SIC 3643

CURRENT-CARRYING WIRING DEVICES

The current-carrying wiring devices industry is comprised of establishments principally engaged in manufacturing current-carrying wiring devices, primarily interior electrical components used to connect equipment to a power source.

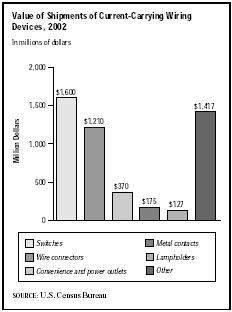

The industry is divided into six major categories: switches, wire connectors, convenience and power outlets, lamp holders, metal contacts, and other devices such as plug caps and connector bodies. Miscellaneous products encompass items such as trolley line materials, lightning protectors, and fluorescent starters.

NAICS Code(s)

335931 (Current-Carrying Wiring Device Manufacturing)

Industry Snapshot

While total sales fell steadily in the early 2000s—from $5.4 billion in 2000 to $4.9 billion in 2002—there remained bright spots on the horizon for manufacturers of current-carrying wiring devices. A rebounding U.S. economy was expected to generate renewed construction of both residential and commercial buildings, a sector to which this industry was closely tied. At the same time, an increasing proportion of those new construction projects were being outfitted for networking of various stripes. The current-carrying wiring devices industry was well poised to take advantage of these developments, and the early and mid-2000s saw industry players jockeying for position to take advantage of these emerging opportunities.

Background and Development

The basic technology for this industry was discovered in 1729, when Stephen Gray, an English physicist, found that some substances could carry electricity from one location to another. These substances were called conductors. In 1820, Danish physicist Hans Christian Oersted found that a metal wire carrying a current of electricity would cause a compass needle to change direction. Georg Simon Ohm is credited with developing the theory of electric circuits in 1825. Subsequent advances gave birth to manufactured current-carrying wiring devices.

Rapid development of residential, commercial, and institutional structures in the United States between 1945 and 1980 propelled industry revenues past $2.5 billion per year. Strong development during most of the 1980s resulted in average annual growth of about 8 percent. By 1989, sales of current-carrying devices had surged to about $4.4 billion. Economic recess in 1990 stalled industry growth, as sales dropped nearly 2 percent. Stagnant construction markets repressed growth throughout the early 1990s, although an increase in housing starts and general economic improvement through the 1990s boosted shipments to about $5.4 billion in 1997.

To compensate for slow domestic sales, some industry participants capitalized on expanding export demand, which rose as a result of a weak U.S. dollar. Exports gained 14 percent in 1991, reaching a record $1.4 billion, or nearly 30 percent of total shipments, but growth of exports was flat through the mid-1990s. In combination with slow export growth, imports increased significantly in the mid-1990s, adding to the deficit trend that began in the early part of the decade. Major importers into the United States were Japan, Mexico, Taiwan, and Germany. Imports from Mexico were expected to continue growing in the mid- and late 1990s, particularly after the North American Free Trade Agreement (NAFTA) was initiated in 1994.

In the mid- and late 1990s, wiring device manufacturers benefited from steady residential construction markets and an upsurge in home renovations. In addition, new government building regulations mandated the use of certain wiring products. The National Electrical Code (NEC) that was implemented in 1993, for example, required the installation of special ground-fault circuit interrupters (GFCIs) that detect ground faults and shut off power to protected circuits. The revised 1996 NEC code augmented GFCI requirements. The sale of these and other devices were expected to bolster industry growth.

Current Conditions

The early 2000s were troubled times for wiring-device manufacturers. According to Plant Engineering, average production costs rose 3.3 percent in the year ended February 2003, while the prices manufacturers charged for their products rose less than 1 percent, resulting in lowered profit margins and pressure to raise prices and cut costs, measures that carried clear burdens for the industry.

The industry tagged along with the continued surge of home- and office-networking systems. The structuredwiring segment—which included switches and other wiring systems for data and voice networks, high-speed Internet connections, lighting and appliance controls, and automation and security applications—was among the brighter spots in the industry. According to residential-technology consultants Parks Associates, this segment's total sales were expected to top $500 million

in 2004. Coming on the heels of the early 2000s downturn in the economy and its attendant slowing of construction projects, the news that about one in six of all new residential homes was expected to feature structured-wiring systems was a beacon of hope to manufacturers of wiring equipment.

Industry Leaders

In the early 2000s the industry was extremely fragmented, and most leading firms were diversified manufacturers of electrical and wiring equipment. Among the major specialists, market leader Leviton Manufacturing Co. Inc. of Little Neck, New York, employed 5,000 and had sales of $350 million in 2002. The company, founded in 1906, manufactured over 22,000 kinds of electrical and electronic components, more than any other firm in the industry. Leviton specialized in home networking supplies and was particularly strong in the residential structured-wiring market, a segment for which Leviton made a number of strategic acquisitions in the early 2000s.

Eaton Corporation of Cleveland, Ohio, employed 48,000 and brought in $7.2 billion in revenues in 2002, down from $8.3 billion in 2000. The firm continued to acquire businesses strongly positioned in their respective market segments throughout the 1990s and early 2000s. Eaton Electrical accounted for $1.99 billion of total sales in 2002.

Hubbell Incorporated was a diversified manufacturer of electronic and electrical components, with 11,476 employees and sales of $1.59 billion in 2002. The firm's Electrical Segment, home of its Wiring Systems operations, accounted for 64 percent of Hubbell's sales. The 3Com Corporation of Santa Clara, California, specialized in data networking equipment and solutions. In 2002, the firm employed 8,165 and generated revenues of $5.4 billion. Another strong contender, Norwalk, Connecticut-based ABB Inc. was a subsidiary of Zurich-based ABB Ltd.

Workforce

Prospects for most occupations in this industry were expected to be weak through the late 2000s. According to the United States Census Bureau, the current-carrying wire devices industry's 434 firms employed 39,973 workers in 2001, receiving a payroll of $1.28 billion. Of that number, 28,311 employees worked in production, putting in more than 53 million hours to earn wages of more than $694 million. All these figures represented steady decline from 1997, a trend that few analysts expected to change before decade's end. The industry remained fragmented enough that nearly half of all companies employed fewer than 100 workers, while only 12 percent of the firms employed over 500.

Further Reading

"Industries Face Low Margins." Plant Engineering, May 2003.

Lucy, Jim. "Building Your Home-Networking Business." Electrical Wholesaling, February 2002.

U.S. Census Bureau. Statistics of U.S. Businesses, 2001: Manufacturing. Washington, DC: GPO, 2003. Available from http://www.census.gov/epcd/susb/2001/us/US31.HTM .

——. Current Industrial Reports: Wiring Devices and Supplies, 2002. Washington, DC: GPO, July 2003. Available from http://www.census.gov/industry/1/ma335k02.pdf .

Comment about this article, ask questions, or add new information about this topic: