Golf Grip Manufacturer

BUSINESS PLAN

PROGRIP

P.O. Box 4567

Atlanta, Georgia 30314

ProGrip's mission is to develop and actively seek out innovative and advanced technologies that can be marketed and sold to the approximately $150 billion global wholesale sporting goods industry, to become a premier provider of quality and unique athletic products, and to establish a strong reputation for offering creative solutions to the needs of athletes and sports enthusiasts.

- EXECUTIVE SUMMARY

- COMPANY OVERVIEW

- MARKET OPPORTUNITY

- COMPETITIVE ANALYSIS

- PRODUCT & POSITIONING

- MARKETING STRATEGY

- MANUFACTURING & DISTRIBUTION

- MANAGEMENT

- THE OFFERING

EXECUTIVE SUMMARY

The Opportunity

ProGrip develops and actively seeks out innovative and advanced technologies that are marketed and sold to the $150 billion global wholesale sporting goods market. Its first line of products, the Impress golf grip line, provides an elegant design that solves the serious and unmet problems a golfer experiences when his or her club makes impact with the ball (or the ground). Specifically, the revolutionary design that ProGrip exclusively owns significantly reduces harmful shock and vibration for the user while preserving the "feel" of the club. For the approximately 27 million U.S. golfers, this results in greater comfort and swing control, a reduction in the risk of repetitive stress injuries, less fatigue, and more rounds of golf played for more years. As a community, golfers are extremely passionate about the sport and are very receptive to innovative technologies that promise to improve their performance or enjoyment of the game. The Impress grip provides a level performance that meets or exceeds that provided by other anti-vibration devices and, in addition, provides many other advantages, including customization, a greater degree of style selectivity and durability, and easy, noninvasive installation.

This is a unique and superior investment opportunity for the following reasons:

- Large, Established, and Identifiable Market. 26.7 million Americans currently play golf (66 million worldwide). Approximately 51 percent of U.S. players are "core" golfers, accounting for 88 percent of the 586 million rounds of golf played annually. Of this core segment, over 46 percent are "avid" golfers, defined as those who annually play at least 25 rounds. Although avid golfers comprise the smallest player segment (25%), they account for over 50 percent of all golf-related spending. ProGrip will initially be targeting this core golfer segment, with particular focus paid to avid golfers.

- Expected Market Growth. This market is expected to grow due to increasing interest from nontraditional golfers (i.e., juniors and women) and two population trends 1) the aging of Baby Boomers, and 2) the emergence of the Echo Boom generation (those born between 1977 and 1995).

- Frequency of Golf Injuries. 87 percent of golfers reporting golf-related injuries suffer from maladies of the hand, wrist, or elbow. Many of these injuries are caused by harmful shock and vibration and may be prevented with the appropriate equipment—such as the proper grip.

- Proven Need for a Vibration Solution. In a random sample of over 150 golfers, 73 percent of respondents claimed that shock and vibration reduced both their enjoyment and performance of the game. Of those golfers using anti-vibration devices, 75 percent to 98 percent feel that the devices are not effective. Only 7 percent of golfers claimed that their grips are effective at reducing shock and vibration.

- Underserved Market. The vast majority of research and development to date has focused only on the club head and the shaft. The third part of the club, the grip, has been virtually ignored and has undergone very little change or innovation.

- Technology-Focused Consumers. The rapid evolution of technology in the golf equipment industry accelerates the rate at which golfers purchase new clubs and other equipment, and it has also created a market that is very accepting of new technologies. 83 percent of respondents in our survey said they are interested in a new anti-vibration grip technology.

- Proven Science Behind the Product. The Impress grip design is a descendant of a hammer grip technology that decreases repetitive stress injuries and fatigue as well as increases productivity of its users. That technology is currently the basis for several premium hammers on the market that are generating over $30 million of annual sales. Dr. Dennis Williams, a plasma-physicist, the Chief Scientist for Atlanta-based SuperTech, Inc., and a minority shareholder of ProGrip, developed both the hammer and golf grip technologies.

- Disruptive Technology. In a survey conducted by the company, the Impress grip was rated up to 87 percent better than two competing grips in all observed categories. 96 percent rated it to be equal or superior in performance to the Comfort grip made by Baker/GolfLife, currently the market leader in golf grips.

- Relationship with Golfworld International. After trying a prototype of the Impress grip, Golfworld CEO John Danko provided ProGrip with valuable resources for its product and market research and pledged to publish a paper on the Impress grip design in Golfworld Magazine , the industry's largest technical journal with over 125,000 subscribers.

- Initial Seed Funding Secured. ProGrip has received a $100,000 funding commitment from the PGOT CORP® Ludington Fund, Ltd. Additionally, to date the shareholders of the company have personally invested over $15,000 towards the venture.

- Mitigated Risks. ProGrip has researched the market, operational, and product risks associated with the Impress grip and has taken many steps to mitigate them, including conducting extensive market and product surveys, building a strong Board of Advisors, and establishing important relationships with such firms as Freightways, Golfworld, Morgan Field & Rice, Advance Elastic Corporation, Jones & Puch, Calypso, and Dow Chemical. Each of these firms is a leader in its respective market. These steps, as well as others that will be implemented, will help to insure the long-term success of the company and an attractive financial return for ProGrip's shareholders.

Product and Benefits

The revolutionary new design of ProGrip's premium golf grips—the Impress grip line—has several unique advantages over other products currently on the market, including:

- Effectiveness —The Impress grip was rated 87 percent more effective than a standard grip at reducing shock and vibration while maintaining the balance and "feel" of the club and control of the swing.

- Versatility —The ability to create an anti-vibration grip with conventional manufacturing methods, using any commercially viable materials, and for any type of club (graphite or steel, wood or iron).

- Convenience —The grip is noninvasive to the club and it is installed like other slip-on grips.

- Value —While the Impress grip will be priced at a premium to most other golf grips, it offers consumers a less expensive alternative to other (non-grip) anti-vibration solutions. Consumer research shows that golfers are willing to pay a premium price for the benefits offered by the Impress grip.

- Customization —ProGrip introduces a new concept in grip design—Precise Shock Reduction (PSR). Golfers can now select a grip with the degree of anti-vibration quality that best suits their game, setting a new standard in customization that will precisely meet the needs of individual golfers.

The Market

ProGrip's primary market for the Impress golf grip is the approximately 35 million core golfers worldwide (13.7 million in the U.S.), who purchase grips through original equipment manufacturers (OEMs), distributors, mail-order houses, golf pro shops, and specialty golf retailers. In 2000, worldwide golf grip sales represented approximately $350 million. While the golf equipment market as a whole has contracted since 1997, the golf grip market has exhibited moderate growth due to golfers delaying new club purchases and instead purchasing grips in the aftermarket (the re-grip market) to replace older and worn grips on existing clubs.

In addition to the golf grip technology, ProGrip is in negotiations with Georgia State University to license a related grip technology developed by Dr. Williams that can be utilized for other sports instruments such as baseball bats and tennis racquets. These and other potential uses for the technology are expected to bring the total worldwide market for the Impress grip to over $500 million and represent approximately $43 million in sales for ProGrip by 2006. Beyond that, ProGrip will continue to acquire and develop innovative solutions for athletes and sports enthusiasts in the $150 billion global sports equipment market.

Competitive Strategy/Barriers to Entry

Due to the extremely competitive nature of the golf equipment market, ProGrip recognizes the vital need to create sustainable competitive advantages. This will be accomplished through the following:

- Securing intellectual property protection for the company's proprietary technology and trademarks.

- Outsourcing all phases of manufacturing, warehousing, and distribution to maintain flexibility in design and production, eliminate the need for extensive fixed assets, and leverage excess capacity.

- Bringing aggressive and innovative sales and marketing techniques to the mature and conservative golf grip market, thereby quickly establishing the ProGrip and Impress grip brands as well as building a sense of community among ProGrip's customers.

- Rapid rollout of new technology-based sports and leisure products into profitable markets.

Financial Summary and Offering

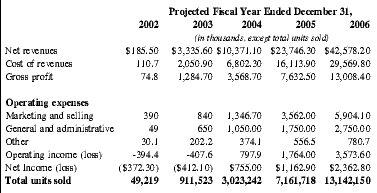

Set forth below is a summary of our projected financial information. The summary financial projections for the years ended December 31, 2002 through 2006 were derived from our financial projections.

| Projected Fiscal Year Ended December 31, | |||||

| 2002 | 2003 | 2004 | 2005 | 2006 | |

| (in thousands, except total units sold) | |||||

| Net revenues | $185.50 | $3,335.60 | $10,371.10 | $23,746.30 | $42,578.20 |

| Cost of revenues | 110.7 | 2,050.90 | 6,802.30 | 16,113.90 | 29,569.80 |

| Gross profit | 74.8 | 1,284.70 | 3,568.70 | 7,632.50 | 13,008.40 |

| Operating expenses | |||||

| Marketing and selling | 390 | 840 | 1,346.70 | 3,562.00 | 5,904.10 |

| General and administrative | 49 | 650 | 1,050.00 | 1,750.00 | 2,750.00 |

| Other | 30.1 | 202.2 | 374.1 | 556.5 | 780.7 |

| Operating income (loss) | -394.4 | -407.6 | 797.9 | 1,764.00 | 3,573.60 |

| Net Income (loss) | ($372.30) | ($412.10) | $755.00 | $1,162.90 | $2,362.80 |

| Total units sold | 49,219 | 911,523 | 3,023,242 | 7,161,718 | 13,142,150 |

As a result of ProGrip's unique technology and the attractiveness of the golf grip market, the company will reach positive cash flow in fiscal year 2004. ProGrip is seeking $750,000 in capital commitments to fund the company's initial launch. In return, the investor(s) will receive ownership of ProGrip in the form of preferred stock with a very attractive projected return on his or her original investment in five years. This return will be realized most likely from an acquisition of ProGrip by a large sports equipment company or through an IPO.

COMPANY OVERVIEW

Background

The revolutionary design for the Impress grip was developed by Dr. Dennis Williams, Ph.D., a plasma-physicist and the Chief Scientist for an Atlanta-based nanotechnology firm. While working on his doctorate, Dr. Williams became intrigued with the idea of developing a hammer that could actually hit harder. Based upon this research, he developed a radical new grip design that significantly reduces the shock and vibration felt in the hand, wrist, and elbow from impact with a target, thereby reducing fatigue and repetitive stress disorders. Simultaneously, the technology allows the hammer to provide greater momentum transfer. That is, it "hits harder" than before. By simultaneously decreasing the shock and vibration felt by the user and increasing the momentum transfer, the user experiences a significant increase in productivity and comfort. In addition, the grips can be incorporated into existing products with standard, commercially accepted materials, utilize conventional manufacturing methods, and look and feel like an ordinary hammer grip. This technology is owned by Georgia State University and is the basis for several premium hammers currently on the market that are generating over an estimated $30 million in annual revenues. Since a hammer is, in essence, simply an elongated impact instrument, Dr. Williams then sought similar uses for his radical new design.

The Company

ProGrip owns a derivative technology from the one developed by Dr. Williams for hammers that the company has applied to golf clubs. The company's first product, the Impress line of premium golf grips, has a revolutionary design that significantly reduces shock and vibration to the user while maintaining a level of performance that equals or exceeds that of existing products. The company will offer a variety of custom shock-absorbing models, all of which will feature several advantages over existing grips in the market. Our grips will initially be sold to distributors, as well as mail-order houses, golf pro shops, and specialty golf retailers that serve those golfers seeking to replace grips that have become worn and slick due to prolonged use. After gaining sufficient market acceptance, ProGrip grips will be sold to original equipment manufacturers (OEMs) for installation onto new clubs (woods, irons, and putters) and club sets.

ProGrip's mission is to develop and actively seek out innovative and advanced technologies that can be marketed and sold to the approximately $150 billion global wholesale sporting goods industry, to become a premier provider of quality and unique athletic products, and to establish a strong reputation for offering creative solutions to the needs of athletes and sports enthusiasts.

The company's short-term growth strategy is to:

- Initially focus primarily on the re-grip market for golf grips and on selected OEMs. While the re-grip market represents only about one-half of volume sales, it provides the greatest profit margins for manufacturers. Flynt Grips, a reputable brand, successfully used the strategy of focusing on this market for its launch in 1996. In addition, the largest OEMs such as Allegra will not use new suppliers until there is sufficient demand present in the marketplace. Therefore, ProGrip will focus initially on smaller OEMs such as Golf Authority and those focused on the women and junior markets, such as ProWomen Golf and Premier Golf.

- Rapidly build its share of the golf club grip market by leveraging its unique technology. The golf market is very accepting of new technologies and core golfers are especially eager for innovative products. In many cases a golf product's "mystique," such as the following among men for the Lady Precept MC golf ball, can lead to phenomenal success. In less than one year, the Lady Precept MC went from a cult product in Alabama to the #2 selling golf ball in the United States, with over a 6 percent share of the retail market. ProGrip will focus on the advanced design of its Impress grip and its unique benefits in all product marketing and initially build word-of-mouth through proven, as well as innovative, grass roots efforts.

- Introduce new golf grip designs and models that best meet the needs of golfers. ProGrip must quickly expand its golf product line to meet the needs of a very diverse customer base. Golf is a game that is played by both men and women and by a variety of age groups. In fact, women and juniors are golf's fastest growing segments. The flexibility of the Impress grip technology provides the company with a number of product design choices that can be marketed to specific golfer segments.

- Implement innovative marketing techniques to build consumer awareness and acceptance. Building demand is vital for getting initial orders from distributors and OEMs. The golf grip market is a mature one and historically very conservative. The company will utilize marketing techniques that will differentiate the company and the Impress grip from the competition.

- Expand its relationship with Golfworld International. Golfworld is based in Atlanta, Georgia and is the world's largest direct marketer and superstore retailer of golf equipment. The company founded the golf component industry in 1967 and since then has grown to become the leading retailer worldwide of all major brands of golf equipment. In addition, Golfworld mails over 13 million catalogues annually. Golfworld's CEO, Mr. John Danko, has tried the Impress grip and expressed his support for both the technology and the company.

ProGrip's long-term growth strategy is to:

- Build a strong brand in the sports market that represents quality, performance, and innovation. A strong reputation in the sports equipment industry will not only help the company seek out additional technologies, but also enter new sports segments.

- Strongly pursue the junior, women, and senior sports markets with products specific to them and their preferences. These markets have been the fastest growing segments since 1986. In addition, these market segments should derive the most benefit from an anti-vibration sports technology. Seniors suffer more from ailments such as arthritis that are compounded by harmful shock and vibration and women suffer greater incidences of elbow ailments than do male golfers.

- Develop new product designs based on our current technology that can be applied to other sports markets. The company will leverage its experience with golf grips to expand its Impress line of grips to other sports markets such as baseball and tennis. These products will be important additions to the company's product lines.

- Develop new solutions for athletes and sports enthusiasts. ProGrip will expand its portfolio of technologies and broaden its product mix within the broader sports equipment industry. Developing or acquiring new products will provide ProGrip with its long-term growth.

- Expand the company's sales internationally. Golf, baseball, and tennis are each sports with large numbers of enthusiasts overseas. Some of the largest markets for sports apart from the U.S., and that the company will target, include: Canada, France, Germany, Japan, and Mexico.

Current Status

First, ProGrip competed in the Atlanta PGOT CORP® Competition on December 6, 2001, and was voted First Runner-Up by a panel of distinguished venture capitalists and business leaders. Subsequently, the PGOT CORP® Ludington Fund, Ltd. announced its commitment to make a $100,000 investment in ProGrip, pending completion of the requisite documentation. The decision to make an investment in two competitors instead of just the first place team is unique for the PGOT CORP® Competition and was prompted by the Funds' confidence in ProGrip's business plan and management team.

Second, ProGrip has formalized its relationship with Dr. Williams, the inventor of the technology behind the Impress grip. In exchange for a 17.5 percent equity ownership in the company, a $7,500 note with a five-year term, and a seat on ProGrip's board of directors, Dr. Williams has agreed to sell all rights to the golf grip technology to ProGrip. In addition, Dr. Williams will provide his services to the company as needed to insure ProGrip's growth and ultimate success. These services include, but are not limited to, designing and creating an advanced prototype of the Impress grip, speaking with potential customers and investors, designing grips and equipment for other sports uses, and other advice and support as may be needed.

Third, ProGrip is in negotiations with Georgia State University to license a related hammer grip technology that Dr. Williams developed. This technology provides many of the same advantages as the Impress grip with the added benefit that it can provide greater momentum transfer; that is, the sports implement can actually hit harder. This technology has a patent filed in 1997 that is currently pending, although several of the major claims have been allowed as of February 2002, and covers the original hammer grip design as well as designs for similar grips that can be used on baseball bats and tennis racquets, as well as possibly other as yet undefined uses. This derivative technology will provide the company with valuable future products that will help ensure its long-term growth. The design for the golf grip is sufficiently different from the hammer design such that ownership did not fall to Georgia State University but to Dr. Williams directly, and now to ProGrip.

Fourth, ProGrip and Dr. Williams are working closely with Joseph Murphy, an engineer with SportsCreate LLC, on creating a number of revolutionary designs for the Impress grip. Several issues are being considered in choosing the most appropriate designs, including anti-vibration effectiveness, versatility, manufacturing practicality, cost, comfort, durability, and distinctiveness. Mr. Murphy is formerly the Director of Engineering and a 9-year veteran of Cutting Edge, an Atlanta-based professional design firm with such distinguished clients as Adidas, Boeing, Cingular, Dell, General Motors, Hewlett Packard, Shell, Sprint, and Sun. These designs will be used in creating advanced prototypes with which we can conduct additional product research and testing manufacturing methods.

Fifth, ProGrip secured its membership with the Golf Clubcraft Association and will join other organizations that will contribute to the company's success, including the Golf Merchandisers Association, the National Golf Foundation (NGF), and the United States Golf Association (USGA).

ProGrip has clearly identified an attractive opportunity with its innovative golf grip design. Accordingly, we are taking the necessary next steps to bring the company's product to market, including:

- Securing protection for our intellectual property.

- Conducting additional product and market research, including focus groups.

- Identifying and establishing relationships with potential customers.

- Creating marketing materials and campaigns.

- Securing additional financing.

MARKET OPPORTUNITY

Overview

In a market survey conducted by ProGrip, more than one-third of respondents claimed they had suffered a golf-related injury, and 87 percent of those suffered maladies of the hand, wrist, or elbow. Medial Epicondylitis ("Golfer's Elbow") and injuries to the hand and wrist are often associated with repetitive shock and vibration. In addition to contributing to injuries, the shock and vibration associated with striking the ball or ground can detract from a golfer's enjoyment of the game. In fact, 73 percent of respondents said that shock and vibration detracted from their enjoyment and performance of the game. Using appropriate equipment, such as an effective anti-vibration grip, can reduce the likelihood of injury, increase enjoyment of the game, and enhance a golfer's performance.

The rapid evolution of technology in the golf equipment industry accelerates the rate at which golfers purchase new clubs and other equipment, and it has also created a market that is very accepting of new technologies. Although there are three parts to every golf club (the head, the shaft, and the grip), the vast majority of research and development and innovation have focused on the head and the shaft. However, 94 percent of golfers surveyed stated that their grips play an important role in their enjoyment of the game. In terms of innovation that has occurred in the grip market, manufacturers have offered simple, materials-based products (such as the Flynt grip) instead of focusing on design solutions. Anti-shock products that do currently exist are frequently expensive, invasive to the club, add weight, or not particularly effective. In support of this, 87 percent of golfers surveyed indicated their interest in a new anti-shock grip design and only 7 percent claimed that their grips are effective at reducing shock and vibration. To address this underserved market, ProGrip's Impress grip contains an innovative, proprietary design that affordably solves the problem of harmful shock and vibration, that can improve sports health, that increases overall performance, and that enhances a golfer's enjoyment of the game.

Market Size and Segmentation

For true lovers of the game, golf is not simply a sport—it's an obsession. In the U.S., 26.7 million golfers—including more than one of every six adults—currently play golf. Approximately 51 percent are considered core golfers, and nearly half of this core segment are avid golfers, defined as those who annually play at least 25 rounds. In addition, there are an estimated 2.9 million golfers between the ages of 5-17, a segment that plays more rounds of golf (and will continue to play for years to come) than the average adult golfer.

Golf Participation in the U.S.

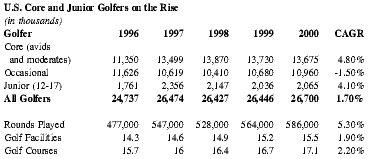

Due to the large size of the market and the wild popularity of the sport, golfers are a closely researched and clearly identifiable group. The following information illustrates some summary statistics regarding golf participation in the U.S. in 2000, as published by the National Golf Foundation.

| U.S. Core and Junior Golfers on the Rise | ||||||

| (in thousands) | ||||||

| Golfer | 1996 | 1997 | 1998 | 1999 | 2000 | CAGR |

| Core (avids and moderates) | 11,350 | 13,499 | 13,870 | 13,730 | 13,675 | 4.80% |

| Occasional | 11,626 | 10,619 | 10,410 | 10,680 | 10,960 | -1.50% |

| Junior (12-17) | 1,761 | 2,356 | 2,147 | 2,036 | 2,065 | 4.10% |

| All Golfers | 24,737 | 26,474 | 26,427 | 26,446 | 26,700 | 1.70% |

| Rounds Played | 477,000 | 547,000 | 528,000 | 564,000 | 586,000 | 5.30% |

| Golf Facilities | 14.3 | 14.6 | 14.9 | 15.2 | 15.5 | 1.90% |

| Golf Courses | 15.7 | 16 | 16.4 | 16.7 | 17.1 | 2.20% |

We are encouraged by the dramatic increase in the number of core golfers—that is, those golfers aged 18 and above who play eight or more rounds per year. The core golfer segment has shown tremendous growth over the last five years, increasing by over 20 percent, or at a compound annual rate of 4.8 percent. Of this core segment, over 46 percent are "avid" golfers, defined as those who annually play at least 25 rounds. Although avid golfers comprise the smallest player segment (25%), they account for over 50 percent of all golf-related spending.

We are also encouraged by the rapid growth in the number of total rounds played by golfers annually. The more rounds a golfer plays, the more rapidly his or her golf grip will suffer excessive wear and, ultimately, the more frequently he or she will have to re-grip.

With 87 percent of the core segment male, and with over two-thirds of the households earning $50,000 or more, core golfers represent an attractive, and demographically identifiable, primary target market. ProGrip will initially be targeting this core golfer segment, with particular focus paid to avid golfers. The segment is educated, committed to the game, and informed regarding trends in golf technology. However, despite the core golfers' financial wherewithal, many have recently been delaying the purchase of new golf clubs and other equipment, preferring instead to preserve their current set of clubs. Therefore, golfers have been re-gripping their clubs at a higher rate, leading to a 5 percent growth in grip sales despite a contraction in the overall golf equipment industry. Thus, the timing is ideal for an innovative and lower-priced anti-vibration solution such as the Impress grip.

Future growth in the industry will be fueled by two trends, 1) increasing interest from nontraditional golfers, and 2) shifting population trends. We point out the consistently high number of new players of golf each year. Attracting roughly 2.2 million new golfers annually, the sport has witnessed resurgence in popularity. Young, exciting, and successful personalities like Tiger Woods and Sergio Garcia, and international grudge matches like the Ryder Cup, have helped give rise to tremendous interest and participation in golf. According to the NGF, the total number of Junior golfers increased by over 4 percent per annum in the past five years. In addition, the successes of the Ladies Professional Golf Association (the "LPGA") Tour and such female golfers as Annika Sorenstam of Sweden have increased the appeal of the sport to women. These markets are expected to be particularly receptive to the comfort and athletic health benefits of ProGrip's Impress grip.

More than most other sports, golf stands to benefit from upcoming favorable demographic trends. In particular, over the next several years: 1) the aging of Baby Boomers (those born between 1946 and 1964) and 2) the emergence of the Echo Boom generation (those born between 1977 and 1995) will impact the sport of golf. As golfers age, they tend to play golf more often and spend more money on the sport, particularly in the over-50 age group. In addition, they become more health conscious and become more susceptible to such ailments as arthritis. Accordingly, because a majority of Baby Boomers are entering their 40s and 50s, the company expects interest in and spending on golf to increase along with a greater need for golf products that provide greater comfort in addition to performance enhancement. Further, because Echo Boomers are beginning to enter their 20s, the age most golfers begin to play the sport, the company believes they will further increase their participation in and spending on golf.

The Golf Grip Industry

Every time a golfer buys a new club, he or she buys a new golf grip installed on the club. In addition, golfers purchase replacement grips for their clubs as the original grips age or become worn from use. According to ProGrip's survey, golfers re-grip their clubs on average every six months to a year. Annually, golfers spend approximately $22 billion on equipment and fees in the U.S. Global golf grip sales are estimated to be $350 million, of which $140 million represents grip sales in the U.S. Roughly two-thirds of grip sales are to OEMs with the remainder being sold in the aftermarket for club re-grips. Golfers typically pay between $1.50 and $5.50 per club to re-grip them, exclusive of labor, and golfers carry on average 12 clubs in his or her bag.

Market Research

In addition to secondary research from a variety of sources, ProGrip conducted two primary research studies to ascertain golfers' needs and preferences, reactions to the Impress grip, and purchase intentions. The studies included a golf grip market survey involving 151 respondents and comparative consumer trials of 30 golfers.

Market Survey

ProGrip administered a market survey to 151 golfers. The survey was administered at two Golfworld stores in Atlanta, Georgia. The sample is considered representative of the core market segment for golf equipment and accessories. (See "Demographics" below.) Respondents were asked a series of 42 questions to determine demographics, skill level, golf-related injuries, equipment usage and satisfaction, preferred characteristics, and price sensitivity. The data was manually entered into a spreadsheet and analyzed with statistical software. Following is a summary of the analysils.

Demographics

89 percent of respondents were male, 11 percent were female. The median household income was between $60K and $80K, with 18 percent representing the less than $40K segment and roughly 17 percent representing the greater than $125K segment. Nearly 63 percent of respondents were between the ages of 30 and 60. 15.2 percent rated themselves beginners, 51 percent as intermediate, 32.5 percent as advanced, and 1.3 percent as professional. The demographics correspond to those of the target core golfer segment.

Golfers Who Re-grip

79.5 percent of respondents said they re-grip their clubs every two years or more frequently. 52.3 percent said they re-grip annually, and 14.6 percent said they re-grip their clubs every 6 months.

Effect of Shock and Role of Grips

73.3 percent of all respondents claimed that shock and vibration detracted from their enjoyment of the game. Additionally, 72.5 percent of all respondents claimed that shock and vibration reduced their performance. 94 percent of all respondents claimed that their golf grips played an important role in their enjoyment of the game, and 72 percent of those claimed the role was very important.

Anti-Vibration Equipment Effectiveness and Awareness

59 percent of respondents have tried gloves to reduce shock and vibration, but only 31 percent of those who have used gloves say they were effective at reducing shock and vibration. Of those who have used shaft inserts (33.8% of the sample), only one-third said they were effective in reducing shock. Nearly half of respondents have used graphite shafts, but only about half of those claimed they were effective at reducing shock and vibration. Oversized clubs were used by 41.1 percent of respondents, with about 44 percent of the users claiming effectiveness in shock reduction. Finally, of those who have tried grips currently on the market that claim to reduce vibration (22.5% of the sample), less than one-third of them said they were effective. Of those who were aware of anti-vibration grips currently on the market, less than half (47%) identified the Flynt grip as an anti-vibration grip, 11 percent identified Mercury, 5 percent identified GolfLife, and 5 percent identified Plex. (Figures do not add up to 100 because some respondents did not identify a specific brand of grip.)

Price Sensitivity and Purchase Intent

Currently, golfers in the target segment claimed to spend $6.22 per club, on average, to re-grip their clubs. The same segment claimed they were willing to pay, on average, $4.44 for a new anti-vibration grip. The difference between current spending and willingness to pay is due to 1) respondents' reluctance to admit a higher willingness to pay, and 2) to labor costs associated with re-gripping for those in the sample who do not re-grip their own clubs. Adjusting for labor costs and percentages of those who did not re-grip themselves, a new anti-shock grip priced at $4.79 would be priced attractively for the target segment.

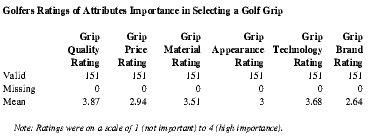

Ranking of Golf Grip Attributes Used in Purchase Decision

The survey asked respondents to rate the importance of six attributes of golf grips: quality, price, material, appearance, technology, and brand. The results in the table below indicate the most significant discriminator is product quality. Product technology, however, was the second most significant attribute. Material, appearance, price, and brand were rated third through sixth, respectively. The results suggest flexibility in pricing and brand with respect to product quality and technology. (In other words, golfers would pay more for a high quality product that uses the latest technology and would readily switch brands.)

| Golfers Ratings of Attributes Importance in Selecting a Golf Grip | ||||||

| Grip Quality Rating | Grip Price Rating | Grip Material Rating | Grip Appearance Rating | Grip Technology Rating | Grip Brand Rating | |

| Note: Ratings were on a scale of 1 (not important) to 4 (high importance). | ||||||

| Valid | 151 | 151 | 151 | 151 | 151 | 151 |

| Missing | 0 | 0 | 0 | 0 | 0 | 0 |

| Mean | 3.87 | 2.94 | 3.51 | 3 | 3.68 | 2.64 |

Consumer Trials

ProGrip administered a controlled trial to 30 golfers at the driving range located at Golfworld's corporate headquarters in Atlanta, Georgia. The trial consisted of each golfer taking as many swings as he or she liked with each of three golf clubs. The clubs were identical with the exception of the grip. The grips included a standard Lee grip, a GolfLife Comfort grip (a comfort grip also identified as an "anti-shock" grip by market survey respondents), and the prototype Impress grip. Upon completion of the trial, each golfer was asked to complete a comparative survey of several observed attributes, and to add comments with respect to the ProGrip grip.

Descriptive Statistics

The Impress grip outperformed the standard grip (Lee) and the anti-vibration grip (GolfLife) decisively in all areas. In terms of comfort, the ProGrip grip scored an average 4.62 on a scale of 1 to 6. The score was 20 percent higher than the GolfLife anti-vibration grip and 58 percent higher than the Lee standard grip. The Impress grip scored 4.39 for control, 21 percent higher than GolfLife and 39 percent higher than Lee. A score of 4.66 on performance was 23 percent higher than GolfLife and 45 percent higher than Lee. In terms of preference, the Impress grip scored 4.61, which was 23 percent higher than GolfLife's score and 54 percent higher than Lee. Most telling was the rating for shock reduction: ProGrip's score of 4.93 was 31 percent higher than GolfLife and 87 percent higher than Lee.

COMPETITIVE ANALYSIS

Overview

The golf equipment industry is highly competitive. There are numerous companies competing in various segments of the golf equipment markets including those which manufacture and sell golf grips to OEMs as a component of new clubs, and alternatively to retailers. Retail grips are, in turn, sold to golfers who need to replace old or worn grips. Some of the company's competitors have greater brand name recognition, more extensive engineering, manufacturing and marketing capabilities, and greater financial, technological, and personnel resources than the company. ProGrip will be competing primarily on the basis of product quality, product specifications and design, on-time deliveries, customer relationships, price, and brand name recognition.

The golf industry is generally characterized by rapid and widespread imitation of popular technologies, designs, and product concepts. ProGrip may face competition from manufacturers introducing new or innovative products or successfully promoting golf grips that achieve market acceptance. Therefore, in order to compete effectively in the long-term, ProGrip must continue introducing innovative products and designs, differentiate itself in the marketplace, and create lasting competitive advantages.

Competition

ProGrip competes with a number of established golf grip manufacturers. The company's primary competitors include Baker/GolfLife and GolfMax, with estimated worldwide market shares of 56 percent and 20 percent, respectively, and who dominate the larger OEM firms such as Allegra and Made Well. In addition, there are at least a dozen smaller golf grip manufacturers that primarily sell into the re-grip market. Of these, ProGrip will be primarily competing against Van Grips and Flynt Grips, since each boasts products with anti-vibration qualities. Finally, ProGrip will be competing against other, non-grip, anti-vibration solutions currently on the market, including oversized club heads, graphite shafts, and Atlas's Ultra product. However, despite the fiercely competitive nature of the market, ProGrip is confident, based upon the success of Flynt Grips, that its Impress line of premium golf grips can gain significant market acceptance.

Established in 1977, Flynt Incorporated entered the sports equipment industry as a maker of tennis racquet strings. The company's technological advances in string filaments propelled Flynt to its position as one of the leading suppliers of quality tennis racquet strings in the world. In the 1980s, Flynt revolutionized the tennis grip market, replacing leather grips with a synthetic grip made from a proprietary polymer called Elastom ETM®, resulting in 20 U.S. and foreign patents.

In 1996, Flynt entered the golf industry with a line of golf grips made with Elastom ETM®. Initially, the company penetrated the golf industry as an aftermarket product for golf club re-gripping. As a result of the distinctive feel and slip-resistance of the grip, as well as its purported anti-vibration qualities, Flynt quickly made inroads with major golf club manufacturers and now serves as one of the preferred OEMs for golf grips. Flynt's success has also led to widespread imitation among the larger manufacturers. Flynt currently commands the highest premium price in the marketplace for its grips, with standard grip prices ranging from $2.95 to $5.50, with higher prices for putter grips.

The Impress grip, being a design innovation rather than merely a change to the materials of the grip, provides a number of advantages over any other grip currently in the market, and it has several compelling advantages over other anti-vibration solutions. In addition, ProGrip can utilize standard manufacturing methods in the production of its Impress grips. These advantages, combined with the innovative sales and marketing techniques that the company plans to utilize, will help insure ProGrip's success in the golf grip market.

PRODUCT & POSITIONING

Product Summary

ProGrip owns a revolutionary golf grip that significantly reduces the shock and vibration that results from striking the ball or the ground. The grip has been designed to dissipate the pattern of vibration specific to golf clubs before it reaches the hand, as opposed to dampening the vibration between the grip and the hand. The ultimate effect is a preservation of the "feel" of the club and the sense of control, while reducing injuries and stress that can result from profound continuous impacts. The sections below explain the various grips that will be offered and how they will be positioned in the market.

The Impress Grip

The physical principles and behavior of the Impress grip are identical to the anti-vibration grip developed for hammers by Dr. Williams, although the design takes on a different form. The Impress grip uses the physical structure and properties of the club shaft to absorb specific frequency vibrations within the grip itself, while still transferring other frequencies so that the "feel" of the club is not sacrificed. This design-based solution to shock and vibration provides a number of distinct advantages over other products, including:

- A significant reduction of harmful shock and vibration felt by a golfer. In the trial tests for the Impress grip, golfers found it reduced shock and vibration 87 percent more than standard grips.

- The ability to create an anti-vibration grip with conventional manufacturing methods, using any commercially viable materials, and for any type of club (graphite or steel, wood or iron). This will provide flexibility in manufacturing and help keep costs to a minimum. This benefit also expands our market beyond a single type of club—Ultra is only used with steel shafts.

- The grip is nondestructive and noninvasive to the club, and it is installed like any other grip. The Ultra product requires the use or purchase of steel shafts. Other solutions introduce additional devices onto the club.

- A significant decrease in cost to the consumer from many other nongrip anti-vibration solutions. The Ultra product costs over 3 times more than a premium golf grip. Oversized club heads are even more expensive.

- An introduction of a completely new concept to the grip market, Precise Shock Reduction (PSR). This refers to ProGrip's ability to manufacture grips that have anti-shock qualities of varying degrees, customizable to suit the particular grip characteristics desired by a diverse market.

These improvements strongly differentiate the Impress grip from its competition. The Impress grip simply makes golf more enjoyable for the average player. Since the Impress grip works on all clubs and is installed in a normal fashion, it may address both the OEM and re-grip markets.

The innovative design of the Impress grip allows the company to manufacture and offer the product with a wide range of materials without losing its anti-vibration qualities. Golfers prefer grips with a distinctive set of features, including: size, texture, comfort, materials, durability, and tackiness. ProGrip's grip technology is extremely versatile and will allow the company to offer products that best meet the specific needs of golfers.

The company intends to provide consumers with the concept of Precise Shock Reduction (PSR), an option that is available to golfers only with the ProGrip grip. With PSR, players will have the ability to choose a grip with the level of vibration absorption that best suits their needs, in the size and style of grip that they prefer. Specifically, for men and women, standard size grips will be initially available as well as a men's mid-size grip, with the golfer's choice of three levels of PSR. A total of 18 SKUs will be introduced initially, at an average retail price of $5.00. Eventually, men's jumbo and women's mid-size grips will be introduced, increasing the total number of SKU's to 30. By comparison, Flynt has 54 SKUs, of which 37 are non-putter grips, and GolfMax reports a total of 64 models.

Positioning

The Impress grip will be positioned as a premium product competing with standard and high-end grip products in the re-grip market, and later in the OEM market. ProGrip's various product offerings will be promoted as high performance grips based on a revolutionary design that significantly reduces shock and vibration, has a comfortable feel, mitigates the risks of sports-related injuries, and that can improve a player's performance and enjoyment of the game. ProGrip is currently in the process of developing unique looking designs for the Impress grip and also choosing the most appropriate materials with which to make the grip that will provide a unique feel and a high degree of durability. The company will always maintain itself as a provider of premium products that innovatively meets the needs of its customers.

MARKETING STRATEGY

Strategic Overview

Beyond product development, ProGrip creates value primarily through the marketing stage. (Manufacturing and distribution will be outsourced.) Building demand plays a central role to the acceptance of the Impress grip in the marketplace and the success of the company. Retailers and OEMs will not purchase component products without demonstrated demand from the market, and golfers will not be motivated to switch brands unless they are convinced of the benefits of a new product. Therefore, ProGrip will pursue grass roots, traditional, and innovative marketing and sales strategies to aggressively build acceptance of and demand for its premium line of Impress grips. Based on a careful review of other standard and premium grips and of other anti-vibration devices, ProGrip will price its Impress line at a premium. Market data indicate a high willingness to pay a premium for innovative products—particularly for grips, which are relatively low-priced compared to golf clubs and their other components.

Build Regional Demand

ProGrip will concentrate building demand in the top ten states in the country with the most number of golfers age twelve and higher. In descending order, those states are: California, New York, Pennsylvania, Michigan, Illinois, Ohio, Georgia, Florida, Wisconsin, and Minnesota.

The company will then expand its focus to include selected markets within other states and offer the Impress grip nationwide by late 2003. The company will eventually expand sales globally and intends to enter into joint venture agreements with foreign distributors and retailers of golf equipment, starting with Japan and the UK.

Channel Selection (Market/Distribution/Retail)

Half of all golf grip sales are made through the re-grip market—to golfers who put new grips on existing clubs. The other half are sold to OEMs who install the grips as components of new clubs. ProGrip's strategy involves first penetrating the re-grip market and then gradually entering the OEM market. The sequential approach is favored for two reasons. First, the re-grip market offers higher margins. Second, the OEM market is a difficult market for new products to enter. Consumer demand created in the golf equipment components market (i.e., grips, heads, shafts) is what typically drives OEM club manufacturers to eventually offer new product components on their clubs. Additionally, Flynt (a relative newcomer to golf grips) used the sequential strategy to introduce its line of golf grips in 1996 and has since established itself as a reputable brand. Allegra, a major golf OEM, now installs Flynt grips on some of its clubs.

Initial channels include those distributors and retailers who cater to the re-grip market. ProGrip will pursue relations with over 400 retailers and distributors of golf equipment nationwide, concentrating on those doing business in the ten key states that have the most golfers. The intent is to develop strong relationships similar to the one ProGrip currently has and continues to build with Golfworld. Winning the support of retailers' sales forces and teaching pros who influence consumer decisions will be vital, and that support will come through their understanding of the benefits of the Impress grip. To accomplish this, ProGrip will teach distributors and retailers, their sales forces, and teaching pros the benefits of the Impress grip through a training video, product demonstrations, and sales representatives. (The video and product demos will also be used for promotion to consumers.) Finally, ProGrip will keep our retail and distribution partners informed of our marketing campaigns and promotions to ensure they are familiar with the demand levels we generate.

Private Label

ProGrip will explore opportunities to enter into private label agreements with major retailers in the U.S. such as Golfworld and Winners. Golfworld has already expressed interest in such a venture.

Promotion

In the golf equipment industry in general and the re-grip market in particular, it is extremely important to build product demand at a grass roots level in order to gain user acceptance. This is because golfers' purchase decisions are heavily influenced by the advice of friends, pro shop sales agents, and local teaching professionals, as well as through the emulation of golf professionals who succeed while using particular products. To build a "buzz" around the Impress grip, ProGrip has developed and will implement grass roots and viral marketing tactics concentrated in the ten key golf states. Such tactics include traditional approaches like buying print and broadcast ads, publishing articles on the Impress technology in influential journals, developing relations with local pros and teaching them about our product, distributing our training video, direct mailing, conducting product demonstrations at prominent and well-visited driving ranges, golf courses, and country clubs, and finally seeking pro usage on prominent tours. ProGrip will also employ innovative approaches to promote understanding of importance of re-gripping one's clubs and to build customer loyalty to the Impress grip. Two such approaches are "Re-Grip Day" and the "ProGrip Community." After initial market penetration, the company will pursue top-tier pro endorsement, broadcast sponsorship, and additional co-branding opportunities.

Print Promotions

The company will pursue editorial coverage and advertisements in golf and trade publications as well as general consumer magazines and newspapers worldwide. These include Golf Digest, Golf Magazine, Sports Illustrated, the Wall Street Journal, and USA Today . The cost of a full-page advertisement in Golf Digest and Golf Week are $60,000 and $17,500 respectively. Additionally, the company will use other media to convey the benefits of the technology to key industry influencers. For example, Golfworld CEO John Danko offered to publish an article on the Impress technology in Golfworld's Clubcraft magazine, the largest technical journal in the trade with a nationwide subscriber base of 125,000. Readership includes respected and influential equipment specialists and sales representatives.

Broadcast Promotions

The company intends to utilize 30 and 60-second direct television commercials on national stations such as ESPN and the Golf Channel as well as radio advertising, once the brand gains a foothold with core golfers. Advertising will include a series of innovative commercials to run during major golf tournaments and other golf-related programs.

Use of Impress by Professionals

The company will win support from local teaching professionals who are key opinion leaders in their respective golfing communities through leveraging existing relationships between ProGrip and several key industry contacts. ProGrip industry contacts include manufacturers and distributors (e.g., GolfSmith, Golf Authority, and Head), golf courses (Myrtle Beach, Cedar Grove in Atlanta, and the Atlanta Country Club), and acquaintances of PGA members such as Ben Crenshaw and Tom Kite. ProGrip will seek wide-ranging use of the Impress grip from many second-tier pro golfers. The company also considers the Buy.com Tour (formerly the Nike Tour) and the PGA Senior Tour as the two best opportunities for Impress grip trial by top-tier pros. Pro usage of a golf product (second tier and top tier) can spur extremely effective word-of-mouth marketing in the golf equipment industry.

Re-Grip Day

ProGrip will host "Re-Grip Day" at major corporate campuses and office complexes. Golfers will be encouraged to bring in their clubs to have them re-gripped by ProGrip representatives at our portable workshops. A short video loop will provide useful information, and representatives will help golfers select the right grips for their clubs. Golfers can learn how to perform the relatively easy task of re-gripping their own clubs, or they can simply drop off their clubs and return later to pick them up with the new Impress grips installed.

The ProGrip Community

Golfers who express interest in or purchase one of the company's products will receive informational newsletters on golf issues related to technology, performance, and health, and they will receive ProGrip promotional offers. This will be part of ProGrip's campaign aimed at building and maintaining a community following. The company has already developed a database of hundreds of potential customers, which continues to grow. The information was collected from market research and includes contact information as well as demographic and behavioral data.

Sponsorship

Sponsorship of selected golf tournaments and the Golf Channel's weekly instructional program, "Living Room Lessons" as well as other golf-related events with wide exposure would serve to build continued brand recognition among the golf community.

Co-Branding Opportunities

ProGrip has already initiated discussions with Walt Disney Corporation for the licensed use of certain of its copyrighted characters on its grips marketed for junior golfers. In addition, the company will seek to license characters from the Cartoon Channel and Nickelodeon, two media brands popular among young people.

PGA Golfer Endorsement

Formal endorsements from top-tier golf professionals are an important strategy for golf products to gain acceptance from amateur golfers, although the expense necessitates demonstrated acceptance on at least a regional level. The company will eventually seek endorsement from a top-25 ranked professional golfer on the PGA Tour to promote its product lines and build brand strength.

Additional Promotional Activities

The company will engage in a variety of additional promotional activities to sell and market its products. Such activities include 1) consumer sweepstakes; 2) promotional giveaways with certain purchases, including items such as instructional videos and audiotapes; and 3) promotional campaigns. Working with Golfworld, the company has already conducted the first such promotion—a drawing for a $100 Golfworld gift certificate for participants of one of our market research surveys.

Pricing

Primary consumer research has shown that golfers will pay a premium for technology-based products that reduce shock and vibration and promise to improve their game. The research specifically indicates that the average Impress grip could be priced attractively at $5.00, comparable to the pricing of other premium grips, which range from (roughly) $4.50-$5.50 per grip.

MANUFACTURING & DISTRIBUTION

Industry and Channels

The golf grip market is a mature industry and, therefore, manufacturing methods have become fairly standardized. Golf grips manufacturers typically have facilities located in China, Taiwan, or Mexico and produce rubber and elastomeric products for a wide variety of industrial uses. While the production of grips is not particularly complex, usually involving some injection or extrusion molding process, it is important that they can be manufactured in large batches and with a high degree of consistency. It is also necessary to have the flexibility to manufacture grips of a variety of materials, qualities, sizes, and even colors to meet the myriad tastes of golfers of differing sexes, ages, and skill levels. The company will become a supplier to golf equipment retailers and, eventually, to several major golf club OEMs. Most major OEMs demand high standards of quality and service from all suppliers and require reliable second sources for most components, including grips. The company's success with OEMs will be dependent upon its ability to supply high quality grips and provide a high level of service.

Strategy

ProGrip will outsource all phases of production and distribution for the foreseeable future. This strategy eliminates the need for extensive fixed assets while maintaining flexibility in design and production. In addition, this strategy allows the company to best meet the needs of its OEM customers, which are projected to collectively account for 20 percent of sales by year five. It will also allow the company to better establish initial market acceptance by focusing its attention on product development, marketing, and sales. Sourced products will be manufactured according to ProGrip's strict quality control specifications. To assure the quality of its sourced products, the company will work closely with third-party manufacturers, emphasizing product reliability, performance standards, and strict quality controls to which all producers must adhere. ProGrip will monitor its sourced products to improve quality. We will establish product specifications, select the materials to be used to produce the grips, and test the specifications of all grips received by the company. In addition, ProGrip will maintain redundant sources of supply for each of its grips.

ProGrip is currently negotiating with Freightliners to provide for all of the company's warehousing and distribution needs and with Calypso, one of the leading manufacturers in Indonesia, to supply the company's initial products. In addition, ProGrip is in discussions with Advance Elastic Corporation, a wholly owned subsidiary of Dow Chemical, to provide the company with premium materials to use in the manufacture of the Impress grip.

MANAGEMENT

Management Team

The management team of ProGrip is one of the company's greatest strengths. The members collectively have more than 31 years of real world experience in the areas of entrepreneurship, finance, marketing, and operations. The individual members of the management team and their positions are listed below.

Martin Roland, Chief Executive Officer and Chief Financial Officer —Martin has more than four years of experience as a small business owner and six years of financial experience. He currently works as an Associate with Brooks Company, an Atlanta-based venture capital firm. Prior to this, Martin was an Associate with Benz Willow & Dodd where he completed over $25 million in private equity and debt placements for Georgia-based companies. In addition, he completed $550 million in public equity and debt offerings and over $1 billion in M&A transactions as an analyst in the Atlanta office of Friedman, Smitherman & Flip Securities Corp. Martin received a B.F.A. from the University of North Carolina, a B.B.A. from North Georgia College, and is currently pursuing his M.B.A. from Georgia State University.

James Martow, Vice President of Operations —James has a background in industrial management and manufacturing, with a particularly strong record of process improvements and change management. As a U.S. Army lieutenant, James' weapons department consistently achieved the highest performance ratings. He saved the Army hundreds of thousands of dollars through cost-savings measures in training and in maintenance procedures. After receiving a Master of Science from the Massachusetts Institute of Technology, James joined CNN, where he identified over $60,000 in annual savings in manufacturing processes. Later, he led a 24,000-member volunteer organization through a challenging organizational transition while meeting all operational objectives. While working toward his M.B.A. at Georgia State University, James remained active in practicum and ancillary work, identifying over $700,000 in process savings to a single client.

Govinder Rama, Vice President of Sales and Marketing —Govinder Rama has a B.A. in economics from the University of Massachusetts, a master's degree in Public Health from the University of Missouri, and is currently a candidate for an M.B.A. from Georgia State University. Professionally, he has experience in business development and marketing in the pharmaceutical industry, first for Global Pharmaceuticals and most recently Pfizer. Govinder has experience developing strategic marketing plans, establishing joint ventures, evaluating business plans, and negotiating contracts.

ProGrip will supplement its management team with individuals possessing product development and sales experience in the sports industry.

Advisory Group

ProGrip has selected a number of individuals to advise management. The advisors were chosen because of their excitement about our product and its potential and their valuable experience in areas critical to the company's success. Each member has been instrumental in advising ProGrip through its initial development, and management is confident that the board of advisors will continue to play a valuable role in the company's growth. Our advisors include:

Aaron Zhender—Managing Director, Project Ventures —Mr. Zhender is a venture capitalist with extensive hands-on experience in starting and growing new ventures. Mr. Zhender was founder and President of CyberWays Company, acting COO for Online Solutions, and interim CEO of 1PC, Inc. and Jazz IT. Mr. Zhender currently serves on the Boards of OmniWare, Design Group, Flatter, and e-Zine.

Patrick Andrews—Principal, Project Ventures —Mr. Andrews is a venture capitalist with many years of project management and operational experience. Mr. Andrews also served for over seven years as a pilot in the United States Army, earning the rank of Lieutenant. Mr. Andrews received his M.B.A. and a B.S. in Electrical Engineering from Georgia State University.

Dr. William Ames—Management Department Chairman, Georgia State University —Dr. Ames is a professor of entrepreneurship and has conducted extensive research in the areas of organizational design, entrepreneurship, small business, and venture capital. Dr. Ames is extensively involved with various corporate and public sector organizations and his research has been widely published. He is the recipient of grants from the Wiseman Foundation, the Sun Foundation, the Donald Frommer, and the National Science Foundation.

Les Flack—Former Director of Marketing, Golf Authority —Mr. Flack played a vital role in the rapid growth of Golf Authority, a designer and manufacturer of premium quality, technologically innovative golf clubs with revenues of approximately $86 million in 2000. In addition, Mr. Flack was instrumental in the success of Adam Golf's initial public offering and in making the company the third largest seller of fairway woods in the U.S.

Dr. Dennis Williams—Chief Scientist, SuperTech —Dr. Williams is the inventor of the technology behind the Impress grip and holds an S.B. in Physics from DeVry Institute of Technology and a Ph.D. in Physics from Georgia State University. He has 12 years of experience in plasma physics and pulsed power and has worked for industry, government, and academia.

THE OFFERING

Deal Structure

ProGrip is seeking $750,000 in equity capital. ProGrip's management is open to negotiating an appropriate investment strategy. As the company's initial products prove successful, we want to quickly expand the availability of the Impress grip and introduce new products. Accordingly, ProGrip will need the financial resources to aggressively move forward and capture the golf grip opportunity and will seek additional financing if and when necessary in the future.

Use of Funds

ProGrip intends to outsource all manufacturing of its premium grips. Thus, the primary use of funds generated from the private placement will be financing the company's initial launch and working capital requirements.

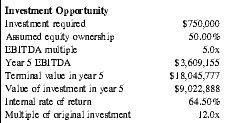

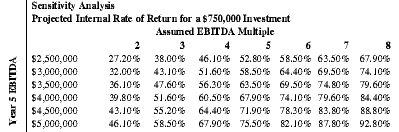

Investor Return

ProGrip's management is open to negotiating an appropriate investment strategy. Staged entries are possible given our current projection framework. Note, however, that such staging may result in lower aggregate returns. The following tables illustrate the calculation of the investor's internal rate of return (IRR) given the projected financial results.

| Investment Opportunity | |

| Investment required | $750,000 |

| Assumed equity ownership | 50.00% |

| EBITDA multiple | 5.0x |

| Year 5 EBITDA | $3,609,155 |

| Terminal value in year 5 | $18,045,777 |

| Value of investment in year 5 | $9,022,888 |

| Internal rate of return | 64.50% |

| Multiple of original investment | 12.0x |

| Assumed EBITDA Multiple | |||||||

| Year 5 EBITDA | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| $2,500,000 | 27.20% | 38.00% | 46.10% | 52.80% | 58.50% | 63.50% | 67.90% |

| $3,000,000 | 32.00% | 43.10% | 51.60% | 58.50% | 64.40% | 69.50% | 74.10% |

| $3,500,000 | 36.10% | 47.60% | 56.30% | 63.50% | 69.50% | 74.80% | 79.60% |

| $4,000,000 | 39.80% | 51.60% | 60.50% | 67.90% | 74.10% | 79.60% | 84.40% |

| $4,500,000 | 43.10% | 55.20% | 64.40% | 71.90% | 78.30% | 83.80% | 88.80% |

| $5,000,000 | 46.10% | 58.50% | 67.90% | 75.50% | 82.10% | 87.80% | 92.80% |

Comment about this article, ask questions, or add new information about this topic: