COST ACCOUNTING

Cost accounting is a subset of accounting that develops detailed information about costs as they relate to units of output and to departments, primarily for purposes of providing inventory valuation (product costing) for financial statements, control, and decision making.

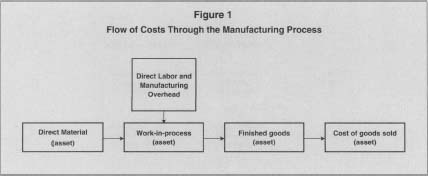

Manufacturing costs flow through three basic responsibility centers: the raw materials storeroom, the factory, and the finished good storeroom. These inventory accounts are usually provided to accumulate costs as they relate to the three responsibility centers: raw material inventory, work-in-process inventory, and finished good inventory. When goods are sold, costs are transferred from the finished goods inventory account to the cost of goods sold account. The flow of costs through the manufacturing process is illustrated in Figure 1.

TYPES OF COST SYSTEMS

Either a job-order cost system or a process cost system is used to assign costs to manufactured products for purposes of controlling costs and costing products. A job-order cost system accumulates costs of material, labor, and manufacturing overhead expense by specific orders, jobs, batches, or lots. Job-order cost systems are widely used in construction, furniture, aircraft, printing, and similar industries where the costs of a specific job depend on the particular order specification.

Process cost systems are used by firms that manufacture products through continuous-flow systems or on a mass-production basis. Industries that use process cost systems include chemicals, petroleum products, textiles, cement, glass, mining, and many others. In a process cost system, costs for a department or process are accumulated. Per-unit costs are obtained by dividing the total departmental costs by the quantity produced during a given period in the department or process.

MANUFACTURING COSTS

Manufacturing costs include direct material, direct labor, and

manufacturing overhead costs. Direct material and direct labor costs can

usually be traced directly to particular units manufactured. Manufacturing

overhead costs incurred during a period are usually allocated to units

manufactured based on a predetermined overhead rate. This overhead rate is

based on the budgeted overhead costs for the period and the estimated

level of activity (for example, units produced, direct labor hours, direct

labor costs). The predetermined factory overhead rate per direct labor

hour would be computed as shown in the formula below (using assumed data):

If 400 direct labor hours were worked on a particular job, $2,000 (400 x $5) in overhead costs would be assigned to that job. Any difference between the total overhead costs actually incurred during a year and the total amount assigned to units in production can be charged to cost of goods sold for the year if the amount is not material. If material, the variance can be distributed among the work-in-process inventory, finished goods inventory, and cost of goods sold.

STANDARD COST SYSTEMS

Standard cost systems are widely used for budgeting and performance evaluation purposes in both job-order and process cost systems. Standard costs are predetermined target costs, and are used to assist in the budget process, identify trouble areas, and evaluate performance. In a standard cost system, product costing is achieved by using predetermined standard costs for material, direct labor, and overhead. Standard costs are developed on the basis of historical cost data adjusted for expected changes in the product, production techniques, engineering estimates, and other considerations. Standards may be established at any one of the following levels:

- Ideal standards are set for the level of maximum efficiency.

-

Normal standards are set to reflect the conditions that are expected to

exist over a period sufficient to take into consideration seasonal and

cyclical fluctuations.

Figure 1

Figure 1

Flow of Costs Through the Manufacturing Process - Currently attainable standards are set at a level that represents anticipated conditions assuming efficient operations.

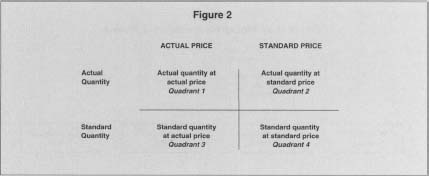

Because predetermined standards usually differ from actual costs incurred, a variance typically exists. An unfavorable variance results when actual cost exceeds standard cost; a favorable variance results when standard cost exceeds actual cost. The usual approach followed in standard cost analysis is to separate price factors from efficiency factors. When the actual amount paid differs from the standard amount, the variance is referred to as a price, rate, or spending variance. When the actual input quantity (e.g., tons, labor hours) differs from the standard input quantity, the variance is referred to as a quantity, volume, or yield variance. The relationships between actual and standard price/quantity are illustrated in the diagram in Figure 2. The diagram shows two types of prices and quantities: actual and standard. A price variance is conceptualized as the difference between quadrant 1 and 2. A quantity variance is reflected in the difference between quadrants 2 and 4.

The formulas for typical direct material and direct labor variances include the following:

- Direct material price variance = Actual quantities purchased × (Actual price—Standard price).

- Material quantity (usage, efficiency) variance = (Actual quantity used—Standard quantity allowed) × Standard price.

- Direct labor rate variance = Actual hours used × (Actual labor rate—Standard labor rate).

- Direct labor efficiency variance = (Actual hours used Standard hours allowed) × Standard labor rate.

Controlling overhead costs is usually more difficult than controlling direct material and direct labor costs because it is difficult to assign responsibility for overhead costs incurred. A general approach to controlling overhead costs involves computing two variances: the controllable overhead variance and the overhead volume variance. The controllable overhead variance is the difference between the actual overhead costs incurred and the factory overhead budgeted for the level of production achieved. This variance measures the difference between the overhead costs actually incurred and the costs that should have been incurred at the level of output attained. The overhead volume (or usage) variance is the difference between the factor overhead budgeted for the level of production achieved and the overhead applied to production using the standard overhead rate. A volume variance arises if more or less plant capacity than normal is actually used. When the expected capacity usage is exceeded, the overhead volume variance is favorable.

Variances should be analyzed if the cost of doing so does not exceed the benefits that can be expected from the analysis. If the variances are to be analyzed, they should be examined to find their causes. At this point, it should be determined what action should be taken, if any.

JUST-IN-TIME COSTING

Just-in-time (JIT) costing is used in manufacturing whereby each unit of product is produced only upon request or requisition. This can result in the maintenance of minimal inventory levels of finished goods, work-in-process, and raw material. When JIT costing is used as a costing system, material cost and work-in-process costs are combined into a single "resources in process" account. Direct labor and overhead are also combined into a conversion cost account.

ACTIVITY-BASED COSTING

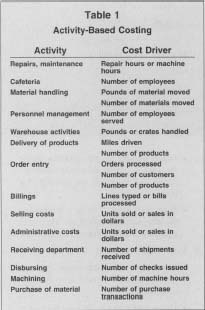

Under activity-based costing (ABC) overhead costs are allocated to products on the basis of the resources consumed in each activity relating to the design, production, and distribution of particular products. Costs are assigned to homogeneous cost pools that represent specific activities. The allocation of these costs to products is accomplished through appropriate cost drivers. Cost drivers are transaction-related and volume-related, which represent the causes of costs incurred in specific activities (see Table 1).

Activity-Based Costing

| Activity | Cost Driver |

| Repairs, maintenance | Repair hours or machine hours |

| Cafeteria | Number of employees |

| Material handling | Pounds of material moved |

| Number of materials moved | |

| Personnel management | Number of employees served |

| Warehouse activities | Pounds or crates handled |

| Delivery of products | Miles driven |

| Number of products | |

| Order entry | Orders processed |

| Number of customers | |

| Number of products | |

| Billings | Lines typed or bills processed |

| Selling costs | Units sold or sales in dollars |

| Administrative costs | Units sold or sales in dollars |

| Receiving department | Number of shipments received |

| Disbursing | Number of checks issued |

| Machining | Number of machine hours |

| Purchase of material | Number of purchase transactions |

JOINT PRODUCTS AND BY-PRODUCTS

Joint costs are costs of simultaneously producing or acquiring two or more products that are produced or acquired together. Joint products resulting from the single-production process usually require further processing. Typically, none of the joint products have a relative value of such a size that it can be designated a major product. Joint products have common costs incurred before the split-off point. The split-off point is the point of production when the joint products can be identified and removed from the common process.

By-products are those products emerging at the split-off point that have minor sales value as compared with those of the major products. In many operations, by-products are the same as scrap. By-products frequently are not allocated to any of the total joint costs incurred in the process. If additional costs incurred alter the split-off to further process the by-products, these costs are usually assigned to the by-product.

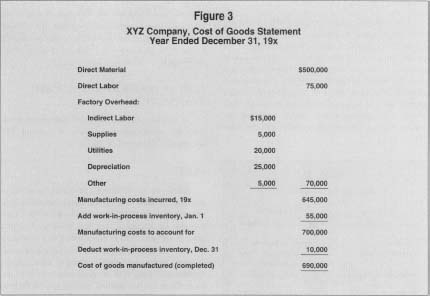

COST OF GOODS MANUFACTURED

STATEMENT

A cost of goods manufactured statement summarizes the manufacturing activities of a period. The statement is illustrated in Figure 3.

COSTS

Costs are expenditures (decreases in assets or increases in liabilities) made to obtain economic benefit, usually resources that can produce revenues. Cost can also be defined as sacrifices made to acquire a good or service. Used in this sense, a cost represents an asset. An expense is a cost that has been used by the company in the process of obtaining revenue, i.e., the benefits associated with the good or service have expired. Costs can be classified in many ways including:

-

Direct and indirect costs:

- Direct costs are outlays that can be identified with a specific product, department, or activity. For example, the cost of material and labor that are identifiable with a particular physical product are direct costs for the product.

- Indirect costs are those outlays that cannot be identified with a specific product, department, or activity. Taxes, insurance, and telephone expense are common examples of indirect costs.

-

Product and period costs:

- Product costs are outlays that can be associated with production. For example, the direct costs of materials and labor used in the production of an item are product costs.

- Period costs are expenditures that are not directly associated with production, but are associated with the passage of a time period. The president's salary, advertising expense, interest, and rent expenses are examples of period costs.

-

Fixed, variable, and mixed costs:

-

Fixed costs are costs that remain constant in total (not per unit)

regardless of the volume of production or sales, over a relevant

range of production or sales. Rent

and depreciation are typically fixed costs.

Figure 3

Figure 3

XYZ Company, Cost of Goods Statement Year Ended December 31, 19x - Variable costs are costs that fluctuate in total (not per unit) as volume of production or sales fluctuates. Direct labor and direct material costs used in production and sales commissions are examples of variable costs.

- Mixed costs are costs that fluctuate with production or sale, but not directly in proportion to production or sales. Mixed costs contain elements of fixed and variable costs. Costs of supervision and inspection are usually mixed costs.

-

Fixed costs are costs that remain constant in total (not per unit)

regardless of the volume of production or sales, over a relevant

range of production or sales. Rent

-

Controllable and uncontrollable costs:

- Controllable costs are costs that are identified as a responsibility of an individual or department, and that can be regulated within a given period. Office supplies would ordinarily be considered controllable costs for an office manager.

- Uncontrollable costs are those costs that cannot be regulated by an individual or department within a given period. For example, rent expense is an uncontrollable cost for the factory manager.

-

Out-of-pocket costs and sunk costs:

- Out-of-pocket costs are costs that require the use of current economic resources. Taxes and insurance are out-of-pocket costs.

- Sunk costs are outlays or commitments that have already been incurred. The cost of equipment already purchased is a sunk cost.

-

Incremental, opportunity, and imputed costs:

- Incremental cost (or differential cost) cost is the difference in total costs between alternatives.

- Opportunity cost is the maximum alternative benefit that could be obtained if economic resources were applied to an alternative use.

- Imputed costs are costs that can be associated with an economic event when no exchange transaction has occurred.

- Relevant cost is an expected future cost and a cost that represents the difference in costs among alternatives.

[ Charles Woelfel ,

updated by Joan K. Cousins ]

FURTHER READING:

Horngren, Charles T. Cost Accounting. Prentice Hall, 1996.

——. Management and Cost Accounting. Prentice Hall, 1998.

Polimeni, Ralph S., Sheila A. Handy, and James A. Cashin. Schaum's Outline of Theory and Problems of Cost Accounting. McGraw-Hill, 1994.

Comment about this article, ask questions, or add new information about this topic: