SIC 0213

HOGS

This category covers establishments primarily engaged in the production or feeding of hogs on their own account or on a contract or fee basis. A general trend toward vertical integration in the industry has resulted in larger, more integrated hog operations that often play diverse roles—including breeding, raising, feeding, feed production, butchering and processing, distribution and marketing—in the process of getting hogs from the weaning pen to the market place.

NAICS Code(s)

112210 (Hog and Pig Farming)

Industry Snapshot

The U.S. Department of Agriculture estimates that American producers maintained about 97 million hogs on farms and feedlots in 2003, compared to 61 million in 1997. Processed pork totaled 97 million pounds in 2003. Throughout the late 1990s and early 2000s, consumer demand for pork continued to grow, fueling roughly $38 billion in annual sales by 2003, as well as $72 billion in economic activity. U.S. hog production is only about 10 percent of the world total, but the United States is the second-largest exporter of pork in the world.

Organization and Structure

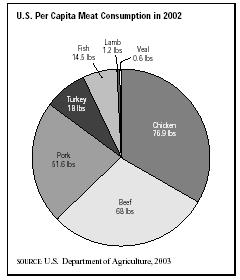

Besides meat, pork products provide a broad range of needs, serving as a source for over 40 drug and pharmaceutical products as well as varied industrial and consumer products, from chemicals to leather goods. Such widespread demand fueled increasingly fierce competition, with a general trend toward larger farms and vertically integrated operations that controlled every step of the production process, from birth to grocery store sales. With escalating competition, industry leaders in the 1990s and 2000s strove to increase pork's market share by appealing to consumers. Lower prices resulting from supply surfeits of the early 1990s were a start. But the pork industry was faced with the task of reversing years of market decline largely brought on by consumers' growing health concerns, which had resulted in a general shift in consumption from pork, beef, and red meats to less fatty fish and poultry. In 1986 the National Pork Producers Council (NPPC) launched its "Pork—the Other White Meat" promotional campaign to emphasize a new health-awareness in the industry and to lend fresh pork a brand name type identity. In 1996, NPPC began a new phase of its campaign, emphasizing the versatility of pork, epitomized by its "Taste What's Next" slogan.

In December 1991 the University of Wisconsin, working with the U.S. Department of Agriculture and the hog-raising industry, published findings that indicated that pork examined in 1990 contained 31 percent less fat, 17 percent fewer calories, and 10 percent less cholesterol than its equivalent in the 1983 USDA Nutrient Handbook. The NPPC estimated that in contrast to the hog of the 1950s, the hog of the 1990s contains 50 percent less fat. Whereas before the average hog had 2.86 inches of backfat, now the average hog only has 1.1 inches.

In the early 2000s, roughly 80 percent of the nation's hogs came from farms that produced over 5,000 hogs a year. Furthermore, a survey by Brock Associates of Milwaukee and Elanco Animal Health division of Eli Lilly & Co., suggested that the country could have as few as 100 producers by the year 2050. The majority of survey participants—250 leading hog producers, veterinarians, meatpackers, and scientists—believed that the pork industry would move along the same lines that the poultry industry had in previous years, with a massive shakedown in the number of small or independent producers. Industry observers noted that hog production was rapidly becoming less labor-intensive and more capital-intensive, a condition that had not been problematic for corporate outfits able to bring significant resources to bear. Independent farmers, however, have to compensate for their lack of capital through extra work and by securing the latest technology through public universities, cooperative deals, and other sources.

Competition for such resources to acquire the necessary funding for the buildings, equipment, and technology needed to produce the most competitive hogs has grown increasingly fierce. Producers have to seek increasingly tight financing through combinations of credit institutions, investor groups, insurance companies, and allied industries such as feed producers and packers. Financing is contingent on overall efficiency, management ability, complete and accurate records, and a sound business plan. In order to best meet such demands, producers have to rely increasingly on genetics, nutrition, and advanced record-keeping systems.

The Typical Hog Farm. Whether corporate or independent, typical hog farms have operated along roughly similar lines, consisting of designated buildings or areas for breeding, farrowing, nursing, growing, and finishing the animals. Depending on various factors—available capital, amount and type of labor, future plans, existing facilities, and management style—a producer could provide a comfortable and efficient environment in many ways. To conserve land for harvesting purposes and to better control animal environments, producers increasingly turned to enclosed buildings for the different stages of production. In the past, fully controlled environments were almost exclusively reserved for nurseries, where baby pigs had to be carefully protected against weather, insects, and disease.

From Gestation to Market. The gestation period for a sow or gilt (young female that has not yet had its first litter) lasts 114 days, during which a careful diet is provided to ensure a healthy litter. Farrowings averaged 8.8 pigs per litter in feeder pig production and 8.52 pigs saved in farrow-to-finish operations, with average pigs weaned increasing to 8.4 in 1995 up from 7.1 in 1980. Facilities for farrowing (giving birth to baby pigs) ranged from pasture systems with A-frames or other types of shelter to confined quarters that could be totally or partially confined. Though significantly more expensive, total confinement facilitated handling of hogs, disease control, feeding control, and reduced labor expenditure for the farmer.

After three to five weeks, pigs are weaned (removed from their mother) and moved to a nursery—dry, warm, and draft-free facility that generally features slotted floors to keep the young animals free of their own waste. After reaching an age of eight or nine weeks, by which time the pigs weigh an average of 50 pounds, the pigs are moved to another area for growing until they reach roughly 120 pounds; finally, they are finished (fattened or fed in preparation for slaughter) until they've reached the marketable weight of 220 to 250 pounds.

Feed and Supplements. From farrow to finish, food intake is carefully monitored to assure proper growth and development and, above all, marketable fat-to-muscle ratio. They are usually fed a ration of 20 percent protein in the nursing stage, changed in an incremental fashion to 13 to 15 percent for finishing. U.S. producers tended to prefer corn as the staple diet, supplemented by high-protein soybean meal and other feeder concentrates usually acquired from specialized feed producers.

Breeding. Generally, eight major breeds remained prominent in the United States throughout the 2000s: Yorkshire, Landrace, Chester White, Berkshire, Hampshire, Duroc, Poland China, and Spot. Purebred hogs are generally raised to be sold to commercial producers as seed stock for crossbreeding purposes. The objective of crossbreeding programs is to combine the most desirable traits of select breeds in order to arrive at the desired characteristics of leanness, meatiness, feed efficiency, growth rate, and durability. In the 1990s and early 2000s, farmers have increasingly depended on the research and expertise of independent breeders to provide them with stock designed to yield a more competitive hog herd. In addition, a growing proportion of breeding stock consists of hybrid (crossbred) hogs. Hybrid hogs have become a significant part of breeding stock replaced annually in the U.S. herd.

Whether a producer secures breeding stock from a breeder or from the resident herd, choice of breeders can make or break a herd. Considerations in boar selection include such traits as temperament, birth rate, feed efficiency, carcass merit, feet and leg soundness, and past performance records with litter mates. Sow herd replacements are often gilts from large litters that exhibited fast growth and leanness.

Three basic breeding systems have been commonly employed: the simplest lets one boar run with a group of sows and gilts. Although such a method requires little labor, it complicates the detailed record keeping of breeding dates. Another option is a hand breeding system that puts one boar with one female at a time; this puts less stress on the boar and is easier for record keeping. A third breeding method involves artificial insemination. This route requires the greatest level of management for the producer, but minimizes the spread of disease organisms or uncontrolled genetic material.

The Market. Once a hog has reached an average of 230 pounds and 4.5 to 6.5 months of age, it is considered ready to market. The producer has several options at this juncture, including livestock exchanges, cooperative marketing agreements, terminal markets, auctions, and direct sales to packers. Terminal markets are typically located near major metropolitan areas, where commission firms represent the producer before the product is brought to nearby slaughtering plants. Auctions, on the other hand, were developed to provide a point of sale for small lots of livestock in rural communities. Direct sales to packers became increasingly popular with advances in animal transportation vehicles, which facilitated both delivery of livestock to packers and shipment of dressed carcasses to consumption centers.

Playing off the ever-shifting forces of supply and demand, producers can also sell their product at livestock exchanges, hedging their hogs on futures markets like the Chicago Mercantile Exchange (CME). Market prices for hogs and pork products can be extremely volatile, influenced by a wide range of factors, including seasonal and cyclical supply fluctuations; shifting consumer demand patterns due to seasonal influences like holidays and temperature patterns; the impact of the fortunes of competing products like beef and poultry; and the price of grains, such as corn and soybeans, that serve as hog feed.

Industry Cooperation. In order to best address changes in production, marketing, technology, and consumer preferences, pork producers have organized at local, state, and national levels. In addition to countless cooperatives and local clubs and councils, the pork industry was represented by four main organizations in the 2000s: the National Pork Bureau (NPB), the National Pork Producers Council (NPPC), the Pork Industry Group (PIG) of the National Live Stock & Meat Board, and the U.S. Meat Export Federation (MEF).

The National Pork Bureau was established by Congress under provisions of the Pork Promotion Research and Consumer Information Act of 1985. Its purpose was to organize and manage funds raised by a legislative check-off on all hogs and pork products sold domestically and imported, at the rate of 35 cents per $100 of value. The NPB contracted different organizations to coordinate specific checkoff-funded programs. The NPPC, for example, coordinated national product promotion and marketing efforts. That group was also responsible for a wide range of programs in producer research and education. The MEF assisted NPPC in cultivating foreign markets of U.S. pork. PIG coordinated informational programs aimed at health care professionals and schools, including nutrition and product research related to pork.

Meat Inspection Policy. In 1996 President Clinton announced a new, expanded meat inspection program that would require the participation of the private sector as well as the USDA. The USDA implemented the Hazard Analysis and Critical Control Points (HACCP) system to replace the look-touch-smell system that began in 1907. The new system requires companies to use new technology, anti-microbial chemical sprays, and irradiation, to combat meat contamination hazards, to determine where in the production process contamination takes place and prevent it from occurring, and to submit samples to the USDA. Besides these measures, the NPPC has taken steps to ensure pork does not become contaminated. Calling for participation at the producer level as well as at the processing level, the NPPC strove to reassure consumers of pork's safety.

Background and Development

Dating back 40 million years according to fossil records, hogs were domesticated in China by 4900 B.C. and in Europe by 1500 B.C.. The animal was reputedly brought to the New World from Europe by Columbus and then, more notably, by Hernando de Soto, who was dubbed "the Father of the American Pork Industry" for landing hogs at Tampa Bay, Florida, in 1539. By the time of de Soto's death in 1542, his herd of 13 had grown to 700 strong. Pork colonization continued with other explorers: Hernando Cortez introduced hogs to New Mexico in 1600 and Sir Walter Raleigh brought them to the Jamestown Colony in 1607.

Hog population grew alongside, and sometimes in conflict with, humans—a long solid wall was constructed on the northern edge of Manhattan Island to control roaming hogs, eventually becoming the Wall Street area of the country's largest city. By the end of the seventeenth century, the typical farmer owned between four and five hogs, which were raised largely on Indian corn. Pioneers carried a growing hog population westward in the nineteenth century.

By the mid-1800s, pork was being commercially slaughtered in Cincinnati, which acquired the moniker Porkopolis as a result. During this period, 40,000 to 70,000 hogs per year were driven along trails to eastern markets. The development of railroad lines and eventually the refrigerated railroad car ushered in the modern era of the hog industry. The midwestern states led the nation in hog production after 1920.

Current Conditions

About 97 million hogs were slaughtered in 2003, generating 19 billion pounds of processed pork and retail pork sales of roughly $38 billion. Compared to 3 million in the 1950s, the number of U.S. pork producers in 2003 totaled only 85,760. Consolidation has contributed significantly to this decline as farms producing 5,000 or more hogs per year accounted for 80 percent of total U.S. hog production in 2003. This situation for the small farmer continued a trend that saw the industry concentrating itself into corporate-based finishing and marketing operations. More than 50 percent of the inventory share of U.S. hog marketings come from the large contract hog operations. In this contractual situation, the contractor agrees to provide the hogs, feed, medication and supplies. The contractee supplies the housing, utilities and labor.

Animal Rights. The pork industry's efforts to produce an efficient, lean pig, as well as the consumption of its product have aroused animal rights groups. Common ground between these two groups is perhaps impossible to achieve, since the industry's livelihood is predicated on continued consumption of pork and other hog byproducts. But numerous, if not effective, measures had been taken over the years. As early as 1873 legislation—the Humane Treatment of Livestock Act—was enacted to prevent cruelty to livestock while in transit on railroads. It was repealed and replaced in 1906 by the 28-hour law controlling feed and water availability and handling procedures of livestock. The Humane Slaughter Act of 1958 also contained humanitarian guidelines, though no noncompliance penalties were enforced. These and numerous other rules continued to spark controversy over such issues as animal confinement, feed supplements, and slaughtering methods. Groups such as the People for the Ethical Treatment of Animals (PETA), a Washington, D.C.-based nonprofit animal protection organization, continue their opposition to the pork and beef industries.

Drugs and Pork. Concerns were also voiced by consumers, veterinarians, hog buyers, and the NPPC over the use of drugs by hog farmers. Efforts have been mounted in recent years to develop better methods of detecting drug residues in table-ready pork in an effort to alert producers and curtail the practice. Industry interest also revolved around the possible uses and abuses of porcine somatotropin (PST), a growth hormone that would greatly reduce fat while increasing lean meat and diminishing the amount of feed needed for a pound of weight.

Industry Leaders

In 2003 the leading pork producers in the United States were Smithfield Foods, of Smithfield, Virginia, followed by PSF Group Holdings, of Kansas City, Missouri; Seaboard Corporation, of Shawnee Mission, Kansas; Prestage Farms, of Clinton, North Carolina; and Cargill, Incorporated, of Minneapolis, Minnesota. Sales at Smithfield Foods grew 7.5 percent to nearly $8 billion in 2003, although net income declined 87 percent to $26.3 million. Revenue for PSF Group declined 10 percent to $608 million in 2003. According to the U.S. Department of Agriculture, the leading hog-producing states include Iowa, North Carolina, Minnesota, Illinois, Indiana, and Nebraska. Other leading states included Missouri, Ohio, South Dakota, and Kansas. During the early 2000s, pork production expanded outside the corn-belt states to Colorado, North Carolina, and Texas.

America and the World

The United States imported and exported substantial quantities of hog products in the early 2000s and is among the world's largest pork exporters in the world, accounting for roughly 10 percent of global production. The world's leading exporter of pork in 2003 was Canada, and the United States and Denmark tied for second place. The top customers for U.S. pork exports in the early 2000s were Japan, Russia, Canada and Mexico. In 1996 U.S. exports of pork had reached the $1 billion mark, a milestone which the NPPC attributed in part to the implementation of the General Tariffs and Trade Agreement (GATT) and to the North American Free Trade Agreement (NAFTA). U.S. pork exports were expected to grow 7 percent to 1.3 billion pounds in 2004.

Research and Technology

Checkoff-funded programs organized by the pork industry forged ahead in research and development toward efficient and safe pork production that would better attract domestic consumers and compete in world markets. Of the many advances sure to affect the hog industry of the future, several could be especially notable, including the use of repartitioning agents as feed additives to encourage less fat, leaner meat, and faster growth; and biotechnology that would advance gene mapping to a point where growth, fat-to-lean ratio, and prolificacy could be better controlled from the laboratory. In fact, by 2003, technological advances in genetics had allowed North Carolina to increase efficiency to the extent that it ranked as the second-largest pork producing state as of 2003.

Further Reading

Today's U.S. Pork Industry. Des Moines, IA: National Pork Producers Council (NPPC), 2004. Available from http://www.nppc.org/about/pork_today.html .

United States Department of Agriculture Economic Research Service. "Livestock, Dairy & Poultry Outlook." Washington, DC: 2004. Available from: http://usda.mannlib.cornell.edu/reports/erssor/livestock/ldp-mbb/2004/ldpm116t.pdf .

Comment about this article, ask questions, or add new information about this topic: