SIC 0179

FRUITS AND TREE NUTS, NOT ELSEWHERE CLASSIFIED

This category covers establishments primarily engaged in the production of fruits and nuts, not elsewhere classified. This classification also includes establishments deriving 50 percent or more of their total value of sales of agricultural products from fruits and tree nuts (Industry Group 017) but less than 50 percent from products of any single industry.

NAICS Code(s)

111336 (Fruit and Tree Nut Combination Farming)

111339 (Other Noncitrus Fruit Farming)

This relatively small American industry produces fruits that are normally grown in more tropical regions of the hemisphere. Members of this category are avocado orchards, banana farms, coconut groves, coffee farms, date and fig orchards, kiwi fruit farms, olive groves, and pineapple and plantain farms. Avocado, olive, and date production comprises the bulk of crops in this category. Most producers are small commercial enterprises situated in warmer states such as Hawaii, California, and Florida. The number of such farms engaged in producing fruits and tree nuts in this industry has been in steady decline since the 1980s. The production value for tree nuts was $1.5 billion in the early 2000s, while the value of U.S. fruit production was roughly $10.5 billion. The value of fruits, tree nuts, and berries is forecast to increase by about $4.9 billion between 2003 and 2012.

As of 2004 the two top companies were Dole Food Company of Westlake Village, California, a privately owned company with over $4.3 billion in revenue, and Chiquita Brands International, of Cincinnati, Ohio, which emerged from Chapter 11 bankruptcy in 2002 to post sales of roughly $1.4 billion.

Looking at the individual components of this industry classification is necessary due to great fluctuations in various crop yields from year to year. The apparent lack of any one statistical pattern over a span of a decade may be due to the fragile nature of such perishables as avocados and olives. These smaller, exotic crops are extremely dependent on favorable weather conditions for the success of the year's harvest. The import market also plays some role in the fluctuation within the industry.

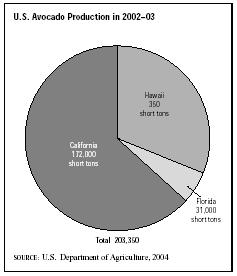

California avocados continue to yield steady profits for growers, who produce about 90 percent of the American avocado crop; Florida produces almost all of the rest. Despite wildfire damage in California during 2003, the state still managed to increase production 15 percent to 198,000 short tons in the 2003-04 growing season. Florida avocado production increased from 23,000 short tons in 2001-02 to 31,000 short tons in 2002-03. Many U.S.-grown avocados are exported to Canada, Japan, the Netherlands, and France. Imports account for roughly 33 percent of U.S. avocado consumption, compared to 17 percent in the early 1990s. As of 2003, Chile remained the leading supplier of avocados to the United States, accounting for 65 percent of total imports.

California is also the center of olive production in the United States. Black olives are the most commonly grown variety. The output from the state's olive groves varies greatly from year to year; production dropped from 134,000 tons in 2001 to 99,000 tons in 2002. In this sector approximately 2 to 5 percent of the year's crop is crushed for oil. Much of the rest is canned or used in other products.

Date production in the United States is centered primarily in Coachella Valley, an arid region about 130 miles east of Los Angeles. In the early years of the twentieth century, ranchers received date plantings from the USDA as an incentive to settle the region. The industry did not begin to thrive until 1913, when a collective organization was formed to purchase imported date plants from North Africa. In 2002 production was roughly 20,000 tons.

The center of the U.S. fig-growing industry is likewise located in California. Per capita consumption in the United States, however, has declined steadily since the 1960s. Though they are grown year-round, fig harvest is at its heaviest during the fall months. In 1993 production reached the highest levels since 1966—59,000 tons—but sank to 40,000 in 2001. Imported figs from Turkey and Spain provide the greatest competition to American fig growers.

Hawaii is the center of the coffee-growing industry in the United States; it is also the locus of American banana production. This state's annual banana yield has seen steady increases since the 1980s—with some declines from year to year. In 2001, 28,000 tons were produced, although this figure dropped to 19,000 tons in 2002. And while U.S. banana consumption rose to 30.7 pounds in 1999, by 2002 this had waned to 26.7 pounds. The largest American grower—Cincinnati-headquartered Chiquita Brands International—performed poorly as a result of a corporate takeover; in 1995 the value of one of its shares rose only one cent. Chiquita's main rival, the Dole Food Company, assumed Chiquita's former number-one spot in the market. Eventually Chiquita filed for Chapter 11 bankruptcy protection, from which it emerged in 2002.

In this industry, growers of fruits and tree nuts face stiff competition from foreign competitors. This sector of agriculture in the United States is relatively small compared to its status in other countries. For instance, countries in North Africa produce a sizable portion of figs and dates for export abroad, while olive tree acreage figures for areas in the Middle East, Greece, and Italy are staggering. In such countries these industries have been vital components of the local economy for literally thousands of years. Coffee growers in the United States face heavy competition from foreign countries—most notably Brazil, Mexico, and Ecuador. However, American growers are finding some success in the cultivation of exotic fruits such as mangoes and passion fruit.

Further Reading

National Agricultural Statistics Service. Statistics of Fruits, Tree Nuts, and Horticultural Specialties. 2000. Available from http://usda.mannlib.cornell.edu .

U.S. Department of Agriculture. "Fruit and Tree Nuts: Background." Washington, DC: Economic Research Service, 10 September 2002. Available from http://www.ers.usda.gov/Briefing/FruitandTreeNuts/background.htm .

U.S. Department of Agriculture. "Fruit and Tree Nuts Outlook." Washington, DC: Economic Research Service, 28 January 2004. Available from http://www.ers.usda.gov .

U.S. Department of Agriculture. "Washington Agri-Facts." Washington, DC: Washington Agricultural Statistics Service, 28 January 2004. Available from http://www.nass.usda.gov/wa/agri2jan.pdf .

Comment about this article, ask questions, or add new information about this topic: