HEDGING

Often cited as the major economic justification for futures markets, hedging is the act of taking a temporary position in the futures market that is equal to, yet opposite, one's position in the cash market in order to protect that cash position against loss due to unfavorable price fluctuations. This form of risk management can be accomplished through several types of futures and options contracts traded on a number of exchanges, and is usually practiced by corporations, money managers, or other professional investors.

Since futures trading began, hedgers and speculators have interacted to determine commodity prices. The hedger uses the futures market to protect against the risk of unfavorable price movement, while the speculator, using risk capital, assumes risk in the hope of making a profit by correctly forecasting future price movement.

Futures markets exist only in relation to cash markets, which are the underlying markets in which actual commodities are bought and sold. For many basic commodities, price volatility is inherent and that volatility is a source of significant financial risk for those who produce, market, process, or ultimately consume these commodities and any products which are derived from them. The hedger uses the futures market to protect against the risk of unfavorable price movement.

The first organized commodity exchanges in the United States date back to the 19th century; the Chicago Board of Trade (CBOT), founded in 1848, is the oldest existing U.S. futures exchange. When first established, the CBOT was a centralized cash market, formed in response to the need for a central marketplace that would bring together large numbers of buyers and sellers, thus providing liquidity, as well as providing a place with rules for ethical trading practices and reliable standards of weights and measures. Soon after the founding of the exchange, grain brokers began trading in "cash forward contracts" in order to assure buyers a source of supply and sellers the opportunity to sell 12 months a year.

As the use of the cash forward contracts escalated, futures contracts evolved. Futures contracts differ from cash forward contracts in that they specify the price at the time the contract is made, as well as the quantity, quality, and delivery time. Unlike cash forward contracts, though, futures are often traded solely as paper transactions and delivery of the underlying instrument or goods never takes place. Options are one step further removed: the buyer or seller pays a fee for the right to buy or sell on an agreed date and for an agreed amount, but is never required to follow through. Forward contracts, futures, and options are all used widely for various hedging needs, as are a variety of other transactions.

There are two types of hedges: the long or buying hedge and the short or selling hedge. In a long or buying hedge, futures contracts (or call options) are purchased in anticipation of making a purchase in the cash market sometime in the future. In the case of a call option, the buyer has a right—but no obligation—to purchase at the arranged price. The long hedge is utilized by individuals who want to protect the cost of a cash commodity that they intend to buy at a later date. Anyone who uses or merchandises raw commodities is a potential long or buying hedger.

In a short or selling hedge, futures contracts (or put options) are sold equal to the cash position to be hedged. The short hedger often tries to sell futures contracts for the month after the anticipated sale in the cash market. For example, if a farmer plans to sell wheat in the cash market in November, he or she would hedge the commodity by selling December wheat futures contracts. The owner of a commodity would use a selling hedge to protect against inventory losses due to adverse price changes.

Hedging is best accomplished when the underlying commodity traded in the futures market is most similar to the actual commodities the hedger trades in cash markets. In other words, if one wishes to protect cattle prices, cattle futures should be traded rather than hogs. This may seem obvious, but in reality hedgers don't always have access to trading futures contracts on the exact commodity they need. No single futures exchange lists every kind commodity, and the typical trader doesn't have access to every market in the world. For instance, if a U.S. company is depending on sales in a small developing country and wants to hedge against a declining currency there, it may not have easy access to a futures market that trades in that country's currency. Instead, the hedger may need to identify a related commodity, in this case probably another currency, that tends to move in the same direction and proportion as the smaller currency. This process of substituting related commodities during hedging is known as cross-hedging.

The difference between the cash price of a commodity at a particular time and place and the price of that commodity on the futures market is called the cash-futures basis. Basis is important in hedging because basis risk is generally more tolerable than outright price risk. As an example, the cash price may fluctuate one cent during a specific period, the futures price may change ten cents, while the basis may change only five cents.

EXAMPLE 1

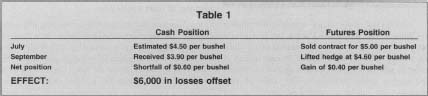

Suppose it's July and a farmer expects an unfavorable drop in the selling price of corn by the time his anticipated 15,000 bushels are ready for sale in September. The current price as of July is $4.50 per bushel. To hedge his risk of getting a low price for his corn, he sells three 5,000-bushel futures contracts (5,000 bushels is the customary amount for a single contract) on October corn for more than the current price, say at $5.00 per bushel.

When September arrives and he sells to the local grain elevator, prices have indeed fallen to $3.90 a bushel. To offset this cash position he is now able to buy, or extinguish, his October corn contract on the market, where prices have also fallen. He pays $4.60 per bushel to lift his hedge.

Between his cash and futures positions, he has effectively reduced his losses from the price decline. In the cash market he earned $3.90 per bushel and in the futures market he earned the difference between his selling and buying prices, or $0.40 per bushel. This yields an effective selling price of $4.30 per bushel or $64,500.00 for the entire crop. Although this is still $3,000.00 less than he would have made at July prices ($4.50 × 15,000 = $67,500.00), it is $6,000.00 more than he would have made had he not hedged ($3.90 × 15,000 = $58,500.00). Table I summarizes the hedging process in this example.

EXAMPLE 2

Now suppose it is February and a South Korean manufacturer is scheduled in November to pay a $50,000 debt, denominated in U.S. dollars rather than the local currency. The company's management is concerned about adverse fluctuations in the international exchange rate that could cause the Korean won to loose value versus the dollar and result in an effective increase in its dollar-denominated debt burden. When the loan was made the exchange rate was 800 won to the dollar, creating a 4 million-won debt at the then-current rate. Because financial markets in neighboring countries have been unstable, the company wishes to hedge against the won's possible decline.

| Cash Position | Futures Position | |

| July | Estimated $4.50 per bushel | Sold contract for $5.00 per bushel |

| September | Received $3.90 per bushel | Lifted hedge at $4.60 per bushel |

| Net position | Shortfall of $0.60 per bushel | Gain of $0.40 per bushel |

| EFFECT: | $6,000 in losses offset |

The company enters a forward contract for November to buy $50,000 at 820 won to the dollar, thereby locking in a price of 4.1 million won. This rate includes a 20-won premium for the guarantee of a constant rate. By November the South Korean won has been battered by international currency markets and has dropped to 1,200 won to the dollar. However, the manufacturer executes its forward contract and obtains the $50,000 it needs for 4.1 million won—a substantial savings from the 6 million won it would have needed to pay if it hadn't hedged.

SEE ALSO : Futures/Futures Contracts

FURTHER READING:

Futures Industry Institute. Introduction to the Futures and Options Markets. Washington, 1998. Available from www.fiafii.org/tutorial/index.html .

Kozoil, Joseph D. Hedging: Principles, Practices, and Strategies for the Financial Markets. New York: John Wiley & Sons, 1990.

Taleb, Nissim. Dynamic Hedging: Managing Vanilla and Exotic Options. New York: John Wiley & Sons, 1996.

Comment about this article, ask questions, or add new information about this topic: