ABSORPTION ACCOUNTING

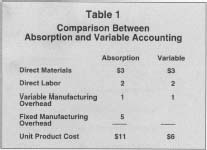

Absorption accounting is a method of accounting where all the costs of manufacturing, (including fixed, variable and mixed costs) are allocated to the produced units. This method is in contrast to variable (or marginal or direct) costing, which attaches only variable costs to the manufactured output and charges the fixed costs to the accounting period. Another name for absorption accounting is full costing. Absorption accounting causes per unit product costs to be higher than variable costing (see Table 1) and is a generally accepted accounting principle required for external financial reporting as well as U.S. tax returns.

All other costs for a firm are categorized as period costs. For absorption accounting this is primarily selling and administrative expense, whereas variable costing includes the same selling and administrative expense plus the fixed manufacturing overhead expenses. In the long run both absorption and variable cost accounting have the same total expenses, but in the short run the reporting of costs can provide very different information, especially when sales and inventory fluctuate. Both income and inventory valuation vary between these two methods as the following case shows.

Comparison Between

Absorption and Variable Accounting

| Absorption | Variable | |

| Direct Materials | $3 | $3 |

| Direct Labor | 2 | 2 |

| Variable Manufacturing overhead | 1 | 1 |

| Fixed Manufacturing overhead | 5 | |

| Unit Product Cost | $11 | $6 |

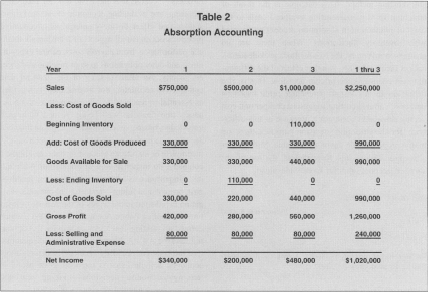

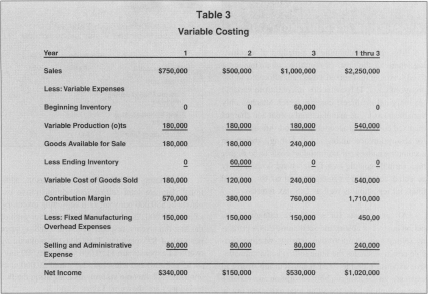

Continuing with the earlier comparison, additional data are total selling and administrative expenses of $80,000 per year, zero beginning inventory, sales of 30,000, 20,000, and 40,000 units for each of the first three years, respectively, with a selling price per unit of $25 per unit. Total fixed manufacturing overhead expenses are $150,000 yearly (30,000 units × $5 per unit) and a level production of 30,000 units annually. The income statements comparing the two techniques are shown in Tables 2 and 3.

Observing the income statements accounting for the same years and same transactions, it is apparent the net income is different in years 2 and 3 when inventory was built-up and then depleted between absorption accounting and variable costing. Absorption

Absorption Accounting

| Year | 1 | 2 | 3 | 1 thru 3 |

| Sales | $750,000 | $500,000 | $1,000,000 | $2,250,000 |

| Less: Cost of Goods Sold | ||||

| Beginning Inventory | 0 | 0 | 110,000 | 0 |

| Add: Cost of Goods Produced | 330,000 | 330,000 | 330,000 | 990,000 |

| Goods Available for Sale | 330,000 | 330,000 | 440,000 | 990,000 |

| Less: Ending Inventory | 0 | 110,000 | 0 | 0 |

| Cost of Goods Sold | 330,000 | 220,000 | 440,000 | 990,000 |

| Gross Profit | 420,000 | 280,000 | 560,000 | 1,260,000 |

| Less: Selling and Administrative Expense | 80,000 | 80,000 | 80,000 | 240,000 |

| Net Income | $340,000 | $200,000 | $480,000 | $1,020,000 |

Variable Costing

| Year | 1 | 2 | 3 | 1 thru 3 |

| Sales | $750,000 | $500,000 | $1,000,000 | $2,250,000 |

| Less:Variable Expenses | ||||

| Beginning Inventory | 0 | 0 | 60,000 | 0 |

| Variable Production(o)ts | 180,000 | 180,000 | 180,000 | 540,000 |

| Goods Available for Sale | 180,000 | 180,000 | 240,000 | |

| Less Ending Inventory | 0 | 60,000 | 0 | 0 |

| Variable Cost of Goods Sold | 180,000 | 120,000 | 240,000 | 540,000 |

| Contribution Margin | 570,000 | 380,000 | 760,000 | 1,710,000 |

| Less: Fixed Manufacturing Overhead Expenses | 150,000 | 150,000 | 150,000 | 450,00 |

| Selling and Administrative Expense | 80,000 | 80,000 | 80,000 | 240,000 |

| Net Income | $340,000 | $150,000 | $530,000 | $1,020,000 |

accounting dampens the volatility of earnings for both an upswing and downswing in sales. Thus, the income stream is smoothed, projecting an appearance of stability and therefore less risk compared to the greater variability of the profits reported by the variable costing method. This outcome is the result of attaching fixed manufacturing overhead costs to the units of production in absorption accounting coupled with inventory fluctuations. When there are no changes in inventory, the two methods provide identical net income figures. Another effect of the differential unit costing is the pricing decision. That is, if a firm aims for a constant percentage profit based on unit cost, variable costing suggests a cheaper unit cost versus absorption accounting. Because of this difference, for short-run price decision purposes, there are many proponents in favor of variable costing over absorption accounting. Nevertheless, the use of absorption accounting is far more widespread.

SEE ALSO : Accounting

[ Raymond A. K. Cox ]

FURTHER READING:

Garrison, Ray H., and Eric W. Noreen. Managerial Accounting. Boston: Irwin/McGraw-Hill, 1997.