SIC 3493

STEEL SPRINGS, EXCEPT WIRE

This category includes establishments primarily engaged in manufacturing leaf springs, hot wound springs, and coiled flat springs. Establishments primarily engaged in manufacturing wire springs are classified in SIC 3495: Wire Springs.

NAICS Code(s)

332611 (Steel Spring (except Wire) Manufacturing)

According to the U.S. Census Bureau's Statistics of U. S. Businesses , 128 establishments operated in this category for part or all of 2001. According to the 2001 Annual Census of Manufactures , the specific segment of the industry covered by SIC 3493: Steel Springs, Except Wire employed 5,400 people and had a payroll of $201 million. Of these employees, nearly 4,000 worked in production. Industry shipments were valued at $480 million. Projections for 2004 indicated a small decline, with 5,100 employees in 121 establishments. For more information on the spring manufacturing industry as a whole, consult the essay on SIC 3495: Wire Springs.

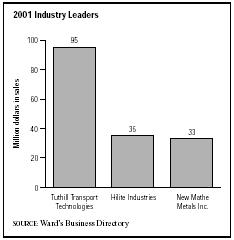

Tuthill Transport Technologies of Springfield, Missouri, led the industry with 2001 sales of $95 million and 400 employees. In second place was Hilite Industries of Elk Grove Village, Illinois, with $35 million in sales and 300 employees. Rounding out the top three was New Mather Metals Inc. of Toledo, Ohio, with $33 million in sales and 200 employees.

The automotive industry is the largest consumer of steel springs. The Spring Manufacturers Institute Inc. (SMI) reported that sales to automotive customers accounted for the largest portion—41.3 percent of industry sales in 1992—followed by industrial equipment customers, which accounted for 8.8 percent of sales. Alloy, carbon, and stainless steels were the most commonly used spring materials because of their strength. Titanium, however, was gaining popularity in the early 1990s because of its superior strength, light weight, and resistance to corrosion. Titanium's high cost was once prohibitive, but new, less expensive titanium alloys expanded its use.

Advances in technology have boosted the production capabilities of some spring manufacturers, but this is not a requirement for survival in the industry. In Springs , George Keremedjiev, president of Tecknow Education Services Inc., noted that spring manufacturing companies were using anything from "state-of-the-art electronics in tooling to machinery and tooling that seemingly is frozen in time back in the 1950s." In other words, the technology employed in spring factories can run the gamut from old machines fitted with electronic sensors that check spring positioning to the Spring Manufacturers Institute Inc.'s (SMI) Spring Design software program, which enables the most novice engineer to successfully design springs. The lack of nationwide standards for spring making has hindered the greater implementation of technology.

Because the capital investments required for advances in technology are high, companies must consider both the

competitive advantages and cost-effectiveness of modernization. If a company is able to maintain or increase sales volume with old assets, it may not be beneficial to modernize its machinery because of the cost involved. SMI's 1992 Annual Market Summary noted that modernization would be an inefficient use of assets unless it helped "to produce a higher profit percentage on net sales." Nevertheless, Keremedjiev predicted that modern methods of production are needed for a spring manufacturer to achieve production processes of the highest quality. Furthermore, Scott Rankin of Vulcan Spring said there is universal recognition that technology will change the industry. Spring making, once known as the "black art" because of its difficulty, can now be mastered by a "spring maker with a month's knowledge and the ability to type numbers on a keyboard," Rankin noted in Springs.

As trade barriers are removed throughout the world, the American spring industry has had to compete for foreign manufacturing customers. Supplying American springs to foreign customers will keep the industry competitive because, according to SMI president Pete Peterson, "We don't worry too much about Japanese springs landing in America. But we must worry about the finished products coming here." To compete globally, some American spring makers have counteracted manufacturers' preferences for national suppliers by forming joint ventures with prominent foreign spring makers. One such joint venture allowed Associated Spring to establish relationships with Japanese automakers through its association with NHK Spring Co. Ltd. of Japan, that nation's largest spring maker.

In addition, the industry saw continued competition from Chinese manufacturers, who during the 2000s took advantage of the favorable currency exchange available by undervaluation of the Yuan, as well as the FSC/ETI tax benefits responsible for hurting many American manufacturing segments, to give large discounts to buyers on Chinese imports.

Spring makers were optimistic at the close of 2003 due to increased production, particularly in the segment of the industry that manufacturers products for OEMs. Despite the upward trend, employment stayed at very low levels into 2004.

Further Reading

Baker, Deborah J., ed. Ward's Business Directory of US Private and Public Companies. Detroit, MI: Thomson Gale, 2003.

Darnay, Arsen J., ed. Manufacturing and Distribution USA. Detroit: Thomson Gale, 2003.

Keremedjiev, George. "Sensors and Electronics in Spring Manufacture … the Key to Savings and Quality." Springs , May 1993.

"Looking Ahead—Not Back—as SMI Celebrates its 60th Anniversary." Springs , October 1993.

Peterson, Bud. "The Family Tree of Springmakers Withstands the Winds of Change." Springs , May 1993, 77-85.

"Petersons Stamp Success on Spring Industry." Springs , October 1993.

"Removing the Veil of the 'Black Art,' Newcomers Share Their Enthusiasm for the Springs Industry." Springs , October 1992.

"Spring Design Enters New Era." Springs , October 1992.

"Spring Industry Data." Spring Manufacturers Institute, March 2004. Available from http://www.smihq.org/public/services/industrydata.html#anchor1keybiz .

U.S. Census Bureau. Statistics of U.S. Businesses: 2001. 1 March 2004. Available from http://www.census.gov/epcd/susb/2001/us/US332311.htm .

U.S. Department of Commerce. Annual Survey of Manufactures. Washington: GPO, 2002.

Comment about this article, ask questions, or add new information about this topic: