TECHNOLOGY MANAGEMENT

Technology has become the key strategic resource needed for the success, indeed the survival, of a business, corporation, or nation. The Persian Gulf War was won by United Nations forces in a short time (a ground attack lasting 100 hours in February 1991), due to the technological sophistication of U.S. weapons and logistic support systems. By contrast, the U.S. consumer electronics industry, with $8 billion in sales and 80,000 employees in the 1960s, has been practically destroyed by Japanese competition, because of the latter's continuous innovation in products and manufacturing processes, lower costs, and higher quality.

DISEMBODIED AND EMBODIED

TECHNOLOGY

Technology is the body of knowledge, tools, and techniques derived from science and practical experience used in the development, design, production, and application of products, processes, systems, and services. Technology is generally available in two forms: disembodied and embodied. Disembodied technology is knowledge and practical expertise recorded in written and electronic form, such as technical papers, drawings, databases, patents, and trade secrets. The value of disembodied technology depends upon its transferability from donor to recipient, and its protection from unauthorized uses. An example of income from disembodied technology is royalties generated from patents.

Embodied technology is incorporated in new or improved products, processes, systems, and services, that are offered to the marketplace. The value of embodied technology depends upon the ability of its producer and marketer to obtain a sustainable advantage over competitors, thereby achieving higher share, sales, and profits.

The following five examples illustrate businesses that profited from embodied technology:

- Incorporating advanced technology in new products. Texas Instruments developed the Speak and Spell toy to teach the intricacies of English grammar to children and adults for whom English is a second language. A simple product that sells in toy and retail stores for a few dollars, it has a sophisticated microchip and voice synthesizer that "spells" and "speaks" words from its very large dictionary. This proprietary technology was the unique advantage that made Speak and Spell user friendly, inexpensive, and very popular.

- Incorporating new or improved technology into a manufacturing process. Italian sweaters, designed and knitted by hand, were very popular in the post-World War II era. At that time, the wages and benefits of Italian garment workers increased rapidly, becoming ten times higher than those of workers in Taiwan, the Philippines, and other Asian countries, where the Italian designs were quickly copied. Recently, Italian engineers mastered the techniques of designing new patterns on personal computers using computer-aided design (CAD) programs, speeding up the design process. They then directly coupled the output of the CAD program to the input of the knitting machines using computer-aided manufacturing (CAM) programs. In the past, setting up the sweater-knitting robots to produce a new pattern was a lengthy and complicated process, requiring long runs of the same pattern to keep production costs down. Now the set up is done very rapidly by computer, producing one-of-a-kind patterns. Because many fashion-conscious customers are willing to pay premium prices for these exclusive patterns, the profitability of the producer is assured. In this case, proprietary process technology was applied to a commodity in order to raise its value and gain a competitive advantage over lower-cost competitors.

- Having new information immediately available wherever needed. Andorra is a small principality of 54,000 inhabitants located in a remote section of the Pyrenees Mountains between France and Spain. Except for a small statistical tax on imported goods, it is virtually a tax-free market. In addition, its bank-secrecy laws make it a haven for money deposits. Andorra's principal bank offers competitive interest rates and a sophisticated computer system with up-to-the-minute information on interest and exchange rates worldwide. Taking advantage of such factors and the time zone differences between major exchanges such as New York, London, and Tokyo, short-term investment officers electronically move billions of dollars continuously, resulting in profits for investors and banks.

- Using new technologies to provide rapid, accurate, and secure advanced services, from legal expert systems to credit card accounting. General Electric (GE) tried in vain to enter the mainframe computer business in competition with IBM, and probably lost $1 billion in the process from 1960 to 1970. GE, however, was able to utilize its hardware and software to develop the worldwide GE Information System Business for international customers. The system consists of three large computer centers in the United States and Europe, connected by cable and satellite communications and accessible by local direct-dialing from 90 percent of the world's phones. Multinational corporations can use this system for online information retrieval, accounting, inventory control, and management information systems. This case illustrates GE's use of proprietary hardware and software to provide a high-value-added service worldwide.

- Serving new expanding markets created by technology. The Internet has opened the market for online information retrieval and electronic commerce. Netscape was founded in 1994 and achieved a market value of $7 billion after two years, thanks to the Navigator browser software developed by Marc Andreessen. Other successful Internet new ventures are Yahoo! and America Online; the latter acquired Netscape in December 1998 for $4.2 billion. Nevertheless, nimble established companies may benefit equally from these market explosions, as witnessed by Microsoft, which developed its Explorer browser software in six months to compete successfully with Netscape.

TECHNOLOGY MANAGEMENT

CATEGORIES

Technology is a highly sophisticated and rapidly changing resource. The average life of a new PC product line is less than three years. As with any business resource, technology must be managed effectively and closely linked to corporate or national strategies and policies. This enables it to create wealth for a corporation or a nation; to improve the quality of life; to minimize physical, economic, and ecological ill effects; and to prevent disasters.

Technology management can be divided into the following categories:

- Technology assessment, planning, and forecasting.

- Technology development (research and development and engineering, R&D&E), acquisition, and integration.

- Technology transfer, application, and sales.

- Selection of the most appropriate technological strategies in relation to the specific environment, capabilities, and competitive position of the organization.

TECHNOLOGY ASSESSMENT AND

PLANNING

For meaningful and effective technology planning, a business or a corporation needs to evaluate the following:

- its technological position in relation to its competition (technology assessment)

- the technologies required, in order of priority, to achieve its business objectives (technology planning)

- the most appropriate technological strategies for achieving its business objectives in relation to trends in the environment, market, competition, government regulation, and the evolution of technology.

Technology assessment should address two questions: (1) Are we working on the "right" technologies for our business? (2) What is our competitive position?

Technology assessment should be a continuous effort by R&D&E personnel acting as "technology gatekeepers," that is, following the evolution of technologies of interest to the business, as inferred from technical meetings and journals, new patents, new product announcements, and similar sources. Formal technology assessment should be conducted annually, during the preparation of the business's strategic plan, and should include 5to 15-year projections, depending on the industry (for example, 5 years or less for computer games and 10 years or more for aircraft engines and pharmaceuticals).

Technology assessment should not be performed exclusively by R&D&E personnel, because of possible "not invented here" (NIH) biases, and the need to relate to other business functions. Chief executive officers (CEOs) have the option of appointing a corporate multifunctional team. Team members would report directly to the CEO and be augmented by independent consultants who have no NIH bias and have access to information that may not be readily available to the corporation.

Technology assessment can be accomplished in three steps:

- identification of core technologies,

- construction of a product/technology matrix,

- construction of a technology importance/competitiveness matrix.

STEP ONE: CORE TECHNOLOGIES.

The core technologies of a business are those critical technologies necessary for advancing the key performance parameters of a company's products, processes, and services. Performance parameters establish a product's value to the customer, and, therefore, influence a company's position in the marketplace. For example, the key performance parameters of a commercial aircraft jet engine are: thrust, weight, fuel consumption, noise, and pollution. Aircraft engine R&D&E has established the following technologies as keys to producing jet engines with high thrust, low weight, and acceptable fuel consumption: high-temperature high-strength alloys, ceramic coatings to reduce corrosion, powder metallurgy, fluid flow, heat transfer, and noise abatement.

STEP TWO: PRODUCTITECHNOLOGY MATRIX.

Once the core technologies have been identified, the importance of each technology for each product line is established. In the case of aircraft engines, product lines might include military jet engines, commercial jet engines, helicopter engines, and stationary gas turbines that produce electric power from oil or natural gas. For example, noise abatement is not important for military aircraft engines, quite important for commercial aircraft engines, and less important for stationary gas turbines, which can be provided with baffles, surrounded by isolating walls, and located in power generating stations, away from residential areas.

Once the ratings for the importance of each core technology for each product line have been determined, they are then ranked according to the relative weight of each product line for the company (as measured by sales, for example), to determine the rating of the technology for the company. Normally, four levels of importance are adequate: high, medium, low, or none.

STEP THREE: THE TECHNOLOGY IMPORTANCE/COMPETITIVENESS MATRIX.

Next, an assessment is made of the relative competitive position of the company in each core technology. This is done by comparing key product-performance parameters of the company and of the principal competitors. The business collects such data by talking to customers, manufacturers, representatives, dealers, and consultants, and by relying on its "technology gatekeepers." Three rating levels are sufficient: the company leads, is equal to, or follows the competition in the specific technology.

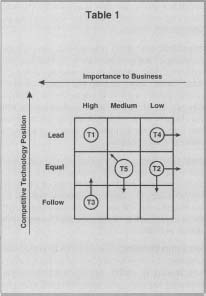

We now have two ratings for each core technology: importance to the company and relative competitive position. These ratings are plotted in Table 1, where the diameter of each circle is proportional to the amount of money budgeted for that specific technology. The aggregate position of the core technologies in the matrix of Table I shows the overall competitive standing of the company. A company with more circles in the upper left-hand corner (high-lead) is in a more competitive position than a company with circles scattered all over the matrix or bunched in the lower right-hand corner (low-follow).

The purpose of technology planning is to achieve company objectives through the proper allocation of limited technological, human, physical, and financial resources. In Table 1, the goal is to shift the circles towards the upper left-hand corner (high-lead) of the matrix, and to drop or starve technologies of lesser importance to the company. Following are some examples, taken from the core technologies of GE Medical Systems.

In the case of TI, the company leads in this technology, which has high importance for the business. The company's business plan should allocate sufficient effort to maintain this lead and strengthen the company's competitive position in the marketplace. An example of a high-lead technology is GE's magnetic resonance imaging (MRI) product line where GE has been the world leader since 1984.

T2 represents a technology of low importance for the company, although its competitive position is equal to competition. In this case, the company should sell the technology to a business where it is of high or medium importance; otherwise, it will die of starvation and drift out of the matrix. Except for this marketing effort, no further resources should be allocated to this technology. Such was the case of with GE's ultrasound product line, which was transferred to a joint venture with the Japanese company Yokogawa Electric. GE now sells the systems developed by this joint venture worldwide.

T3 represents a technology of high importance but in a noncompetitive market position. To meet this challenge, the company must focus its efforts in research and development (R&D), or acquire the means needed to make the technology competitive. This was the case at GE Medical Systems in 1974. At that time GE was the market leader in conventional X-ray equipment, which was being replaced by a new advanced technology, computerized axial tomography (CAT), developed by the British firm Electrical and Musical Industries (EMI). Stung by a staggering loss of market share and the prospect of falling behind the competition, GE started a crash program in the corporate R&D center in order to overtake EMI's lead. Utilizing assets lacking at EMI—manufacturing, marketing, sales, and service—GE Medical Systems met its goal in three years, making it a worldwide leader in CAT. EMI eventually sold what was left of its medical business to GE.

T4 depicts a company leading in a technology that is of low importance to the company. This company has two options: sell the technology or develop a new product line, which could generate substantial sales and profits. Technological superiority does not guarantee new product success (as happened in the case of EMI). The company must establish the manufacturing, marketing, and financial resources required for successfully launching a new product line. This was the situation at GE when its R&D center developed MRI technology without the concurrence of GE Medical Systems management; eventually they adopted the technology.

Finally, T5 represents a technology whose value to the company is unclear. Both technical and strategic planning should be continued, in order to determine whether it warrants additional technical effort.

Up to now, the discussion of technology assessment and planning has been based on current core technologies. Each technology, however, has a limited life cycle, which could last only 2 or 3 years (for certain types of semiconductors) or as long as 40 years (for steam turbines). It is necessary, therefore, to include future core technologies in the technology assessment and planning processes. These are the technologies that have a strong potential of displacing and replacing current core technologies. Computers, for example, initially used electromechanical relays, and later, vacuum tubes. These were replaced first by transistors, then by integrated circuits, currently by microchips, and, in the future, possibly by superconducting Josephson junctions or laser optics. In practice, the three-step assessment and planning exercise described above would be done twice every year: once for today's markets, products, and technologies; and once for the markets and technologies projected for a certain number of years in the future (with the number varying, depending on the nature of the business).

The following process is recommended for this long-range technology plan. The strategic plan of the company or business unit includes a descriptive scenario of the markets targeted, for example, five years into the future, and the products and services to be developed to serve these markets. R&D&E personnel then develop a "technology road map" specifying the new or improved technologies that will be required in five years and the R&D competencies required to develop these technologies. Then, the company's current R&D competencies are compared to the competencies of its competitors, and specific plans are made for enhancing current competencies, developing new competencies in-house, or sourcing them through licensing, recruiting of specialists, or even acquiring other companies.

TECHNOLOGY APPLICATION AND SALES

As an asset, technology may be acquired or sold, stolen, wasted, made obsolete, or applied for company growth and profitability. Once technology has been developed or procured, it is part of a company's assets, and, as such, has value. Technology can be an intangible asset, hard to define, evaluate, or safeguard; therefore, it is difficult and risky to manage. Intellectual property, for example, can be lost if the holder leaves a company without transferring the technology to others or worse, is employed by a competitor. Thus, technology has no value for the company unless it is applied through embodiment in new or improved products, processes, systems, and services, or sold or transferred to other parties. In established companies, the originator of the technology, usually the R&D division, is separate from the user of the technology, usually the manufacturing and marketing departments. Therefore, the technology must be transferred across human, geographical, and organizational barriers, not a simple or smooth process.

Technology application is the practical utilization of technological assets to achieve customer satisfaction, to gain a competitive advantage in the market, and/or to improve the quality of life. In the past, the time span from technology development to application was lengthy. For example, it took 12 years for scientists to develop the first commercial application of the laser after its discovery in 1960. There is evidence that the time span between technology development and application is shortening, as evidenced by the Japanese electronic and electro-optical consumer industry and by the U.S. biotechnology industry.

Just as any company faces a make-or-buy alternative for obtaining technology, it also faces an apply-or-sell alternative for converting its technological assets into profits. Selling technology may be an attractive alternative for a company to cash in on its technological assets, rather than going through the costly and risky process of technology application, and of new product, process, or service development. Following are factors to consider when making the apply-or-sell decision.

STRATEGIC FIT.

R&D may develop new valuable technologies that have no strategic fit with corporate objectives. For example, while working at the GE R&D center, Nobel laureate Ivar Giaever obtained several patents used in the detection of infectious diseases. As GE had no intention of competing with the pharmaceutical industry, it sold the patents to two new ventures for a limited amount of cash and a minority equity position.

OBSOLESCENCE.

As a company develops improved technology, it must decide what to do with its older technology. The company has the option of selling the technology to a developing country with less sophisticated needs and lower production expenses. GE, for example, sold its outmoded copper forming technology to Poland.

HIGH INVESTMENTS.

Normally, R&D expenditures comprise 10 to 30 percent of the total cost of bringing a new product to market. Manufacturing investment, marketing and sales costs, advertising and sales promotion, and customer education usually constitute higher costs than R&D. If a company has difficulty raising additional financing, it may sell the technology to, or enter into a joint venture with, a large, well-established company with plenty of liquid assets. Many emerging biotechnology companies contribute only the technology to a joint venture, with the established company providing cash and marketing expertise.

CLOSED MARKETS.

For various reasons (trade barriers, for example), some markets may be closed to the company that developed the technology. For example, GE Power Systems developed heavy-duty gas turbines as an alternative technology for electric power generation, and had the leading market share in the United States. GE wanted to expand its market to Europe, where the demand for electricity was growing rapidly. In most European countries, however, power utilities are government-owned and, for political reasons, buy only from local suppliers. GE, therefore, had no choice but to enter into cooperative agreements with leading French, Italian, German, and Spanish electrical-equipment manufacturers. The high-technology rotor was built in the United States and shipped to the customer site; the lower technology stator and housing were manufactured by local partners, who were also responsible for sales, installation, and maintenance. GE did not license its rotor technology and thus avoided possible leaks to European competitors. GE guaranteed the performance of the entire system, however.

PREEMPTING COMPETITORS.

Once a proprietary technology has been developed, there is always the risk of a competitor developing an equal or better technology. To preempt the competitor, a company may sell the technology to the competitor at a reasonable price. The seller is at an advantage since the competitor will have increased production costs; may have to pay royalties, which can amount to a significant percentage of sales; and will abandon the idea of developing a superior technology. In such agreements, there is often a cross-licensing clause, giving the licensor company direct access to any improvements made by the licensee, and the right to visit the buyer's plants and audit their books. For instance, GE developed and held a manufacturing-technology patent for the first manmade industrial diamonds, which could be produced at much lower costs than mined diamonds. Nonetheless, GE decided to license its main competitor, South African diamond-mining company De Beers, to preempt them, increase their costs, and, of course, make a profit.

STANDARDS.

As a product and an industry matures, rigid standards are established to facilitate interconnection of equipment and parts replacement, and to reduce operating costs. Various companies aggressively seek to have their specific technologies adopted as industry standards, at times giving away technology free to competitors in order to speed up the adoption process. Sun Microsystems, the leading producer of workstations, once sent engraved invitations to competitors to visit their display booths at trade fairs and obtain a free copy of the proposed standards. Sun wanted to convince competitors to adopt its standards, thereby expanding the market for compatible workstations and related software applications.

MULTIPLE SOURCING.

No company or organization is comfortable when dependent on a single supplier for vital components or products. Therefore, large buyers, such as the U.S. military or IBM, insist that their preferred supplier license other potential suppliers to ensure a steady flow of goods in cases of strikes, calamities, shortages of materials, and so forth. Having multiple sources also can prevent arbitrary price escalations by the initial supplier.

CROSS-LICENSING.

New technologies being developed by businesses may violate existing patents held by competitors. To avoid costly litigation and royalty payments, several large corporations may enter into cross-licensing agreements that exempt their core technologies. For many years GE, AT&T, and IBM had royalty-free cross-licensing agreements for patents not pertaining to core technologies. GE excluded new alloys for jet engines, and steam and gas turbines; AT&T, switching systems; and IBM, computer architecture.

ANTITRUST.

While a patent is a legal monopoly for 20 years, the U.S. government contends that a patent cannot be used to violate antitrust acts and laws. Therefore, if a company achieves a dominant market position because of its unique technology, it may be subject to antitrust investigations and litigation. For example, the U.S. Antitrust Division forced the Xerox Corp. to license its copier patents to its weaker U.S. competitors (this occurred long before the Japanese moved in the U.S. copier market). As a result, many companies today prefer to license to their competitors, to avoid such a problem.

JOINT VENTURES.

In some cases, a company does not have the expertise needed to market a new technology. As a result, one company may contribute the technology; and a second, the marketing know-how, channels of distribution, local sales and service, and so forth, creating a joint venture. GE Medical Systems entered into such an agreement with a Japanese company, Yokogawa Electric, to develop the Japanese and Far Eastern markets.

In conclusion, the main reasons for selling technology rather than incorporating it into new products are the desires to reduce exposure and risk, and to make a quick profit, even if the gain is less than one realized over a technology life cycle or patent validity.

TECHNOLOGICAL STRATEGIES

Technology is a valuable asset that a corporation can and should employ to gain a competitive advantage in the market. This can be achieved by utilizing business strategies in which technology is a major component. The choice of the most appropriate technological strategy for a business depends upon the environment, its strengths and weaknesses in relation to the competition, and the resources available—not only technological but also manufacturing, marketing, sales, distribution, and financial. Mixed strategies are utilized, but may cause organizational problems when implemented. Four basic technological strategies are: (1) first to market; (2) fast follower and … overtaker; (3) cost minimization; and (4) market niche or specialist.

FIRST TO MARKET.

The first to market strategy is offensive, with a high-risk and high-reward potential. This strategy is implemented after a radically innovative technology is discovered by chance or by design, and then is embodied in a product of high functional utility for the customer. It is often used by high-tech new ventures, such as the MapInfo company, for PC map displays; and by progressive, established firms with plenty of resources, such as GE, for man-made diamonds and engineering plastics. If the company's competitive advantage can be maintained, the company enjoys a temporary monopoly or quasi-monopoly that can be exploited to optimize sales and profits. This was the case for GE's man-made diamonds and its first engineering plastic, Lexan. Scientists discovered these products in GE's R&D center while researching the behavior of simple elements, such as carbon, under high pressure and temperature; and a hard enamel for insulating copper wires. GE recognized the potential value of these inventions, devoted plenty of resources to their development and application, and waited patiently (ten years, in the case of Lexan) for the cash flow to become positive. Due to this strategy, GE Plastics, launched in 1957, had grown into a $7 billion business by 1998.

Long-term first-to-market strategy success requires more than a technology breakthrough. It is also necessary either to continue producing new products based on technological and market innovation, or to maintain market leadership through continuous price reduction, which in turn, depends upon cost reductions. This is not always easy, as shown by VisiCalc, a pioneering company that developed the first spreadsheet software program for personal computers. After the initial success, VisiCalc was not willing or able to develop an improved version or a second product; it was overtaken by Lotus Development Corporation, and is now bankrupt.

MapInfo is a case in contrast. It was founded by four Rensselaer Polytechnic Institute students who had developed, as part of their computer science project, the first program for displaying maps on a PC. While other programs used on mainframes cost $5,000 to $20,000, Maplnfo offered their first software package in 1987 for only $750, making it affordable to the 30 million IBM-compatible PC owners worldwide. To stay ahead of the competition, every few months MapInfo introduces advanced versions of the first program, and new packages with additional functions. It has grown rapidly from $60,000 sales in 1987 to $60 million in 1998.

FAST FOLLOWER … AND OVERTAKER.

After a pioneer has demonstrated that a technology actually works, and that the market is receptive to the innovation, a fast follower can move in rapidly, capture a large market share, and even overtake the first entrant. To succeed with this strategy, the fast follower should not duplicate the product of the pioneer and rely on lower production costs, as is practiced by some companies in the Pacific Rim. Rather, the fast follower should practice innovative imitation by offering a similar product that can be differentiated from the first entrant's offering. Fast followers capitalize on their existing complementary assets, such as production facilities, marketing channels, customer contacts, company image, and so forth, in order to achieve a substantial market share and even surpass the leader.

This was the case with the first IBM personal computer. Stung by the unexpected success of the Apple II, IBM started a crash program to develop its personal computer. Director Don Estridge was given a blank check to secure all the needed resources, make or buy the technology, and organize his project team. In less than one year, his team developed the IBM PC, more or less equivalent in performance and price to Apple II. IBM's PC, however, was painted "bright blue"; that is, IBM relied on its strong image in the marketplace, and a large base of loyal customers, thereby commanding a market share equal to Apple's.

GE presents another example of a fast follower. In the field of computerized axial tomography, GE differentiated its offerings from developer EMI's not only through improved performance but also through its well-respected trademark, extended warranties , application engineering, customer training, and endorsements by leading doctors and clinics.

COST MINIMIZATION.

The cost minimization strategy is effective for mass-produced goods, where significant economies of scale can be realized through process innovation. This strategy has been successfully used by the Japanese and other Pacific Rim countries to gain dominant market share in consumer electronics, IBM-compatible PC clones, and even the fashion industry.

As a technology matures, products become standardized, functional differences between various brands decline in importance, personal selling is replaced by mass marketing, and price becomes the dominant factor in the customer's decision to buy. To minimize production costs, product innovation is gradually replaced by process innovation, utilizing the learning curve, which projects declining unit costs as volume increases. Similarly, marketing and distribution costs are reduced—for instance, by telemarketing, direct mail sales, and discount stores. Utilizing the cost minimization strategy, the company strives to become the lowest cost producer and, therefore, the price leader. By reducing selling price and production costs according to the learning curve, the company forces less efficient competitors to withdraw, the market stabilizes, and the company increases its market share and profits.

In some cases, the company can practice "forward pricing" below actual costs, in anticipation of the learning curve; this will "shake out" competition, but also, more importantly, will discourage more powerful potential competitors from entering the market. Because of possible antitrust litigation, this practice is more common in Japan—particularly among computer and consumer electronics manufacturers—than in the United States.

To succeed with cost minimization, a business needs superior process-engineering and value analysis skills. In addition, a company must strive to reduce its total costs, not just manufacturing costs, while maintaining a high level of quality. Most customers will not, however, trade lower costs for lower quality. Detroit discovered this when it produced compact cars after the first oil crisis, to compete with the Europeans and Japanese. While Detroit's prices were 15 to 20 percent lower than their foreign competitors, the quality of its cars—measured by the number of defects in a new car—was one-third to one-half of foreign competitors. As a result, American consumers were willing to pay premiums of $1,000 to $1,500 per car and wait several months for the Japanese models, while the American versions sat unsold in dealers' lots.

MARKET NICHE OR SPECIALIST.

The market niche or specialist strategy is generally adopted by new high-tech ventures that are searching for "a place in the sun" in competition with established dominant suppliers. In the early days of the computer industry, Digital Equipment Corp., Wang, and Control Data Corp. all adopted this strategy to compete with IBM. Normally the selected market niche is initially of little or no interest to the dominant supplier, who is willing to let competitors develop it. For instance, IBM avoided serving the R&D laboratories, and university scientific computing and data acquisition markets, because of their limited size, In addition, laboratory researchers and university professors demanded special features, nonstandard components, and complex application engineering that IBM was unable or unwilling to provide. Digital Equipment and Control Data were willing and able to provide specialist services for this small but rapidly growing market. Similarly, Wang developed the word processor market niche, a hybrid of electronic typewriters and small computers, and for a while, competed successfully with IBM and Olivetti.

To succeed, a market niche must be carefully selected and followed. If the market niche is too small, it will be saturated within a relatively short time, since the opportunity for growth is limited. For example, Control Data, to increase sales, was forced to abandon its original profitable but limited niche of data acquisition and control systems and compete directly with IBM in data processing, an area with low profits and fluctuations in market share.

Conversely, if the niche becomes too large, it becomes an attractive target for competitors. Cray Research illustrates this point. Cray was the original leader in the then-limited, but highly profitable market niche for supercomputers. Seymour Cray founded the company in 1972 with a mission "to design and build a larger more powerful computer than anyone now has." Initially the market niche was quite small, estimated at 80 users worldwide in 1976. The niche grew to a $1 billion market by 1990, with large companies, such as Control Data, IBM, Fujitsu, and Hitachi entering the market. Cray Research lost market share, encountered serious cash flow problems, had to cut back on its advanced R&D efforts, and was swallowed up in an acquisition by Silicon Graphics in 1997.

Another danger of the market niche strategy is that the niche may be destroyed by new technology. For instance, Wang's word processor market was eliminated by the rapid progress in microcomputer technology. While word processors are limited in their functions, the PC's features include computations, spreadsheet calculations, graphics, and word processing, making them the preferred office tool.

To succeed with the market niche or specialist strategy, a company should be very selective in accepting orders that entail too much specialization. Such orders require excessive and expensive efforts in development and design engineering to meet the customer's unique specifications. Thus a company eventually becomes a "job shop," adapting its designs to serve various customers, but unable to reduce costs according to the learning curve. The secret is to have one or two basic designs that can be easily and rapidly adapted to meet customer requirements, while utilizing standardized factory and software processes.

CONVERGENT AND DIVERGENT

TECHNOLOGICAL AND APPLICATION

STRATEGIES

A company or strategic business unit may gain a sustainable competitive advantage in a targeted market by utilizing convergent or divergent technological strategies for the design and application of its products and services:

- A convergent technological strategy is defined as the development and synergistic integration of all technologies necessary to achieve worldwide leadership for a new product, process, or service. A typical example is the first laptop computer by Toshiba, in which the goal of hardware and software development was to produce a small, lightweight laptop computer fully compatible with the IBM personal computer and its clones.

- A divergent technological strategy is defined as the development of alternative technologies, related or unrelated, that will assure leadership in a given market. A typical example is GE Medical Systems which has achieved leadership in the medical imaging diagnostic market through a variety of product lines based on different technologies: conventional X rays, CAT scanners, MRI, and ultrasound.

- A divergent application strategy is defined as targeting a broad spectrum of customers across many industries, with a great variety of diverse applications. A typical example is the Toray Company of Japan which has achieved worldwide leadership in the application of carbon fibers for aerospace to automobile brake linings and consumer products such as fishing rods.

Following are three examples of such technological strategies, which illustrate different ways of managing technology to achieve global leadership.

TOSHIBA LAPTOP COMPUTER: CONVERGENT TECHNOLOGIES.

The first truly portable, IBM-compatible personal computer was the Toshiba laptop, an "under-the-table" project of a small team of passionate Japanese engineers led by Tetsuya Mizoguchi. The process of conceiving, designing, developing and building prototypes of this radical innovative product was driven by the "back to the future" approach, which can be summarized as follows.

The product concept is first developed based on an intensive market study in the field and on the factors that will ensure product leadership five years later. Considering the fast progress of the core technologies of personal computers, this is a difficult forecast that must be based, in part, on an intuitive feel for the marketplace. Then the engineering design process begins, based on stringent specifications. These are given to the engineers as design constraints that cannot be changed. The design is improved through subsequent iterations and optimized to satisfy the dominant constraint. (This constraint was size and weight for the laptop computer.) After market launch, improved or new models are developed to remain at least two years ahead of the competition.

In this case, all technologies to be embodied into the final product must converge to meet the design specifications. All components must work together as a system, and trade-offs must be made continuously in order to optimize the performance, and meet the dominant constraints, such as price, size, and weight of the final product. The engineers and scientists of the design team may be specialists in different disciplines—computer architecture, circuit design, design and manufacture of integrated circuits, heat transfer, mechanical design, liquid crystal and plasma displays, semiconductor and optical memories, ergonomics, etc.—but they are all working toward the common goal of optimizing the product. Future enhancements and new models, such as Toshiba's notebook, build on the established core competencies as the learning process continues and the market evolves towards miniaturization and ease of use.

GE MEDICAL SYSTEMS: DIVERGENT TECHNOLOGIES.

The customers and users of GE Medical Diagnostic Systems products are medical doctors, radiologists, and hospital or clinic administrators. The required functional specifications are: a diagnostic imaging system that will yield high-quality images, in a very short time, with minimum hazard and discomfort to the patient, at a reasonable cost. The equipment should be reliable, rugged, and easy to operate. The value of meeting these specifications is very high: accurate and fast imaging can save human lives, help select the most appropriate diagnosis, and avoid unnecessary surgery and treatments.

The customers do not care, and often do not even understand, the technologies by which images are produced. In fact, there are many competing technologies to produce medical images of the human body: X rays, CAT, MRI, ultrasound, nuclear medicine (where the patient drinks a radioactive liquid), single photon emission computer tomography, etc. These technologies are both competitive and complementary, that is, they partially overlap (X rays, CAT, and MRI) and partially have their own preferred applications (ultrasound for pregnant women). In addition, the boundaries between application areas are constantly shifting and new models are under development. Consequently, a manufacturer cannot arbitrarily select one technology and hope that it will prevail in the marketplace. To achieve and maintain global leadership it is necessary to offer a broad spectrum of technical solutions, and constantly monitor the emergence of new competing technologies, in conjunction with the evolving functional requirements of the marketplace.

GE Medical, a leader in conventional X-ray radiography, found this out the hard way when EMI emerged as an unexpected competitor with the first CAT scanner. GE reacted with a crash program in the R&D center to follow and overtake EMI in technology and market leadership. Having learned the lesson well, GE was then a pioneer in developing MRI. In ultrasound, however, GE lagged behind in technology and especially cost. Yet a survey in 1994 showed that one out of three hospitals was in the market for additional ultrasound equipment. Consequently, GE could not afford not to be in this market segment. GE first had the product redesigned by another company, and then decided to produce a lower-cost version in a joint venture with a Japanese partner, Yokogawa Electric. We conclude that, in the case of medical diagnostics, we are faced with divergent technologies, with few common core competencies. The management challenge is to select and orchestrate these technologies for optimum customer benefits and company profitability.

TORAY CARBON FIBERS: DIVERGENT APPLICATIONS.

The origin of Toray's carbon fiber business goes back to a "happy accident" that was exploited by company management's long-range vision and determination to achieve global leadership. In 1966, when Toray was producing rayon and nylon, one researcher had discovered a new monomer. His manager suggested carbonizing it to develop an acrylic textile fiber. Instead, the monomer turned into a strong and stiff carbon fiber, in one-tenth of the normal processing time. Fifteen years later, about 45 percent of all carbon fibers produced in the world were produced or licensed by Toray. In 1993 Toray had more than 50 percent of the market and built a new pre-preg plant near Seattle, Washington, to supply at least 20 percent of the structural components for the Boeing 777 aircraft. At the same time, its major competitors—Courtaulds, BASF, Amoco, Hercules, and Hitco—were downsizing their plants or offering them for sale.

How did Toray achieve this global market leadership? First, the product was positioned correctly on the price-performance scale, 20 to 30 times more expensive than commodities such as glass fibers, which are sold on price, but 3 to 8 times cheaper than specialized super-strength materials such as boron fibers, which are sold in very limited quantities.

Second, the applicability of carbon fibers was greatly expanded by:

- offering the fibers not as basic material but as fabrics that are easier to incorporate into the final product, such as noncrimp woven, welded, triaxial, mesh, and stitching threads.

- finding other materials that can be significantly strengthened with carbon fibers, such as organic resins, aluminum, steel, copper, magnesium, and high-strength engineering plastics. For example, lightweight, high-strength bicycle frames are made of plastic tubes reinforced by carbon fibers, as are nose cones of spaceships.

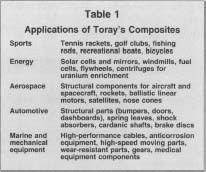

Third, all possible markets for fibers and composites were explored by finding market niches where carbon fibers could contribute a high added-value in terms of strength, stiffness, reduced weight, and resistance to shocks, abrasion, heat, and contamination. Table I presents a list of applications of Toray's advanced composite materials.

Applications of Toray's Composites

| Sports | Tennis rackets, golf clubs, fishing rods, recreational boats, bicycles |

| Energy | Solar cells and mirrors, windmills, fuel cells, flywheels, centrifuges for uranium enrichment |

| Aerospace | Structural components for aircraft and spacecraft, rockets, ballistic linear motors, satellites, nose cones |

| Automotive | Structural parts (bumpers, doors, dashboards), spring leaves, shock absorbers, cardanic shafts, brake discs |

| Marine and mechanical equipment | High-performance cables, anticorrosion equipment, high-speed moving parts, wear-resistant parts, gears, medical equipment components |

As can be seen from this list, the targeted markets are extremely different in terms of customers and distribution channels. We can therefore define Toray's applications and markets as highly divergent. The management challenge is to develop sufficient engineering competencies to explain to the varied potential users the advantages of Toray's products for their specific applications.

In conclusion, the most important factor for effective technology management is the close coupling of technology and business strategies, the cooperation of the R&D&E functions with the manufacturing, marketing, and financial functions, and close contact with internal and external users.

[ Pier A. Abetti ]

FURTHER READING:

Abetti, Pier A. Linking Technology and Business Strategy. New York: American Management Association, 1989.

Betz, Frederick. Strategic Technology Management. New York: McGraw Hill, 1993.

Burgelman, Robert A., Modesto A. Maidique, and Steven C. Wheelwright. Strategic Management of Technology and Innovation. 2nd ed. Homewood, IL: Irwin, 1996.

Levy, Nino S. Managing High Technology and Innovation. Upper Saddle River, NJ: Prentice Hall, 1998.

Martin, Michael J. C. Managing Technological Innovation and Entrepreneurship in Technology-Based Firms. Reston, VA: Reston, 1994.

Tushman, Michael L., and Philip Anderson. Managing Strategic Innovation and Change. New York: Oxford University Press, 1997.

Comment about this article, ask questions, or add new information about this topic: