SIC 2861

GUM AND WOOD CHEMICALS

The gum and wood chemicals industry is comprised of establishments primarily engaged in manufacturing hardwood and softwood distillation products, natural dyes, tanning materials, and related products. Companies that make synthetic organic tanning materials and synthetic organic dyes are classified in SIC 2869: Industrial Organic Chemicals, Not Elsewhere Classified and SIC 2865: Cyclic Organic Crudes and Intermediates, and Organic Dyes and Pigments, respectively. Gum and wood chemical producers are part of the larger industrial organic chemical industry.

NAICS Code(s)

325191 (Gum and Wood Chemical Manufacturing)

Industry Snapshot

According to the U.S. Census Bureau, roughly 60 establishments manufactured gum and wood chemicals at the turn of the twenty-first century. They shipped $942 million worth of goods in 2001 (down from about $967 million in 1997), spent $435 million on materials, and paid $34 million for buildings and other structures, machinery, and equipment. About 30 percent of those businesses had at least 20 employees. These larger operations accounted for more than 90 percent of the industry's shipments. Missouri had the largest concentration of businesses in this classification.

Background and Development

This industry grew substantially after World War II when construction companies, for example, needed wood treatment chemicals, adhesives, and sealants. The increasing popularity of outdoor barbecue grills during the 1950s and 1960s boosted sales of charcoal briquettes. Revenues and profits declined during the 1980s, however. Synthetic chemicals displaced many natural wood and gum chemicals in everything from dyes to sealants. In addition, environmental laws restricted the burning of charcoal.

Like organic chemicals derived from petroleum and natural gas, thousands of natural chemical products can be distilled from wood. Turpentine, for example, is extracted from pine gum and pine wood. Numerous oils and finishes can also be obtained from pine or other woods, as can many dyes, fuels, and resins.

By the mid-1990s the outlook seemed brighter as environmental concerns about synthetics brought renewed interest in natural chemicals, such as dyes and fuel additives. At that time about 40 percent of the industry's revenues came from sales of hardwood charcoal briquettes, 30 percent came from hardwood distillates such as oak extract, and 17 percent came from softwood distillates such as resin and turpentine.

Most merchandise in this category is sold to individual consumers who primarily purchase charcoal, turpentine, and other products for home use. Manufacturers of plastics used 11 percent of production in the early 1990s to create base resins and additives. Other industries used distillates and extracts to manufacture soaps, detergents, paperboard, drugs, paints, printing ink, leather tanning chemicals, rubber, adhesives, sealants, and many other goods. About 12 percent of production in the early 1990s was exported.

In 1995 weak demand, low prices, stiff competition (especially from cheaper Asian products), and new styles of clothing brought the U.S. dyes industry to a ten-year low, according to Chemical Week magazine. Prices throughout the gum and wood chemicals industry dropped substantially in 1996, according to Chemical Market Reporter.

The Census Bureau estimated that in 1997 the industry shipped about $357 million worth of hardwood charcoal and charcoal briquettes, $263 million worth of crude tall oil, $51 million worth of refined tall oil, $20 million worth of rosin and other tall oil derivatives, and $239 million worth of other gum and wood chemicals.

Current Conditions

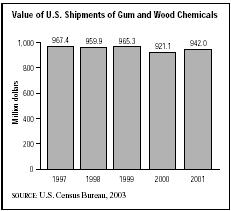

The value of shipments in the gum and wood chemicals industry, which includes wood distillation products, fluctuated throughout the late 1990s and early 2000s. Between 1997 and 1998, shipments declined from $967 million to $959 million. Shipments increased to $965 million in 1999 and then dropped to $921 million in 2000. In 2001, shipments rebounded to $942 million.

Industry Leaders

Among companies that make gum and wood chemicals as their primary business, Royal Oak Enterprises Inc. (Roswell, Georgia) was one of the leaders in 2000 with 400 employees and estimated sales of $61 million. Royal Oak is the largest privately owned charcoal manufacturer in the world, and it makes more private label (store brand) charcoal than any other company.

Hickory Specialties Inc. (a subsidiary of Bob Evans Farms Inc. based in Brentwood, Tennessee) also specializes in charcoal. It has 150 employees and estimated sales of $29 million. Campfire Charcoal Company Inc. (Jacksonville, Texas) has 65 employees and estimated sales of $20 million. It is a subsidiary of Arrow Industries Inc., which is part of the ConAgra Inc. conglomerate.

Workforce

This industry employed 2,216 people in 2000, including 1,636 production workers who earned an average hourly wage of $15.91. The total workforce had been about 3,500 people in the early 1980s and had dropped below 2,500 in the early 1990s.

Further Reading

U.S. Census Bureau. "Statistics for Industry Groups and Industries: 2000." February 2002. Available from http://www.census.gov/prod/2002pubs/m00as-1.pdf .

——. "Value of Shipment for Product Classes: 2001 and Earlier Years." December 2002. Available from http://www.census.gov/prod/2003pubs/m01as-2.pdf .

Comment about this article, ask questions, or add new information about this topic: