SIC 3589

SERVICE INDUSTRY MACHINERY, NOT ELSEWHERE CLASSIFIED

Companies in this classification are principally engaged in manufacturing miscellaneous equipment for use in service businesses. Examples of industry products are floor sanding machines, cafeteria food warmers, commercial fryers, sludge processors, sewage treatment equipment, mop wringers, and commercial corn poppers. Household appliances and machinery are classified in 3630: Household Appliances. For more information on the history and structure of U.S. machinery industries, see SIC 3552: Textile Machinery through SIC 3559: Special Industry Machinery, Not Elsewhere Classified.

NAICS Code(s)

333319 (Other Commercial and Service Industry Machinery Manufacturing)

The miscellaneous service machine industry is highly fragmented. Some of its diverse products include cafeteria equipment, sewer cleaning equipment, water treatment equipment, industrial vacuum cleaners, car washing machinery, janitorial carts, and floor sanding machines.

One of the larger segments of the miscellaneous service machine industry is food service equipment, which accounted for about 20.0 percent of total industry shipments in 1997. Commercial ranges, stoves, and broilers made up the bulk of that group. Commercial and industrial vacuum cleaners, including parts and attachments, accounted for another 5.4 percent of the market. The biggest single category was miscellaneous machinery products, which included an array of products ranging from commercial car washing machinery to service industry water heaters. This miscellaneous category alone accounted for nearly half of all industry shipments in 1997.

General industry expansion between 1950 and 1980 resulted in aggregate shipments of more than $2.5 billion by the early 1980s. Steady growth of service industries during the 1980s, particularly food services, resulted in rapid growth. Sales went from about $2.6 billion in 1983 to $3.4 billion by 1986, and to $4.9 billion by 1990. The 1990s witnessed even more dramatic growth as industry shipments jumped just over 90 percent to $9.3 billion by 1997. As the industry's revenues grew steadily through the 1980s and 1990s, employment jumped from 31,000 in the early 1980s to nearly 57,000 by 1997.

Despite U.S. economic malaise in the early 1990s, most service machinery manufacturers performed well into the second half of the decade. Sales of commercial food service equipment, for example, grew 38.4 percent

from $1.3 billion in 1992 to $1.8 billion in 1997. Shipments of commercial and industrial vacuum cleaners, including parts and attachments, jumped 66.9 percent from $319.5 million in 1992 to $533.2 million in 1997.

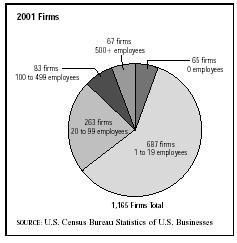

The miscellaneous service machinery industry is extremely fragmented and is dominated by relatively small, specialty manufacturers. Nearly all of the 1,165 firms operating in 2001 employed fewer than 100 workers. According to the Annual Survey of Manufactures, these companies employed a total of 57,114 workers, of which 31,795 were engaged in production. Total payroll was in excess of $870 million, and the value of industry shipments was almost $11 billion.

The industry leader for 2001 was Johnson Diversey Inc. of Sturtevant, Wisconsin, with sales of $1.1 billion. Other players in the miscellaneous service machinery industry were Ionics Inc., a supplier of water treatment equipment, and Tennant Co., which was involved in the floor care sector. Headquartered in Watertown, Massachusetts, Ionics posted 2001 sales of $467 million, and Minneapolis-based Tennant posted sales of $423 million.

Despite continued productivity increases and the movement of some manufacturing facilities to foreign countries, employment prospects for the overall service machinery industry were positive. Opportunities for most occupations were expected to swell 10-20 percent between 1990 and 2005, according to the U.S. Bureau of Labor Statistics. Jobs for assemblers and fabricators, which account for about 25 percent of the workforce, will likely decline slightly. However, the number of labor positions should grow. Openings for some workers, including sales and marketing professionals, will likely increase by as much as 50 percent. The overall outlook for the commercial and service industry machinery manufacturing industry was for small but steady annual growth through 2012.

Further Reading

Baker, Deborah J., ed. Ward's Business Directory of US Private and Public Companies. Detroit, MI: Thomson Gale, 2003.

Hoover's Company Fact Sheet. "Ionics, Inc." 6 March 2004. Available from http://www.hoovers.com .

U.S. Census Bureau. Statistics of U.S. Businesses: 2001. 1 March 2004. Available from http://www.census.gov/epcd/susb/2001/us/US332311.htm .

U.S. Department of Commerce. Annual Survey of Manufactures. Washington: GPO, 2002.

U.S. Department of Labor, Bureau of Labor Statistics. Economic and Employment Projections. 11 February 2004. Available from http://www.bls.gov/news.release/ecopro.toc.htm .

Comment about this article, ask questions, or add new information about this topic: