SIC 0742

VETERINARY SERVICES FOR ANIMAL SPECIALTIES

This industry consists of establishments of licensed practitioners primarily engaged in the practice of veterinary medicine, dentistry, or surgery for animal specialties, including horses, bees, fish, fur-bearing animals, rabbits, dogs, cats, and other pets and birds, except poultry. Establishments primarily engaged in the practice of veterinary medicine for cattle, hogs, sheep, goats, and poultry are classified in SIC 0741: Veterinary Services for Livestock.

NAICS Code(s)

541940 (Veterinary Services)

Industry Snapshot

The veterinary services industry is responsible for the care and treatment of companion animals (pets), sport animals (e.g., racehorses), and some livestock, as well as the protection of the public from exposure to animal diseases such as rabies. These services are generally performed by more than 58,000 licensed veterinarians in the United States, often within the confines of one of the roughly 22,500 animal hospitals and clinics in existence during the early 2000s.

According to the American Animal Hospital Association (AAHA), it is estimated that Americans spend roughly $20 billion in veterinary services for their pets. Total pet industry expenditures reached $31 billion in 2003. It is expected that spending on pets, both for veterinary and other products and services, will continue to increase.

Organization and Structure

The term veterinary clinic is used to describe any veterinary establishment where animals are seen, usually as outpatients needing such services as physical exams, vaccinations, and treatment of minor illnesses and injuries. A veterinary hospital is an establishment that has facilities to treat animals needing to be hospitalized for more than a day. Treatments requiring overnight stays include surgery (most commonly spaying and neutering), tooth extraction, bone repair, and the suturing of wounds.

Because of the substantial investment needed for drugs, instruments, and other start-up costs, most veterinary establishments are group practices, either partnerships or larger facilities that hire individual veterinarians and technicians as employees. Smaller establishments may consist of one to three veterinarians and a technician, who may also serve as receptionist and bookkeeper. Larger establishments may employ several veterinary specialists, additional technicians, an animal dietician, a dental hygienist, and an office manager.

VCA Antech Inc., based in Los Angeles, California, is the country's largest provider of comprehensive health care services for animals. By 2004, the company owned about 230 animal hospitals in 34 states. VCA's 20 diagnostic laboratories provided services for more than 13,000 animal hospitals throughout America. The company owned 50.5 percent of Vet's Choice pet food and had investments in Veterinary Pet Insurance. Veterinary Centers of America, Inc. reported 2003 sales at $544 million, a 22.8 percent growth over 2002. VCA had 3,600 employees, 700 of whom were veterinarians, at the end of 2003. Hill's Pet Nutrition, Petco, and PETsMART were its closest competitors in the early 2000s.

About 72 percent of the industry is comprised of veterinarians in private practice. Of these, approximately 50 percent treat small animals, which may be either dogs and cats exclusively, or may include birds, rabbits, hamsters, monkeys, snakes, turtles, and other companion animals. Small-animal services involve pharmacy, surgery, dentistry, ophthalmology, cardiology, orthopedics, oncology, nutrition counseling, obstetrics, radiology, anesthesiology, and internal medicine. Mobile and house-call facilities often have established relationships with local veterinary hospitals so that surgical facilities are available when needed.

Geographical region seems to influence the type of veterinary practice. In metropolitan areas, for example, services are generally aimed at treating small companion animals; in rural areas, establishments are more likely to treat livestock and horses.

Large-animal practices comprise less than 15 percent of the industry. Except for horses, these establishments are covered under SIC 0741: Veterinary Services for Livestock. Those veterinary services specializing in horses often care for racing horses; such establishments are better compensated financially than most others. Roughly 25 percent of establishments are mixed practices, involving both clinic and house-call facilities. Some of these facilities are affiliated with zoos and primarily provide preventive treatment and health upkeep, including vaccinations, dental care, worming, and grooming.

The cost of routine veterinary services is paid for directly by the individual. However, since the early 1980s, health insurance covering accidents, major injuries, and certain chronic illnesses for dogs and cats has been available in most states. For an annual premium of about $50 to $220, with a deductible ranging from $20 to $300, animal owners can purchase major medical benefits for their pets that like those available for humans. As a result, there is a growing trend to continue care for many animals that would have previously undergone euthanasia.

All personnel engaged in the private sector of the industry must be licensed. Veterinarians are required to have a Doctor of Veterinary Medicine (D.V.M. or V.M.D) degree from one of the 28 accredited colleges of veterinary medicine, and must pass state board proficiency examinations. Those engaged in specialty services must complete an approved residency program, as well as pass board exams and other board requirements. Some states require licensing of animal health technicians based on minimum educational requirements, an examination, and a fee. In addition, some larger companies, such as VCA, require their vets to have a minimum number of hours of continuing education on a yearly basis. Veterinarians employed by the government need not be licensed.

Background and Development

Because most of the procedures and medicines developed for the treatment of human diseases were first tested on animals, the advancement of veterinary medicine, and therefore the development of the veterinary services industry, is closely related to the advancement of human medicine. Although people have kept animals for companionship for thousands of years, the need for practitioners of veterinary medicine did not arise in the United States until 1883, when bans on interstate transportation and exportation of diseased animals to Europe began to hurt this country's growing livestock industry.

The establishment of the Veterinary Division of the U.S. Department of Agriculture (USDA) in 1883 was the first step toward recognition that treatment and preventive care of animals was a necessity. In May 1884 Congress passed an act that established The Bureau of Animal Industry (BAI). Among its aims was "to provide means for the suppression and extirpation of … contagious diseases among domestic animals."

With the industrialization of the United States came shorter work hours, more leisure time, earlier retirement, and longer life expectancies. Animals' status as pets began to receive greater attention and a corresponding demand for better veterinary services resulted. According to a 1990 survey, approximately 43 percent of all households had pets, whereas only 38 percent had children. Many of these pet owners treat their animals as family members, which includes ensuring that they receive competent medical care.

Current Conditions

By 2002, 28 percent of all licensed veterinarians were self-employed. The majority of the nation's 58,000 licensed veterinarians catered exclusively to small animals. These veterinarians served the 63.4 million U.S. households owning a cat or dog in the United States as of 2002. Along with being responsible for the care of 60 million dogs and 70 million cats, veterinarians also served other

pets such as birds, which accounted for 2 million veterinarian visits in 2001, as well as rabbits, ferrets, guinea pigs, hamsters, rodents, turtles, and other reptiles.

Veterinary services and specialties exist for nearly all human equivalents, including chemotherapy, CAT scans, ultrasound, prosthetic hip surgery, pacemaker implants, electrocardiograms, kidney transplants, arthroscopic surgery, dental care, and acupuncture. As a result, the industry is expected to become more and more specialized in the coming years. The rising popularity of medical insurance for pets is already allowing more pet owners to afford these technologically-advanced treatments that otherwise would have been too expensive, and some believe that the small, one-to three-person practice will eventually be replaced by large, centralized veterinary hospitals with staffs of 30-50 specialized veterinarians and technicians.

A trend toward more unconventional methods of private practice, such as mobile clinics, low-cost spay clinics, vaccination clinics, and tax-exempt government subsidized animal welfare groups, has already been noted. Some veterinary facilities also are taking a more holistic approach, considering environmental factors, nutrition, and the psychological needs of animals.

In an effort to increase revenues, veterinary establishments now include the sale of over-the-counter drugs and pet supplies such as food and parasite-control products. This practice allows for competition with feed stores, pet health centers, and pet supply stores, which also tend to offer free advice on the use of drugs and other animal health products.

The industry is expected to grow faster than the average of all occupations through the year 2012 with a higher demand for specialized facilities in metropolitan areas. An increasing need for additional small-animal clinics is predicted as the pet population increases, although small animal practices might become more competitive because most graduates preferred to live in more populated areas rather than rural ones caring for larger animals. Large, multi-hospital corporations (such as VCA) and clinics that incorporate pet stores and grooming all in one facility may be one way to counteract competition and increase revenues. Advertising, including television, direct mail, newspapers, Yellow Pages advertisements, and advertisements in professional publications, once shunned, will also play a greater role as this industry develops.

Workforce

The veterinary services industry employs approximately 73,000 people, about 58 percent of whom are doctors of veterinary medicine. Veterinary assistants, technicians, and office workers make up the remainder of the work force. Women account for nearly 40 percent of all practicing veterinarians in the United States.

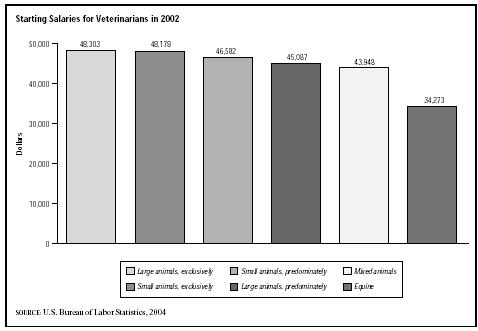

In 2002, the lowest paid practitioners, typically those first starting out in the industry, earned an average annual salary of about $38,000. The middle 50 percent of veterinarians averaged between $49,050-$85,770, less than half the average gross of a doctor of human medicine and about two-thirds as much as a human dentist with comparable experience. Those earning the highest 10 percent of salaries made roughly $123,400.

Entry level animal-health technicians, many of whom are trained in laboratory procedures, assisting and monitoring patients, preparation for surgery, administering medication, and feeding, are paid an average of $16,000 a year. Salaries increase gradually with experience, ranging from about $23,390-$28,390 after seven years. The low starting salaries, coupled with the lack of financial growth, has led to a shortage of qualified technicians at a time when the industry itself has become more and more technically-oriented.

America and the World

The World Veterinary Association (WVA) meets every three years to discuss animal welfare throughout the world. One of the association's objectives in the early 2000s was to develop a policy statement to help set worldwide standards. Another major concern was the potential of diseases being spread across country borders. The organization prides itself on keeping politics out of the discussions and maintaining animal welfare as their priority.

Further Reading

American Veterinary Medical Association. Center for Information Management. "U.S. Pet Ownership and Demographic Sourcebook." 2002.

Hoover's. Company Capsules. 2004. Available from http://www.hoovers.com .

U.S. Department of Labor. Occupational Outlook Handbook, 2004-05 Edition. Washington, DC: Bureau of Labor Statistics, February 2004. Available from http://www.bls.gov/oco/print/ocos076.htm .

Comment about this article, ask questions, or add new information about this topic: