SIC 0279

ANIMAL SPECIALTIES, NOT ELSEWHERE CLASSIFIED

This category includes establishments primarily engaged in the production of animal specialties, not elsewhere classified, such as pets, bees, worms, and laboratory animals. This industry also includes establishments deriving 50 percent or more of their total value of sales of agricultural products from animal specialties, but less than 50 percent from products of any single industry. Establishments included in this group are alligator farms, apiaries, aviaries, cat farms, dog farms, frog farms, honey production farms, kennels that breed and raise their own stock, laboratory animal farms (rats, mice, guinea pigs), rattlesnake farms, and silk and silkworm farms.

NAICS Code(s)

112910 (Apiculture)

112990 (All Other Animal Production)

Developments in this industry in the late 1990s and early 2000s included rising sales of exotic birds, which pet owners increasingly preferred over cats and dogs, as well as the expansion of the market for reptiles and their prey, crickets. Informed consumers who saw the poor breeding conditions of exotic birds began to demand better breeding practices. The growth of the exotic bird market spurred growth in the entire pet industry. Fluker Farms Inc. of Baton Rouge, Louisiana, which led the industry in breeding and supplying reptiles and crickets, sought to strengthen its market by expanding into iguana breeding; they also added novelties to its feed supplies like chocolate-covered crickets, which it sold in the United States as well as in Japan.

Industry leader Charles River Laboratories of Wilmington, Massachusetts, with sales of $554 million in 2002, had been sold by parent company Bausch and Lomb Inc. to Global Health Care Partners in July 1999. Charles River dominated the industry by supplying laboratory animals to research facilities. Though renounced conspicuously by animal rights groups and activists, laboratory animal production was a successful facet of this industry, due to the constant demand for medical research. The industry's second leading company was Denver-based Covance Research Products Inc., which operated five facilities throughout the United States. The remainder of the list of industry leaders is dominated by overseas operations.

Honey. Honey production in the United States has fluctuated since 1986, when beekeepers garnered about 16.9 million gallons of honey. In 1989 production fell to only 14.9 million gallons, then rose in 1992 to 19.4 million gallons. In 1994 production dropped slightly to 18.3 million gallons.

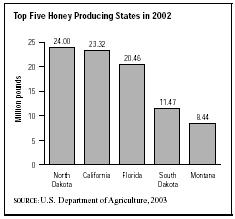

The number of colonies producing honey in 2002 totaled 2.52 million, 1 percent higher than in 2001. The yield per colony declined 8 percent between 2001 and 2002, falling from 74 pounds to 67.8 pounds. Honey production over this time period declined from 185.4 million pounds to 171.1 million pounds. The leading

honey producing states in 2002 were North Dakota, California, Florida, South Dakota, and Montana.

Llamas. As competition in many show animal industries has escalated, many farmers have turned to llama production. In 2004 the International Llama Registry reported 27,870 llama owners in the United States. Producers—both professional and amateur—gravitated towards llamas because of their relatively low cost and their low-maintenance dispositions. Llamas do not require expensive feed; they can thrive on hay. The average llama sells for $750, although high quality show animals cost upwards to $15,000.

Further Reading

Infotrac Company Profiles, 20 January 2000. Available from http://web5.infotrac.galegroup.com .

U.S. Department of Agriculture National Agricultural Statistics Service. Honey. Washington, DC: 28 February 2003. Available from http://usda.mannlib.cornell.edu/reports/nassr/others/zhobb/hony0203.txt .

Comment about this article, ask questions, or add new information about this topic: