 13,000 | 13,000 |

| Benefits and Employer Deductions | - | 1,300 | 1,300 | 1,300 | 1,300 | 1,300 |

| Rent | - | 2,125 | 2,125 | 2,125 | 2,125 | 2,125 |

| Common Expense | 75 | 75 | 75 | 75 | 75 | 75 |

| Taxes | 550 | 550 | 550 | 550 | 550 | 550 |

| Utilities | 575 | 575 | 575 | 575 | 575 | 575 |

| Repair and Maintenance Equipment | 50 | 50 | 50 | 50 | 50 | 50 |

| Phone | 60 | 60 | 60 | 60 | 60 | 60 |

| Office Supplies | 30 | 30 | 30 | 30 | 30 | 30 |

| Business Licenses | 2,500 | - | - | - | - | - |

| Liquor Licenses | 800 | - | - | - | - | - |

| Cleaners and Chemicals | 1,000 | - | - | - | - | - |

| Legal and Accounting Fees | 1,000 | - | - | - | - | - |

| Bank Fees | 5 | 5 | 5 | 5 | 5 | 5 |

| Advertising | - | 1,500 | 100 | 100 | 100 | 100 |

| Grand Opening | - | 1,500 | - | - | - | - |

| Credit Card Discounts | - | 368 | 920 | 598 | 598 | 736 |

| Total Operating Expenses | - | 6,645 | 21,188 | 18,840 | 18,518 | 18,656 |

| Operating Profit (PBIT) | (6,645) | (8,991) | 11,670 | 1,313 | 1,313 | 5,762 |

| -49% | 25% | 4% | 4% | 16% | ||

| Interest | 492 | 488 | 443 | 398 | 395 | 350 |

| Depreciation | 283 | 283 | 283 | 283 | 283 | 283 |

| Profit before Tax | (7,420) | (9,763) | 10,944 | 631 | 635 | 5,128 |

| Provision for Income Tax | - | - | - | - | - | 1,795 |

| Profit after Tax | (7,420) | (9,763) | 10,944 | 631 | 635 | 3,333 |

| -53% | 24% | 2% | 2% | 9% |

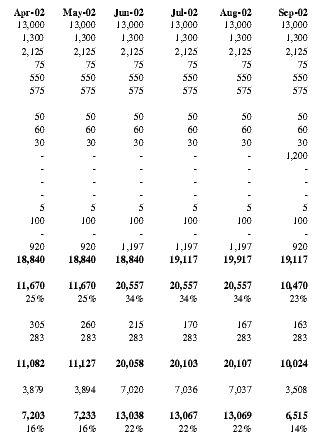

| Apr-02 | May-02 | Jun-02 | Jul-02 | Aug-02 | Sep-02 |

| 13,000 | 13,000 | 13,000 | 13,000 | 13,000 | 13,000 |

| 1,300 | 1,300 | 1,300 | 1,300 | 1,300 | 1,300 |

| 2,125 | 2,125 | 2,125 | 2,125 | 2,125 | 2,125 |

| 75 | 75 | 75 | 75 | 75 | 75 |

| 550 | 550 | 550 | 550 | 550 | 550 |

| 575 | 575 | 575 | 575 | 575 | 575 |

| 50 | 50 | 50 | 50 | 50 | 50 |

| 60 | 60 | 60 | 60 | 60 | 60 |

| 30 | 30 | 30 | 30 | 30 | 30 |

| - | - | - | - | - | 1,200 |

| - | - | - | - | - | - |

| - | - | - | - | - | - |

| - | - | - | - | - | - |

| 5 | 5 | 5 | 5 | 5 | 5 |

| 100 | 100 | 100 | 100 | 100 | 100 |

| - | - | - | - | - | - |

| 920 | 920 | 1,197 | 1,197 | 1,197 | 920 |

| 18,840 | 18,840 | 18,840 | 19,117 | 19,917 | 19,117 |

| 11,670 | 11,670 | 20,557 | 20,557 | 20,557 | 10,470 |

| 25% | 25% | 34% | 34% | 34% | 23% |

| 305 | 260 | 215 | 170 | 167 | 163 |

| 283 | 283 | 283 | 283 | 283 | 283 |

| 11,082 | 11,127 | 20,058 | 20,103 | 20,107 | 10,024 |

| 3,879 | 3,894 | 7,020 | 7,036 | 7,037 | 3,508 |

| 7,203 | 7,233 | 13,038 | 13,067 | 13,069 | 6,515 |

| 16% | 16% | 22% | 22% | 22% | 14% |

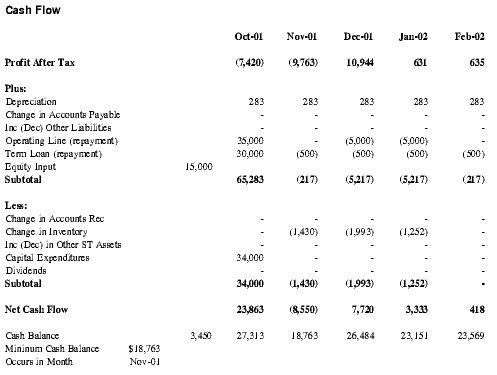

| Oct-01 | Nov-01 | Dec-01 | Jan-02 | Feb-02 | |||

| Profit After Tax | (7,420) | (9,763) | 10,944 | 631 | 635 | ||

| Plus: | |||||||

| Depreciation | 283 | 283 | 283 | 283 | 283 | ||

| Change in Accounts Payable | - | - | - | - | - | ||

| Inc (Dec) Other Liabilities | - | - | - | - | - | ||

| Operating Line (repayment) | 35,000 | - | (5,000) | (5,000) | - | ||

| Term Loan (repayment) | 30,000 | (500) | (500) | (500) | (500) | ||

| Equity Input | 15,000 | ||||||

| Subtotal | 65,283 | (217) | (5,217) | (5,217) | (217) | ||

| Less: | |||||||

| Change in Accounts Rec | - | - | - | - | - | ||

| Change in Inventory | - | (1,430) | (1,993) | (1,252) | - | ||

| Inc (Dec) in Other ST Assets | - | - | - | - | - | ||

| Capital Expenditures | 34,000 | - | - | - | - | ||

| Dividends | - | - | - | - | - | ||

| Subtotal | 34,000 | (1,430) | (1,993) | (1,252) | - | ||

| Net Cash Flow | 23,863 | (8,550) | 7,720 | 3,333 | 418 | ||

| Cash Balance | 3,450 | 27,313 | 18,763 | 26,484 | 23,151 | 23,569 | |

| Mininum Cash Balance | $18,763 | ||||||

| Occurs in Month | Nov-01 | ||||||

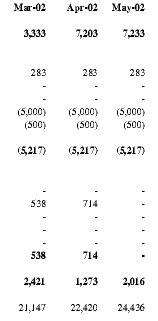

| Mar-02 | Apr-02 | May-02 | |||

| *May-Dec | |||||

| 3,333 | 7,203 | 7,233 | |||

| 283 | 283 | 283 | |||

| - | - | - | |||

| - | - | - | |||

| (5,000) | (5,000) | (5,000) | |||

| (500) | (500) | (500) | |||

| (5,217) | (5,217) | (5,217) | |||

| - | - | - | |||

| 538 | 714 | - | |||

| - | - | - | |||

| - | - | - | |||

| - | - | - | |||

| 538 | 714 | - | |||

| 2,421 | 1,273 | 2,016 | |||

| 21,147 | 22,420 | 24,436 | |||