U.S. INFLATION-ADJUSTED

SECURITIES

INFLATION-PROTECTED U.S. TREASURY

NOTES

Beginning in 1997, the U.S. Treasury began issuing a new series of savings securities that have their returns linked to the rate of inflation. For many years, risk-averse investors have been purchasing U.S. savings bonds as a safe-haven from credit risks and the risks of the stock market. These new securities, called "inflation-protected securities" or TIPS, provide investors protection against not only both of these risks, but inflation as well. Like other Treasury instruments, TIPS are guaranteed by the U.S. government so they are free from default risk.

The new securities, which were promoted by Treasury Secretary Robert Rubin, carry a fixed rate of interest, which is set when the securities are originally sold and is paid semiannually. The security's principal is adjusted semiannually by the change in the nonseasonally adjusted U.S. City Average All Items Consumer Price Index for All Urban Consumers (CPI-U) causing the semiannual interest payment to be a function of the fixed rate multiplied by the adjusted face amount of the security. It is this adjustment in the principal that affords investors the inflation protection.

A major component in the determination of any interest rate is the premium for inflation. At the time of issuance, the coupon rates on traditional Treasury instruments, so-called "risk-free" rates, reflect this premium. Because of their inflation adjustment, however, the coupon rate offered on TIPS is lower than other Treasury securities with comparable maturities. If the coupon rate reflected the inflation premium, there would be, in essence, double payment for the inflation premium.

To illustrate how this works, assume a $1,000 face inflation-indexed note was sold with a 3.5 percent yield. If there were no change in the CPI-U from the time the security was issued, the investor would receive a semiannual interest payment of $17.50 ($1,000 × .035 ÷ 2). If the CPI-U were to increase by 2 percent, the principal of the note would increase to $ 1,020 ($ 1,000 × 1.02) and the semiannual interest payments would rise to $17.85 ($1,020 × .035 ÷ 2). The interest payment is based on the immediately adjusted principal. So, using our example, if inflation rose 2 percent during the first six months of a TIPS existence, the first interest payment the investor would receive would be $17.85. Further, at maturity the investor would receive the final inflation-adjusted principal amount or the par amount at original issue, whichever was greater. Recently, due to the low rate of inflation, concern has arisen that we may enter a period of deflation. Should the CPI-U decrease, the principal amount of TIPS will also decrease, but not below the original principal.

This does not come without a tax cost, however. The interest payments are subject to federal income taxes in the year received, plus, the amount of the periodic principal inflation adjustment is treated as ordinary income and is taxable in the year of adjustment, even though the principal will not be paid until maturity. Like all U.S. Treasury securities, the interest on inflation-adjusted securities is exempt from state and local taxes. Because of the tax treatment of the principal adjustment, many financial planners recommend using TIPS only in tax deferred retirement accounts such as individual retirement accounts (IRAs). The wisdom of this can be appreciated if inflation should return to the higher rates of the 1980s. It would then be mathematically possible for the tax bill on a TIPS to be greater than the annual cash interest payments received!

TIPS are sold at quarterly auctions held the first month of each calendar quarter. As is true with all Treasury security auctions, winning competitive bids are awarded at a single price. Noncompetitive tenders are accepted in the range of $1,000 to $5,000,000 and are also issued at the single price. Because of the inflation adjustment to a TIPS' principal, their coupon interest rate tends to be lower than regular Treasury securities. For example, the TIPS maturing in July 2002 have a coupon rate of 3.625 percent; the Treasury note maturing the same month has a coupon rate of 6 percent. Thus, the coupon rate on these securities comes very close to being an estimate of the so-called "real" interest rate. Because of the recent budget surplus, the Treasury has announced plans to cut the amount of inflation-indexed securities sold at periodic auctions. In addition, the Treasury is considering the frequency of some new issues.

All sales are in book-entry form—no actual securities are issued. All TIPS are eligible for stripping into their principal and interest components. To date, TIPS have been sold as notes with maturities of five and ten years and as bonds with a 30-year maturity. TIPS can be purchased through a broker for a fee or directly from the Treasury Department, similar to other Treasury notes and bonds.

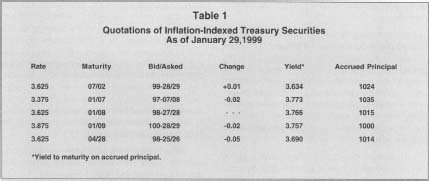

There is a very active secondary market for TIPS. As a result, they can be resold before maturity through a broker or the Treasury's Sell Direct program. Like other debt instruments, TIPS are subject to interest rate risk. Therefore, as market interest rates change, the market value of TIPS will fluctuate. TIPS are included in the daily government securities quotation in the leading financial press. They are typically reported in a separate section entitled inflation-indexed treasury securities. Like other Treasury instruments, they trade in 32nds of a dollar. The quotations include the coupon rate and the inflation-adjusted (accrued) principal. The reported yield to maturity is based on the adjusted principal (see Table 1).

These securities are an ideal way for investors to avoid inflation risk and therefore protect purchasing power. With traditional bonds, both corporate and governmental, real returns to investors decrease as inflation increases. With TIPS, however, because the principal is adjusted by the CPI-U, inflation risk disappears. The relative attractiveness of TIPS depends on the general level of interest rates vis-à-vis the rate of inflation and the shape of the yield curve. On the negative side, the yield of TIPS will likely remain below the long-term average for equity investments. As a result, investors should seek vehicles other than TIPS if they are concerned about the impact of inflation on items whose rate of increase in cost has typically been greater than the CPI-U.

INFLATION-INDEXED SAVINGS BONDS

Because of the booming stock market in the late 1990s, sales of traditional U.S. savings bonds have fallen from their peak of $17.5 billion annually to slightly over $5 billion. In an attempt to attract small investors back to savings bonds, the U.S. Treasury in

Quotations of Inflation-Indexed Treasury Securities

As of January 29,1999

| Rate | Maturity | Bid/Asked | Change | Yield * | Accrued Principal |

| 3.625 | 07/02 | 99-28/29 | +0.01 | 3.634 | 1024 |

| 3.375 | 01/07 | 97-07/08 | -0.02 | 3.773 | 1035 |

| 3.625 | 01/08 | 98-27/28 | … | 3.766 | 1015 |

| 3.875 | 01/09 | 100-28/29 | -0.02 | 3.757 | 1000 |

| 3.625 | 04/28 | 98-25/26 | -0.05 | 3.690 | 1014 |

| * Yield to maturity on accrued principal. | |||||

September 1998 began offering U.S. savings bonds that have their returns tied to the rate of inflation (I-bonds). These bonds are sold at their principal amounts, unlike Series EE bonds, which are sold at discounts. The face amounts of I-bonds range from $50 to $10,000. Fixed interest rates for new purchases are set twice a year, in May and November, and prevail for all purchases during the six-month period and remain for the life of the bond. In addition to the fixed rate, there is an inflation component derived from the CPI U (see above). This component is adjusted twice a year, also in May and November. The total yield on the bond is the sum of the fixed rate and the inflation component. The bonds can be purchased at banks, savings and loan associations, and other authorized financial institutions. Purchases are also available through some payroll savings plans. These bonds are seen as attractive alternatives to those investors still keeping savings in low-yielding bank accounts.

I-bonds do not pay periodic cash interest payments. Instead, the interest is compounded semiannually and paid when the bond is redeemed. I-bonds can earn interest for up to 30 years. Unlike other savings bonds, they cannot be exchanged for other series of savings bonds. Like Series EEs, the bonds must be held at least six months before redemption and if they are redeemed less than five years after purchase, investors must forfeit one quarter's interest. In the event of a negative CPI-U (i.e., deflation) the inflation adjustment is reduced and if deflation is severe, the adjustment can cause a negative inflation component, driving the total return below the fixed return. The Treasury has announced, however, that the combined interest rate will not be allowed to go below zero. So, to that extent, investors in I-bonds are not only protected against inflation, but deflation, as well.

Unlike TIPS, but similar to Series EE bonds, investors may elect to have the income from I-bonds taxed on either the cash or accrual basis. If the cash basis is elected, any increase in principal value will not be taxed until the bonds are redeemed. Should an investor elect the cash basis, the cash basis must be used for all I-bonds and any other savings bonds purchased on a discount basis (e.g., Series EE). I-bonds are eligible for tax benefits upon their redemption when the proceeds are used for qualifying education expenses.

SEE ALSO : U.S. Treasury Notes

[ Ronald M. Horwitz ]

FURTHER READING:

Lexington Software Corporation. "United States Savings Bond Public Information Pages." Milwaukee: Lexington Software Corporation, 1999. Available from www.savingsbond.com .

U.S. Department of the Treasury. "Welcome to the U.S. Department of Treasury." Washington: U.S. Department of the Treasury, 1999. Available from www.ustreas.gov .

Comment about this article, ask questions, or add new information about this topic: