SIC 0782

LAWN AND GARDEN SERVICES

The lawn and garden services industry is comprised of establishments primarily engaged in performing a variety of landscape maintenance services. Companies that install artificial turf are included in SIC 1799: Special Trade Contractors, Not Elsewhere Classified.

NAICS Code(s)

561730 (Landscaping Services)

The industry encompasses an abundance of firms that provide a wide range of services, including sod laying, lawn mowing, and seeding. Firms can also serve niche markets such as lawn mulching, cemetery maintenance, garden planting, fertilizing, lawn spraying and treating, highway center-strip maintenance, and athletic field and golf course turf installation. Lawn maintenance service was the largest segment of the lawn and garden industry in 2003, accounting for 36.8 percent of industry revenues.

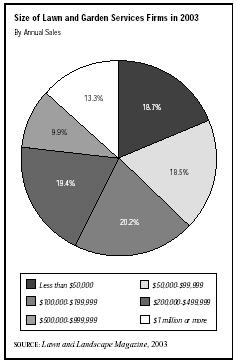

The lawn and garden services industry is mostly comprised of thousands of small, privately owned firms. In fact, firms with sales of less than $50,000 accounted for 18.7 percent of the industry in 2003. Firms with sales between $50,000 and $99,999 accounted for 18.5 percent; while those with sales between $100,000 and $199,999 accounted for the highest percentage of industry revenues, 20.2 percent. Firms with sales between $200,000 and $499,999 garnered 19.4 percent of industry sales. Businesses with sales between $500,000 and $999,999 secured only 9.9 percent of this total; those with sale of $1 million or more, just 13.3 percent.

Typically, companies in this industry fertilize four to six times and apply herbicides two or three times a year. Some may offer a soil test or a lawn analysis. One kind of lawn management offered by some companies is called Integrated Pest Management, which operates on the idea that all pests cannot be killed, but need to be reduced to acceptable levels through monitoring and total yard management.

The lawn and landscape industry established itself as an important component of the service sector of the economy in the late 1990s. By the early 2000s, retails sales of lawn and garden products and services, including professional landscape, lawn care, and tree care services and related supplies, had reached $22 billion. Nearly one quarter of U.S. households utilized professional lawn care services. Industry sales were estimated to reach $25 billion by 2007, according to the Professional Lawn Care Association of America.

An identifiable lawn and garden service industry did not emerge until the post-World War II U.S. economic expansion. Housing developments ballooned from just 139,000 in 1944 to 1.9 million per year in 1950, and thousands of tract subdivisions were built on the perimeter of urban America. As an entire suburban culture emerged, replete with private lawns and gardens, the demand for landscape services flourished.

More recently, strong housing starts throughout most of the 1980s, as well as favorable demographic trends, boosted sales in many traditional segments of the landscape services industry. Relatively new services, such as chemical lawn treatments and hydroseeding, also offered growth opportunities. A general trend toward more elaborate landscaping bolstered industry profits as well. Although stalled housing developments and a virtual depression in commercial construction markets soured demand for new landscape installations in the late 1980s and early 1990s, many landscape maintenance firms enjoyed steady growth. Booming new home sales in the late 1990s and early 2000s, fueled by historically low interest rates, also bolstered industry growth.

The continued rise in two-income families throughout the 1990s and early 2000s left homeowners with less available time for lawn care. People also became more aware of the positive environmental effects of lawns such as oxygen production, temperature modification, and pollutant absorbent. At the same time, many firms had started stressing environmentally friendly, "green" landscape installation and maintenance services. New high-tech natural products included slow-growing golf course turf and insect resistant grass seed. Other technological advances that affected the industry included Magic Circle Corporation's new Dixie Chopper, a hydrostatical driven mower. The mower incorporated a turbine-powered military helicopter power unit and boasted a maximum mowing speed of 18 miles-per-hour. Such technological advances and environmental concerns have brought the industry greater expansion and success.

A series of mergers throughout the 1990s resulted in the domination of the industry by one firm. TruGreen merged with ChemLawn in 1992, creating the nation's largest professional lawncare provider, which specialized in chemical landscape treatments. TruGreen Landcare LLC, operating as a unit of ServiceMaster Co., generated sales of $525.9 million with about 200 employees in 2002. The second largest and fastest-growing company was Barefoot, Inc. of Ohio. Following rapid expansion through mergers and acquisitions, Barefoot had garnered mid-1990s sales of $95 million and was active in 75 metropolitan markets. But in 1997, TruGreen had purchased Barefoot as well as Orkin Lawn Care, and in March 1999 the company further added LandCare USA, Inc., to its list of acquisitions, thereby solidifying its control of the commercial landscaping market. Purchases in 2000 included Leisure Lawn, based in Dayton, Ohio.

The Professional Lawn Care Association of America (PLCAA), organized in 1979, promotes education, legislation, and public awareness of the environmental and aesthetic benefits of turf. The PLCAA represents more than 1,200 lawn and landscape companies, industry suppliers, and grounds managers in the United States, Canada, and other countries. They have also established a training program for lawn and garden professionals.

Further Reading

"Lawn-care Industry Booms as Recession Blankets U.S." Landscape and Irrigation, March 2002.

"Lawn-care Industry Has a Banner Year." Landscape and Irrigation, January 2003.

Professional Lawn Care Association of America. "The Importance of Turf." 2004. Available from http://www.plcaa.org/prof.html .

"State of the Industry 2003." Lawn & Landscape, October 2003.

TruGreen-ChemLawn, 2004. Available from http://www.trugreen.com .

Comment about this article, ask questions, or add new information about this topic: