SIC 2899

CHEMICALS AND CHEMICAL PREPARATIONS, NOT ELSEWHERE CLASSIFIED

This industry consists primarily of establishments engaged in manufacturing miscellaneous chemical preparations, not elsewhere classified, such as fatty acids, essential oils, gelatin (except vegetable), sizes, bluing, laundry sours, writing and stamp pad ink, industrial compounds, such as boiler and heat insulating compounds, metal, oil, and water treating compounds, waterproofing compounds, and chemical supplies for foundries. Establishments primarily engaged in manufacturing vegetable gelatin are classified in SIC 2833: Medicinal Chemicals and Botanical Products; those manufacturing dessert preparations based on gelatin are classified in SIC 2099: Food Preparations, Not Elsewhere Classified; those manufacturing printing ink are classified in SIC 2893: Printing Ink; and those manufacturing drawing ink are classified in SIC 3952: Lead Pencils, Crayons, and Artists' Materials.

NAICS Code(s)

325510 (Paint and Coating Manufacturing)

311942 (Spice and Extract Manufacturing)

325199 (All Other Basic Organic Chemical Manufacturing)

325998 (All Other Miscellaneous Chemical Product Manufacturing)

As the specialty chemical industry entered the 1990s, many corporations implemented organizational restructuring coupled with cost reduction measures. Based on these management decisions, the industry appeared to be in the beginning of a business recovery from the cyclical downturn experienced during the last portion of the 1980s. However, the pickup was more difficult and slower than expected, in part because of the continued sluggishness of foreign economies. This factor reduced the export demand for chemicals and, consequently, the industry's trade surplus. Although demand picked up in the late 1990s, the economic downturn of the early 2000s undermined the industry's performance.

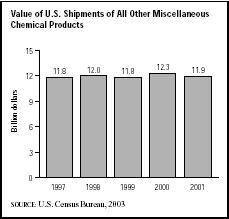

Between 1992 and 1997, the value of total industry shipments grew from $9.9 billion to $11.8 billion. After climbing to a peak of $12.3 billion in 2000, however, shipments declined to $11.9 billion in 2001. Chemical preparations, including essential oils, were the most important category in this industry in 2001. Shipments in this sector were about $6.7 billion, which accounted for 56.5 percent of total shipments. Water treating compounds were the second-largest category with shipments reaching more than $2.5 billion, or 21.5 percent. Shipments of automotive chemicals, such as antifreeze and engine cleaning chemicals, were $878 million in 2001, representing 7.3 percent of the total. Gelatin shipments were more than $519 million, while evaporated salt shipments topped $417 million, comprising 4.3 percent and 3.5 percent respectively. Matches were the weakest category in the industry, accounting for only $42 million, or less than 0.3 percent of total shipments in 2001.

The growth of miscellaneous chemicals, such as sodium chlorate, posted double-digit growth since the late 1980s. Sodium chlorate is used in the form of chlorine dioxide as a substitute for traditional chlorine in pulp and paper bleaching. While the substitution of this chemical has been greater in Canada than the United States due to greater environmental concerns over chlorine, the use of the chemical in the United States was expected to continue increasing. About two-thirds of the North American production capacity of sodium chlorate was located in Canada. Considering the dramatic growth prospects for sodium chlorate, major producers have made sizeable capacity expansions in the early 2000s. With the ability to produce 580,000 metric tons per year, industry leader Erco Worldwide, formerly known as Sterling Chemicals, held roughly 26 percent of North American sodium chlorate capacity as of 2003.

Demand for basic chemicals strengthened in response to the prolonged economic expansion of the 1980s. Output in the early 1990s, as measured by the Federal Reserve Board (FRB) Basic Chemicals Production Index, was at its highest level since the prior peak reached in the late 1970s. Over the long run, the demand for basic chemicals was expected to pace the rise in real (inflation-adjusted) gross domestic product (GDP), with the automobile, housing, export, agricultural, and paper markets, in particular, holding sway. The prolonged economic upswing of the late 1990s brought further growth to the industry. However, this growth trend was tempered when the U.S. economy bottomed out in the early 2000s.

The number of establishments involved in this industry in the early 2000s was roughly 1,000—down from 1,409 in 1996. Considerable consolidation in the chemical industry had reduced the number of key players. The

vast majority of companies in this sector employed less than 20 workers. Less than 500 of the total number had 20 or more employees. Texas led other states with the greatest number of chemical preparation establishments, followed by California and Illinois.

Major U.S. corporations that produce specialty chemicals include ExxonMobil Corp., Kich Industries Inc., ChevronTexaco Corp., and Merck and Company Inc. Other leading companies are Nalco Chemical, a subsidiary of Suez Lyonnaise des Faux; as well as Akzo Nobel Inc. and Henkel of America, a subsidiary of German chemical giant Henkel.

Employment in this industry has increased modestly, despite consolidation. The number of employees increased from 35,896 people in 1997 to 37,565 in 2000, of whom 22,607 were production employees. Production workers earned an average of $16.38 per hour. Texas was home to the greatest number of employees in this industry, followed by Illinois.

Further Reading

"Former Sterling Pulp Acquires Chlorate Firm." Chemical Week, 8 October 2003.

U.S. Census Bureau. "Statistics for Industry Groups and Industries: 2000." February 2002. Available from http://www.census.gov/prod/2002pubs/m00as-1.pdf .

——. "Value of Shipments for Product Classes: 2001 and Earlier Years." December 2002. Available from http://www.census.gov/prod/2003pubs/m01as-2.pdf .

Comment about this article, ask questions, or add new information about this topic: