SIC 2329

MEN'S AND BOYS' CLOTHING, NOT ELSEWHERE CLASSIFIED

This category includes establishments primarily engaged in manufacturing men's and boys' clothing, not elsewhere classified, from purchased or woven fabrics. These items include, but are not limited to, athletic clothing, bathing suits, down-filled clothing, shorts, nontailored sports clothing, sweaters, athletic uniforms, and windbreakers. Establishments primarily engaged in manufacturing leather and sheep-lined garments are classified in SIC 2386: Leather and Sheep-Lined Clothing. Knitting mills primarily engaged in manufacturing outerwear are classified under SIC 2253: Knit Outwear Mills.

NAICS Code(s)

315211 (Men's and Boys' Cut and Sew Apparel Contractors)

315228 (Men's and Boys' Cut and Sew Other Outerwear Manufacturing)

315299 (All Other Cut and Sew Apparel Manufacturing)

Industry Snapshot

The U.S. Census Bureau estimates that roughly 60 establishments manufacture clothing in this classification. They shipped $869.9 million worth of goods in 2001, and they spent $405 million on materials. Of the 13,061 employees operating in this industry, 10,599 were production workers earning an average wage of $11.08 per hour. Total payroll costs were $266 million.

Organization and Structure

While many manufacturers in this sector of the apparel industry were small, family-owned businesses, several large and growing establishments dominated the category, which was comprised of manufacturers, contractors, and jobbers. Contractors were independent manufacturers hired by various and often competing manufacturers. Contractors specialized in sewing the garment from pieces provided them. They were hired by producers that did not have their own sewing facilities or whose own capacity had been exceeded.

Jobbers were design and marketing businesses that were hired to perform specific functions, including purchasing materials, designing patterns, creating samples, cutting material, and hiring contractors to manufacture the product. After purchasing materials needed to produce the pieces, jobbers then sent the cut material to contractors for assembly.

In creating apparel from the purchased materials, manufacturers produced designs or bought them from freelancers, and they purchased the fabric and trimmings. Garments were usually cut and sewed in the manufacturer's factories, but outside contractors were hired when demand for an item exceeded the manufacturer's capacity or shipping deadlines could not be met. For the purposes of this entry, the term "manufacturers" will refer cumulatively to contractors, jobbers, and manufacturers.

Background and Development

During the 1980s interest in men's fashions increased, augmented by the introduction of several new men's fashion magazines. Office wear became more comfortable and less formal, and sweaters and sports coats became acceptable in some work environments. As the men's apparel industry grew and diversified, manufacturers and retailers began to target specific markets according to income, age, and education—a strategy already common in the women's fashion industry. Many retailers expanded their men's wear departments, and the industry grew at a faster pace than women's wear throughout the 1980s and well into the 1990s.

As in other sectors of the apparel industry, consolidation and competition from imported clothing were the industry's primary concerns in the early 1990s. The economic recession of the early 1990s prompted manufacturers to produce more comfortable and moderately priced casual wear such as fleece sweat shirts, jackets, and pants. Shipments for all types of men's and boys' clothing were valued at about $2.3 billion in 1992, up from $1.6 billion in 1982. Employment in the industry expanded from approximately 44,600 people in 1982 to 53,300 in 1990.

The value of men's and boys' apparel production dropped 2 percent in 1996. However, retail sales of men's

apparel climbed 7.3 percent, and retail sales of boys' apparel grew 4.4 percent. While the production of sweat pants, shorts, and sweaters declined in 1996, the production of team sport uniforms grew slightly.

In 1998 the retail value of all apparel sold in the United States was $177 billion, up 4.7 percent from 1997, according to Apparel Industry magazine. Men's clothing increased by 6.8 percent, compared to 3.7 percent for women's clothing.

Casual wear accounted for the largest percentage of sales that year. This widespread trend toward dressing less formally helped the sportswear industry, since some companies began allowing employees to wear casual clothes to work instead of tailored suits. In the late 1990s, some clothing manufacturers were designing sportswear in modern, comfortable styles to appeal to younger men who wanted to look sophisticated yet casual. Some of these lines of sportswear were intended to be worn both at work and in leisure time.

Other companies offered innovative features to attract customers. For example, some swimwear designers began incorporating utilitarian cargo pockets and toggles into their products.

Current Conditions

The U.S. apparel industry faced two major problems in the early 2000s: increased imports from China and a weak domestic economy. Between 1997 and 2002, cotton textiles and apparel imports from China, which reached $9.8 billion in 2002, had increased 17 percent. Imports were only expected to increased throughout the early 2000s, particularly as the Uruguay Round agreement, which was passed in the late 1990s by the World Trade Federation, mandated the elimination of textile quotas by 2005.

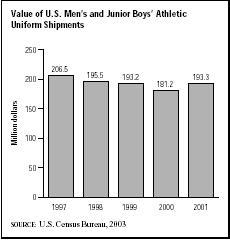

As the economic situation in the United States worsened in the early 2000s, exacerbated by highly publicized corporate scandals and the September 11 terrorist attacks, apparel sales began to wane. After growing a mere 2 percent in 2000 to $18.23 billion, apparel sales actually began to decline. The value of shipments for the contract men's and boys' cut-and-sew apparel sector declined from $1.94 billion in 1998 to $1.37 billion in 2001. Over the same time period, the value of shipments for the other men's and boys' cut-and-sew outerwear sector declined from $2.1 billion to $1.28 billion. One area of growth was men's and junior boys' athletic uniforms, which saw the value of shipments increase from $181.2 million in 2000 to $193.3 million in 2001.

Total apparel sales in 2002 declined 1.7 percent; however, men's wear sales did climb 1.8 percent that year, compared to a 6.1 percent decline in women's wear. Sales of men's wear in 2002 were estimated at $52 billion.

Industry Leaders

Among firms that manufactured products in this classification as their primary business, Calvin Klein Sport Div. (a subsidiary of Calvin Klein Inc. based in New York, New York) was one of the largest with 1,100 employees and estimated sales of $190 million. This company had been known previously as Puritan Fashions Corp. It specialized in sportswear.

Russell Corp., based in Alabama, was another leader in this industry with sales of $1.18 billion in 2003. Other major companies in the category were Columbia Sportswear Co. of Portland, Oregon, with 2,092 employees and estimated sales of $952 million, and Jos. A. Bank Clothiers Inc. of Hampstead, Maryland, with 1,540 employees and sales of $299 million.

Among the large, diversified firms that also competed in this industry were Levi Strauss and Co. of San Francisco, California, with 2003 sales of $4.09 billion; Reebok International Ltd. of Stoughton, Massachusetts, with sales of $3.48 billion; and Eddie Bauer Inc. (a subsidiary of Spiegel Holdings Inc. based in Redmond, Washington) with sales of $1.6 billion. When Spiegel declared bankruptcy in 2004, it put Eddie Bauer up for sale.

Workforce

In 2000 the average hourly wage for men's and boys' clothing production workers was $11.08. The Census Bureau estimated that in 2000 this segment of the apparel industry employed 13,061 people, including 10,599 production workers.

A long-time center of the apparel business in the United States, New York was home to the majority of men's and boys' wear manufacturers in the early 2000s. California, however, reported the greatest value of shipments, while Tennessee reported having the highest number of employees in the industry. Alabama and Pennsylvania also had significant concentrations of workers in this category.

America and the World

In the 1960s the U.S. men's and boys' apparel industry began to lose significant market share to imports, which offered consumers lower prices and acceptable quality. By the 2000s, imports had reached all-time highs. With U.S. manufacturers relying more heavily on offshore assembly plants, the industry experienced further losses.

In the 1960s U.S. apparel makers began moving their manufacturing operations abroad, focusing on Hong Kong, Taiwan, and South Korea, where labor costs were low. By the 1980s, however, labor costs in these countries had increased and operations were moved to Bangladesh, Thailand, Pakistan, Indonesia, Malaysia, Sri Lanka, and India. By the early 1990s, China had replaced Hong Kong as the greatest supplier of imports to the United States. Hong Kong, Taiwan, and South Korea, as well as China, continued to lose market share to new players and represented only 28 percent of apparel imports in 1995. In the late 1990s and early 2000s the largest gains in import market share belonged to the Caribbean countries and Mexico.

During the early 1990s, more imports entered the United States under Provision 9802 (formerly known as Section 807) of the Harmonized Tariffs Schedule of the United States. This provision allowed clothing assembled abroad—from pieces cut in the United States and then exported—to be re-imported with duty paid only for the value added abroad. This meant that companies could pay foreign workers lower wages to complete the most labor-intensive part of the assembly process. Many U.S. manufacturers moved assembly operations to the Caribbean, where they expected to reduce costs and more successfully compete against imports from Asia. They encountered logistics problems, however, and it appeared that Mexico might ultimately become a more popular manufacturing location than the Caribbean.

The North American Free Trade Agreement (NAFTA) was ratified in 1993 to create a free-trade zone between the United States, Mexico, and Canada by gradually eliminating tariffs over 15 years. It was generally supported by executives in the men's apparel industry, but workers' unions tried unsuccessfully to stem the loss of jobs among Americans in the industry by limiting the imports allowed in the country. Due to NAFTA, U.S. textile exports to Mexico jumped from $1.1 billion to more than $3 billion between 1995 and 2002.

Research and Technology

In the battle against imports, U.S. apparel makers tried using more automation, delivering higher quality goods, and closely tracking consumer's needs and desires. Most of the larger manufacturers continually sought newer machinery to improve efficiency, but apparel manufacture remained a highly labor-intensive industry.

Another new strategy involved "quick response," the idea that bringing apparel to the retailer more rapidly would shorten the production cycle, reduce inventories, improve productivity, and help manufacturers avoid overstocking. Using computers to track inventory, sales, and consumer response, domestic manufacturers hoped to compete more effectively with importers. Department stores and manufacturers worked together to speed deliveries and increase efficiency.

Further Reading

Palmieri, Jean E. "The Light at the End of the Tunnel." Daily News Record, 18 August 2003, 54.

U.S. Census Bureau. "Statistics for Industry Groups and Industries: 2000." February 2002. Available from http://www.census.gov/prod/2002pubs/m00as-1.pdf .

——. "Value of Shipment for Product Classes: 2001 and Earlier Years." December 2002. Available from http://www.census.gov/prod/2003pubs/m01as-2.pdf .

U.S. Department of Agriculture. "NAFTA: A Clear Success for U.S. and Mexican Textile and Cotton Trade." January 2004. Available from http://www.fas.usda.gov/info/agexporter/2004/January/pgs%2022-23.pdf .

Comment about this article, ask questions, or add new information about this topic: