SIC 2391

CURTAINS AND DRAPERIES

The establishments covered in this category are primarily engaged in manufacturing curtains and draperies from purchased materials. Those establishments primarily engaged in manufacturing lace curtains on lace machines are classified in SIC 2258: Lace and Warp Knit Fabric Mills, and those manufacturing shower curtains are classified in SIC 2392: House Furnishings, Except Curtains and Draperies.

NAICS Code(s)

314121 (Curtain and Drapery Mills)

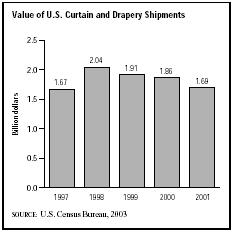

In the early 2000s, more than 2,000 U.S. companies operated curtain and drapery mills, according to the U.S. Census Bureau. These companies shipped $1.69 billion worth of goods, down from two billion dollars in 1998. They spent one billion dollars on materials. States with high concentrations of establishments in this industry included California, Florida, Texas, and New York.

Most curtains are manufactured in standard, readymade sizes. Draperies include ready-made items as well as custom-made versions. These made-to-measure draperies are ordered from a showroom or a catalog and then produced by the manufacturer. Cost conscious consumers tended to prefer the less expensive ready-made curtains and draperies in the early 2000s.

Curtains and draperies were once considered the only options for dressing windows, especially in the home. Attitudes shifted over time, however, and by the 1980s, consumers wanted their homes to feel more comfortable and less formal. Spending on home furnishings grew throughout the 1980s. At that time imports did not have much effect on this segment of the market. The market for lined, pinched, and pleated draperies declined as one-inch mini-blinds became popular. By the early 1990s, many companies that manufactured traditional window treatments expanded into alternative products. Many analysts said that the manufacture of formal draperies was on a downward spiral but by 1996 products such as sheer curtains and pinch-pleat draperies were regaining their popularity.

During the late 1990s, this industry began selling more merchandise via home improvement centers that offered items of interest to both men and women. Mass merchants sold about 50 percent of the category's goods

in 1996, department stores sold nearly 33 percent, and the remainder was sold through specialty stores and catalogs. The market for soft window treatments was particularly robust in the late 1990s as consumers chose fashionable new designs that coordinated with their bedding and other home furnishings.

Retail sales of curtains and draperies grew to $2.8 billion in the United States in 2001. Despite continued growth, however, the industry did feel the effect of domestic economic weakness in the early 2000s, according to HFN: The Weekly Newspaper for the Home Furnishing Market. Despite being the least expensive option for covering windows, the curtain and drapery industry underwent dramatic changes when "growth in the economy came to a halt, the terrorist attacks slowed consumer spending, and the retail landscape changed. The demise of Wards, which was a major player in windows, and to a lesser extent, Bradlees and HomePlace, made an impact on the total volume of windows. Ames' bankruptcy and subsequent store closings were also felt. Some of the business was picked up by remaining retailers, specifically J.C. Penney, which added Wards' pinch-pleat business to its own. The mass and specialty chains grabbed what they could."

Most companies in this industry had fewer than 100 employees, but most of the business in this category went to the larger operations. Among the leading firms whose primary products were curtains and draperies was New York-based CHF Industries Inc., which operated manufacturing plants in Illinois, North Carolina, South Carolina, and Texas and employed 1,200 workers. Another industry leader was Hunter Douglas Inc., based in Upper Saddle River, New Jersey, which posted 2003 sales of $929.7 million and employed 6,537 workers.

In 2000, the total number of employees working at establishments that manufacture curtains and draperies was 23,672, down from 25,524 in 1997. About 18,476 of those employees were production workers who earned an average hourly wage of $11.82.

Further Reading

Meyer, Nancy. "The Curtain Rises." HFN: The Weekly Newspaper for the Home Furnishing Market, 18 March 2002.

U.S. Census Bureau. "Statistics for Industry Groups and Industries: 2000." February 2002. Available from http://www.census.gov/prod/2002pubs/m00as-1.pdf .

——. "Value of Shipment for Product Classes: 2001 and Earlier Years." December 2002. Available from http://www.census.gov/prod/2003pubs/m01as-2.pdf .

Comment about this article, ask questions, or add new information about this topic: