FIVE TIGERS

Much has transpired in east Asia since several of its dynamic, export-driven economies earned the appellation "tigers" at the height of their rapid economic expansion. After years of remarkable growth, the five—Hong Kong, Singapore, South Korea, Taiwan, and Thailand—along with other nations in the region hit a stumbling block in the mid-1990s that severely curtailed the vigorous growth associated with the so-called Asian economic miracle. Felt worldwide, the crisis impacted each country differently, slowing the growth of some and causing economic contraction in others. By the end of the 1990s, the five tigers and the emerging economic strength they symbolized were hardly dead, but they were perhaps tamed a bit by events over the decade.

BACKGROUND

While each of the five tigers experienced rapid growth, as did neighboring economies labeled by some as cubs, they often did so in different ways. Originally, observers of Asia recognized four tigers. Thailand was added to the list later, and some experts have also considered several other fast-growing Asian economies to rank among the tigers.

The distinguished four—Hong Kong, Singapore, South Korea, and Taiwan—began their ascent in the 1960s by developing their industrial bases and focusing on international trade. In manufacturing, they enjoyed a cost advantage over industrialized countries because of comparatively low wages. Thus, in the early stage the tigers emphasized exporting inexpensive, low-quality merchandise to large trading partners like Japan and the United States. Spurred by heavy internal investment (both domestic and foreign) and increasing worker productivity, they moved toward higher quality goods, but continued to reap a cost advantage. In some cases, the Asian tigers used trade barriers, exchange rate controls, and other forms of government intervention to advance their domestic economies.

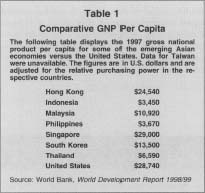

Comparative GNP Per Capita

| The following table displays the 1997 gross national product per capita for some of the emerging Asian economies versus the United States. Data for Taiwan were unavailable. The figures are in U.S. dollars and are adjusted for the relative purchasing power in the respective countries. | |

| Hong Kong | $24,540 |

| Indonesia | $3,450 |

| Malaysia | $10,920 |

| Philippines | $3,670 |

| Singapore | $29,000 |

| South Korea | $13,500 |

| Thailand | $6,590 |

| United States | $28,740 |

The economic development of the tigers was marked not only by the growth of their gross domestic products and foreign trade, but also by a significant rise in their standards of living and the material well-being of their populations. Despite various political barriers and occasional instability, poverty receded and a thriving middle class coalesced as per-capita incomes reached par with those of the world's richest nations.

By the 1980s a few more countries of the Pacific Rim, notably Indonesia, Malaysia, and Thailand, began to show similar promise. They achieved similar growth rates at the macroeconomic level; however, they failed to advance as rapidly in socioeconomic areas such as education, skilled labor, and poverty reduction.

SLOWDOWN AND SETBACKS

In the 1990s the glow of Asia's buoyant economies dimmed slightly at two key points: a general recession in the early 1990s and a regional financial crisis in the mid-1990s. First was the general world recession. Japan, one of the tigers' biggest partners, was especially crippled by what was known as the burst of its bubble economy in 1990. As most of Asia recovered from the recession, though, it grew increasingly apparent that other problems plagued several of the Asian economies. Some maintained only loose controls over sound practices in the private banking sector, even as it gained new importance in an era of privatization and deregulation. This was coupled with a business culture that favored repeated corporate bailouts over allowing companies to go under and that emphasized long-term employer-employee bonds over flexible, market-driven labor practices.

By mid-decade, financial stability began to crumble in some places. In 1996, as Japan's economy continued to stagger, Thailand exhibited a plethora of financial woes. It grappled with a widening current account deficit, rising inflation, steep interest rates, an overvalued currency, and a banking system teetering on insolvency—all characteristics that to some extent described several of Thailand's neighbors as well. Thailand's government fought desperately to preserve the value of its currency and engineer a smooth market correction, but failed miserably. After Thailand finally let its currency float on the open market in July 1997, the Thai baht lost 40 percent of its value in the following months.

The devaluation of the baht triggered similar jitters in markets for other Asian currencies, and worse, a rapid withdrawal of foreign capital from Asian countries. In addition to Thailand, Indonesia, South Korea, Hong Kong, and Malaysia were particularly ravaged by the crisis in the latter half of 1997, some experiencing stock market crashes, escalating values of foreign debt, and rising prices. Continued weakness in Japan, which had its own bank insolvency crisis to manage, only made matters worse. Singapore and Taiwan fared better, but they, too, were hurt by the regional recession that had settled in.

The causes of the crisis were complex and varied. Many were linked to poor government policies and general overinvestment in some places. Bad policies allowed problems such as excessive borrowing to accumulate when the production side of the economy couldn't keep pace. On the investment side, figures published by the International Monetary Fund show that in places like South Korea and Thailand the effects of capital investment were diminishing for years. In other words, more money was being spent for smaller and smaller gains in output. Moreover, even output was often growing faster than demand, signaling overcapacity and a potential price slump. When investors (and governments) finally realized there was less underlying value in the economies than the level of investment had assumed, there was a sudden rush to pull money out, resulting in currency plunges and stock market dips. Meanwhile, firms within the region were already carrying too much debt and their troubles were amplified by the shortage of liquidity and the unfavorable moves in exchange rates.

ACCOMPLISHMENTS AND FUTURE

PROSPECTS

Though painful, the setbacks of the 1990s can't overturn the fundamental gains and future promise of the developing Asian economies. Whether there are five tigers or ten, the countries of the Pacific Rim have proven their long-term economic significance and viability as industrial nations.

Just as much has changed in the Asian economies over the past few decades, their character and nature will continue to evolve. Hong Kong has rejoined mainland China's jurisdiction in 1997 as scheduled; the continued independence of Taiwan remains an open question. An ongoing tension also exists between heavy-handed Asian governments, some dominated by the military, and the growing political and economic strength of the region's expanding middle class. The 1998 fall of Indonesia's decades-old Suharto regime (which lost even the confidence of the military, its former ally) suggests how economic unrest may play out in the political realm. Developing Asia can look forward to a bright economic future, but it can also expect more growing pains along the way.

FURTHER READING:

"Bailing and Flailing: Thailand." Economist, 28 June 1997. International Monetary Fund. World Economic Outlook. Washington, October 1998.

Montagnon, Peter. "Over-Capacity Stalks the Economies of Asian Tigers." Financial Times, 17 June 1997.

"Six Deadly Sins: The Recent Troubles Have Exposed Many Myths about the Tigers' Past Economic Success." Economist, 7 March 1998.

World Bank. World Development Report 1998/99. Washington, 1998.

Comment about this article, ask questions, or add new information about this topic: