SIC 1793

GLASS AND GLAZING WORK

This category is comprised of establishments primarily engaged in cutting, coating, tinting, and installing glass. Companies that install automotive glass are described in SIC 7536: Automotive Glass Replacement Shops.

NAICS Code(s)

235920 (Glass and Glazing Contractors)

This industry consists of a few companies offering a range of services. Common industry activities include installing plate glass in storefronts and other commercial buildings, cutting and installing windowpanes for homes, and tinting windows. Other niche markets exist for firms that install revolving glass doors; cut and install mirrors and safety glass; create custom glass doors, signs, shelves, and glass tabletops; or cut and install architectural and ornamental custom glass work.

The U.S. glass and glazing work industry includes roughly 4,700 establishments according to the latest figures available from the U.S. Census Bureau. Most of these firms employ less than 10 workers, and the total employee count for this industry ranges from 35,000 to 40,000. According to an April 2002 issue of Glass Magazine, attracting skilled workers will be the industry's most pressing challenge throughout 2010.

Although glass was invented in about 4000 B.C., it wasn't until the early twentieth century that advancements in manufacturing technology made it inexpensive and widely available. In 1900, the use of glass was primarily limited to windows, mirrors, optical lenses, and containers. During the early and mid-1900s, however, glass applications proliferated. As the U.S. economy boomed after World War II, the demand for glass by commercial, institutional, and residential sectors ballooned, spurring growth in the glass installation and glazing industry.

By the mid-1980s, the United States was consuming about $2 billion worth of non-automotive flat glass, much of which was installed by contractors in the glass and glazing industry. Approximately 80 percent of that glass was used by construction industries, with the remainder used to make signs, mirrors, solar panels, and other specialty products.

A recession in commercial and residential building markets in the early 1990s curtailed glass shipments and cut the need for glass installation contractors. U.S. glass demand plummeted 8 percent per year between 1990 and 1992, to less than $1.5 billion, as building contractors faced a major economic setback. Glass contractors also suffered as trends in architectural design moved away from the expensive glass office enclosures and stoic glass buildings so popular the decade before.

However, the sustained economic recovery in residential housing that began in 1992 continued past the middle part of the decade, spurring renewed demand for

glass contractors. Single-family houses accounted for 16.3 percent of the value of construction work done by this industry in 1992, up sharply from 10.6 percent in 1987, according to the U.S. Economic Census. However, the leading category of construction work done by the glass and glazing work industry in 1992 was "other commercial buildings," such as stores and restaurants, with 28 percent of the total (up from 21.7 percent in 1987). Office buildings accounted for another 21.5 percent of the industry's work in 1992, but this was down sharply from 28.8 percent in 1987.

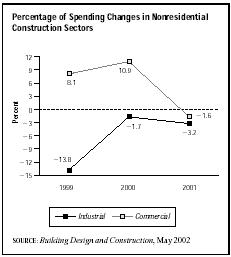

The economic recession of the early 2000s prompted a slowdown in commercial and industrial construction, undercutting the performance of the glass industry as a whole. Nonresidential construction spending dropped by 6 percent in 2003 as even the strongest sectors, such as healthcare construction, began to see previously rapid growth rates slow. Spending on office building construction slowed considerably to roughly $43 billion in 2002 and to $39 billion in 2003. Spending on industrial buildings in the United States had declined 13.8 percent in 1999 to $32.6 billion, and then continued to deteriorate at a slower pace, falling 1.7 percent in 2000 and another 3.2 percent in 2001 to $31.1 billion. However, strong residential construction, spurred by record low interest rates, did help to offset this decline somewhat for glass manufacturers.

Industry trends included greater use of riot-and bulletproof glass, more skylights and windows in residences, and greater use of metal frames and finishes. By the mid-1990s many successful glass and glazing contractors had started concentrating on developing niche markets, including the installation of energy-saving glass and safety glass. Some also expanded their services to include such activities related to glass installation as designing and building window frames. Technological advances that affected the glass and glazing work industry included a new "two-phase" adhesive glazing technique that lowered costs and enhanced aesthetics. In the wake of the September 11 terrorist attacks, many glass manufacturers began to offer security glazing. In fact, the U.S. Department of Justice issued a report in 2003 advocating the use of protective glazing on glass used in government buildings.

This industry has supported several thousand small contractors, but there are several large firms that lead the industry. In 2003, the top two companies in the industry were Harmon Contract, of Bloomington, Minnesota, and Benson Industries, Inc., of Portland, Oregon.

Further Reading

Brown, Andrew. "Glazing Solution for Homeland Security." Glass Magazine. February 2003.

Delano, Daryl. "Clouds Over Industrial Sector Won't Break Until '03." Building Design and Construction, May 2002.

"Home Building Strong, But Commercial Construction Falters." Indianapolis Business Journal, 17 February 2003.

"Security Glazing: An Emerging Market Niche." Glass Magazine. February 2003.

U.S. Department of the Census. 1997 Economic Census, 20 March 2000. Available from http://www.census.gov .

Voreis, Ricard D. "Industry Hurt By Lack of Skilled Employees." Glass Magazine, April 2003.

Comment about this article, ask questions, or add new information about this topic: