MUTUAL FUNDS

A mutual fund is an investment trust in which investors may contribute funds in exchange for a share of that trust. Contributed funds are, in turn, invested in various securities, such as stocks, bonds, commodities, money market instruments, guaranteed investment contracts, Treasury bills, and other vehicles. Ninety percent of the fund's income must be derived from dividends and interest, and 90 percent of its sales must be distributed to shareholders. Corporate taxes are paid on any undistributed income.

Mutual funds are administered by companies, which employ an investment management board, which is in turn regulated by a board of directors. These companies collect an investment fee—normally about .5 percent of invested capital—and are provided an administrative expense budget, usually I percent of invested capital.

Mutual funds generally feature low minimum investment requirements. Investors may enter a fund with an initial investment of as little as $500 or regular investments of as little as $50 or $100 per month, withdrawn automatically through investor checking or savings accounts.

As a result, mutual funds permit individual investors with smaller amounts of investment capital to build a diversified portfolio of investments. They enable small investors to employ investment managers used by wealthy investors and investment institutions such as pension funds. As a result, individual investors may take advantage of the pooling of assets to retain skilled investment managers capable of making shrewd investment decisions.

For example, without a mutual fund an individual wishing to invest in a broad number of stocks and bonds would require substantial capital to take maximum advantage of the economies of scale associated with purchasing investments. Because its assets are invested in dozens of companies, a mutual fund enables an investor to contribute a much smaller amount, say $1,000, and gain holdings through the fund in all those companies. Consequently, the $1,000 investment may be comprised of $40 worth of shares in one company, $25 in another, $10 in another, and even 40 cents in yet another. The investor could not otherwise gain such small positions in these companies.

Each month, quarter, or year, the fund declares a dividend to its holders. This dividend reflects dividend distributions from each of the companies in its portfolio. In effect, it is the average dividend of all the shares in the portfolio.

The price of each share of a mutual fund is based on the aggregate value of all the shares in the portfolio. In other words, if the value of the shares owned by the fund rises by 5 percent during a quarter, the mutual fund share price may be expected to rise by 5 percent as well.

Mutual funds came into existence as investment clubs during the 1920s, when public interest in the stock market was growing strongly. Due to their popularity, mutual funds came under regulatory authority of the Securities and Exchange Commission through the Investment Company Act of 1940. The act established strict fiduciary standards for mutual funds, requiring reporting and disclosure statements similar to those required for publicly held companies.

In the late 1990s, there were more than 7,000 mutual funds trading. This demand created opportunities for market segmentation in the investment community. Fund managers have tailored investment portfolios to economic and social screens. For example, investors may participate in funds concentrated on power utilities, telecommunications, or biotechnology; on companies with good environmental records; on companies that are not involved in tobacco, alcohol, or defense; or on companies whose performance mirrors the performance of the broader market. Many funds are geared specifically toward share price appreciation, while others concentrate on dividend income.

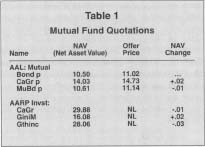

The majority of mutual funds are "open-ended," meaning that they may be purchased or sold based on published closing prices. These values are printed in newspaper financial sections, listed first under the management company, and then by fund name. Open-ended funds are sold directly through the fund or its sales reps and can issue as many shares as the market demands. Excess funds can be held as cash or invested in other vehicles such as money market securities or additional stocks. (See Table 1).

Mutual Fund Quotations

| Name | NAV (Net Asset Value) | Offer Price | NAV Change |

| AAL: Mutual | |||

| Bond p | 10.50 | 11.02 | … |

| CaGr p | 14.03 | 14.73 | +.02 |

| MuBd p | 10.61 | 11.14 | -.01 |

| AARP Invst: | |||

| CaGr | 29.88 | NL | -.01 |

| GiniM | 16.08 | NL | +.02 |

| Gthinc | 28.06 | NL | -.03 |

Each share is listed first by net asset value (NAV)—calculated as the value of assets in the fund, less management charges, divided by the number of shares outstanding—and second by purchase price, which is higher to reflect marketing and other management charges.

Dividends may be collected by holders either as payments (dividend checks) or reinvested to purchase additional shares. As a result, the number of shares in open-ended funds may be constantly increased.

Other funds are "closed-end" funds. While also listed in newspapers, these funds include a finite number of shares and are publicly traded on a stock exchange. Because no additional shares are issued, dividends are distributed as cash and shares trade based purely on demand. Shares are traded at whatever price sellers and buyers agree upon.

Loads, or management charges, are figured into share prices through the spread between NAV and purchase price. No-load funds do not feature these spreads, but charge management fees directly out of profits from the portfolio.

[ John Simley ,

updated by Wendy H. Mason ]

FURTHER READING:

Boroson. Warren. Keys to Investing in Mutual Funds. Hauppauge, NY: Barron's Educational Series, 1997.

Griffin, Ricky W., and Ronald J. Ebert. Business. 2nd ed. Englewood Cliffs, NJ: Prentice-Hall, 1991.

Laderman, Jeffrey M. Business Week Guide to Mutual Funds. New York: McGraw-Hill, 1997.

Comment about this article, ask questions, or add new information about this topic: