CASH FLOW STATEMENT

A cash flow statement is a financial report that tells the reader the source of a company's cash and how it was spent over a specified time period. This is an important indicator of financial soundness because it is possible for a company to show profits while not having enough cash to sustain operations. A cash flow statement counters the ambiguity regarding a company's solvency that various accrual accounting measures create. It also categorizes the sources and uses of cash to provide the reader with an understanding of the amount of cash a company generates and uses in its operations, as opposed to the amount of cash provided by sources outside the company, such as borrowed funds or funds from stockholders. The cash flow statement also tells the reader how much money was spent for items that do not appear on the income statement, such as loan repayments, long-term asset purchases, and payment of cash dividends.

DEVELOPMENT OF THE REPORTING

STANDARD

In November 1987, the Financial Accounting Standards Board (FASB) adopted Statement of Financial Accounting Standards No. 95—Statement of Cash Flows. FASB 95 requires that a full set of financial statements includes a cash flow statement as the fourth required financial statement (along with a balance sheet, income statement, and statement of retained earnings). This statement established standards for cash flow reporting, and superseded the Accounting Principles Board (APB) Opinion No. 19, Reporting Changes in Financial Position.

APB Opinion No. 19, adopted in March 1971, had permitted, but did not require, enterprises to report cash flow information in a statement of changes in financial position, also commonly known as a funds statement. There was no required format or universally accepted definitions for categories in the statement, however, and the term "funds" itself was not sufficiently defined. Hence, the statement referred to changes in funds, but what constituted those funds differed across companies. Among the ambiguities, some firms defined funds as cash, some used cash and short-term investments, some used quick assets, and some used working capital.

While it was widely recognized that the funds statement provided valuable and relevant information, the lack of consistency in format and focus from one firm to another was part of the reason that the FASB eventually took up the matter and, with extensive commentary from accountants and other interested parties, adopted the standards espoused in FASB 95. The standard, which took effect in 1988, discouraged use of the word "funds" in cash flow statements because the term had been cl6aked in so much ambiguity.

REQUIREMENTS FOR CASH FLOW

STATEMENTS

FASB 95 requires that a statement of cash flows classify cash receipts and payments according to whether they stem from operating, investing, or financing activities. It also provides that the statement of cash flows may be prepared under either the direct or indirect method, and provides examples of how to prepare statements using each method.

Under the FASB standard, the core concept, cash, is defined as "cash and cash equivalents." Cash includes currency and bank deposits, whereas cash equivalents include other highly liquid investments like U.S. Treasury bills, money market accounts, and commercial paper. Other sorts of investments such as stocks, bonds, futures contracts, and so forth are not considered cash.

CLASSIFICATIONS OF CASH RECEIPTS

AND PAYMENTS

Nearly all business transactions completed during the fiscal year impact cash flow in one way or another, and in summary form they are factored into the year's cash flow statement. Exactly where on the statement depends on the nature of the transaction. As noted, the three essential categories of cash flow are operating activities, investing activities, and financing activities. The components of each of these will be addressed separately.

OPERATING ACTIVITIES.

Operating activities are the bread-and-butter transactions that keep the business running. Most notably, they include incoming revenue from the sale of goods or services and most kinds of outgoing payments. Cash flow from operating activities doesn't include principal paid on or received from loans, and only includes transactions that were completed during the period. This simply means that an operating transaction is not considered cash flow until the cash is actually received or paid, as opposed to just being recorded as accounts receivable or payable. In general, if an activity would appear on the company's income statement, it would be a candidate for the operating section of the cash flow statement. Net changes in balance sheet categories from period to period also represent cash flow; thus, a net decrease in accounts receivable from year to year normally suggests an increase in cash flow for that period.

Sometimes goods or services are paid for prior to the period in which the benefit is matched to revenue (recognized). This results in a deferred or prepaid expense. Items such as insurance premiums that are paid in advance of the coverage period are classified as prepaid. Sometimes goods or services are received and used by the company before they are paid for, such as telephone service or merchandise inventory. These items are called accrued expenses, or payables, and are recognized on the income statement as an expense before the cash flow occurs.

INVESTING ACTIVITIES.

Investment cash flow results from (1) the purchase or sale of property and equipment, (2) the purchase or sale of securities and related investments, and (3) loans made to other businesses. It includes only the principal or book value of the investment. Interest and depreciation are classified as operating cash flow, as are net gains or losses on investments. Because of these distinctions, cash flow from investment activities is typically more complex to calculate than that from other categories.

FINANCING ACTIVITIES.

Financing activities consist of transactions affecting a company's liabilities and shareholder equity. Mainly involving how the company obtains capital and enhances the value of its stock, they include such things as issuing bonds, payments on debt, paying dividends, and issuing and buying back stock.

METHODS OF PREPARING A CASH FLOW

STATEMENT

FASB Statement No. 95 allows the preparer a choice of the direct or the indirect method of cash flow statement presentation, although the FASB prefers the direct method. The difference lies in the presentation of the operating cash flow information.

DIRECT METHOD.

Companies that use the direct method are required, at a minimum, to report separately the following classes of operating cash receipts and payments:

Receipts:

- Cash collected from customers

- Interest and dividends received

- Other operating cash receipts, if any

Payments:

- Cash paid to employees and suppliers of goods or services (including suppliers of insurance, advertising, etc.)

- Interest paid

- Income taxes paid

- Other operating cash payments, if any

Companies are encouraged to further break down any operating cash receipts and payments that they consider meaningful.

INDIRECT METHOD.

The indirect method, by contrast, reports operating cash flow based on changes in the balance sheet (the distribution of assets and liabilities) from period to period as they relate to net income. Thus, instead of reporting the total cash received from customers, an indirect statement only lists the change in cash received from the previous period. The net cash flow reported should be the same as in the direct method, but in the indirect method the level of detail tends to be less.

The key elements of the operating activities section using the indirect method are as follows:

- Net income

- Depreciation and amortization

- Deferred income taxes

- Interest income

- Change in accounts receivable

- Change in accounts payable

- Change in inventories

- Net gains from sale of investments or assets

A few additional categories are used in some circumstances. Each category is either added or subtracted from net income depending on whether it corresponds to an inflow or outflow of cash. When all of these factors are combined, they equal the net operating cash flow for the period.

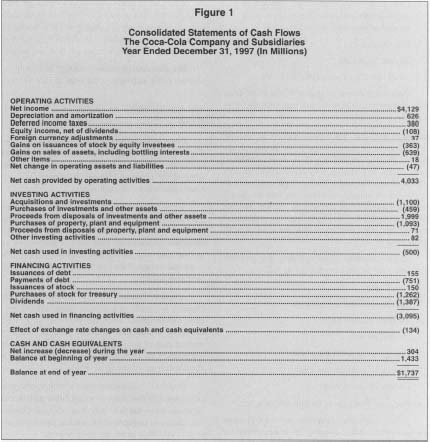

As an alternative, some cash flow statements using the indirect method report operating cash flow as a single line item and present the reconciliation details elsewhere in a supplementary schedule. According to FASB standards, the direct method also requires a supplementary schedule that essentially incorporates the indirect measures into the statement. Due to this added burden, the majority of companies tend to use the indirect method only, despite the FASB's stated preference for the direct. Figure I shows a modified statement of cash flows from the Coca-Cola Company using the indirect method.

Regardless of whether the direct or the indirect method is used, the operating section of the cash flow statement ends with net cash provided (used) by operating activities. This is the most important line item on the cash flow statement. A company has to generate enough cash from operations to sustain its business activity. If a company continually needs to borrow or obtain additional investor capitalization to survive, the company's long-term existence is in jeopardy.

The presentation of the investing and financing sections of the statement is the same in each method.

BALANCE SHEET ACCOUNTS AND CASH

FLOW

Every balance sheet account reflects specific activity. There are only a few distinctive transactions that affect each account. Following are examples of some of the common changes in balance sheet accounts that register as cash flow.

Accounts receivable increases when the company sells merchandise or does a service on credit, and decreases when the customer pays its bill. Accounts receivable is associated with sales or revenue on an income statement. The change in accounts receivable or the cash collected from customers is classified as an operating activity.

Inventory increases when the company buys merchandise for resale or use in its manufacturing process, and decreases when the merchandise is sold. Inventory is associated with the income statement account cost of goods sold (COGS). The change in inventory or the cash paid for inventory purchases is classified as an operating activity.

Prepaid insurance increases when the company pays insurance premiums covering future periods and decreases when the time period of coverage expires. The change in prepaids or the amount paid for insurance is classified as an operating activity.

Land, building, and equipment accounts increase when the company purchases additional assets and decrease when the assets are sold. The only time the income statement is affected is when the asset is sold at a price higher or lower than book value, at which time a gain or loss on sale of assets appears on the income statement. The amount of cash used or received from the purchase or sale of such assets is classified as an investing activity. The gain or loss is reported as operating cash flow.

Accumulated depreciation increases as the building and equipment depreciates and decreases when building and equipment is sold. Depreciation expense does not appear on a cash flow statement presented using the direct method. Depreciation expense is added back to net income on a cash flow statement presented using the indirect method, since the depreciation caused net income to decrease during the period but did not affect cash.

Goodwill increases when the parent company acquires a subsidiary for more than the fair market value of its net assets. Goodwill amortizes over a time period not to exceed 40 years. Goodwill is associated with amortization expense on the income statement. Amortization expense appears in the operating section of a cash flow statement prepared using the indirect method. Amortization expense does not appear on a cash flow statement prepared using the direct method.

Notes payable increases when the company borrows money, and decreases when the company repays the funds borrowed. Since only the principal appears on the balance sheet, there is no impact on the income statement for repaying the principal component of the note. Notes payable appears in the financing section of a cash flow section.

Premiums and discounts on bonds are amortized through bond interest expense. There is no cash flow associated with the amortization of bond discounts or premiums. Therefore, there will always be an adjustment in the operating section of the cash flow statement prepared using the indirect method for premium or discount amortization. Premium or discount amortization will not appear on a cash flow statement prepared using the direct method.

Common stock and preferred stock increase when additional stock is sold to investors, and decrease when stock is retired. There is no income statement impact for stock transactions. The cash flow associated with stock sales and repurchases appears in the financing section.

Retained earnings increase when the company earns profit and decreases when the company suffers a loss or declares dividends. The profit or loss appears as the first line of the operating section of the cash flow statement. The dividends appear in the financing section when they are paid.

SIGNIFICANT NONCASH

TRANSACTIONS

Noncash transactions aren't incorporated in the statement of cash flows, but often they need to be disclosed elsewhere in financial statements. Examples of these types of transactions include

- converting bonds to stock

- acquiring assets by assuming liabilities

If there are only a few such transactions, it may be convenient to include them on the same page as the statement of cash flows, in a separate schedule at the bottom of the statement. Otherwise, the transactions may be reported elsewhere in the financial statements, clearly referenced to the statement of cash flows.

Other events that are generally not reported in conjunction with the statement of cash include stock dividends, stock splits, and appropriation of retained earnings. These items are generally reported on a statement of retained earnings or schedules and notes pertaining to changes in capital accounts.

FURTHER READING:

Hackel, Kenneth S., and Joshua Livnat. Cash Flow and Security Analysis. 2nd ed. Chicago: Irwin Professional Publishing, 1996.

"Official Releases, Statement of Financial Accounting Standards No. 95—Statement of Cash Flows." Journal of Accountancy, February 1988, 139, 147.

Plewa, Franklin J., Jr., and George T. Friedlob. Understanding Cash Flow. New York: John Wiley & Sons, 1995.

If a company issues stocks for the purchase of say,Equipment : is the purchase of fixed asset reported in the investing activity or in the Financing activity of the statement of cash flow?

Waiting your reply.

Berhane