Import/Export Store

BUSINESS PLAN CENTRAL IMPORT/EXPORT

67110 Middlebelt Road

Livonia, Michigan 48154

Central Import/Export will be a start-up wholesale distribution/retail store. This import/export business will be run by owner Ramon Juarez as a Limited Liability Company. Central sells quality products and provides excellent customer service for Mexican food and product lovers. Central will offer these products, imported directly from Mexico, to the state of Michigan.

- EXECUTIVE SUMMARY

- COMPANY SUMMARY

- PRODUCTS AND SIC CODES

- MARKET ANALYSIS SUMMARY

- STRATEGY

- IMPLEMENTATION SUMMARY

- MANAGEMENT SUMMARY

- FINANCIAL PLAN

- APPENDIX

EXECUTIVE SUMMARY

Central Import/Export will be a start-up wholesale distribution/retail store. This import/export business will be run by owner Ramon Juarez as a Limited Liability Company. Central sells quality products and provides excellent customer service for Mexican food and product lovers. Central will offer these products, imported directly from Mexico, to the state of Michigan. The business will be located at 67110 Middlebelt Road, Livonia, Michigan, and will also have an export market in Mexico that serves youth and adults. Our intent is to provide the community and state with unique Mexican food products and merchandise.

The business will be financed with $17,195 of the owner's money and $17,805 from a business loan. Starting costs are $35,000. Sales are estimated at $73,000 per year by the first year. A positive cash flow will be produced at the end of the first year.

The closest import/export business of Mexican products is in Detroit, Michigan, some 20 miles away. Livonia is an urban city of approximately 104,000 people, which is also located in Michigan containing approximately 9,295,297 people.

Objectives

Central's objectives are to:

- achieve a profit in the first year

- establish an import/export business in the city of Livonia, Michigan

- create jobs

- provide quality products and customer service at a reasonable price

- achieve the largest market share in the city for imported products

- increase average length of customer relationships and decrease customer turnover

Export Policy Commitment Statement

The mission of Central Import/Export is to provide quality products to the United States and Mexico's retail market. Our company is willing to utilize necessary resources to ensure the success of our import/export venture. Central is also committed to providing in-depth service to this market in terms of assistance in distribution, advertising, and promotion.

The overall goals are to:

- develop long-term relationships with the Mexican wholesalers and resellers

- successfully compete in the Mexican and U.S. markets

The short-term goals are to:

- secure contracts with major wholesalers in the Mexican market

- develop prosperous business relationships with these wholesalers

The long-term goal is to, within eight years:

- establish a strong market presence

- obtain a market share of 3 percent

- provide custom brokering services

The goal of Central Import/Export is to supply restaurants, gift shops, landscaping companies, and party stores with imported frozen foods and interior/exterior decorations imported from Mexico, and to sell to walk-in customers out of our retail store. We will also provide an export service from Livonia, Michigan, to Mexico, which includes packaging, delivery service, and transportation of local business goods.

Key Advantages of Exporting

Central Import/Export will play a significant role in improving the U.S. balance of trade while protecting our competitiveness and improving our profits. Entering the Mexican marketplace offers many benefits for our business, including:

- increased growth

- increased profits

- extended product/service life cycles

- increased numbers of customers

- tax advantages

- added product/service lines

- improved competitiveness

- favorable publicity and recognition

- enhance domestic competitiveness

- gain global market share

- reduce dependence on existing markets

- exploit corporate technology and know-how

- extend the sales potential of existing products

- stabilize seasonal market fluctuations

- enhance potential for corporate expansion

- sell excess production capacity

- gain information about foreign competition

COMPANY SUMMARY

The name of the business is Central Import/Export. This name was chosen to identify the company with the products and methods in which they will be sold. The name has also been registered in Wayne County. The business will be a wholesale distribution and retail store of Mexican products, frozen foods, decorations, furniture, and leather goods.

Company Ownership

Central Import/Export will be registered as a Limited Liability Company with the owner being Ramon Juarez.

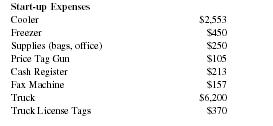

Start-up Summary

Forty-five percent of start-up costs will go to assets. Total start-up expenses (transportation costs and deposits) total $35,000. Start-up assets required include $6,000 in inventory and $9,153 in working capital. The owner's investment includes purchasing truck, equipment, and fixtures totaling $17,195. The remaining amount needed for start-up is $17,805, which Central will finance with a commercial loan.

Start-up Plan

| Start-up Expenses | |

| Cooler | $2,553 |

| Freezer | $450 |

| Supplies (bags, office) | $250 |

| Price Tag Gun | $105 |

| Cash Register | $213 |

| Fax Machine | $157 |

| Truck | $6,200 |

| Truck License Tags | $370 |

| Truck Repairs and Maintenance | $3,010 |

| Travel | $700 |

| Hauling Fees | $1,200 |

| Shelves | $550 |

| Display Cases | $200 |

| Counter | $200 |

| Rent | $2,100 |

| Permits/Registrations | $25 |

| Grand Opening | $544 |

| Consultants | $270 |

| Import Bond | $750 |

| Other | $0 |

| Total Start-up Expenses | $19,847 |

| Start-up Assets Needed | |

| Cash Requirements | $9,153 |

| Start-up inventory | $6,000 |

| Other Short-term Assets | $0 |

| Total Short-term Assets | $15,153 |

| Long-term Assets | $0 |

| Total Assets | $15,153 |

| Total Start-up Requirements: | $35,000 |

| Left to finance: | $0 |

| Start-up Funding Plan Investment | |

| Owner's Equity | $17,195 |

| Other | $0 |

| Total Investment | $17,195 |

| Short-term Liabilities | |

| Unpaid Expenses | $0 |

| Short-term Loans | $17,805 |

| Interest-free Short-term Loans | $0 |

| Subtotal Short-term Liabilities | $17,805 |

| Long-term Liabilities | $0 |

| Total Liabilities | $17,805 |

| Loss at Start-up | ($19,847) |

| Total Capital | ($2,652) |

| Total Capital and Liabilities | $15,153 |

| Checkline | $0 |

Location and Facilities

We currently lease a building/warehouse located at the corner of Schoolcraft Road and Middlebelt Road, Livonia, Michigan. Nearby is I-96, with eastbound and westbound exits. Also located in the vicinity is a medium size congregational church. The building is located in the center of Livonia's Hispanic population.

The building is approximately 640 square feet and contains an employee restroom, shelving and store fixtures, coolers, and counters. The parking is limited, but arrangements are being made to utilize adjacent parking for customer overflow.

Business Operations

This wholesale distribution and retail import/export business will have unique items imported directly from Mexico and exported directly into Mexico. The majority of these items will be hand-picked. Customers can buy food products, decorations, landscaping products, and more. The store will be open from 9:30 A.M. to 8:00 P.M. Monday thru Saturday, and 9:30 A.M. to 5:00P.M. Sundays.

We will have one full-time employee and one part-time employee. The owner's draw will be a salary of $16,632 and the part-time employee will be paid approximately $6.83 an hour. We will not be offering benefits for the first few years. Employees will maintain the building's cleanliness.

Inventory will be purchased through several vendors that include: Flores del Rio, Milagro X Guago, Chili Pepper Produce, San Juan, A.Q. MER. V., and Zentavo. We estimate our inventory to turnover 6 times a year. Starting inventory will be $6,000 with a markup of 100 percent or more.

The following are our operation policies and will be posted throughout the store:

- No cash refunds

- $25 fee for check returns

- Accepting credit cards: Visa, Mastercharge, Discover, and American Express

The owner has basic knowledge of bookkeeping and is familiar with accounting software. An accountant will be hired in the future to examine records and make recommendations.

An attorney will be retained in the future to handle legal aspects of the business.

Ramon Juarez has over 14 years of import/export experience and will be attending Schoolcraft Community College, majoring in International Trade. He is therefore technically qualified to handle the products the business will offer. Central will be aided in development by a licensed U.S. Customs Broker, Manuel Rodriguez. Central will also utilize the services of International Trade Administration of the U.S. Department of Commerce (ITA/DOC), World Trade Center Institutes, Small Business Development Centers, Global Trade Point Network, Fedworld, International Trade Law, U.S. Customs, Trade Show Central, MCB Publications, American Chamber of Commerce of Mexico, and SBA Export Small Business Development Center.

We will open our store in the month of January. We hope to capitalize on the buyers of Mexican products who normally travel to Detroit, by giving them a closer location. Opening during this time will give us the opportunity to establish new customer relationships before the peak in our spring season.

Import/Export Laws and Licensing

Central is aware of the many international laws that can affect our export activities. Five of the most prominent laws and agreements that have influenced our decisions and actions in business with Mexico are:

- Antitrust Laws

- Antiboycott Regulations

- Foreign Corrupt Practices

- World Trade Organization

- NAFTA

Central understands that all goods and services leaving the United States require some form of export licensing. By obtaining a general export license from the Export Administration Regulations (EAR), Central is essentially receiving authorization from the U.S. government to export our products.

According to exporting rules, Central will verify that our customer is not:

- on the Table of Denial Orders (TDO)

- on the list of Specially Designated Nationals (SDN)

- located in an embargoed country

- involved with the production of nuclear, chemical, or biological weapons

Central has acquired the assistance of a customs broker to manage any additional import/export issues.

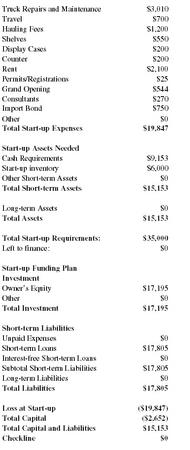

PRODUCTS & SIC CODES

Listed below is the Mexican food product line and its Standard Industry Codes:

| • candy, chewing gum, other confections | SIC 2064-2067 |

| • fats and oils | SIC 207 |

| • beverages | SIC 208 |

| • miscellaneous food and kindred products | SIC 209 |

| • snack foods | SIC Snack Food Concordance |

| • candy confectionery and chocolate products | SIC 2064-68 |

| • canned frozen and preserved fruits, veggies | SIC 203 |

| • cookies and crackers | SIC 2032 |

| • frozen food | SIC 2037, 2038 |

| • pasta | SIC 2099 |

| • snack food | SIC 2096 |

| • processed food and beverages | SIC 20 |

| • meat products | SIC 201 |

| • dairy products | SIC 202 |

| • preserved fruits and veggies | SIC 203 |

| • grain mill products | SIC 204 |

| • sugar and confectionery products | SIC 206 |

Inventory

Inventory will be controlled by indexing the products as they are brought in and as they are sold. Central's tracking system will tell the management what merchandise is in stock, what is on order, when it will arrive, and what was sold. With such a system, Central can plan purchases more intelligently and quickly recognize the fast moving items we need to reorder and the slow moving items we should mark down or specially promote.

Inventory will turn approximately 6 times a year. We will keep 25 percent of our initial inventory or $1500 worth of goods on hand at all times. For inventory valuation we will use the Last In, First Out (LIFO) method. We will sell the recently purchased inventory first. This method will help us pay less in taxes.

Suppliers will be independent craftspeople, import sources, distributors, and manufacturers. We have established a list of possible suppliers and requested quotes, prices, and available discounts. We also will ask for customer references. We will establish accounts with these suppliers prior to opening our store.

The goods to be imported into the U.S. and sold from the retail location include processed food and beverages, meat products, dairy products, preserved fruits and vegetables, sugar and confectionery products, candy, chewing gum and other confections, fats and oils, beverages, Miscellaneous food and kindred products, snack foods, decorations, furniture, and leather goods.

The goods to be export into Mexico and sold to retailers include toys, rebuilt auto parts, tennis shoes, and tools.

Pricing Methods

Central will use the cost-plus method of international pricing. Cost-plus method is based on our domestic price plus exporting costs (documentation expenses, freight charges, customs duties, and international sales and promotional costs). Any costs not applicable, such as domestic marketing costs, are subtracted. The cost-plus method allows us to maintain our domestic profit margin percentage, and thus to set a suitable price. This method does not, however, take into account local market conditions. So we continually research the local foreign market in order to maintain our competitiveness.

MARKET ANALYSIS SUMMARY

Consumer goods marketers who wonder where their growth will come from in the future should explore multicultural markets. While sizable population increases among nonwhites are a given, many marketers haven't awoken to ethnic buying-power growth.

The New America Marketbasket Index points out that household expenditures among multicultural families will grow faster than white households. The study, developed by New America Strategies Group and DemoGraph Corporation, looked at 13 different key areas of consumer spending—such as entertainment, clothing, vehicle, and home purchases—by race. It offers projections from 1995 to 1998 based on purchase behavior trends from 1992 to 1995.

The Index documents the accelerating purchasing power, financial strength, and upward mobility of African, Asian, and Hispanic American consumers by analyzing household spending, and tracks their per-household spending growth based on a weighted average of multicultural household expenditures compared to that of white households.

In 10 of the 13 categories, minorities posted stronger growth than white households. Only in restaurant expenditures, public transportation, and rent did white growth exceed that of minorities. Expenditures from multicultural households exceeded white households in five categories—groceries, entertainment, personal care products, clothing, and education.

Why the greater increases from minorities? Laura Teller, chief executive officer of Miami-based DemoGraph, attributes it to a strong economy, near full employment, and minorities having more money to spend. "A rising tide lifts all the ships," she said. "The economic expansion has more money flowing into those communities."

The study forecasts healthcare outlays and entertainment spending growing nearly three to three-and-a-half times faster in minority households compared to white families. Electric utility expenditures grew twice as fast in minority households.

"Grocery and clothing expenditures are higher due to the size of the households," Teller said, citing the fact that minorities have more family members in average households. Multicultural households also have more people contributing to the family income, especially in Hispanic homes, she added.

The study projected Asian Americans to increase average spending 17.7 percent from 1995 to 1998. African Americans were close behind at 17.6 percent, while Hispanic expenditure growth was 15.5 percent. Whites, meanwhile, spent only 13.7 percent more over the three-year period.

DemoGraph projected expenditure increases through extrapolating data from the 1995 U.S. Consumer Expenditure Survey, U.S. Center for Educational Statistics, the National Auto Dealers Association, and the Harvard Joint Center for Housing Studies. The company didn't factor out inflation since it believed that it affects all groups equally.

While some of the gains occur in smaller-ticket items, such as groceries and clothing, multicultural families tend to outspend whites in more expensive goods, such as cars and homes. Minorities plan to increase spending on vehicles by 37.2 percent, while growth for whites is about 13.4 percent between 1995 and 1998. Minorities will boost their spending on home ownership by 16.9 percent, compared to 12.4 percent for whites. The study said 40 percent of all first-time home buyers between 1995 and 1998 are multicultural consumers.

"Multicultural families are becoming part of the burgeoning middle class," Teller said. "Their first purchase is a car, and they also have a high desire to own their home."

Most of the expenditure increase from African Americans can be attributed to increased spending on clothing, entertainment, and healthcare. Hispanics are expected to have large increases in vehicle purchases, clothing, and entertainment, while gains in Asian expenditures are in restaurants, vehicles, and education. Whites spent more of their dollars in restaurants, clothes, and public transportation.

For several demographic categories, expenditures on rent are expected to decline, due to those families moving into their first homes. Spending by African Americans on rent is projected to decline 13 percent, and 20.2 percent for Hispanics. Both whites and Asian Americans plan to increase average spending for rent by 6.3 percent. African Americans are expected to decrease spending on public transportation.

"Multicultural consumers are purchasing the good life," Teller says. However, an economic recession could definitely curb spending. Teller said that while Asian Americans save more than other minorities, African Americans and Hispanics have a smaller savings and income cushion if the economy falters. "Losing jobs would be a big shock to their systems," Teller says.

The Hispanic population has grown at a steady pace for the last 20 years and is continuing to grow. The number of people buying and renovating homes and landscapes is increasing according to the Home Builders Association. Hispanics, ages 0 to 64 with an income of $15,000 and up will be targeted for Mexican food, African Americans and Anglo Americans, ages 35 to 64 with an income of $15,000 and up will be targeted for the home and garden decorations.

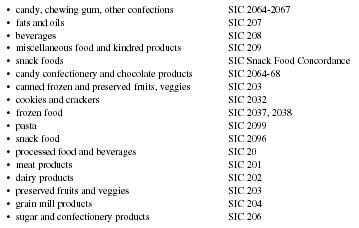

Market Segmentation

Our customers are multicultural, male and female, ages 0 to 64, employed and unemployed and live in Michigan. According to the U.S. Census Bureau, Michigan's total population is 9,295,297: 4,512,781 are male and 4,782,516 are female. 7,786,237 or 84% of Michigan residents are between the ages of 0 to 64. 18% of the Michigan residents are multicultural with 1,291,706 being African American; 55,638 being American Indian, Eskimo, or Aleut; 104,983 being Asian or Pacific Islander; 86,884 being "other"; and 201, 596 being Hispanic. Wayne County, where Central will be located, has a population of 437,349 as of July 1, 1999, which was an increase of 6,890 over the 1990 census.

According to Tradeport.org, Mexico is the most Spanish-speaking country in the world. Its population is approximately 98,552,776 (July 1998 est.): 70% of the people live in urban areas; 36% of the population is 0-14 years of age (male 17,883,007, female 17,193,082); 60% of the population is 15-64 (male 28,932,074, female 30,511,443); and 4% are 65 years and over (male 1,808,581, female 2,224,589). Population growth is approximately 1.77%.

Central has products for the entire age group, both male and female mestizos (Amerindian-Spanish) individuals. We will market our products to those individuals that make up 96 percent of Mexico's population.

| Market Analysis | |||||||

| Potential Customers | Growth | 2001 | 2002 | 2003 | 2004 | 2005 | CAGR |

| Caucasian | 1% | 7,554,490 | 7,630,035 | 7,760,335 | 7,783,398 | 7,861,232 | 1.00% |

| African Americans | 1% | 1,291,706 | 1,304,623 | 1,317,669 | 1,330,846 | 1,344,154 | 1.00% |

| American Indian, Eskimo, or Aleut | 1% | 55,638 | 56,194 | 56,756 | 57,324 | 57,897 | 1.00% |

| Hispanic | 2% | 201,596 | 205,023 | 208,508 | 212,053 | 215,658 | 1.70% |

| Asian or Pacific Islander | 1% | 104,983 | 106,033 | 107,093 | 108,164 | 109,246 | 1.00% |

| Other | 1% | 86,884 | 87,753 | 88,631 | 89,517 | 90,412 | 1.00% |

| Total | 1.02% | 9,295,297 | 9,389,661 | 9,484,992 | 9,581,302 | 9,678,599 | 1.02% |

Target Market/Export Program Strategy

To keep track of our target market growth, we have implemented the following market research program in which we will:

- Keep abreast of world events that influence the international marketplace, watch for announcements of specific projects, or simply visit likely markets. For example, a thawing of political hostilities often leads to the opening of economic channels between countries.

- Analyze trade and economic statistics. Trade statistics are generally compiled by product category and by country. These statistics provide the U.S. firm with information concerning shipments of products over specified periods of time. Demographic and general economic statistics, such as population size and makeup, per capita income, and production levels by industry can be important indicators of the market potential for a company's products.

-

Obtain advice from experts. There are several ways of obtaining this

advice:

–Contact experts at the U.S. Department of Commerce and other government agencies.

–Attend seminars, workshops, and international trade shows.

–Hire an international trade and marketing consultant.

–Talk with successful exporters of similar products.

–Contact trade and industry association staff.

Gathering and evaluating secondary market research can be complex and tedious. However, several publications are available that can help us simplify the process.

Our Export Program Strategy is simply that Central will treat our export sales no differently than its domestic sales, using existing personnel and organizational structures. As international sales and inquiries increase, then we may separate the management of our exports from that of our domestic sales.

The advantages of separating our international from domestic business include the centralization of specialized skills needed to deal with international markets and the benefits of a focused marketing effort that is more likely to increase export sales. A possible disadvantage is that segmentation might be a less efficient use of corporate resources.

When we separate international from domestic business, we may do so at different levels in the organization. For example, when Central first begins to export, we may create an export department with a full-or part-time manager who reports to the head of domestic sales and marketing. At later stages, we may choose to increase the autonomy of the export department to the point of creating an international division that reports directly to the president.

Larger companies at advanced stages of exporting may choose to retain the international division or to organize along product or geographic lines. Since Central has distinct product lines we may create an international department in each product division. A company with products that have common end users may organize geographically. For example, it may form a division for Europe and another for the Pacific Rim.

Because we are a small company, our initial needs may be satisfied by a single export manager who has responsibility for the full range of international activities. Regardless of how we organize our exporting efforts, the key is to facilitate the marketer's job. Good marketing skills will help Central operate in unfamiliar markets. Experience has shown that a company's success in foreign markets depends less on the unique attributes of its products than on its marketing methods.

Once Central is organized to handle exporting markets other than Mexico, a proper channel of distribution will be carefully chosen for each market. These channels include sales representatives, agents, distributors, retailers, and end users.

Advertising and Promotion Strategies

Advertising will be accomplished by mailing flyers to potential buyers. A newspaper ad will run announcing our Grand Opening. We will have our logo and business information printed on our delivery truck, which will be visible throughout the city. We believe flyers and word-of-mouth networking should be sufficient advertising for our product. This promotional strategy is also very inexpensive.

To build our export trade leads we will utilize the following resources:

- National Export Offer Service

- Commercial news USA

- Export Yellow Pages

- ComFind—Global Business Directory

- Network of Americas—Export Directory

To develop leads for service matchmaking we will utilize the following resources:

- Import-Export Bulletin Boards—Post buy/sell offers

- IBEX—International Business Exchange

- Free Web Trader

- Global Trade Point Network

- Global Traders Forum

- The Netsource Trade Center

- GoldSite Europe

- The Trading Floor

- Trade Compass

- Barter Worldwide, Inc.

- ITEX Barter Industry

- alt.business.import-export

- International Business Newsgroup

- Inter-American Development Bank

- African Development Bank

- Asia Development Bank

- Bidworld.com

Future forms of promotion may include trade press ads, trade shows, catalog shows, cross border buying trips, trade missions, and a website.

Industry Analysis and Trends

World trade is increasingly important to the strength of our economy and to the growth of U.S. companies. Exporting and importing creates jobs and provides small firms with growth, new markets, and additional profits.

Every billion earned in U.S. export dollars generates about 20,000 jobs. There has never been a better time for American businesses to begin exporting. As the world economy becomes more interdependent, the opportunities for small businesses become more attractive.

Exporting is booming in the United States, and small businesses are beginning to realize that the world is their market. A business does not have to be big to sell in the global marketplace. Experience shows that small businesses do export successfully. Finding your niche in the world market is similar to finding it in the U.S. market. Many of the same qualities that make small business owners successful in the United States apply to success in global markets.

- Based on 1992 data from the U.S. Department of Commerce, small firms (fewer than 500 employees) represented 95.7 percent of exporters of goods in 1992. Of the 112,854 goods exporters, 108,026 were small firms.

- By major industry, in 1992, 9.3 percent of manufacturing firms exported goods or services. Comparable figures for other industries include 8.0 percent of wholesale trade firms, 1.5 percent of retail and service firms, 1.0 percent of finance, insurance, and real estate firms, and only 0.3 percent of construction firms.

- By race or origin in 1992 the percent that exported goods or services was 2.7 percent for Hispanic-owned firms, 2.3 percent for Asian, Pacific, American Indian, or Aleut Eskimo owned firms, 1.8 percent for white-owned firms, and 0.8 percent for black-owned firms.

In 1992 Michigan had a total of 6,338 exporters and from those 1,838 had 1 to 19 employees, similar to Central.

Competition and Buying Patterns

Central will save its customers hundreds of dollars by cutting our shipping costs. We will pick up our inventory and drop off our inventory. While Central will not be the only store selling Mexican products, it will have the advantage of selling products at a lower price with a larger variety. Livonia customers no longer will have to drive to Detroit, Michigan, to purchase similar goods.

STRATEGY & IMPLEMENTATION SUMMARY

Thousands of small firms already compete in the global market. They account for 97 percent of companies involved in direct merchandise exporting, yet generate only about 30 percent of the dollar value of the nation's export sales. Small firms, then, represent the largest pool for potential growth in export sales.

Entering the Mexican market will not be difficult. The same import strategies applied in the U.S. market can be used to develop export markets. Central understands selling abroad demands hard work, perseverance, and a commitment of resources. It requires planning, market research, and attention to detail. It may also involve changes, like new packaging and metric conversion.

Central has taken the mystery out of exporting by using these fundamental elements of the exporting process:

- Analyzing the capabilities of our small business

- Knowing the export potential of our product/service

- Identifying foreign markets that are right for us

- Studying market-entry strategies and export procedures

- Learning how to process exports

We will implement our import segment of our business by e-mailing a list of goods we are interested in purchasing to our Mexican contact, Rosa Marie Juarez, located in Nuevo Laredo, Mexico. She will then purchase merchandise and our U.S. customs broker will prepare the documentation. The merchandise is then brought into the U.S. to be housed in a warehouse in Laredo, Texas. The goods will then be picked up by Ramon Juarez (who will be bringing with him items to be exported) and brought back to Michigan for distribution.

Our implementation of our export segment consists of receiving e-mail from our Mexican contact, Rosa Marie Juarez, requesting U.S. merchandise to be exported. We will then purchase the merchandise and e-mail a list of products to our customs broker for documentation. The merchandise will be transported to Laredo, Texas. We will then deliver the items to be exported and pick up items to be imported.

Competitive Edge

Our location is a very important competitive edge. The nearest import/exporter of Mexican goods is in Detroit, Michigan. There are a few local stores selling the goods such as Target, Kmart, Jason's Music Shop, and a few party stores. These stores are selling the product at a higher retail cost than Central. Central will take these stores and distribute our goods to them, saving them transportation and shipping costs.

Sales Strategy

Central will initially open as a wholesale distribution and retail store with a variety of Mexican food, and interior and exterior decorations made of brass ceramic, wrought iron, clay, and wood. After establishing ourselves as a retail import/export store, we will then begin to distribute our products to gift shops, restaurants, landscaping companies, and other retail shops selling similar products.

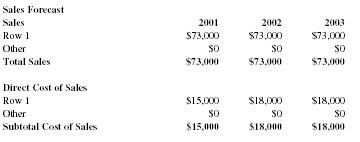

Sales Forecast

The following chart gives a rundown on forecasted sales.

| Sales Forecast | |||

| Sales | 2001 | 2002 | 2003 |

| Row 1 | $73,000 | $73,000 | $73,000 |

| Other | $0 | $0 | $0 |

| Total Sales | $73,000 | $73,000 | $73,000 |

| Direct Cost of Sales | |||

| Row 1 | $15,000 | $18,000 | $18,000 |

| Other | $0 | $0 | $0 |

| Subtotal Cost of Sales | $15,000 | $18,000 | $18,000 |

Strategic Alliances

Central has taken the time to form alliances both here, in the United States, and across the border of Mexico. Those alliances are as follows:

The United States

- Chili Pepper Produce—Distributor

- Manuel Rodriguez—Customs Broker

- U.S. Department of Commerce, International Trade Administration—Support

- World Trade Organization—Support

- National Trade Data Bank—Research

Mexico

- Rosa Marie Juarez—Buyer

- Milagro X Guago—Vendor

- Flores del Rio—Vendor

- Fontino Ltd.

- Goodrich Itda.

- Hong Kong Knitting Co. Ltd

Risks

The risks of this business are low. Items that will be imported or exported vary according to demand and there will be a pre-arrangement for purchasing and selling goods beforehand.

The difficulties the business foresees are:

- small size of the parking lot

- constant changes in import/export regulations

- cost of transporting increases with fuel increases

- transportation breakdowns

The solutions for these difficulties are to:

- work out an agreement with adjacent businesses for use of their parking area for overflow traffic

- stay informed on changes of regulations through personal research and assistance from our Customs Agent

- increase the volume of merchandise purchased and decrease number of trips made to Mexico

- keep truck on a consistent maintenance program until new truck can be purchased

The owner has injected $17,195 of the $35,000 capital needed to start the business. Therefore, 49 percent of the risk is with the owner's money. In the event of business failure it is estimated that the owner's assets and current income would produce the $17,805 needed to repay the loan.

MANAGEMENT SUMMARY

Ramon Juarez has been transporting merchandise and personal belongings to and from Michigan to Texas and Mexico as a nonprofit group for the past 14 years. He regularly visits family and friends in Mexico and has gained a good knowledge of driving time, cost, and requirements for transportation of goods. Ramon is a full-time employee as an engineer for Ford Motor Company. It is the intent of the owner to be the key manpower in starting this business. Ramon Juarez will be assisted by one part-time employee.

The complexities and dynamics of international trade are such that Ramon has found it extremely advantageous to obtain the services of a customs broker in order to facilitate the importation of goods. Ramon will also be assisted by Manuel Rodriguez, a U.S. Customs Broker. Mr. Rodriguez's operation transcends Customs, calling for contact with over 40 other government agencies such as the U.S. Department of Agriculture (USDA) on meat importation, the Environmental Protection Agency (EPA) on vehicle emission standards, or the Food and Drug Administration (FDA) on product safety. For these reasons, the services of a Customs Broker are highly recommended for Central.

Mr. Rodriguez will act as an agent for Ramon in conducting customs business on his behalf. Mr. Rodriguez will also prepare and file the necessary customs entries, arrange for the payment of duties found due, take steps to the effective release of the goods in customs custody, and represent Ramon in custody matters. Mr. Rodriguez has an excellent understanding of trade requirements and procedures and customs tariff regulations. Furthermore, Mr. Rodriguez will assist Ramon with advice on other transportation options, types of carriers, and shipping routes. Mr. Rodriguez will assist with exchange rates, appraisals, and proper classifications and duties. Mr. Rodriguez is aware of potential problems involving every entry item represented, including cargo handling. This includes all factors affecting appraisement, exchange rates, and many regulations concerning calculation of duties.

Central believes very strongly that relationships should be forthright, work should be structured with enough room for creativity, and pay should commensurate with the amount and quality work completed. No person is better than another except in ability, knowledge, and experience.

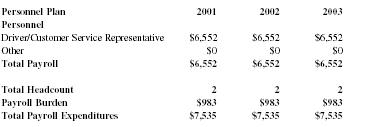

Personnel Plan

It is the intent of the owners to operate the business with one full-time employee and one part-time employee. The employees will be proficient in English and Spanish to communicate with Hispanics as well as other ethnic groups. As the business grows, a third employee will be added to conduct sales outside the Livonia area. The personnel plan is included in the following table. It shows the one part-time employee salary for driver/customer service representative and a total of two employees, one being the owner.

| Personnel Plan | 2001 | 2002 | 2003 |

| Personnel | |||

| Driver/Customer Service Representative | $6,552 | $6,552 | $6,552 |

| Other | $0 | $0 | $0 |

| Total Payroll | $6,552 | $6,552 | $6,552 |

| Total Headcount | 2 | 2 | 2 |

| Payroll Burden | $983 | $983 | $983 |

| Total Payroll Expenditures | $7,535 | $7,535 | $7,535 |

FINANCIAL PLAN

Our financial plan anticipates the following:

- Growth will be moderate, cash flows steady

- Marketing will remain below 15 percent of sales

- The company will invest residual profits into financial markets and company expansion

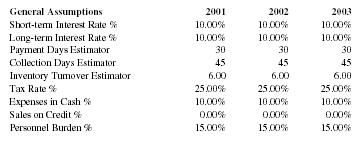

Important Assumptions

Our financial plan depends on important assumptions, most of which are shown in the following table as annual assumptions:

Some of the more important underlying assumptions are:

- We assume strong economy, both in the U.S. and Mexico

- We assume, of course, that there are no unforseen changes in the use of the product which make the need for the product obsolete.

| General Assumptions | 2001 | 2002 | 2003 |

| Short-term Interest Rate % | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate % | 10.00% | 10.00% | 10.00% |

| Payment Days Estimator | 30 | 30 | 30 |

| Collection Days Estimator | 45 | 45 | 45 |

| Inventory Turnover Estimator | 6.00 | 6.00 | 6.00 |

| Tax Rate % | 25.00% | 25.00% | 25.00% |

| Expenses in Cash % | 10.00% | 10.00% | 10.00% |

| Sales on Credit % | 0.00% | 0.00% | 0.00% |

| Personnel Burden % | 15.00% | 15.00% | 15.00% |

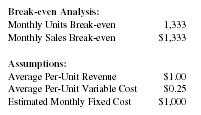

Break-even Analysis

A break-even analysis table has been completed on the basis of average per-unit revenue. With fixed costs of $3,720, we need to generate sales of at least $1,333 per month or sell approximately $50 worth of goods per day.

| Break-even Analysis: | |

| Monthly Units Break-even | 1,333 |

| Monthly Sales Break-even | $1,333 |

| Assumptions: | |

| Average Per-Unit Revenue | $1.00 |

| Average Per-Unit Variable Cost | $0.25 |

| Estimated Monthly Fixed Cost | $1,000 |

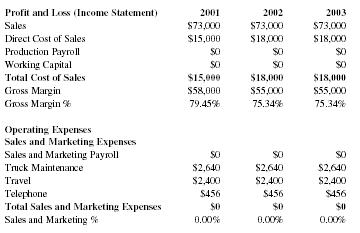

Projected Profit and Loss

Central will have a profit to sales ratio of just over 11 percent. Normally, a start-up concern will operate with negative profits through the first two years. We will avoid this kind of operating loss by knowing our competitors and our target market.

| Profit and Loss (Income Statement) | 2001 | 2002 | 2003 |

| Sales | $73,000 | $73,000 | $73,000 |

| Direct Cost of Sales | $15,000 | $18,000 | $18,000 |

| Production Payroll | $0 | $0 | $0 |

| Working Capital | $0 | $0 | $0 |

| Total Cost of Sales | $15,000 | $18,000 | $18,000 |

| Gross Margin | $58,000 | $55,000 | $55,000 |

| Gross Margin % | 79.45% | 75.34% | 75.34% |

| Operating Expenses Sales and Marketing Expenses | |||

| Sales and Marketing Payroll | $0 | $0 | $0 |

| Truck Maintenance | $2,640 | $2,640 | $2,640 |

| Travel | $2,400 | $2,400 | $2,400 |

| Telephone | $456 | $456 | $456 |

| Total Sales and Marketing Expenses | $0 | $0 | $0 |

| Sales and Marketing % | 0.00% | 0.00% | 0.00% |

| General and Administrative Expenses | |||

| General and Administrative Payroll | $0 | $0 | $0 |

| Payroll Expense | $6,552 | $6,552 | $6,552 |

| Payroll Burden | $983 | $983 | $983 |

| Depreciation | $0 | $0 | $0 |

| Truck | $4,200 | $4,200 | $4,200 |

| Utilities | $1,200 | $1,200 | $1,200 |

| Insurance | $1,332 | $1,332 | $1,332 |

| Rent | $3,600 | $3,600 | $3,600 |

| Total General and Administrative Expenses | $0 | $0 | $0 |

| General and Administrative % | 0.00% | 0.00% | 0.00% |

| Other Expenses | |||

| Other Payroll | $0 | $0 | $0 |

| Bank Loan Repayment | $3,744 | $3,744 | $3,744 |

| Owner's Withdrawals | $16,632 | $16,632 | $16,632 |

| Customs Broker | $900 | $900 | $900 |

| Total Other Expenses | $0 | $0 | $0 |

| Other % | 0.00% | 0.00% | 0.00% |

| Total Operating Expenses | $44,639 | $44,639 | $44,639 |

| Profit Before Interest and Taxes | $13,361 | $10,361 | $10,361 |

| Interest Expense Short-term | $1,781 | $1,781 | $1,781 |

| Interest Expense Long-term | $0 | $0 | $0 |

| Taxes Incurred | $2,895 | $2,145 | $2,145 |

| Extraordinary Items | $0 | $0 | $0 |

| Net Profit | $8,686 | $6,436 | $6,436 |

| Net Profit/Sales | 11.90% | 8.82% | 8.82% |

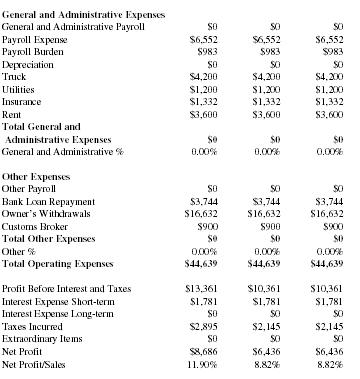

Projected Cash Flow

We are positioning ourselves in the market as a low-risk concern with steady cash flows. Accounts payable are paid at the end of each month, while sales are in cash and credit cards, giving Central excellent cash structure. Intelligent marketing will secure a cash balance of $32,072 by 2001.

| Projected Cash Flow | 2001 | 2002 | 2003 |

| Net Profit | $8,686 | $6,436 | $6,436 |

| Plus: | |||

| Depreciation | $0 | $0 | $0 |

| Change in Accounts Payable | $5,046 | ($657) | ($45) |

| Current Borrowing (repayment) | $0 | $0 | $0 |

| Increase (decrease) Other Liabilities | $0 | $0 | $0 |

| Long-term Borrowing (repayment) | $0 | $0 | $0 |

| Capital Input | $9,153 | $0 | $0 |

| Subtotal | $22,884 | $5,779 | $6,391 |

| Less: | |||

| Change in Accounts Receivable | $0 | $0 | $0 |

| Change in Inventory | $0 | $1,200 | $0 |

| Change in Other Short-term Assets | $0 | $0 | $0 |

| Capital Expenditure | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 |

| Subtotal | $0 | $1,200 | $0 |

| Net Cash Flow | $22,884 | $4,579 | $6,391 |

| Cash Balance | $32,037 | $36,616 | $43,007 |

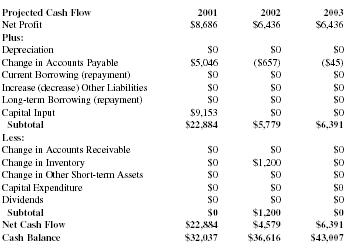

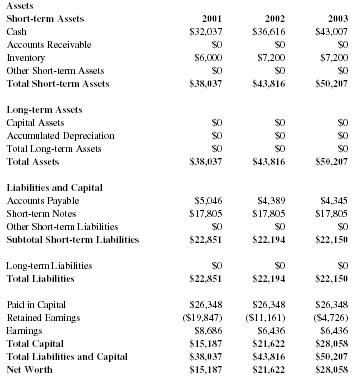

Projected Balance Sheet

All of our tables will be updated monthly to reflect past performance and future assumptions. Future assumptions will not be based on past performance, but rather on economic cycle activity, regional and international industry, strength, and future cash flow possibilities. We expect a solid growth in net worth beyond the year 2002.

| Projected Balance Sheet | |||

| Assets | |||

| Short-term Assets | 2001 | 2002 | 2003 |

| Cash | $32,037 | $36,616 | $43,007 |

| Accounts Receivable | $0 | $0 | $0 |

| Inventory | $6,000 | $7,200 | $7,200 |

| Other Short-term Assets | $0 | $0 | $0 |

| Total Short-term Assets | $38,037 | $43,816 | $50,207 |

| Long-term Assets | |||

| Capital Assets | $0 | $0 | $0 |

| Accumulated Depreciation | $0 | $0 | $0 |

| Total Long-term Assets | $0 | $0 | $0 |

| Total Assets | $38,037 | $43,816 | $50,207 |

| Liabilities and Capital | |||

| Accounts Payable | $5,046 | $4,389 | $4,345 |

| Short-term Notes | $17,805 | $17,805 | $17,805 |

| Other Short-term Liabilities | $0 | $0 | $0 |

| Subtotal Short-term Liabilities | $22,851 | $22,194 | $22,150 |

| Long-term Liabilities | $0 | $0 | $0 |

| Total Liabilities | $22,851 | $22,194 | $22,150 |

| Paid in Capital | $26,348 | $26,348 | $26,348 |

| Retained Earnings | ($19,847) | ($11,161) | ($4,726) |

| Earnings | $8,686 | $6,436 | $6,436 |

| Total Capital | $15,187 | $21,622 | $28,058 |

| Total Liabilities and Capital | $38,037 | $43,816 | $50,207 |

| Net Worth | $15,187 | $21,622 | $28,058 |

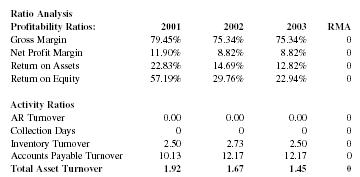

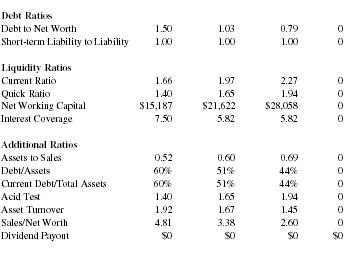

Business Ratios

The following table shows the projected ratios. We expect to maintain healthy ratios for profitability, risk, and return.

| Ratio Analysis | ||||

| Profitability Ratios: | 2001 | 2002 | 2003 | RMA |

| Gross Margin | 79.45% | 75.34% | 75.34% | 0 |

| Net Profit Margin | 11.90% | 8.82% | 8.82% | 0 |

| Return on Assets | 22.83% | 14.69% | 12.82% | 0 |

| Return on Equity | 57.19% | 29.76% | 22.94% | 0 |

| Activity Ratios | ||||

| AR Turnover | 0.00 | 0.00 | 0.00 | 0 |

| Collection Days | 0 | 0 | 0 | 0 |

| Inventory Turnover | 2.50 | 2.73 | 2.50 | 0 |

| Accounts Payable Turnover | 10.13 | 12.17 | 12.17 | 0 |

| Total Asset Turnover | 1.92 | 1.67 | 1.45 | 0 |

| Debt Ratios | ||||

| Debt to Net Worth | 1.50 | 1.03 | 0.79 | 0 |

| Short-term Liability to Liability | 1.00 | 1.00 | 1.00 | 0 |

| Liquidity Ratios | ||||

| Current Ratio | 1.66 | 1.97 | 2.27 | 0 |

| Quick Ratio | 1.40 | 1.65 | 1.94 | 0 |

| Net Working Capital | $15,187 | $21,622 | $28,058 | 0 |

| Interest Coverage | 7.50 | 5.82 | 5.82 | 0 |

| Additional Ratios | ||||

| Assets to Sales | 0.52 | 0.60 | 0.69 | 0 |

| Debt/Assets | 60% | 51% | 44% | 0 |

| Current Debt/Total Assets | 60% | 51% | 44% | 0 |

| Acid Test | 1.40 | 1.65 | 1.94 | 0 |

| Asset Turnover | 1.92 | 1.67 | 1.45 | 0 |

| Sales/Net Worth | 4.81 | 3.38 | 2.60 | 0 |

| Dividend Payout | $0 | $0 | $0 | $0 |

This page left intentionally blank to accommodate tabular matter following.

APPENDIX

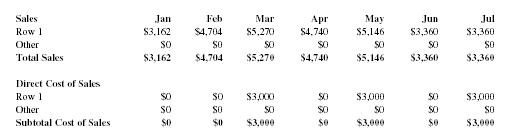

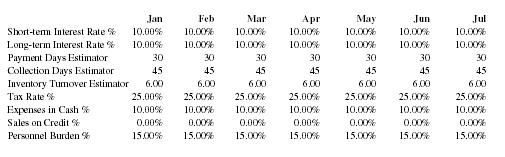

Sales Forecast

| Sales | Jan | Feb | Mar | Apr | May | Jun | Jul |

| Row 1 | $3,162 | $4,704 | $5,270 | $4,740 | $5,146 | $3,360 | $3,360 |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Sales | $3,162 | $4,704 | $5,270 | $4,740 | $5,146 | $3,360 | $3,360 |

| Direct Cost of Sales | |||||||

| Row 1 | $0 | $0 | $3,000 | $0 | $3,000 | $0 | $3,000 |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Cost of Sales | $0 | $0 | $3,000 | $0 | $3,000 | $0 | $3,000 |

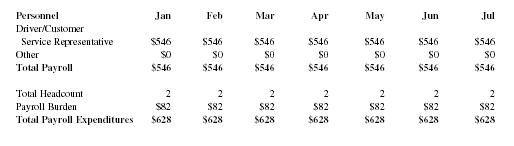

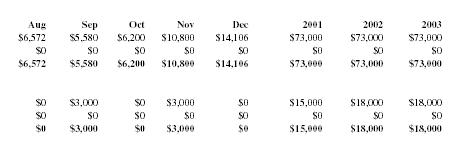

Personnel Plan

| Personnel | Jan | Feb | Mar | Apr | May | Jun | Jul |

| Driver/Customer Service Representative | $546 | $546 | $546 | $546 | $546 | $546 | $546 |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Payroll | $546 | $546 | $546 | $546 | $546 | $546 | $546 |

| Total Headcount | 2 | 2 | 2 | 2 | 2 | 2 | 2 |

| Payroll Burden | $82 | $82 | $82 | $82 | $82 | $82 | $82 |

| Total Payroll Expenditures | $628 | $628 | $628 | $628 | $628 | $628 | $628 |

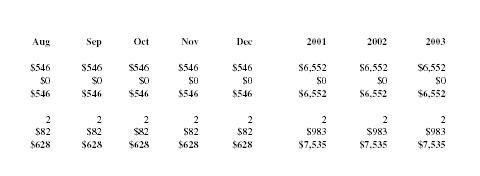

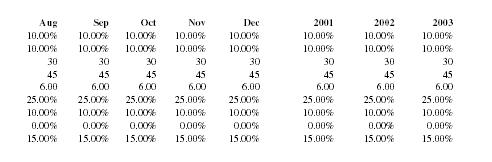

General Assumption

| Jan | Feb | Mar | Apr | May | Jun | Jul | |

| Short-term Interest Rate % | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate % | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% |

| Payment Days Estimator | 30 | 30 | 30 | 30 | 30 | 30 | 30 |

| Collection Days Estimator | 45 | 45 | 45 | 45 | 45 | 45 | 45 |

| Inventory Turnover Estimator | 6.00 | 6.00 | 6.00 | 6.00 | 6.00 | 6.00 | 6.00 |

| Tax Rate % | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% |

| Expenses in Cash % | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% |

| Sales on Credit % | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Personnel Burden % | 15.00% | 15.00% | 15.00% | 15.00% | 15.00% | 15.00% | 15.00% |

| Aug | Sep | Oct | Nov | Dec | 2001 | 2002 | 2003 |

| $6,572 | $5,580 | $6,200 | $10,800 | $14,106 | $73,000 | $73,000 | $73,000 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $6,572 | $5,580 | $6,200 | $10,800 | $14,106 | $73,000 | $73,000 | $73,000 |

| $0 | $3,000 | $0 | $3,000 | $0 | $15,000 | $18,000 | $18,000 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $0 | $3,000 | $0 | $3,000 | $0 | $15,000 | $18,000 | $18,000 |

| Aug | Sep | Oct | Nov | Dec | 2001 | 2002 | 2003 |

| $546 | $546 | $546 | $546 | $546 | $6,552 | $6,552 | $6,552 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $546 | $546 | $546 | $546 | $546 | $6,552 | $6,552 | $6,552 |

| 2 | 22 | 2 | 2 | 2 | 2 | 2 | |

| $82 | $82 | $82 | $82 | $82 | $983 | $983 | $983 |

| $628 | $628 | $628 | $628 | $628 | $7,535 | $7,535 | $7,535 |

| Aug | Sep | Oct | Nov | Dec | 2001 | 2002 | 2003 |

| 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% |

| 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% |

| 30 | 30 | 30 | 30 | 30 | 30 | 30 | 30 |

| 45 | 45 | 45 | 45 | 45 | 45 | 45 | 45 |

| 6.00 | 6.00 | 6.00 | 6.00 | 6.00 | 6.00 | 6.00 | 6.00 |

| 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% | 25.00% |

| 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% |

| 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| 15.00% | 15.00% | 15.00% | 15.00% | 15.00% | 15.00% | 15.00% | 15.00% |

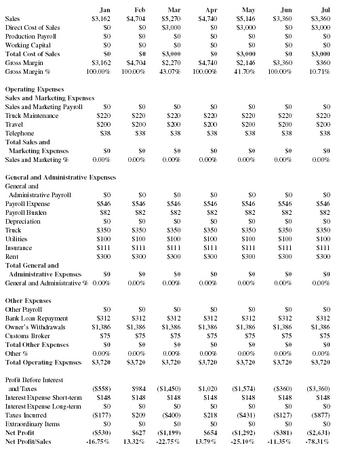

Profit and Loss (Income Statment)

| Jan | Feb | Mar | Apr | May | Jun | Jul | |

| Sales | $3,162 | $4,704 | $5,270 | $4,740 | $5,146 | $3,360 | $3,360 |

| Direct Cost of Sales | $0 | $0 | $3,000 | $0 | $3,000 | $0 | $3,000 |

| Production Payroll | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Working Capital | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Cost of Sales | $0 | $0 | $3,000 | $0 | $3,000 | $0 | $3,000 |

| Gross Margin | $3,162 | $4,704 | $2,270 | $4,740 | $2,146 | $3,360 | $360 |

| Gross Margin % | 100.00% | 100.00% | 43.07% | 100.00% | 41.70% | 100.00% | 10.71% |

| Operating Expenses | |||||||

| Sales and Marketing Expenses | |||||||

| Sales and Marketing Payroll | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Truck Maintenance | $220 | $220 | $220 | $220 | $220 | $220 | $220 |

| Travel | $200 | $200 | $200 | $200 | $200 | $200 | $200 |

| Telephone | $38 | $38 | $38 | $38 | $38 | $38 | $38 |

| Total Sales and Marketing Expenses | $0 $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales and Marketing % | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| General and Administrative Expenses | |||||||

| General and Administrative Payroll | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Payroll Expense | $546 | $546 | $546 | $546 | $546 | $546 | $546 |

| Payroll Burden | $82 | $82 | $82 | $82 | $82 | $82 | $82 |

| Depreciation | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Truck | $350 | $350 | $350 | $350 | $350 | $350 | $350 |

| Utilities | $100 | $100 | $100 | $100 | $100 | $100 | $100 |

| Insurance | $111 | $111 | $111 | $111 | $111 | $111 | $111 |

| Rent | $300 | $300 | $300 | $300 | $300 | $300 | $300 |

| Total General and Administrative Expenses | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| General and Administrative % | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Other Expenses | |||||||

| Other Payroll | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Bank Loan Repayment | $312 | $312 | $312 | $312 | $312 | $312 | $312 |

| Owner's Withdrawals | $1,386 | $1,386 | $1,386 | $1,386 | $1,386 | $1,386 | $1,386 |

| Customs Broker | $75 | $75 | $75 | $75 | $75 | $75 | $75 |

| Total Other Expenses | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Other % | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Total Operating Expenses | $3,720 | $3,720 | $3,720 | $3,720 | $3,720 | $3,720 | $3,720 |

| Profit Before Interest and Taxes | ($558) | $984 | ($1,450) | $1,020 | ($1,574) | ($360) | ($3,360) |

| Interest Expense Short-term | $148 | $148 | $148 | $148 | $148 | $148 | $148 |

| Interest Expense Long-term | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Taxes Incurred | ($177) | $209 | ($400) | $218 | ($431) | ($127) | ($877) |

| Extraordinary Items | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Net Profit | ($530) | $627 | ($1,199) | $654 | ($1,292) | ($381) | ($2,631) |

| Net Profit/Sales | -16.75% | 13.32% | -22.75% | 13.79% | -25.10% | -11.35% | -78.31% |

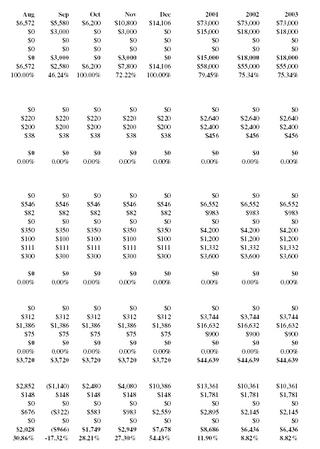

| Aug | Sep | Oct | Nov | Dec | 2001 | 2002 | 2003 |

| $6,572 | $5,580 | $6,200 | $10,800 | $14,106 | $73,000 | $73,000 | $73,000 |

| $0 | $3,000 | $0 | $3,000 | $0 | $15,000 | $18,000 | $18,000 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $0 | $3,000 | $0 | $3,000 | $0 | $15,000 | $18,000 | $18,000 |

| $6,572 | $2,580 | $6,200 | $7,800 | $14,106 | $58,000 | $55,000 | $55,000 |

| 100.00% | 46.24% | 100.00% | 72.22% | 100.00% | 79.45% | 75.34% | 75.34% |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $220 | $220 | $220 | $220 | $220 | $2,640 | $2,640 | $2,640 |

| $200 | $200 | $200 | $200 | $200 | $2,400 | $2,400 | $2,400 |

| $38 | $38 | $38 | $38 | $38 | $456 | $456 | $456 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $546 | $546 | $546 | $546 | $546 | $6,552 | $6,552 | $6,552 |

| $82 | $82 | $82 | $82 | $82 | $983 | $983 | $983 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $350 | $350 | $350 | $350 | $350 | $4,200 | $4,200 | $4,200 |

| $100 | $100 | $100 | $100 | $100 | $1,200 | $1,200 | $1,200 |

| $111 | $111 | $111 | $111 | $111 | $1,332 | $1,332 | $1,332 |

| $300 | $300 | $300 | $300 | $300 | $3,600 | $3,600 | $3,600 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $312 | $312 | $312 | $312 | $312 | $3,744 | $3,744 | $3,744 |

| $1,386 | $1,386 | $1,386 | $1,386 | $1,386 | $16,632 | $16,632 | $16,632 |

| $75 | $75 | $75 | $75 | $75 | $900 | $900 | $900 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| $3,720 | $3,720 | $3,720 | $3,720 | $3,720 | $44,639 | $44,639 | $44,639 |

| $2,852 | ($1,140) | $2,480 | $4,080 | $10,386 | $13,361 | $10,361 | $10,361 |

| $148 | $148 | $148 | $148 | $148 | $1,781 | $1,781 | $1,781 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $676 | ($322) | $583 | $983 | $2,559 | $2,895 | $2,145 | $2,145 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $2,028 | ($966) | $1,749 | $2,949 | $7,678 | $8,686 | $6,436 | $6,436 |

| 30.86% | -17.32% | 28.21% | 27.30% | 54.43% | 11.90% | 8.82% | 8.82% |

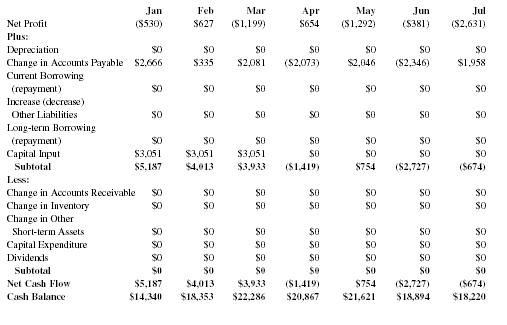

Projected Cash Flow

| Jan | Feb | Mar | Apr | May | Jun | Jul | |

| Net Profit | ($530) | $627 | ($1,199) | $654 | ($1,292) | ($381) | ($2,631) |

| Plus: | |||||||

| Depreciation | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Change in Accounts Payable | $2,666 | $335 | $2,081 | ($2,073) | $2,046 | ($2,346) | $1,958 |

| Current Borrowing (repayment) | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Increase (decrease) Other Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Long-term Borrowing (repayment) | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Capital Input | $3,051 | $3,051 | $3,051 | $0 | $0 | $0 | $0 |

| Subtotal | $5,187 | $4,013 | $3,933 | ($1,419) | $754 | ($2,727) | ($674) |

| Less: | |||||||

| Change in Accounts Receivable | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Change in Inventory | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Change in Other Short-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Capital Expenditure | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Dividends | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Net Cash Flow | $5,187 | $4,013 | $3,933 | ($1,419) | $754 | ($2,727) | ($674) |

| Cash Balance | $14,340 | $18,353 | $22,286 | $20,867 | $21,621 | $18,894 | $18,220 |

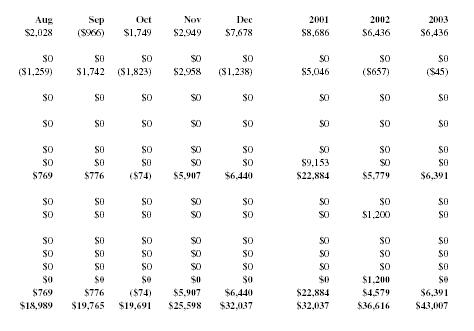

| Aug | Sep | Oct | Nov | Dec | 2001 | 2002 | 2003 |

| $2,028 | ($966) | $1,749 | $2,949 | $7,678 | $8,686 | $6,436 | $6,436 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| ($1,259) | $1,742 | ($1,823) | $2,958 | ($1,238) | $5,046 | ($657) | ($45) |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $0 | $0 | $0 | $0 | $0 | $9,153 | $0 | $0 |

| $769 | $776 | ($74) | $5,907 | $6,440 | $22,884 | $5,779 | $6,391 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $0 | $0 | $0 | $0 | $0 | $0 | $1,200 | $0 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $0 | $0 | $0 | $0 | $0 | $0 | $1,200 | $0 |

| $769 | $776 | ($74) | $5,907 | $6,440 | $22,884 | $4,579 | $6,391 |

| $18,989 | $19,765 | $19,691 | $25,598 | $32,037 | $32,037 | $36,616 | $43,007 |

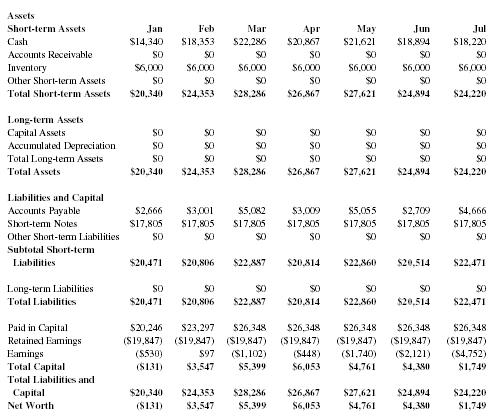

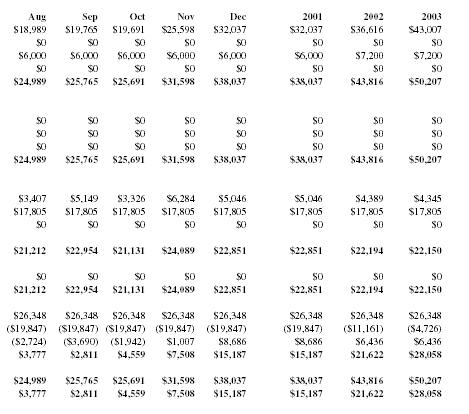

Projected Balance Sheet

| Assets | |||||||

| Short-term Assets | Jan | Feb | Mar | Apr | May | Jun | Jul |

| Cash | $14,340 | $18,353 | $22,286 | $20,867 | $21,621 | $18,894 | $18,220 |

| Accounts Receivable | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Inventory | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 |

| Other Short-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Short-term Assets | $20,340 | $24,353 | $28,286 | $26,867 | $27,621 | $24,894 | $24,220 |

| Long-term Assets | |||||||

| Capital Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Accumulated Depreciation | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Assets | $20,340 | $24,353 | $28,286 | $26,867 | $27,621 | $24,894 | $24,220 |

| Liabilities and Capital | |||||||

| Accounts Payable | $2,666 | $3,001 | $5,082 | $3,009 | $5,055 | $2,709 | $4,666 |

| Short-term Notes | $17,805 | $17,805 | $17,805 | $17,805 | $17,805 | $17,805 | $17,805 |

| Other Short-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Subtotal Short-term Liabilities | $20,471 | $20,806 | $22,887 | $20,814 | $22,860 | $20,514 | $22,471 |

| Long-term Liabilities | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Liabilities | $20,471 | $20,806 | $22,887 | $20,814 | $22,860 | $20,514 | $22,471 |

| Paid in Capital | $20,246 | $23,297 | $26,348 | $26,348 | $26,348 | $26,348 | $26,348 |

| Retained Earnings | ($19,847) | ($19,847) | ($19,847) | ($19,847) | ($19,847) | ($19,847) | ($19,847) |

| Earnings | ($530) | $97 | ($1,102) | ($448) | ($1,740) | ($2,121) | ($4,752) |

| Total Capital | ($131) | $3,547 | $5,399 | $6,053 | $4,761 | $4,380 | $1,749 |

| Total Liabilities and Capital | $20,340 | $24,353 | $28,286 | $26,867 | $27,621 | $24,894 | $24,220 |

| Net Worth | ($131) | $3,547 | $5,399 | $6,053 | $4,761 | $4,380 | $1,749 |

| Aug | Sep | Oct | Nov | Dec | 2001 | 2002 | 2003 |

| $18,989 | $19,765 | $19,691 | $25,598 | $32,037 | $32,037 | $36,616 | $43,007 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | $7,200 | $7,200 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $24,989 | $25,765 | $25,691 | $31,598 | $38,037 | $38,037 | $43,816 | $50,207 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $24,989 | $25,765 | $25,691 | $31,598 | $38,037 | $38,037 | $43,816 | $50,207 |

| $3,407 | $5,149 | $3,326 | $6,284 | $5,046 | $5,046 | $4,389 | $4,345 |

| $17,805 | $17,805 | $17,805 | $17,805 | $17,805 | $17,805 | $17,805 | $17,805 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $21,212 | $22,954 | $21,131 | $24,089 | $22,851 | $22,851 | $22,194 | $22,150 |

| $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| $21,212 | $22,954 | $21,131 | $24,089 | $22,851 | $22,851 | $22,194 | $22,150 |

| $26,348 | $26,348 | $26,348 | $26,348 | $26,348 | $26,348 | $26,348 | $26,348 |

| ($19,847) | ($19,847) | ($19,847) | ($19,847) | ($19,847) | ($19,847) | ($11,161) | ($4,726) |

| ($2,724) | ($3,690) | ($1,942) | $1,007 | $8,686 | $8,686 | $6,436 | $6,436 |

| $3,777 | $2,811 | $4,559 | $7,508 | $15,187 | $15,187 | $21,622 | $28,058 |

| $24,989 | $25,765 | $25,691 | $31,598 | $38,037 | $38,037 | $43,816 | $50,207 |

| $3,777 | $2,811 | $4,559 | $7,508 | $15,187 | $15,187 | $21,622 | $28,058 |