JUNK BONDS

Junk bonds are corporate debt securities of comparatively high credit risk, as indicated by ratings lower than Baa3 by Moody's Investors Service or lower than BBB- by Standard & Poor's. This usually excludes obligations that are convertible to equity securities, although the bonds may have other equity-related options (such as warrants) attached to them. Junk bonds are also known as high-yield, noninvestment-grade, below-investment-grade, less than-investment-grade, or speculative-grade bonds.

HISTORY

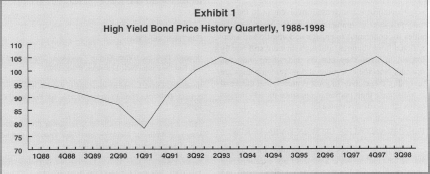

The term "junk bonds" dates to the 1920s, apparently originating as traders' jargon. Financial publisher John Moody applied the less pejorative label, "high-yield bonds," as early as 1919, but noninvestment-grade debt received little attention outside a small circle of professional specialists prior to the mid-1980s. For a few years during that period, high-yield bonds were employed extensively in financing of mergers and acquisitions, including two controversial variants— leveraged buyouts (LBOs) and hostile takeovers. Junk bonds, by virtue of their name alone, became convenient targets for critics of the merger and acquisition boom and its perceived excesses. Public awareness continued to grow as a number of excessively debt-laden LBOs collapsed, causing default rates to surge and high-yield bond prices to plummet in 1989-90. See Exhibit 1.

Notwithstanding the sudden notoriety they achieved in the 1980s, high yield bonds by then had been a fixture of the capital markets for several decades. During the 1920s, noninvestment-grade paper accounted for 15 to 20 percent of total corporate bond issuance. Additionally, "fallen angels," i.e., bonds originally issued with investment grade ratings but subsequently downgraded, offered an attractive niche for a few investors and market makers.

Demand for higher-risk, higher-return debt remained limited, however, until the establishment of several new mutual funds specializing in the high-risk sector, beginning in 1969-70. The assets of these funds grew dramatically during the bond bull market of 1975-76. At the same time, the supply of lower-rated issues shrank through upgradings and refinancings. Investment banks responded by stepping up new issues from the modest level observed in the early 1970s. By the late 1980s, annual primary volume exceeded $30 billion.

Although Drexel Burnham Lambert was not the first underwriter to capitalize on this market opportunity, it did become the dominant player in junk markets. Under the leadership of Michael Milken, Drexel's high-yield operation accounted for nearly half of all underwriting volume during the 1980s. As the decade ended, Milken was first dislodged from the firm and then convicted of several securities law violations. Drexel went bankrupt during the high-yield market's severe slump in 1990, apparently a victim of excessive concentration in a single line of business and a precarious capital structure. Supporters contended, however, that Milken and Drexel had been undone by a vendetta of entrenched corporate managers and government regulators, who supposedly felt threatened by the freer access to capital that "junk bonds" provided.

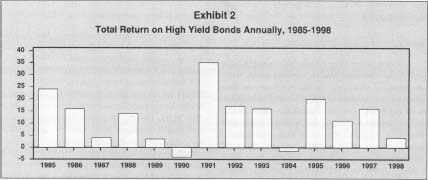

By 1991, the high-yield market was healthy once again. Total returns remained strong for the next few years (see Figure 2), aided by declining interest rates and the rehabilitation of many distressed issuers. The use of proceeds in new offerings shifted from mergers and acquisitions to more conventional corporate purposes. Replacement of shorter-term bank borrowings and older, higher-cost public high-yield debt were frequently observed applications of funds. Another notable change was the increased prominence of issuance

High Yield Bond Price History Quarterly,1988-1998

Total Return on Hign Yield Bonds Annually,1985-1998

ADVANTAGES AND DISADVANTAGES

Junk bonds offer corporations several distinct advantages over other types of financing. They avoid the equity dilution that can result from the issuance of new common shares. In addition, high-yield bonds can be a less costly source of funds on an after-tax basis than equity. Compared to private debt (whether in the form of commercial bank loans or private placements with insurance companies or other financial institutions), high-yield bonds generally impose less stringent restrictive covenants on the issuer. Furthermore, longer maturities are available in the high-yield market than the commercial banks offer.

An offsetting disadvantage, vis-a-vis equity financing, is the higher level of fixed charges that results from issuing high-yield debt. For privately owned companies that would not otherwise have to comply with Securities and Exchange Commission registration and financial reporting requirements, floating public noninvestment-grade bonds in lieu of private debt entails incremental expenses. Also, such companies may not wish, for competitive reasons, to disclose as much information about their operations as high-yield bond issuance necessitates.

The substantial fixed charge requirement created by issuing noninvestment grade bonds makes them best suited to well-established companies with fairly predictable levels of cash flow. Accordingly, high technology industries, which are characterized by potentially wide swings in earnings and which generate only modest amounts of cash from depreciation, have historically accounted for a minor portion of high-yield issuance. Equity and convertible bonds have represented the more appropriate vehicle for such classes of issuers.

In other respects, however, noninvestment-grade debt has proved adaptable to the borrower's needs, as well as to market conditions. For example, zero-coupon (or deferred-interest) bonds meet the requirements of companies that expect to be large net users of cash in the near term, but substantial cash generators in the future. During the late 1990s, many early-stage telecommunications companies fit this description and turned to zero-coupon high-yield bonds as an alternative to venture capital. Zero-coupon instruments pay no cash coupons, but instead are offered at a discount, with the appreciation to par at maturity providing the investor's return. Uneven or unpredictable cash generation patterns can also be accommodated by allowing the coupon rate to vary with the general level of interest rates or with the price of a specified commodity.

From the investor's viewpoint, high-yield bonds provide both income and potential for capital gains. The latter tends to be limited by early redemption provisions, which allow issuers to retire the obligations prior to maturity, at modest premiums to par. Significant appreciation may occur, however, in bonds trading at steep discounts to par, reflecting either past credit deterioration or a rise in the general level of interest rates since issuance. Additional returns to high-yield bondholders arise from tender offers and payments offered for consent to modification of financial covenants.

Noninvestment-grade bond funds generally emphasize the income feature. They ordinarily offer small investors higher yields than they can earn on alternatives such as savings accounts, certificates of deposit, money market funds, or investment-grade bonds. In addition, high-yield funds provide a diversification benefit, otherwise impractical for an investor of modest means to achieve. By holding portfolios of many different issues, a fund cushions the investor against possible default or underperformance of individual securities.

WHO USES JUNK BONDS?

Other types of mutual funds also invest in high-yield bonds. Medium quality corporate bonds funds are typically permitted, by the provisions of their prospectuses, to allocate a portion of their assets to securities rated lower than Baa3/BBB-. This latitude enables the funds to raise the overall yield on their portfolios. Another category of high-yield investor includes "asset allocation funds," which achieve diversification by combining noninvestment-grade holdings with other fixed-income investments such as foreign bonds or mortgage-backed securities. Some equity mutual fund managers participate in the high-yield market as well. Their objectives include speculating in specific issues and increasing the income in their funds during periods in which the stock market offers little potential for capital gains.

Life insurance companies represent a major market for high-yield bonds, which they hold in conjunction with a variety of other fixed-income investments. Some states limit the percentage of assets that insurers can allocate to bonds rated less than investment grade. In all states, reserving requirements of the National Association of Insurance Commissioners effectively establish ceilings on the ownership of high-yield debt, while also generally skewing such ownership toward the better-quality portion of the market.

Pension funds face few specific restrictions on their high-yield investments. On the other hand, the diversification benefits are substantial. High-yield bonds are comparatively insensitive to general movements in interest rates, so they tend to stabilize the performance of portfolios composed of other fixed-income instruments.

The upheavals of the late 1980s left many plan sponsors wary of the sector, but by 1995, an extended period of strong performance had erased many of the old concerns. A growing number of pension plans began to allocate a portion of their assets to specialized high-yield managers. Many other sponsors authorized their generalist fixed-income managers to invest 10 or 15 percent of their fixed-income assets in high-yield bonds.

ARE THEY WORTH IT?

For all classes of investors who bear the risk of owning high-yield bonds, the central question is whether the rewards represent sufficient compensation. Properly speaking, the analysis should consider not only potential losses through default, but also the risks related to illiquidity in the secondary market, redemptions prior to maturity, and fluctuations in the general level of interest rates.

Arthur Stone Dewing effectively launched the high-yield debate in 1926, citing slightly earlier studies that covered bond returns back to 1900. Dewing argued that lower-rated issues had proved to be superior investments, providing higher returns—net of default losses and price declines—than top-quality bonds. In a theme that was to reappear frequently in later years, Dewing suggested that most investors irrationally despised and therefore undervalued lower-rated issues, allowing more level-headed individuals to profit at their expense. Harold Fraine, in contrast, argued that the supposedly superior returns on high-yield bonds were illusions arising from period-specific changes in interest rates and risk premiums. Later, Milken took Dewing's side in the debate. He frequently cited the work of W. Braddock Hickman, who was actually more reserved in his conclusions than many subsequent high-yield enthusiasts believed.

None of these observers addressed risk in the sense in which contemporary financial theory defines it. Marshall E. Blume and Donald B. Keim made an important advance by considering the variance of returns. They found high-yield bonds to have higher returns and less variance than long-term U.S. Treasury securities. Blume and Keim hypothesized, however, that the anomaly would disappear if the results were controlled for differences in maturity. Kevin Maloney, Richard Rogalski, and Lakshmi Shyam-Sunder further challenged the alleged undervaluation of high-yield bonds. They noted that the upside (limited by earlier redemption provisions) was less than the downside (a 100 percent loss), a disparity for which rational investors would require additional compensation. On balance, the evidence points to a generally correct valuation of high-yield bonds relative to their fully elaborated risk. The securities represent neither a bargain, as alleged by their advocates, nor an inferior investment, as the critics maintain.

[ Martin S. Fridson CFA ]

FURTHER READING:

Alcaly, Roger. "The Golden Age of Junk." New York Review of Books, 26 May 1994, 28-34.

Altman, Edward I., ed. The High-Yield Debt Market: Investment Performance and Economic Impact. Homewood, IL: Dow Jones-Irwin, 1990.

Asquith, Paul A., David W. Mullins Jr., and Eric D. Wolff. "Original Issue High Yield Bonds: Aging Analysis of Defaults, Exchanges, and Calls." Journal of Finance, September 1989, 923-52.

Becketti, Sean. "The Truth about Junk Bonds." Economic Review. Federal Reserve Bank of Kansas City, July/August 1990, 45 54.

Blume, Marshall E., and Donald B. Keim. "The Risk and Return of Low-Grade Bonds: An Update." Financial Analysts Journal, September/October 1991, 85-89.

Cornell, Bradford, and Kevin Green. "The Investment Performance of Low-Grade Bond Funds." Journal of Finance, March 1991, 29-48.

Dewing, Arthur Stone. The Financial Policy of Corporations. Rev. ed. New York: Ronald Press, 1926.

Fabozzi, Frank J., ed. The New High-Yield Debt Market: A Handbook for Portfolio Managers and Analysts. New York: HarperCollins, 1990.

Fons, Jerome S. "The Default Premium and Corporate Bond Experience." Journal of Finance, March 1987, 81-97.

Fraine, Harold G. "Superiority of High-Yield Bonds Not Substantiated by 1927-1936 Performance." Annalist, October 1937, 533, 547.

Fraine, Harold G., and Robert H. Mills. "Effects of Defaults and Credit Deterioration on Yields of Corporate Bonds." Journal of Finance, September 1961, 423-34.

Fridson, Martin S. High Yield Bonds: Identifying Value and Assessing Risk of Speculative Grade Securities. Chicago: Probus Publishing, 1989.

——. "What Went Wrong with the Highly Leveraged Deals? (Or, All Variety of Agency Costs)." Journal of Applied Corporate Finance, fall 1991, 57-67.

Hickman, W. Braddock. Corporate Bond Quality and Investor Experience. Princeton, NJ: Princeton University Press, 1958. Jefferis, Richard H., Jr. "The High-Yield Debt Market: 1980 1990." Economic Commentary. Federal Reserve Bank of Cleveland, I April 1990, 1-6.

Lederman, Jess, and Michael P. Sullivan, eds. The New High Yield Bond Market: Investment Opportunities, Strategies, and Analysis. Chicago: Probus Publishing, 1993.

Maloney, Kevin J., Richard J. Rogalski, and Lakshmi Shyam-Sunder. "An Explanation for the Junk Bond Risk/Return Puzzle." Working Paper. Amos Tuck School of Business Administration, December 1992.

Odean, Kathleen. High Steppers, Fallen Angels, and Lollipops. New York: Dodd Mead, 1988.

Shulman, Joel, Mark Bay less, and Kelly Price. "The Influence of Marketability on the Yield Premium of Speculative Grade Debt." Financial Management, autumn 1993, 132-41.

Yago, Glenn. Junk Bonds: How High Yield Securities Restructured Corporate America. New York: Oxford University Press, 1991.

Comment about this article, ask questions, or add new information about this topic: