SIC 3553

WOODWORKING MACHINERY

This category includes establishments primarily engaged in manufacturing machinery for sawmills, for making particleboard and similar products, and for otherwise working or producing wood products. Establishments primarily engaged in manufacturing hand tools are classified in cutlery, hand tools, and general hardware manufacturing industries, while those engaged in manufacturing portable power-driven hand tools are classified in SIC 3546: Power-Driven Hand Tools.

NAICS Code(s)

333210 (Sawmill and Woodworking Machinery Manufacturing)

According to the U.S. Census Bureau's Statistics of U.S. Businesses , 302 establishments operated in this category for some or all of 2001. Industry-wide employment totaled 8,208 workers receiving a payroll of more than $287 million.

One dilemma the industry faced in the late 1990s was a shortage of qualified and trained workers. Technical schools were not graduating students knowledgeable in woodworking, threatening the future of the industry. To correct this, the Woodworking Machinery Industry Association (WMIA) sent an interactive CD-ROM recruitment kit to high school students and guidance counselors, educating them about the benefits of working in this industry.

In the 1980s, the woodworking machinery industry was affected by a slowdown in the housing industry and a general U.S. economic recession. In the early 1990s, the industry was further affected by cutting limits imposed on the logging industry in the Pacific Northwest. However, in 1992, George Delaney, then president of the Wood Machinery Manufacturers of America (WMMA), which represented more than 100 companies in the industry, said the number one issue facing the organization's membership was product liability reform legislation. Woodworking machinery manufacturers often paid as much as 10 percent of their annual sales for liability insurance, a cost that foreign competitors did not face.

In the early 1990s, the woodworking machinery industry benefited from legislation that required woodworking companies to reduce the amount of dust in the air of their factories. Several companies in the industry increased their revenues by manufacturing dust-reduction equipment. Environmental concerns over logging also prompted production of new machinery. With stricter limits on logging, the forest products industry was buying updated equipment that reduced the amount of waste in manufacturing wood products.

The Coe Manufacturing Co., founded in 1852, was one of the first companies to manufacture computerized woodworking machinery, introducing a computer-controlled veneer lathe in 1977. Equipment made by the industry included machinery used in cutting, shaping, sanding, gluing, laminating, and finishing wood products. According to the WMIA, while the office and household furniture markets would remain slow into the mid-2000s, the market that would be a boon to the industry was cabinetry, especially kitchen cabinets, following the American trend toward remodeling and spending money on the home. Despite market uncertainty, consumer spending was back up in 2004, as was housing construction.

According to WMIA, sales were up for the industry at the close of 2003. The organization also reported a more than 8 percent hike in productivity from the second to the third quarter.

The industry was dealing with a rapidly changing global marketplace in the 2000s. China was coming into the furniture market in 2003; according to an article in Wood & Wood Products , nearly half of the furniture sold in the United States in 2002 was imported. In order to remain competitive with foreign manufacturers, the U.S. industry was focusing not only on efficiency of manufacturing, but also on specialization and individualization of products, providing what foreign competitors did not. In addition, safety was an issue for the industry at the close of 2003. The grace period for the regulations on braking devices for woodworking machine equipment was up this year. Air quality also was a concern for workers in this sector, and industry leader Delta offered a state-of-the art air purifier for the management of wood dust in 2003.

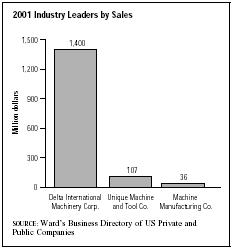

Delta International Machinery Corp. of Pittsburgh was the 2001 industry leader with sales of nearly $1.4 billion and 700 employees. In distant second place was Phoenix-based Unique Machine and Tool Co. with $107 million in sales and 100 employees. Rounding out the top three was Globe Machine Manufacturing Co. of Tacoma, with $36 million in sales and 300 employees.

Further Reading

Baker, Deborah J., ed. Ward's Business Directory of US Private and Public Companies. Detroit, MI: Thomson Gale, 2003.

Christianson, Rich. "Executive Conference Explores Industry Trends." Wood & Wood Products , July 2003.

Darnay, Arsen J., ed. Manufacturing and Distribution USA. Detroit: Thomson Gale, 2003.

"Delta Machinery Eliminates Workshop Concerns." Delta Machinery , 7 October 2003. Available from http://www.deltawoodworking.com/ .

"Industry Trends Report." Woodworking Machinery Industry Association , 2003. Available from http://www.wmia.org .

Lazich, Robert S., ed. Market Share Reporter. Detroit, MI: Thomson Gale, 2004.

"Time to Put the Brakes On." The Safety & Health Practitioner , December 2003.

U.S. Census Bureau. 1997 Economic Census—Manufacturing. 15 February 2000. Available from http://www.census.gov/prod/ec97/97m3332a.pdf .

——. Statistics of U.S. Businesses: 2001. 1 March 2004. Available from http://www.census.gov/epcd/susb/2001/us/US332311.htm .

U.S. Department of Labor, Bureau of Labor Statistics. Economic and Employment Projections. 11 February 2004. Available from http://www.bls.gov/news.release/ecopro.toc.htm .

"WMIA Update." Woodworking Machinery Industry Association , December 2003. Available from http://www.wmia.org/newsletter/1203/wooddigest.htm .

"Woodworking Machinery Industry Assn." Wood & Wood Products , December 1998.

Comment about this article, ask questions, or add new information about this topic: