Medical Equipment Producer

BUSINESS PLAN

PREMIUM THERAPY, LLC

7500 Miller Street

Cambridge, Massachusetts 02142

Premium Therapy, LLC is a medical device company focused on the field of rehabilitation medicine. It has designed and developed a patented technology to deliver ElectroMagnetic Induction Therapy (EMIT) in large markets that include the treatment of arthritis, pain, and muscular atrophy.

- EXECUTIVE SUMMARY

- COMPANY SUMMARY

- TECHNOLOGY

- MARKET

- PRODUCTS

- COMPETITION

- STRATEGY & IMPLEMENTATION SUMMARY

- MANAGEMENT TEAM

- OPERATIONAL PLAN

- FINANCIAL PLAN

- APPENDIX

EXECUTIVE SUMMARY

Premium Therapy, LLC is a medical device company focused on the field of rehabilitation medicine. It has designed and developed a patented technology to deliver ElectroMagnetic Induction Therapy (EMIT) in large markets that include the treatment of arthritis, pain, and muscular atrophy.

Technology

Pulsed electromagnetic stimulation is a well-established technique with a long history of use in medical applications. The scientific principle behind this technology is that an electric current passed through a coil will generate an electromagnetic field. These fields, in turn, have been shown to induce current within conductive materials placed within the field. When applied to the human body, pulsed electromagnetic stimulation has been scientifically proven to be effective in: 1) causing muscles to contract, 2) altering nerve signal transmission to decrease experienced pain, and 3) causing new cell growth in cartilage.

Harnessing these benefits, the company has developed EMIT as a new and improved, patented delivery technology. Using this technology, Premium Therapy plans to treat a variety of medical conditions. A full utility patent that provides protection for Premium Therapy's technology has been filed in the U.S. and is currently pending approval.

Market

Premium Therapy will target market segments comprised of persons desiring treatment for muscular atrophy, neurogenic bladder/bowel (a form of paralysis of the muscles in the bladder/bowel), musculoskeletal pain and/or arthritis. Together, the several market segments yield an initial potential U.S. market of greater than 200 million customers.

In a recent survey of individuals suffering from these conditions, a large percentage of them were found to be completely dissatisfied with current therapies. In fact, almost half of all respondents indicated that they would be willing to try new treatments and would spend more on a treatment if they knew it would work. Based on this data, and Premium Therapy's calculations, over 97 million of the greater than 200 million potential customers are completely dissatisfied with all current therapies and suffer from intractable disease (see Market Segmentation). It is this group of poorly-managed patients that Premium Therapy expects to be the earliest adopters of its technology.

Product

Premium Therapy's new device, the EMIT system, consists of two components: a programmable Logic Controller (LC), which generates the required current, and an Array of Overlapping Coils (AOC), through which the current is channeled in generating the pulsed electromagnetic fields. Premium Therapy's novel technology is embodied in the patented form of its AOC, which contains a series of overlapping coils encased within an ergonomic, body-contoured wrap. The ergonomic wraps have been designed for the multiple applications of EMIT and are easily placed by any untrained user around the lower back, knee, shoulder, and other regions of the body to deliver targeted, therapeutic pulses of electromagnetic stimuli. For example, the ergonomic AOC wrap developed for the knee contains strategically placed coils designed to produce therapeutic magnetic fields within the knee.

Premium Therapy's technology is incorporated into the two models of the EMIT system: EMIT MX and EMIT SX. The two models of this system each target a number of different market segments. The EMIT MX model generates a powerful maximal (MX) current stimulus sufficient to cause contraction in targeted muscle groups and is intended for persons desiring the prevention/treatment of muscular atrophy and/or the treatment of neurogenic bladder and bowel. The EMIT SX model, on the other hand, has been designed to generate a less powerful, submaximal (SX) stimulus which will not cause muscles to contract, but which will alter pain sensations and enhance cartilage growth through the modulation of cell signaling pathways.

The competitive advantages of the EMIT system include:

- Unique therapeutic application of EMIT

- Patented delivery device with multiple user-friendly applicators

- Two models for multiple applications in the treatment of a variety of diseases

- Reduction of healthcare costs with home healthcare applications

Development Status

Research involving the EMIT system has produced encouraging laboratory results and a formal request to perform human clinical trials has been filed. Once this approval is obtained, several leading U.S. medical institutions, including Harvard University, University of California - Berkeley, the Therapeutic Institute, and the University of Arizona, have expressed interest in participating in collaborative research and clinical trials. Given encouraging results, each has also indicated an interest in purchasing the EMIT system.

Competition

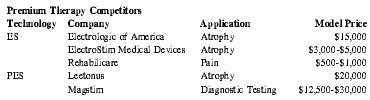

Currently, the two main technologies competing with the EMIT system are Electrical Stimulation (ES) and existing Pulsed Electromagnetic Stimulation (PES). While each of these technologies attempts to treat the same conditions as the EMIT system, both have severe limitations. ES devices, for example, are unable to penetrate tissues to reach deep muscles without causing skin burns and irritation. PES devices, on the other hand, can penetrate deeply and painlessly, but have been developed exclusively for diagnostic applications, such as nerve or muscle testing. As a result, these devices, while effective in a diagnostic setting, make ineffective therapeutic tools and currently are not available in any form that is appropriate for home healthcare.

Leading products in this field include Rehabilitation Center's ES device, which grossed over $62 million in revenues last year, and Top Line Stimulus's Model 500 PES device which sells for $12,500 and has grossed $32.5 million in revenues since its market entrance in 1998. While these technologies are currently among Premium Therapy's main competitors, the company believes that the focus of competition in the future will be between the different technologies, with a paradigm shift to more effective therapy.

Strategy

Premium Therapy will initially market its technology to healthcare providers through established medical device specialty distributors. The specialty distributors will provide sales, support, and distribution functions. Premium Therapy will complement the distributors' sales force with an internal program focused on highlighting the increased efficacy of the EMIT system in research publications and journals in order to encourage adoption of its technology. Premium Therapy expects those involved in the distribution and sales of the EMIT system to be able to charge a sustainable premium for providing patients with access to this breakthrough technology. Premium Therapy will also market its technology to patient/consumers once healthcare providers have begun to adopt the EMIT system.

Regulatory Issues

Medical devices such as the company's EMIT system are subject to regulatory review and approval by the U.S. Food and Drug Administration (FDA). While it is expected that full FDA approval will be gained quickly based on the approval of similar devices, Premium Therapy will seek an expedited market entrance by obtaining an Investigational Device Exemption (IDE) and clearly labeling the device "For Investigational Use Only." IDE approvals are typically obtained within an average of 3 months including necessary revisions. This strategy has been successful with a similar device, Leetonus' LeeTone, where an IDE was obtained and devices were sold prior to full FDA approval.

Despite this accelerated market entrance, Premium Therapy is cognizant of the fact that full FDA approval will be necessary in order to claim therapeutic efficacy of the EMIT system for each of its indications.

Management Team

Premium Therapy's management team includes founders with extensive experience in rehabilitative medicine and in the design and development of novel technology. Credentials include two M.B.A.s, two B.S.E.s in Biomedical Engineering, two M.D.s and a B.S.E. in Electrical Engineering. Furthermore, active consultation is being provided by a serial entrepreneur and technology development expert, an FDA specialist, the director of clinical studies for Harvard University's Physical Therapy Department, and a patent agent specializing in biomedical devices.

Financial

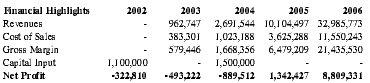

Premium Therapy's principals are heavily invested in the company's success with a planned $100,000 worth of capital input prior to any external funding. Assuming a product diffusion that parallels comparable technology in the medical field and receipt of an additional $1,000,000 in funding, Premium Therapy anticipates profitable operations by year four with a net profit of $1.3 million. International populations were not included in the financial analysis, as global expansion is not anticipated until late in the business plan.

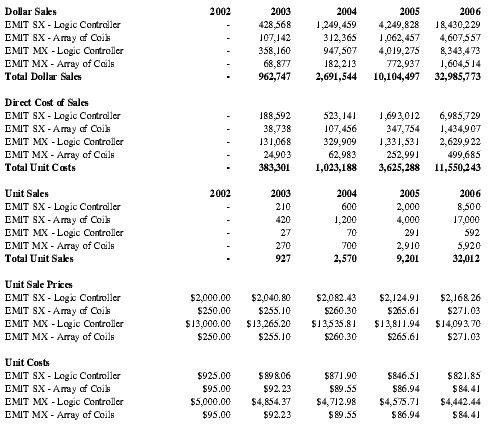

| Financial Highlights | 2002 | 2003 | 2004 | 2005 | 2006 |

| Revenues | - | 962,747 | 2,691,544 | 10,104,497 | 32,985,773 |

| Cost of Sales | - | 383,301 | 1,023,188 | 3,625,288 | 11,550,243 |

| Gross Margin | - | 579,446 | 1,668,356 | 6,479,209 | 21,435,530 |

| Capital Input | 1,100,000 | - | 1,500,000 | - | - |

| Net Profit | -322,810 | -493,222 | -889,512 | 1,342,427 | 8,809,331 |

COMPANY SUMMARY

Premium Therapy will develop biomedical devices, including the EMIT system, to aid in the treatment of a variety of medical conditions. Premium Therapy has developed patented technology to employ ElectroMagnetic Induction Therapy (EMIT) in delivering stimuli to targeted anatomic regions of the human body. While this will be Premium Therapy's initial focus, the company expects to leverage its medical device expertise in capitalizing on other opportunities as they arise.

TECHNOLOGY

Pulsed electromagnetic stimulation (PES) technologies have been developed and refined over the course of several decades of scientific research. These technologies found relatively early application in the setting of medical diagnostics with the commercialization of several devices that have been utilized since the early 1990s at medical centers throughout the United States for the diagnosis of nerve and muscle disorders.

The results of emerging scientific trials, however, have demonstrated the dramatic potential for PES to painlessly and non-invasively treat, rather than simply diagnose, a variety of medical conditions. Studies have shown PES to be effective in: 1) causing muscles to contract, 2) altering nerve signal transmission to decrease experienced pain, and 3) causing new cell growth in cartilage. A number of additional therapeutic effects are postulated and being researched extensively.

It is on this well-established base of research that Premium Therapy has developed and patented an innovative medical device to deliver ElectroMagnetic Induction Therapy (EMIT). Premium Therapy's technology is a further advance in this field designed to effectively treat muscular atrophy, neurogenic bladder/bowel, musculoskeletal pain and arthritis through the use of electromagnetic stimulation in a highly user-friendly format.

Background

The renowned scientist Michael Faraday first observed the concept of pulsed electromagnetic stimulation in 1831. Faraday was able to demonstrate that time varying, or pulsed electromagnetic fields, have the potential to induce current in a conductive object. Faraday's experimental setup was simple. He found that by passing strong electric current through a coil of wire he was able to produce pulsed electromagnetic stimuli. This pulsed electromagnetic stimulus was able to induce the flow of current in a nearby electrically conductive body.

In the years since the discoveries of Faraday, pulsed electromagnetic stimulators have found application in countless areas of scientific investigation. In 1965, the scientists Bickford and Freming demonstrated the use of pulsed electromagnetic stimulation to induce conduction within nerves of the face. Later, in 1982 Polson et al. produced a device capable of stimulating peripheral nerves of the body. This group of investigators was able to stimulate peripheral nerves of the body sufficiently to cause muscle activity, recording the first evoked potentials from pulsed electromagnetic stimulation.

The ability of pulsed electromagnetic stimulation to induce electrical currents within tissues of the human body has prompted medical research in recent years with respect to the diagnosis, monitoring, and therapy of a variety of important conditions.

Technologic Advances

Since the days of Bickford, Freming, and Polson, magnetic fields have been clinically applied to both central and peripheral nerves through the utilization of a single, large coil. Repetitive electromagnetic stimulation of the brain, for instance, has been utilized as an alternative to electroconvulsive "shock" therapy in treating depression, and as a means to trigger seizure activity in locating the source of epilepsy. Peripherally, magnetic stimulation has been used for pain syndromes, for improving neuromuscular function in the setting of chronic progressive multiple sclerosis and for the stimulation of peripheral nerves in the diagnostic detection of nerve conduction abnormalities.

Due to the promise of electromagnetic stimulation in painlessly and non-invasively treating a variety of diseases, research in this field is progressing rapidly. New indications for treatment with electromagnetic stimulation are arising every year with strong, scientifically-supported results. Premium Therapy's technology is a further advance in this field designed to effectively treat muscular atrophy, neurogenic bladder/bowel, musculoskeletal pain and arthritis through the use of electromagnetic stimulation in a user-friendly format appropriate for home healthcare applications.

MARKET

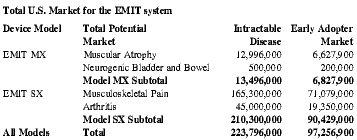

The different models of the EMIT system each target a number of different market segments consisting of persons desiring therapy for multiple conditions, including: muscular atrophy, neurogenic bladder and bowel, musculoskeletal pain and/or arthritis. Together, the several market segments yield a total potential U.S. market for the EMIT system of greater than 223 million customers with over 97 million customers falling into the category of dissatisfied patients.

A recent survey of patients suffering from these conditions found that nearly half were so dissatisfied with current therapies that they would be willing to both try new treatments and pay a premium for these treatments if they were effective. These dissatisfied populations, that are both unable to find relief with current therapies and willing to pay more for an effective new therapy, are expected to be the earliest adopters of EMIT.

Market Segmentation

The United States will serve as Premium Therapy's initial target market for both models of the EMIT system. The potential market for each device was extrapolated using data from reputable, referenced sources. In determining the percentage of patients that Premium Therapy expects to be early adopters, estimates of the percentages of persons in the United States currently suffering from chronic, poorly managed medical conditions in each of the various market segments were used based upon the assumption that individuals who have already used existing therapies without significant success would be most likely to try a novel medical device. Thus, it is expected that the earliest adopters of the EMIT system will be those patients afflicted with muscular atrophy, neurogenic bladder and bowel, musculoskeletal pain and/or arthritis for whom all other therapies have failed.

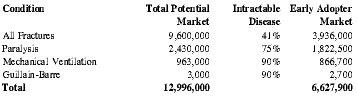

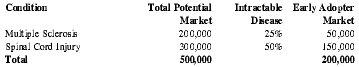

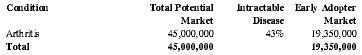

The number of patients that are not being well managed with current therapies, though, is significant. Premium Therapy's principals estimate that in patients with fractures, paralysis, and immobilization (including mechanical ventilation and Guillain-Barre disease), the percentages that subsequently develop long-term complications of atrophy that could be avoided through the use of the EMIT system are 41 percent, 75 percent and 90 percent respectively. In neurogenic bladder and bowel, virtually half of all patients have found no relief through any of the existing therapies. For musculoskeletal pain and arthritis sufferers it was found that "78% are willing to try new treatments, and 43% would spend more on a treatment if they knew it would work." Further supporting these figures, a study published by the Society of Pain Sufferers found that, "56% of pain sufferers have had their pain for more than 5 years and 41% of them described their pain as 'out of control'." These numbers have been factored into the "Intractable Disease" column in the tables below and have been used to calculate the dissatisfied population of patients most likely to try a novel therapy listed under "Early Adopters."

EMIT Market Segments

For a sense of scope, both the total potential market and expected early adopter market are listed in the tables below for all of the indications of the EMIT system.

Prevention and Treatment of Muscular Atrophy:

Muscular Atrophy Patients Treatable with the EMIT system in the U.S.

| Condition | Total Potential Market | Intractable Disease | Early Adopter Market |

| All Fractures | 9,600,000 | 41% | 3,936,000 |

| Paralysis | 2,430,000 | 75% | 1,822,500 |

| Mechanical Ventilation | 963,000 | 90% | 866,700 |

| Guillain-Barre | 3,000 | 90% | 2,700 |

| Total | 12,996,000 | 6,627,900 |

Treatment of Neurogenic Bladder and Bowel:

Neurogenic Bladder/Bowel Patients Treatable with the EMIT system in the U.S.

| Condition | Total Potential Market | Intractable Disease | Early Adopter Market |

| Multiple Sclerosis | 200,000 | 25% | 50,000 |

| Spinal Cord Injury | 300,000 | 50% | 150,000 |

| Total | 500,000 | 200,000 |

Treatment of Musculoskeletal Pain:

Musculoskeletal Pain Patients Treatable with the EMIT system in the U.S.

| Condition | Total Potential Market | Intractable Disease | Early Adopter Market |

| Low Back Pain | 132,300,000 | 43% | 56,889,000 |

| Neck Pain | 33,000,000 | 43% | 14,190,000 |

| Total | 165,300,000 | 71,079,000 |

Treatment of Arthritis:

Arthritis Patients Treatable with the EMIT system in the U.S.

| Condition | Total Potential Market | Intractable Disease | Early Adopter Market |

| Arthritis | 45,000,000 | 43% | 19,350,000 |

| Total | 45,000,000 | 19,350,000 |

TOTAL U.S. Market

The total potential and expected early adopter markets in the United States for the Premium Therapy EMIT system are projected to be the following:

| Device Model | Total Potential Market | Intractable Disease | Early Adopter Market |

| EMIT MX | Muscular Atrophy | 12,996,000 | 6,627,900 |

| Neurogenic Bladder and Bowel | 500,000 | 200,000 | |

| Model MX Subtotal | 13,496,000 | 6,827,900 | |

| EMIT SX | Musculoskeletal Pain | 165,300,000 | 71,079,000 |

| Arthritis | 45,000,000 | 19,350,000 | |

| Model SX Subtotal | 210,300,000 | 90,429,000 | |

| All Models | Total | 223,796,000 | 97,256,900 |

Assuming the entire market were able to be tapped, with pricing, cost schedules, and component use as indicated, the revenues associated with the total potential market and expected early adopter market are $132.4 billion and $57.8 billion respectively.

Industry Analysis

The industry for electromagnetic stimulating technologies is both growing and evolving rapidly. In the 1990s, more than 250,000 prescriptions were written each year in the United States for electrical and electromagnetic stimulating medical devices. As scientific data surrounding PES technology has grown in recent years, trends in both neuromuscular stimulation and pain control have pushed towards the use of this powerful new technology.

The forces driving this trend towards increasing use of PES technology include: 1) the ability to be applied painlessly without the adverse side effects found with electrical technologies, and 2) the demonstrated capability to effectively treat conditions that electrical stimulating technologies fail to adequately address. The problem with PES devices currently in use is that because of design limitations they are either relegated solely to diagnostic purposes or require the constant manipulation of trained personnel for use. Industry product developers have not taken the necessary steps to develop devices that are easily applied in the treatment of medical conditions that have been shown to respond to this form of stimulation.

It is on this stage of emerging demand that the Premium Therapy EMIT system has been created. The proprietary position of Premium Therapy protects the ability to employ EMIT with the use of an ergonomic, body-contoured wrap containing strategically placed induction coils. This protection allows Premium Therapy to assert a unique position within its industry, and helps to support the expectation that those involved with the propagation of EMIT system will be able to charge a sustainable premium and realize economic profits for at least the duration of the patent.

Reimbursement Patterns

Intimate knowledge of third-party payer reimbursement is essential to the marketing plans for any medical device. In the case of the Premium Therapy EMIT system, acceptance of the technology is already demonstrated in the establishment of appropriate billing codes and charge histories for related technologies. Current Procedural Terminology (CPT) for the American Medical Association provides for Category III coding of a number of different forms of magnetic stimulation under the rubric of "investigational treatments". This classification of PES devices as "investigational" becomes an important issue in reimbursement patterns.

In a broader sense, reimbursement plans for pulsed electromagnetic stimulation devices can be supported by established billing practices for related technologies such as electric neurostimulation devices, TENS units, and a host of other electrical stimulation devices. While traditionally the market has been highly sensitive to reimbursement patterns, the fact cannot be ignored that consumers will seek therapeutic intervention with or without third party payor acceptance if they believe a device to be effective.

Experts have estimated that Americans spent $13.7 billion for devices that would fall into the category of "investigational treatments" in 1990 alone. Of these expenditures, $10.3 billion was spent as out-of-pocket, nonreimbursable expenses. These figures highlight the fact that while reimbursement is expected to expand our potential market, a large market exists for medical treatments that are paid out-of-pocket without reimbursement. It is this market that Premium Therapy will target in the early years of the business plan prior to full FDA approval and insurance reimbursement.

Purchasing Patterns

As with most significant investments in medical technology, large-scale adoption of the Premium Therapy EMIT technology will require an executive-level decision at the purchasing institution. In order to convince the decision-making unit at the purchasing institution, Premium Therapy must first prove the efficacy of its EMIT system. This is especially true of the MX system, which requires a larger investment, and much of Premium Therapy's initial efforts will be focused on scientifically proving the efficacy of its technology. Once this has been established, and marketing efforts begin to take effect, demand will be generated among healthcare providers and patients, and institutions and practices will begin investing in the EMIT system.

Typically, individual departments within an institution are held financially accountable and, if they decide to purchase a new technology, the decision is reviewed by the hospital administration. If the department is profitable, the decision is rarely overturned. Therefore, the most important market to consider in targeting sales will be the decision-making unit of the medical department. Premium Therapy's management recognizes that decision-making processes vary at different institutions, and the sales team, in cooperation with the specialty distributors, will consider each institution individually.

Distribution Patterns

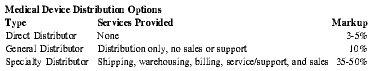

While direct distribution was traditionally an option in the medical field, there have been multiple changes in the last decade including intense consolidation and increasing use of purchasing agreements in the industry that have made this an impractical option for most novel technologies. This is especially true of highly specialized, truly innovative technologies such as Premium Therapy's EMIT system. Due to the importance of utilizing existing distribution channels in the highly developed medical device arena, selecting an appropriate distributor will be one of the keys to Premium Therapy's success.

As illustrated in the table below, medical device distributors vary greatly in services provided, ranging from strictly distribution to warehousing, billing, customer service, shipping, and selling functions. With greater services, though, comes greater cost. Medical device companies that opt for direct distribution incur only the cost of the freight while at the opposite end, use of specialty distributors typically will result in a 35-50 percent markup.

| Type | Services Provided | Markup |

| Direct Distributor | None | 3-5% |

| General Distributor | Distribution only, no sales or support | 10% |

| Specialty Distributor | Shipping, warehousing, billing, service/support, and sales | 35-50% |

In light of Premium Therapy's highly specialized market, and in order to minimize initial costs and develop robust distribution rapidly, Premium Therapy intends to utilize specialty distributors focused on the physical medicine and rehabilitation market. Premium Therapy anticipates conversion to general distribution and a direct sales team when the opportunity arises, but for the timeline of this business plan, specialty distribution will be utilized.

In order to tap the full potential of the market, Premium Therapy intends to utilize the services of regional specialty distributors. Premium Therapy has contacted multiple potential distributors, including Parker Doyle of Medical Products and Barnard Smithson of Applied Medical, and is in the process of developing working relationships with select distributors.

PRODUCTS

Premium Therapy plans on targeting this large and growing market with its innovative EMIT system. Designed to deliver ElectroMagnetic Induction Therapy (EMIT), the EMIT system consists of two components: a programmable Logic Controller (LC), which generates the required current, and an Array of Overlapping Coils (AOC) through which the current is channeled in generating the electromagnetic field. Premium Therapy's novel technology is embodied in the patented form of its AOC, which contains overlapping coils in an ergonomic, body-contoured wrap designed for the lower back, knee, shoulder, and other targeted regions of the body.

Premium Therapy's true innovation resides in its use of electromagnetic stimulation technology in a therapeutic setting along with its patented delivery device and multiple user-friendly applicators. In order to treat a wide range of diseases, Premium Therapy has developed two different models of the EMIT system, both of which are cost-effective with multiple home healthcare applications.

Product Description

The Premium Therapy EMIT system, a powerful therapeutic device created for the purpose of stimulating tissues of the human body, utilizes the revolutionary EMIT technology to deliver pulsed electromagnetic stimuli to targeted regions of the body. This patented technology is embodied in the form of ergonomic, body-contoured wraps containing a series of overlapping coils. A number of different ergonomic wraps have been developed for the lower back, knee, shoulder, and other regions targeted by the various applications of the EMIT MX and SX models. The wraps are designed to be easy to apply, with simple attachments and clear markings in order to ensure correct placement of the wrap by an untrained user. The coils housed within the ergonomic wraps, when placed over targeted areas of the human body, create stimuli powerful enough to cause muscles to contract, alter pain sensations, and/or enhance cell growth.

The EMIT system will be sold in two parts: a programmable logic controller and an array of overlapping coils.

- Programmable logic controller (LC): The logic controller is a sophisticated, but easy-to-use device designed to provide pulses of current, which create electromagnetic fields when channeled through the coils located in the various wraps. The electromagnetic field generated by the LC is capable of being adjusted in terms of amplitude and frequency in order to meet specific patient needs.

- Array of overlapping coils (AOC): The overlapping coils have technological advantages in that they effectively blanket the therapeutic area with electromagnetic stimulation, thus making therapies consistent, rapid, and easy to administer. A flexible, ergonomic wrap has been designed to position the coils over key regions targeted by each specific application. The design of the wrap will be such that markings on the material of the wrap will indicate correct alignment of the device over the intended area of the body. The wraps will also be contoured and fit to the region targeted making application even more consistent and effortless. Every design is available in multiple sizes to accommodate patients of various dimensions. Multiple wraps have been designed including knee, shoulder, pelvic, lower back, etc.

Product Applications

The EMIT MX system generates a maximal (MX) current stimulus sufficient to cause contraction in targeted muscle groups and is used in applications requiring large currents including the treatment and prevention of muscular atrophy and the treatment of neurogenic bladder and bowel. The treatment of musculoskeletal pain and arthritis, though, requires relatively lower levels of current. In order to satisfy this market, the EMIT SX model has been tailored to generate a submaximal (SX) stimulus that will not cause muscular contraction.

EMIT MX Applications

Prevention and Treatment of Muscle Atrophy: The Premium Therapy EMIT MX system addresses the unanswered need for atrophy prevention and treatment in conditions resulting in patient immobilization for greater than two weeks, such as in the case of hip, knee, and shoulder surgery; spinal cord injury; and a number of other cases. In animal models, the average muscle loss after just two weeks of immobilization was noted to be greater than 30 percent of the total pre-immobilization mass. This loss of muscle mass results in increased times to complete recovery and, with prolonged immobilization, in permanent disability. Studies have shown that inactive muscle stimulated by pulsed electromagnetism has better function and reduced loss of mass subsequent to immobilization.

Treatment of Neurogenic Bowel and Bladder: The EMIT MX system also offers a simple, noninvasive solution to the problem of neurogenic bladder and rectum causing retention of urine and bowel contents in persons with spinal cord injuries, Multiple Sclerosis, and various other disorders. Similar to the paralysis of the arms or legs in a patient with spinal cord injuries, patients with neurogenic bladder and bowel have "paralysis" of their bowel and bladder leading to difficulties with defecation and urination. The complications that can arise from neurogenic bladder and bowel are significant. In mortality studies of persons with spinal cord injuries, after a period of high mortality at the time surrounding the initial injury, neurogenic bladder has been shown to be the primary cause of death.

Invasive methods have been attempted to address this problem but without significant success and with multiple side effects. In both human and animal models, pulsed electromagnetic stimulation has been shown to increase bladder and bowel pressures, and to thereby effect evacuation. This technique is simple, safe, noninvasive, and has no known adverse effects. Using a lumbosacral wrap with coils targeting key nerves and muscles, Premium Therapy's EMIT MX system will provide effective, easy-to-use therapy for patients with neurogenic bowel and bladder.

EMIT SX Applications

Treatment of Musculoskeletal Pain: The Premium Therapy EMIT SX system offers the capability to reduce and/or eliminate pain in persons with localized musculoskeletal processes. A number of scientific studies have clearly demonstrated the power of pulsed electromagnetic coil stimulators to control pain. In one study, patients reported a 59 percent decrease in a subjective pain score after a single treatment with pulsed electromagnetic stimulation. The pain relief attained regularly persisted for several days. Additional studies have demonstrated consistent production of analgesia in subjects receiving pulsed electromagnetic stimulation, with long-lasting pain relief occurring in over half of the subjects.

Specifically in the treatment of back pain, the placement of a pulsed electromagnetic stimulator over muscles surrounding the spine consistently demonstrated a significant decrease in patient-reported scores of lower back pain. In addition to its demonstrated efficacy with lower back pain, pulsed electromagnetic stimulation has been found to be beneficial for musculoskeletal pain of all types, including neck, knee, and chronic and acute localized pain conditions.

Treatment of Arthritis: The Premium Therapy EMIT SX system also has applications in the treatment of arthritis where it has been shown that low frequency pulsed electromagnetic field stimulation results in the growth of cartilage cells. This ability to stimulate new cartilage growth creates a tremendous potential to reverse the degenerative changes of arthritis, a disease characterized by the destruction of existing cartilage in and around joint spaces.

In addition to the potential benefits of cartilage repair and growth, pulsed electromagnetic devices have also been shown to be cost-effective in reducing pain, including chronic knee pain, and improving function in osteoarthritis. Due to both its increased efficacy and lack of adverse side effects, pulsed electromagnetic stimulation may prove useful in forestalling joint replacements.

Proprietary Position

A full utility patent has been authored, filed, and is currently pending for "Method and Apparatus for Electromagnetic Stimulation of Nerve, Muscle, and/or Body Tissues." This patent takes into account both offensive and defensive postures in its claims and represents an extension of Provisional Patent No. 60/266,455. Opinions of legal counsel are confident that Premium Therapy's patent applications are enforceable and defensible. Care has been taken to file all potential claims of the invention in order to protect it from possible competition from other technologies. All patent application documents will be made available for examination by potential investors. Trademark applications are in process on the names Premium Therapy and EMIT. No conflicts or other use of these names has been found in an initial search. There are no third party claims for any interest in Premium Therapy technology, as none of the technology was developed using the facilities of any other institution and the developers were not employed by any other institution prior to the filing of their provisional patent.

Development Status

Premium Therapy's technology is currently in the bench-testing stage of development, the results of which have been highly encouraging. An Investigational Review Board (IRB) application has been filed to conduct human clinical studies and rapid approval is expected based on approval of similar studies.

Premium Therapy has contacted leading medical institutions in the U.S., many of which have expressed interest in participating in collaborative research and, given encouraging research results, purchasing the EMIT system. Investigators expressing strong interest include Dr. Henry Dillard of Harvard University, Dr. Floyd Marcus of University of California - Berkeley, Dr. Josh Williamson of the Therapeutic Institute, and Dr. Jason Martinez of the University of Arizona. It is expected that once Premium Therapy's IRB application has been approved, clinical studies will commence at each of these institutions.

Future Products

Premium Therapy anticipates future product development in profitable markets in the medical industry in the form of both the expansion of indications for the EMIT system and the development of novel technologies.

An example of a potentially profitable new indication for the EMIT system is found in the treatment of the major cause of stress urinary incontinence—a condition referred to as "idiopathic detrusor instability." Detrusor instability describes the unstable contractions of the detrusor muscle (a muscle controlling the release of urine from the bladder), which can cause sufferers to unexpectedly release urine. More than 20 million Americans are affected by this condition in which traditional therapies, such as dietary manipulation, surgical procedures, medications, and physical therapy, have been poorly tolerated and ineffective. Studies have shown that electromagnetic stimulation of sacral (an area of the lower spine) nerve roots acutely abolishes unstable contractions in patients with this condition making this a condition that will likely be treatable with the EMIT system.

In addition to researching new uses for the EMIT system, Premium Therapy will also explore novel technologies. To this end, the patent process has been initiated for a device designed to teach correct posture. This device is designed to train the user in maintenance of a healthy posture in order to treat the back and neck problems often associated with incorrect posture. In contrast to current devices that simply hold the spine in the correct position and then allow resumption of incorrect posture upon discontinuation, this device will actually train the user to maintain the correct posture by developing the musculature required for permanent correction of the problem.

While future product development is planned, Premium Therapy will concentrate, for the time being, on the ability of the EMIT system to treat muscular atrophy, neurogenic bladder and bowel, musculoskeletal pain and arthritis. Once success has been demonstrated in these markets, expansion to other markets, such as the treatment of stress incontinence, will be considered and new product development will be explored.

COMPETITION

Competition in the field of electromagnetic stimulating devices is developing rapidly. Established modalities such as electrical stimulation, physical therapy, and pharmacologic therapies have been used for a number of years in the treatment of conditions that are now gaining exposure to the potential of pulsed electromagnetic stimulating devices. Direct competition takes the form of two main technologies: Electrical Stimulation (ES) and existing Pulsed Electromagnetic Stimulation (PES). While each of these technologies attempts to treat the same conditions as the EMIT system, both have severe limitations. ES devices, for example, are unable to penetrate tissues to reach deep muscles without causing skin burns and irritation. PES devices, on the other hand, can penetrate deeply and painlessly, but have been developed exclusively for diagnostic applications, such as nerve or muscle testing. As a result, these devices, while effective in a diagnostic setting, make ineffective therapeutic tools.

Competitive Advantage

Premium Therapy's proprietary position allows for the patented use of an ergonomic, body-contoured wrap and overlapping coils. These proprietary elements allow targeted anatomic regions to be blanketed with pulsed electromagnetic stimulation in a format that is user-friendly and capable of being employed by untrained users including patients in their homes. In this way, Premium Therapy's EMIT technology creates a solution to the most significant limitations of existing pulsed electromagnetic stimulating technologies—namely the difficult nature of manipulating a single coil and the cost-intensive requirement of using highly-skilled medical personnel for operation.

The competitive advantages of the EMIT system can be summarized as follows:

- Unique therapeutic application of pulsed electromagnetic stimulation

- Patented delivery device with multiple user-friendly applicators

- Two models for multiple applications in the treatment of a variety of diseases

- Reduction of healthcare costs due to home healthcare applications

Competition

To date, the company is not currently aware of any product that provides as cost-effective, user-friendly, therapeutic care as the EMIT system. The EMIT system Models MX and SX target distinct market segments. For a more detailed description of competitive technologies, see Appendix A. The main competitors within each of the market segments are listed below (see Appendix B for competitive pricing chart).

EMIT MX Market Segments

Prevention and Treatment of Muscular Atrophy: In the large market for the treatment/prevention of atrophy, existing therapeutic devices have to date involved primarily electrical muscle stimulators. The different competitors include:

-

Electrical Stimulating Devices (ES):

ES units, often referred to as functional electrical stimulators,

employed in large clinic and physical therapy centers cost approximately

$15,000. Smaller ES units for home use can cost from $3,000 to $5,000.

Important manufacturers include:

- Electrolite Products, Inc.: A manufacturer of the StimOne device, a modified exercise type cycle used by persons with spinal cord injuries in order to prevent atrophy and spasms, and to increase range of motion.

- Electro Med Services, Inc.: A provider of a range of devices and electrodes for functional electrical stimulation.

-

Pulsed Electromagnetic Stimulating Devices (PES):

The only significant competitors currently in the field of therapeutic

functional PES are Leetonus and Top Line Stimulus. These companies have

focused solely on products that involve the use of a single stimulatory

coil. The use of these products requires expensive, highly-skilled

operator involvement. Even with the highly-skilled operator, treatments

are lengthy (greater than 15 minutes per muscle group) and inconsistent

due to the constant manipulation required to achieve the desired result.

As a result of these limitations, existing functional pulsed

electromagnetic stimulation devices are not well tailored for

therapeutic applications. Instead, they are primarily suited for the

diagnostic field, in which Top Line Stimulus has captured the greatest

market share.

Important manufacturers include:

- Leetonus: The LeeTone model base cost is $20,000. This unit is designed for a trained operator, such as a physical therapist or physician, to hold the stimulating coil over a specific area of the body in treatments for atrophy, muscle spasms, and decreased blood flow. The Leetonus Company is currently directing marketing focus around the LeeControl device, which is employed in the treatment of urological conditions, and the LeePulse device, which uses transcranial stimulation in the treatment of psychiatric conditions. Leetonus recently received $7.3 million in a second round of venture capital funding, bringing its total to $12.2 million.

- Top Line Stimulus Corporation: Top Line Stimulus' main offering is a hand held coil similar to the Leetonus LeeTone product for the stimulation of specific nerves and nearby tissue. Top Line Stimulus' devices find application primarily in areas of diagnostic evaluation of brain or central motor disorders and spinal injuries. The Top Line Stimulus Model 500 has a base cost of $12,500. Other models range in price from $20,000 to $30,000. As of November 2001, Top Line Stimulus had sold approximately 2,500 units worldwide.

- Electronic Medicals, SupraTimer, and Beingarden GmbH are also involved in the pulsed electromagnetic stimulation business but have only produced devices for diagnostic purposes to date.

Treatment of Neurogenic Bladder and Bowel: There are currently no devices that offer noninvasive treatment for the conditions of neurogenic bladder and bowel. Pulsed electromagnetic stimulation offers the opportunity to effectively treat these conditions without the adverse side effects. Current care options include intermittent catheterization, surgery, and functional electrical stimulation, the latter of which is still in the experimental stage and not commercially available.

EMIT SX Market Segments

Treatment of Musculoskeletal Pain: In the vast market for the treatment of musculoskeletal pain there are numerous therapeutic options available, the majority of which are based solely on pain control. There are few, if any, direct competitors with the noninvasive therapeutic potential embodied in the EMIT system. Therapies currently available, which compete only indirectly with EMIT, include pharmacologic and physical therapies.

-

Electrical Stimulating Devices (ES):

ES technologies have primarily been employed in the form of

transcutaneous electrical nerve stimulation (TENS units). At present,

there are well over 100 different models of transcutaneous electrical

nerve stimulators (TENS) devices in the marketplace and an increasing

number of other electrical devices.

The major manufacturer of TENS devices is:

- Rehabilicare Inc.: A manufacturer and provider of electrotherapy devices for rehabilitation, as well as products for chronic and acute pain management, consisting of small, portable, battery-powered electrical pulse generators. For the fiscal year ended 6/30/01, total revenues rose 5 percent to $62 million. Net income rose 51 percent to $3.3 million. Rehabilicare has a market capitalization of $34.8 million.

Treatment of Arthritis: In the vast market for the treatment of arthritis, existing therapies have focused on pain control issues. No therapy, aside from EMIT, has demonstrated the ability to reverse the wear-and-tear degenerative changes that cause such significant pain for osteoarthritis sufferers. A number of different therapies involved in the treatment of this condition that compete only indirectly with Premium Therapy include: nutritional supplements, hyaluronic acid injections, and pharmacologic therapy.

STRATEGY & IMPLEMENTATION SUMMARY

Premium Therapy's strategy will be to target both the market for the EMIT MX as well as the market for the lower power EMIT SX. The models will be promoted separately in each of their disparate markets and specialty distributors will be utilized in order to rapidly form robust distribution and sales networks.

An important step will be the establishment of the EMIT system at key medical institutions throughout the country. A strategic partnership has already been formed with the Physical Therapy department at Harvard University. Once an IDE has been obtained and pending investigational review board applications are approved, clinical studies will commence with the assistance of Dr. Henry Dillard, Director of Clinical Services in the Physical and Occupational Therapy department at Harvard University. Dr. Dillard is excited to begin the studies and to be a part of a technology that he feels has the potential to revolutionize the industry. Additional institutions expressing interest in collaborative studies include: University of California - Berkeley, the Therapeutic Institute, and the University of Arizona.

Value Proposition

The true value of Premium Therapy's ElectroMagnetic Induction Therapy (EMIT) technology lies with the patient. In using the EMIT system, the patient stands to gain unparalleled, scientifically proven, therapeutic benefits including: improved treatment of muscular atrophy, effective therapy for neurogenic bowel and bladder, consistent production of analgesia in arthritis and musculoskeletal pain, and reversal of the degenerative changes found in arthritis.

Not only will the EMIT system treat multiple, previously poorly-managed diseases, it will do so in a user-friendly manner with cost-effective, home-healthcare applications. Compared to existing technologies that require trained healthcare professionals to operate the complex machinery, the EMIT system is incredibly user-friendly. In fact, once the patient is shown how to use the EMIT system, there will be no need for continued healthcare provider input other than routine follow-up. Thus, with decreased healthcare professional requirements and home healthcare applications, use of the EMIT system will result in an overall decrease in healthcare costs for the patient while providing superior clinical results.

The value proposition for institutions and healthcare providers to adopt the technology is threefold: 1) Premium Therapy's proprietary position will allow a sustainable premium to be charged for the EMIT system; 2) Even with this sustainable premium, assuming only a 20 percent reduction in requirement for existing therapies with the use of the EMIT system, overall treatment costs will decline (see Appendix 1) and 3) Use of the EMIT system will result in superior patient care.

Marketing Strategy

Marketing efforts for Premium Therapy's technology will involve the targeting of two different populations: 1) healthcare providers treating muscular atrophy, neurogenic bowel and bladder, musculoskeletal pain and/or arthritis, and 2) patients suffering from muscular atrophy, neurogenic bowel and bladder, musculoskeletal pain and/or arthritis.

Premium Therapy's success is dependent first upon demonstrating scientific support for the efficacy of the device and then on creating acceptance among health care providers and patients. Promotional strategies will be reflective of this fact. Of course, acceptance by either patients or providers will provide an impetus for the other group to follow suit.

Sales/marketing will be directed in coordination with specialty distributors contracted by Premium Therapy, thus significantly reducing the company's own required sales/marketing expenditures. The efforts of Premium Therapy's internal sales/marketing forces will be focused on marketing the EMIT system, developing educational tools, and training the specialty distributor sales representatives.

Promotion Strategy

Premium Therapy has already worked closely with physicians to design its products. The importance of working with physicians in developing novel therapies is well known. Initiation of clinical studies with the eager assistance of Dr. Henry Dillard, Director of Clinical Services in the Physical and Occupational Therapy department at Harvard University will be invaluable in the promotion of EMIT as a viable medical therapy. It is expected that once the device is found to be effective, Harvard University will use it as a high-profile example of its technological advancement.

Promotion efforts for Premium Therapy's technology will focus on its two target populations, namely: 1) healthcare providers treating muscular atrophy, neurogenic bowel and bladder, musculoskeletal pain and/or arthritis, and 2) patients suffering from muscular atrophy, neurogenic bowel and bladder, musculoskeletal pain and/or arthritis.

-

Healthcare Providers:

Acceptance among the more than 550,000 healthcare providers who treat

muscular atrophy, neurogenic bowel and bladder, musculoskeletal pain

and/or arthritis will be one of the keys to Premium Therapy's

success. Even with strong patient demand, if the healthcare providers

are unwilling to recommend Premium Therapy's technology, then the

market will remain largely untapped. Furthermore, healthcare providers

are persuasive in consulting patients concerning novel therapies and

those healthcare providers who have embraced Premium Therapy's

technology will be powerful advocates.

In marketing the procedure to healthcare providers, the main consideration will be the efficacy of Premium Therapy's technology and its superiority over existing technologies. First and foremost, Premium Therapy will utilize the competent, trained sales force of the specialty distributors to create a demand push for its technology. These efforts will be complemented by Premium Therapy's internal sales force, which will engage in direct calling or visiting in order to encourage trials.

Furthermore, Premium Therapy intends to promote its technology through publications and advertisements in reputable medical journals along with presentations at national conventions. Using this sales/marketing strategy, along with the promise of sustainable premiums for healthcare providers involved with the EMIT system, Premium Therapy expects to generate demand among healthcare providers.

- Patients: Premium Therapy will also market its technology to patient-consumers once healthcare providers have begun to adopt the EMIT system. In promoting Premium Therapy's technology to this population, the most important factor will be concrete research results displaying the superior efficacy of the EMIT system compared to existing technologies. Once these data have been acquired, Premium Therapy will embark on a large-scale, national advertising campaign focusing on television and print media. Using these channels, along with intentionally facilitating publicity, Premium Therapy will be able to generate a demand pull from individuals with conditions treatable with the EMIT system.

Pricing Strategy

The EMIT MX and EMIT SX systems are priced in two components, both in keeping with industry standards. EMIT MX will require more complex, expensive circuitry and will need greater functionality than EMIT SX due to its higher power requirements. Based on these much higher costs, the retail and wholesale price for EMIT MX will be significantly higher than for EMIT SX, but will fall well within the range of industry standards.

Premium Therapy expects to lease the EMIT MX system much more frequently than the SX system, so estimates of one logic controller (LC) per ten patients and one LC per two patients were used for the MX and SX systems respectively. The Arrays of Overlapping Coils (AOCs) are single-patient devices, as they are not designed to withstand the harsh resterilization procedures.

It is expected that the specialty distributor selected for Premium Therapy's technology will use a markup of approximately 50 percent in determining retail price. This is the upper end of estimates received from specialty distributors with quotes ranging from 35 percent to 50 percent. Prices are inclusive of both customer service and technical support as the specialty distributor will provide these functions.

| Component | Wholesale Price | Expected Retail |

| EMIT MX Logic Controller | $13,000 | $20,000 |

| EMIT SX Logic Controller | $2,000 | $3,000 |

| Arrays of Overlapping Coils | $250 | $350 |

Sales Strategy

The key step in generating sales will be to initiate the investment in Premium Therapy's technology after which initial sales efforts are expected to decrease significantly. Therefore, the sales force will be relied on heavily for the initial demand push for the adoption of the EMIT system, then to a much lesser extent for the additional components. While Premium Therapy will maintain a small internal sales force in order to encourage adoption of its technology at select medical centers and to train specialty distributor sales personnel, the bulk of all selling will be accomplished through the use of specialty distributors. The specialty distributors to be utilized have well-established distribution networks and widespread sales contacts, which will prove invaluable in promoting Premium Therapy's innovative technology in the early years of the business plan.

Premium Therapy's internal sales force will initially consist of two personnel in Year 2. This number is expected to increase to approximately twelve by Year 5 with expected dramatic increases in sales. This number is remarkably low as a percentage of sales due to the role of the specialty distributor in providing many sales functions.

Milestones

The following are the key milestones for Premium Therapy's operations:

- Patent process and business plan have been completed.

- Investigational Device Exemption Application filed by June 2002.

- Specialty Distributors selected by June 2002.

- Start-up capital will be raised by August 2002.

- First round of human clinical trials completed by June 2003.

- Full FDA approval obtained by June 2005.

- All other milestones are currently on schedule in accordance with the business plan.

Regulatory Issues

The FDA classifies new devices into one of two categories: experimental or investigational. Experimental devices are innovative devices for which "absolute risk" has not been established, meaning that the initial questions of safety and efficacy have not been resolved. Investigational devices are those for which "incremental risk" is the primary risk in question, meaning that questions of safety and efficacy have been resolved to the satisfaction of the FDA. Due to the precedent set by existing pulsed electromagnetic stimulators as "investigational" devices, Premium Therapy expects its EMIT technology to also be granted the preferable "investigational" status in the form of an Investigational Device Exemption (IDE).

Furthermore, while it is expected that full FDA approval will be gained quickly based on the approval of similar devices, the EMIT system will be produced and marketed prior to this approval. Once the IDE has been granted, Premium Therapy will be able to market and sell the device to interested parties prior to FDA approval with the label "For Investigational Use Only." An example of such expedited market entrance can be seen with Leetonus' LeeTone in which an IDE was obtained and devices were sold prior to full FDA approval. Only minimal delay in market entrance is expected as IDE approvals are typically obtained within an average of 3 months including required revisions.

Once full FDA approval is obtained for therapeutic use of the EMIT system, the market is expected to expand dramatically and entrance into foreign markets will be possible. At this stage, as well, it is expected that insurance companies will begin reimbursing for pulsed electromagnetic therapy, greatly increasing demand for Premium Therapy's products. Full FDA approval will be necessary in order to claim therapeutic efficacy of the EMIT system for each of its indications.

MANAGEMENT TEAM

The founders of Premium Therapy are Dr. Julius Nestor, Mr. Pi Long Su, Dr. Sherman MacDonald, and Ivan Astov. Dr. Nestor will serve the company as interim CEO, Mr. Su will serve as interim CFO, Mr. Astov will serve as interim COO, and Dr. MacDonald will serve as Director of Research and Development.

Several key people, including a CEO, are being sought.

Founders and Principals

Julius Nestor, M.D./M.B.A.: Dr. Nestor has a long history of biomedical device design and testing. During his undergraduate career at the University of Arkansas, Dr. Nestor concentrated in Biomedical Engineering with a cumulative GPA of 4.0 in his major. While pursuing his undergraduate degree, he led a team that designed toys for children with cerebral palsy and was subsequently awarded the Excellence in Senior Design Award by the Department of Bioengineering. To augment his academic experience, Dr. Nestor spent a total of 10 months at the Arkansas Department of Health and Safety both testing devices and writing congressional reports on the current state-of-the-art devices. Dr. Nestor is the inventor of Premium Therapy's patented EMIT system as well as multiple other devices including a myringotomy tube insertion device (patent pending), a non-invasive corneal sculpting device (patent pending), and a peritoneovesicular shunt (patent pending). Dr. Nestor is currently a first-year resident at the Therapeutic Institute in Cambridge, Massachusetts.

Pi Long Su, M.B.A.: Mr. Su was previously involved in several Initial Public Offerings and Mergers and Acquisitions as an investment banker, and is a Certified Public Accountant with extensive experience in the U.S., Asia, and Australia. He is also a founding director of a successful start-up company in Hong Kong involved in organizing round-table conferences for senior bankers, publishing banking journals, and creating banking intelligence and proprietary research reports. Mr. Su is currently employed by National Bank as an investment banker.

Sherman MacDonald, M.D.: Dr. MacDonald is highly involved in the improvement of function in people's lives. With the focus of his training in the specialty of Physical Medicine and Rehabilitation, Dr. MacDonald's areas of interest include chronic pain, musculoskeletal and back pain, as well as sports medicine. He received his training in medicine at the University of Arizona School of Medicine. Prior to entering the field of medicine, Dr. MacDonald received his undergraduate education at Harvard University, where he graduated with honors with a degree in Organismic and Evolutionary Biology. Dr. MacDonald is currently a physician at the Therapeutic Institute in Cambridge, Massachusetts.

Ivan Astov: Mr. Astov has an extensive background in general management, finance and research. As an undergraduate at the University of Arkansas, Mr. Astov researched both the pressure distributions in the human microvasculature and the genetically determined temperature sensitivity of the high molecular weight, low copy number pRts1 plasmid. Mr. Astov's commitment to science while pursuing a dual degree in Electrical and Bioengineering was recognized by admission to the University Scholars program. Having worked with Walters Consulting, StockPrice, and later Chase Manhattan, Mr. Astov has over four years of experience in helping American corporate clients to maximize shareholder value by streamlining operations, reengineering systems, and implementing new business strategies. Mr. Astov is currently completing his M.B.A. degree at the Harvard Business School.

Consultants

Morton S. Biddley, J.D.: Mr. Sheldon's background includes over thirty years of experience in business, law, and education. For 12 years, he was one of two principals in MedTech Group, Inc., a Cambridge-based venture development firm. Two public companies, MedTechlex and MedSys, resulted from MedTech's efforts. Prior to founding MedTech, Mr. Biddley was a principal in or consultant to several high technology startup companies in Cambridge Research Park. These included venture capital-backed firms such as MedFlex,BMG Data, Healthwise Corporation, and Cambridge Biomedical Sciences. In addition, Mr. Biddley has held a faculty position with the Harvard Business School for 24 years. He has served as a member of the Business Review Board of the Department of Technology, Massachusetts Department of Commerce, and the Massachusetts Biotechnology Center Task Force on University-Industry Technology Transfer. Mr. Biddley currently is a founder and principal of Technology Foundations Consulting, an international consulting firm.

Howard Melton: After graduating from Wesleyan University with a degree in Biomedical Engineering, Mr. Melton joined the Medical Device Company where he spent a total of five years. His duties with the Medical Device Company included research in the Hydrodynamics and Acoustics Branch and new device evaluation in the Office of Device Evaluation. He then spent two years with Blue Cross Research prior to his current position with the Radiology Department at Harvard University where he has been employed for one year.

Dr. Henry Dillard: Dr. Dillard is currently the Director of Clinical Services in the Physical and Occupational Therapy department at Harvard University. He has assisted in the launch and management of multiple clinical trials, which have set the standard for physical therapy care. Dr. Dillard will be assisting Premium Therapy in the management of its research.

Dennis MacDonald, J.D./MSCE: Mr. MacDonald's background includes experience in the field of structural engineering and the practice of law. He has worked with Johnson Structural Engineers and then later with Ford in structural engineering positions. He has pursued the practice of law for the past 28 years, with a focus of expertise in the area of intellectual property protection.

Management Team Gaps

The founders of Premium Therapy are actively seeking both an experienced CEO and a VP of Business Development. The desired profile for a CEO is an individual experienced in the medical device arena, ideally who was part of a previous successful start-up venture. The ideal VP of Business Development is an individual with experience in distributing and marketing products based on innovative biomedical technologies. Once recruited, the CEO and VP of Business Development will assist the management team in the search for a COO, a CFO, sales/marketing personnel, and technical personnel.

Dr. Nestor will serve as interim CEO, Mr. Su will serve as interim CFO, Dr. MacDonald will serve as Director of Research and Development, and Mr. Astov will serve as interim COO.

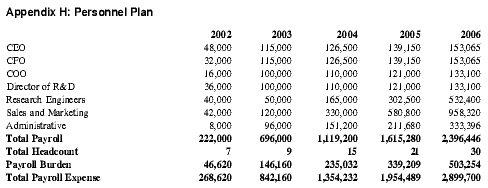

Personnel Plan

The Personnel Plan chronicles the growth of the organization to thirty employees in the first five years. Each year could require a few additional people besides those indicated, based on the growth of the company in accordance with the Business Plan.

Prior to funding, the four principals will be the sole employees and salaries will not be paid unless outside grants are secured. Once funded, the company will hire additional personnel and the principals will begin to earn salaries. See Appendix H for total payroll and headcount.

OPERATIONAL PLAN

Premium Therapy's products will initially consist of manufactured goods. The strategic operational plan is to minimize overhead through the outsourcing of production, distribution, sales and support for both the EMIT MX and SX. Premium Therapy will also decrease required start-up capital through the rental of necessary equipment whenever possible.

Manufacturing

Premium Therapy has arranged to outsource production to Schmidt Scientific, Inc. in Boston, Massachusetts. Schmidt Scientific, Inc., is part of the Schmidt Magnetics Group which has been in magnetics since the late 1800s. Throughout the previous century, Schmidt Scientific, Inc. has gained experience in the production of electromagnetic devices for a variety of applications, including both medical and industrial. The manufactured components will be stored and distributed by specialty distributors contracted for such purposes.

Products

In order to manufacture both the MX and SX models of the EMIT system, three components will need to be produced:

- Logic Controller MX: This device will send powerful currents through the Arrays of Overlapping Coils, causing stimulation of the underlying motor neurons and contraction of the targeted muscle. Due to the requirement for increased power over the SX model, the Logic Controller for the MX model will be significantly more expensive to produce.

- Logic Controller SX: This device will send less powerful pulses of electrical current through the Arrays of Overlapping Coils, stimulating the underlying tissue without contracting the underlying muscle.

- Arrays of Overlapping Coils: This last component will require much more variability than the previous components. Not only will it be necessary to effectively target different regions of the body, but it will also be necessary to accommodate different body sizes. Premium Therapy will initially produce arrays targeting 6 different regions, each with 3 different sizes.

Production Costs

Production costs for each component were estimated using initial price quotes from Schmidt Scientific, Inc. Upon realization of its projected level of sales, Premium Therapy will investigate the feasibility of manufacturing facilities of its own to improve on its cost structure and increase its profitability.

Through outsourcing production, Premium Therapy will be able to keep initial capital requirements lower with the trade-off of higher production costs. It is estimated that the total cost of manufacture for each of the components will be:

- EMIT MX Logic Controller: $5,000.00 per unit

- EMIT SX Logic Controller: $925.00 per unit

- Array of Coils (for models MX and SX): $95.00 per unit

It is estimated, as well, that production costs will drop 3 percent per year as volume increases and experience with manufacturing techniques is gained.

Sourcing

Primary raw materials needed are as follows:

- Electrical components (capacitor, wiring, etc.) for Logic Controller and Arrays of Coils.

- Molds for external console of Logic Controller.

- Material for wraps in which overlapping coils will be placed.

All of these components are easily sourced and multiple suppliers have been identified. Premium Therapy will establish business relationships with these suppliers to be negotiated for preferred pricing structures without compromising quality standards.

Product Support

In the early years, trained employees of the specialty distributors will provide product support for the EMIT systems MX and SX. Once the EMIT system gains acceptance, Premium Therapy will consider adopting the responsibility of product support.

Facilities and Properties

The company will initially be based in Cambridge Research Park, Massachusetts. This location will facilitate research and testing opportunities at Harvard University to be conducted in coordination with the University of Arizona Health Sciences Center.

In view of the strategic plan to contract with third parties for all manufacturing and distribution requirements, the only necessary facilities will be offices for personnel. After Year 5, when the company has reached its anticipated milestones, the company will explore the feasibility of constructing its own manufacturing and distribution facilities.

FINANCIAL PLAN

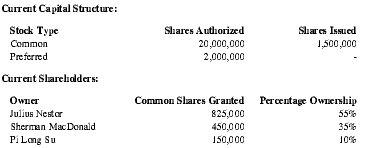

Premium Therapy intends to raise approximately US $1,000,000 worth of seed capital. Founders and principals have already committed $100,000.

| Current Capital Structure: | ||

| Stock Type | Shares Authorized | Shares Issued |

| Common | 20,000,000 | 1,500,000 |

| Preferred | 2,000,000 | - |

| Current Shareholders: | ||

| Owner | Common Shares Granted | Percentage Ownership |

| Julius Nestor | 825,000 | 55% |

| Sherman MacDonald | 450,000 | 35% |

| Pi Long Su | 150,000 | 10% |

For $1,000,000, the investing party will receive convertible, preferred shares with an ownership interest, liquidation preference, and anti-dilution provisions as negotiated.

The proceeds from the offer will be used to fund the working capital requirements including employee compensation, research and development, initial operations facilities, and patent and trademark registration. Premium Therapy has no intention to purchase land, building, or plant, and will attempt to leverage its current assets with lease and rental whenever economical. Premium Therapy intends to issue equity options for subscription of common shares up to 20 percent of the capital as employee incentives, which will result in dilution of current shareholdings.

Liquidity for Investors and Equity Valuation:

Premium Therapy's management intends to grow Premium Therapy into the market leader with its innovative, therapeutic devices. With the attainment of each of its milestones, Premium Therapy's potential will accelerate and its enterprise value will grow accordingly. With consistently strong performance, it is likely that private investors will continue to show interests in Premium Therapy's common and preferred shares, creating market liquidity for current investors even without the benefit of an initial public offering.

To the extent that actual operational results materially exceed those projected herein, the probability of an initial public offering increases dramatically. Alternatively, the medical instrument industry has been experiencing significant consolidation for more than a decade. The company will be receptive to any appropriate merger opportunities, and investors may achieve liquidity through this vehicle.

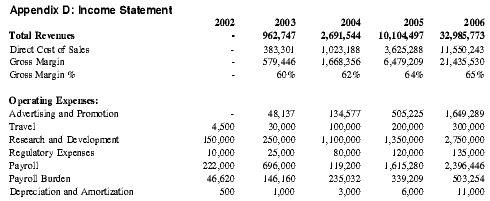

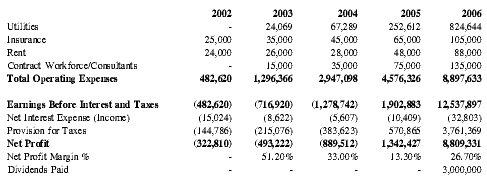

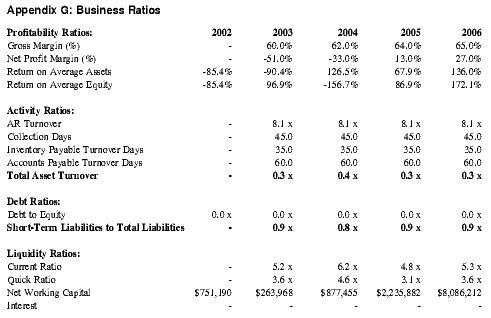

Projected Profit and Loss

Barring any unforeseen circumstances, Premium Therapy anticipates profitability by Year 4 of operations and expects profits in subsequent years to accelerate with the increase in anticipated sales volume, yielding approximately $1.3 million in net profit in Year 4 and $8.8 million in Year 5. See Appendix D for detailed projections.

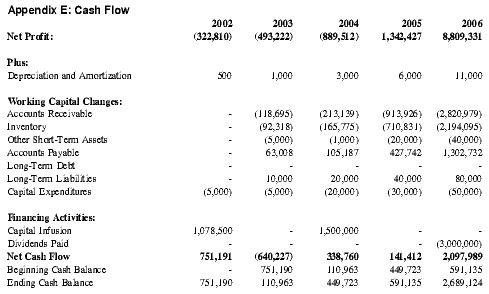

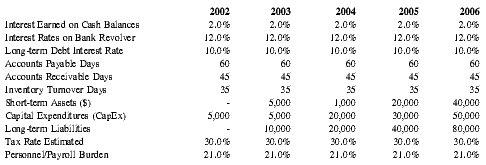

Projected Cash Flow

In Year 1 of the business plan, Premium Therapy expects to raise $1,000,000 in working capital. While Premium Therapy has planned for additional capital raising of $1,500,000 in Year 3 of the business plan, it is expected that many of the research grants for which Premium Therapy has applied, collectively totaling over $2,500,000, will have been secured by this point and that the actual required capital will be significantly less. The potential for securing grants will be greatly enhanced due to Premium Therapy's relationships with multiple renowned investigators at the nations leading universities. See Appendix E for detailed Pro forma Cash Flow projections.

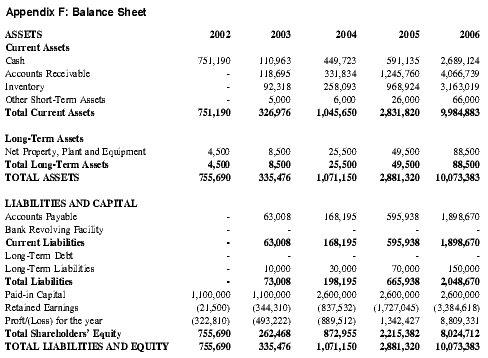

Projected Balance Sheet

In order to minimize required capital in the early years of the business plan, Premium Therapy will lease and rent equipment and supplies whenever possible. This effort will be further complemented by the use of a specialty distributor, which will greatly decrease initial capital requirements. See Appendix F for a detailed Pro-forma Balance Sheet.

APPENDIX

Appendix A: Competitive Technology

The current industry for Premium Therapy's EMIT system is rapidly evolving. Analysis of the current state of the industry surrounding these products must first consider the sum in terms of its parts. The several industry segments for the EMIT system Models MX and SX are outlined below.

EMIT MX Industry Segments

Prevention and Treatment of Muscular Atrophy: The industry for atrophy prevention and treatment currently involves primarily electrical stimulating technologies. Other technologies have made small inroads in the industry, but the bulk of therapeutic intervention consists of traditional exercise and physical therapy-based activities.

- Electrical Stimulating Devices (ES): Commonly referred to as functional electrical stimulators, these devices utilize the direct application of electric potentials in order to excite nerves. There are hundreds of different devices available for ES of muscle. The use of these devices has encountered several significant obstacles in the treatment of atrophy, though. While effective in stimulating superficial muscles, ES technology is limited by the fact that it is not able to penetrate tissues to reach deep muscles without causing skin burns and irritation. As a result, this form of stimulation has found very limited success in the treatment of atrophy for large muscle groups, such as those found in the legs, shoulder, back, and other areas.

- Existing Pulsed Electromagnetic Stimulating Devices (PES): PES has been shown to overcome a number of the limitations of electrical stimulating technology. Significantly, PES has been shown to penetrate much more deeply and to do so much less painfully. What is more, PES has potential indications that do not overlap those of ES. Due to its painless nature, PES can be used more frequently and over a larger area of the body without significant discomfort. Despite these scientifically proven advantages, no competitor, to date, has developed a user-friendly, consistently-effective therapeutic device employing PES technology.

Neurogenic Bladder and Bowel Treatments: The present industry for the treatment of neurogenic bladder and bowel involves principally invasive therapies that are associated with high risks of complications. The treatment options for persons with this condition have, to date, included the following therapies:

- Intermittent Catheterization: Catheters, or hollow tubes, can be inserted into the bladder in order to provide evacuation at regular intervals. While simple and effective, long-term use of catheterization is associated with a number of significant complications, including: bladder and kidney infections, chronic kidney inflammation, kidney stones, and bladder stones.

- Surgery: The alternative to intermittent catheterization for treating these conditions for many patients has been surgical intervention. Surgical procedures can involve the placement of an artificial sphincter around the neck of the bladder or manipulation of the outflow tracts to assist with bladder emptying. Surgical intervention is invasive, and thus associated with long-term complications including infection and continued need for catheterization or similar procedures. In addition, surgical management has failed to demonstrate significant improvements in the quality of life of persons affected with these conditions.

- Electrical Stimulation (ES): This technology has been used on a limited basis for the facilitation of voiding with neurogenic bladder. Application of ES technology in this field has remained largely experimental to date, and has failed to translate into a viable treatment option for patients.

EMIT SX Market Segments