SIC 1541

GENERAL CONTRACTORS—INDUSTRIAL BUILDINGS AND WAREHOUSES

This category covers general contractors primarily engaged in the construction, alteration, remodeling, repair, and renovation of industrial buildings and warehouses, including aluminum plants, automobile assembly plants, food processing plants, pharmaceutical manufacturing plants, and commercial warehouses. General contractors working on nonresidential buildings other than industrial buildings and warehouses are classified in SIC 1542: General Contractors—Nonresidential Buildings, Other Than Industrial Buildings and Warehouses.

NAICS Code(s)

233320 (Commercial and Institutional Building Construction)

233310 (Manufacturing and Light Industrial Building Construction)

Industry Snapshot

Like all construction activity, this category of non-residential construction is crucially dependent on overall U.S. and regional economic health. Specifically, construction of industrial building and warehouses is intimately tied to trends and conditions in the U.S. manufacturing sector; individual projects are, moreover, bound to the economic health of whichever industries are sponsoring those projects.

Therefore, when the U.S. economic bubble of the late 1990s burst, spending on industrial buildings and warehouses began to wane. Employment in the manufacturing sector fell throughout 2001 and 2002, as did industrial production. As a result, spending on new manufacturing plants and warehouses experienced a dramatic slowdown. This downward trend was expected to continue through 2002, according to a May 2002 issue of Building Design and Construction.

Organization and Structure

In this sector of the construction industry general contractors generally bid for a project, assuming responsibility for the project's planning and overall development. Often, however, the general contractor delegates performance of many specific tasks to specialty subcontractors.

Once a contractor is chosen to undertake a given project, he or she often remains in close communication with its owner over many aspects of construction detail while at the same time coordinating the work of various subcontractors and teams of employees. Given the inherent complexity of this arrangement, successful management proved one of the industry's greatest challenges. Project often fail due to miscalculation of budgets and missed deadlines, often attributed to the lack of an efficient communication process between contractors and owners.

Background and Development

Contractors benefited from the booming U.S. economy in the late 1990s, in particular the raging stock market, which encouraged investment in new buildings and modernization schemes as manufacturing industries attempted to increase efficiency through technological innovation. Contractors were called in for building and remodeling projects to accommodate the new production methods and equipment.

Manufacturers that expanded or relocated in the midand late 1990s at the greatest rate were those involved in semiconductor manufacturing, pharmaceuticals, food and kindred products, and paper and allied products. Companies within the pharmaceutical industry as well as semiconductor manufacturers are particularly in constant need of new research, development, and production facilities since their products face ever-shortening product life cycles. In order to be competitive, many manufacturers also need to upgrade into facilities fully equipped to provide advanced telecommunications and computer systems. Moreover, the importance increasingly attached by companies around the world to reducing hazards to the environment was expected to create further remodeling and new construction opportunities.

The food industry, for instance, demanded the construction, expansion, or renovation of a record 867 plants in 1998, an increase of 14.7 percent from the year before. Analysts attributed the bulk of this growth to increasing automation in production. Companies such as Coca-Cola, ConAgra, and Frito-Lay all had a number of projects underway in 1999, with Kraft leading the sector with 24 projects. The food industry in general was leaning toward larger facilities in which automation could be most economically applied.

Also impacting the industry in the 1990s was the increasingly stringent loan requirements set up by banks in the wake of the savings and loan crisis. To counter banks taking a risk position in these projects, developers and their subsequent construction firms were often asked to take an equity position or become a part owner in projects they design or build. Meanwhile, however, the growing strength and popularity of real estate investment trusts (REITs) helped maintain healthy funding for construction in this sector, even in the face of concerns over oversupply or pending interest-rate increases.

The nonresidential repair and renovation market, in general, was seen as having a more secure future than that of new construction. The commercial building boom of the 1980s produced, among other results, record vacancy rates for warehouses, and this over-supply was expected to diminish the market for new warehouse construction for some time. Instead, manufacturers were generally trying to reflect their industries' tightening concentration by expanding their capacities—in short, fewer but larger facilities.

Contractors in this construction sector remained somewhat wary, however, over the increased international presence of the U.S. manufacturing industries. With relaxed trade and investment restrictions, a strong dollar relative to foreign currencies, and the lure of cheaper labor and materials costs overseas, larger firms with capacity to move production facilities to foreign markets began seeing increasing reasons to do so. However, such practices were also expected to lead to a rise in warehouse construction, as goods produced abroad would be shipped to the U.S. and readied for domestic distribution.

Current Conditions

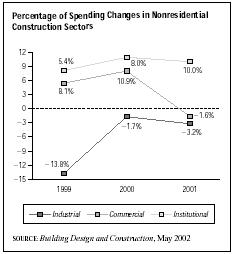

After experiencing substantial growth in the mid-1990s, the industrial building industry experienced a dramatic slowdown beginning in 1999. Spending on industrial buildings in the United States declined 13.8 percent in 1999 to $32.6 billion, and then continued to deteriorate at a slower pace, falling 1.7 percent in 2000 and another 3.2 percent in 2001 to $31.1 billion. According to a May 2000 issue of Building Design and Construction, the decline in spending was related to the slowdown in U.S. industry in general. "Medium-and long-term demand for new industrial space is closely correlated with industrial output, export growth, and capacity utilization rates—all factors that have weakened dramatically during the past 18 months."

Despite continued economic weakness into 2004, the residential construction sector continued to perform well, bolstered by historically low interest rates; however, the nonresidential construction sector, which includes industrial buildings and warehouses, continued to falter. Even

the institutional sector, which flourished in 2000 and 2001 due in large part to the strength of the healthcare industry, had started seeing a slowdown in construction spending by 2002. However, analysts note that the decline in nonresidential construction had begun to level off in 2003, prompting some to predict a turnaround by the end of 2004.

Industry Leaders

The top contractors in this category in the early 2000s were generally engaged in other construction sectors as well. Fluor Corporation of Irvine, California, posted sales of $8.8 billion in 2003, down 11.6 percent from 2002, and employed 29,011 people. Bechtel Corporation of San Francisco, a private company founded in 1898 and still run by its founding family, employed 47,000 people and generated worldwide sales of $11.6 billion in 2003, down 13.4 percent from the previous year. Kellogg Brown & Root, based in Houston, Texas, was the construction unit of Haliburton Company, with sales of $9.2 billion and 64,000 employees. In 2003 Kellogg Brown & Root filed for Chapter 11 bankruptcy protection after being saddled with a $4.4 billion asbestos-related settlement. JA Jones Construction Co. of Charlotte, North Carolina, maintained a payroll of roughly 10,000 workers and generated about $1.5 billion in revenues. A unit of bankrupt Philipp Holzmann Group, the firm's plan to be acquired by Balfour Beatty fell apart in 2003.

There were large numbers of generally small firms tackling a wide variety of projects within a frequently confined geographical area. Nearly half of all establishments in this category employed fewer than 5 workers, while 85 percent employed fewer than 20. With the exception of the giants undertaking business not only nationally but also internationally, even those contractors doing business in more than one state typically relied overwhelmingly on contracts in the state in which they were headquartered for the bulk of their profits.

Workforce

About 5 percent of the U.S. labor force is employed by one branch or another of the construction industry. The industrial building and warehouse sector employed about 139,000 individuals at the turn of the twenty-first century. Construction workers in this category earned an average of $16.50 per hour. The states employing the greatest number of construction workers were Texas, Alabama, and California.

Despite its size, this workforce was by no means monolithic. Employment in construction was seasonal, leading to pronounced swings in the number of workers employed over the course of a year. Moreover, the skilled members of the workforce engaged in a wide variety of different crafts or specialties. As a result, no single voice could adequately represent the various needs and interests of all of these workers. Such considerations were particularly important because labor and management are more intimately tied than in many other industries. That is, in addition to wages and working conditions, unions must negotiate with contractors on issues such as training procedures and hiring practices. Especially in the late 1990s, when skilled labor was in exceptionally short supply, employers and unions were increasingly forced to negotiate to preserve job opportunities. Skilled labor in this category earned about $29 per hour.

Further adding to the lack of uniformity in the workforce were the tendencies for skilled workers to identify with their specialties rather than with a particular employer, as well as for all employees to change employers often, to switch frequently from site to site, to work beside teams hired by other employers, and to engage to an unusual extent in self-supervision.

Supervising contractors typically worked their way into that position from a beginning in some particular craft or specialty. Traditionally, academic training has played a minor role in preparing contractors for their career, though the inherent complexity of managing construction projects—especially the larger ones—seemed likely to make higher levels of education increasingly desirable.

Further Reading

"Construction Spending Continues Its Climb." Real Estate Weekly, 14 January 2004.

Delano, Daryl. "Clouds Over Industrial Sector Won't Break Until '03." Building Design and Construction, May 2002.

"Home Building Strong, But Commercial Construction Falters." Indianapolis Business Journal, 17 February 2003.

Comment about this article, ask questions, or add new information about this topic: