SIC 1479

CHEMICAL AND FERTILIZER MINERAL MINING, NOT ELSEWHERE CLASSIFIED

This category covers establishments primarily engaged in mining, milling, or otherwise preparing chemical or fertilizer mineral raw materials, not elsewhere classified. Establishments primarily engaged in milling, grinding, or otherwise preparing barite not in conjunction with mining or quarry operations are classified in SIC 3295: Minerals and Earths, Ground or Otherwise Treated; similar establishments preparing other minerals of this industry are included here. Establishments primarily engaged in producing salt by evaporation of sea water or brine are classified in SIC 2899: Chemicals and Chemical Preparations, Not Elsewhere Classified.

NAICS Code(s)

212393 (Other Chemical and Fertilizer Mineral Mining)

Industry Snapshot

Salt represents nearly half of all industry chemical and fertilizer mineral industry shipments. Consequently, the performance of the salt industry tends to reflect over-all industry conditions. U.S. salt production between 2000 and 2003 declined from 45.6 million metric tons to 41.2 million metric tons, while consumption declined from 51.6 million metric tons to 50.1 million metric tons over the same time period. Because production was declining faster than production, the United States increased its reliance on imports to 23 percent of domestic consumption in 2003, compared to 16 percent of consumption in 2000. At the same time, exports declined from 1.12 million metric tons in 2001 to 500,000 metric tons in 2003.

Organization and Structure

The major products mined by the chemical and fertilizer minerals industry included salt, sulfur, barite, fluorspar, lithium, and strontium. Salt represents approximately 50 percent of the value of all industry shipments and is primarily produced in Louisiana, Texas, and New York. The second largest segment of the miscellaneous chemicals and fertilizer minerals mining industry is sulfur, which comprises roughly one-third of the value of all industry products. The third largest product in the miscellaneous chemical and fertilizer mineral mining industry is barite, although it represents less than 5 percent of the value of all industry shipments.

Current Conditions

Salt. The United States was the world's largest producer of salt in the early 2000s, followed by China, India, Germany, and Canada. Twenty-nine U.S. companies operated 69 salt-producing plants in 15 states in 2003, producing salt in four basic forms: salt in brine (51 percent of all salt sold or used), rock salt (30 percent), vacuum pan salt (11 percent), and solar salt (8 percent).

There were roughly 14,000 end uses for salts, with the largest being chemicals (45 percent), road de-icing/ice control salt (31 percent), salt sold to distributors (8 percent), industrial uses (8 percent), agricultural salt (6 percent), food (including table salt, 4 percent), primary water treatment applications (2 percent), and exports/other uses (less than 1 percent). Along with limestone, coal, and sulfur, salt was one of the four most important minerals used by the chemicals industry. As early as 1939, salt was being used in the production of 74 industrial chemicals in the form of sodium and chlorine, and the largest U.S. salt mining or producing firms historically were operated by chemical companies that processed the extracted salt into commercial products. Salt was used by the chemical industries as a feedstock in the manufacture of chlorine and caustic soda, which was used to make everything from soap, dyes, and dairy products to glass, pulp, and paper. Other uses included water conditioning and treatment processes, textiles and rayon manufacturing, metallurgical applications, leather treatment, agriculture, refrigeration, meat packing, and fish curing.

U.S. salt producers accounted for 19.6 percent of the world's total production in 2003, and six industry firms accounted for the majority of all salt sold overseas: Akzo Nobel Salt Inc., Cargill Salt Co. and its affiliate Leslie Salt Co., North American Salt Co., Morton Salt Co., Western Salt Co., and United Salt Co.

In 2003, 50.1 million metric tons of domestic and imported salt was used in the United States. In 1970, a total of 50 salt-producing companies had operated 95 plants in the United States. By 2003, several factors had reduced this industry segment to 29 companies and 69 plants. Among these factors were cheaper salt imports, intensified market competition, surplus production capacity, and high energy and labor costs. Among the major salt industry events of 1990s were the announcement of a joint venture between Continental Salt, Eastern Cargill Inc., and Petroquaimica de Venezuela, S.A. to produce solar salt, and the decision by Akzo Nobel Salt Inc. not to replace its collapsed and flooded rock salt mine in Retsof, New York—the largest underground room-and-pillar salt mine in the hemisphere—with a new mine. Instead Akzo decided to sell virtually all its North American and Caribbean salt operations (valued at $450 million) to agricultural giant Cargill Inc., strengthening Cargill in its struggle with Morton Salt for industry dominance. With sales of $708 million, Morton Salt was the retail salt industry leader as of 2003.

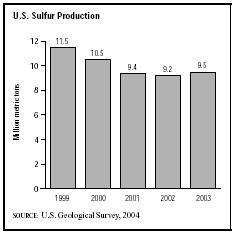

In early 2000s, the United States remained the world's largest producer and consumer of sulfur, one of the four most widely used industrial minerals in the chemical industry. Unlike most other major mineral commodities, sulfur is primarily used not as part of a finished product but as a chemical reagent, namely, sulfuric acid, the most widely produced chemical in the United States. In 2003, 90 percent of all sulfur output was consumed in the form of sulfuric acid ( SIC 2819: Industrial Inorganic Chemical Manufacturing, ) and it was used to make everything from insecticides, soaps, leather, and textiles to artificial fertilizers, paints, dyes, and paper. Roughly 70 percent of all sulfur consumed in the United States in 2003 was used in agricultural chemicals, mainly fertilizers, but also in the manufacture of a myriad of industrial products.

Sulfur. The world sulfur industry was divided into two categories: producers who extracted sulfur or pyrites as their primary mining objective, and those who extracted it solely as a byproduct of the mining of other minerals. In the early 2000s this indirect or "involuntary" production of sulfur accounted for almost three-quarters of the world's sulfur production. In 2003, 8.8 million metric tons of elemental or unrefined sulfur was produced by more than 160 operations in 32 states and U.S. territories. Three-quarters of the world's output of elemental sulfur was recovered from natural gas processing, petroleum refining, and coking plants. Thirty-nine U.S. companies in 26 states and U.S. territories produced recovered sulfur in 2002; they were led by ExxonMobil Corp., BP plc, ConocoPhillips Co., ChevronTexaco Corp., Shell Oil Co., Valery Energy Corp., and CITGO Petroleum Corp. Elemental sulfur was also produced using the Frasch hot-water method, in which native sulfur found in salt domes and sediment was melted underground and brought to the surface with compressed air. In 2000, however, Freeport-McMoRan Sulphur Inc. had shut down the last operational U.S. Frasch mine.

Barite. Barite production grew 14 percent in 2003 to 480,000 metric tons valued at $14 million, compared to 540,000 tons valued at $30 million in 1996. Barite mines operated primarily in Nevada and Georgia. Almost 95 percent of the barite sold in the United States in the early 2000s was used as a weighing agent in oil-and gas-well-drilling

fluids to maintain pressure and prevent blowouts. It was also used as a weighing additive in cement, rubber, and urethane foam and for metal protection and gloss in automobile paint primer and leaded glass, as well as a raw material in barium chemicals. It has found uses in everything from automobile brake and clutch pads, concrete vessels for holding radioactive materials, cathode-ray tube faceplates and funnelglass, as a filler in linoleum, paper, and rubber, as an ingredient in the manufacture of white pigment, inks, oil cloth, and leather, and in the production of glaze, enamels, detonators, and signal flares.

The United States increasingly relied on barium imports in the late 1990s and early 2000s. Between 1999 and 2003, barium imports grew from 66 percent of domestic consumption to 81 percent of domestic consumption. U.S. barium producers found it difficult to compete with the high-grade, low cost imports of foreign rivals. Nevertheless, U.S. production continued to grow as the onshore drill rig count climbed from 790 in July 1996 to 965 in August of 2002, fueling a need for fresh barium. However, most exploratory and development oil drilling occurred outside the United States in the early 2000s, and because it was not cost-effective to ship a low-unit-value commodity like barium overseas, the barium mining industry's future growth depended on the discovery of new gas reserves in the United States.

Other Minerals. Other minerals mined by industry firms in the 2000s included pyrites, fluorspar, lithium carbonate, strontium, wollastonite, natural wollastonite, and natural iron oxide pigments. Major end uses for fluorspar included lead, silver, copper and gold smelting, aluminum manufacturing, high-octane gasoline production, enamel manufacturing, refrigerant, plastics, and in-secticide production, the manufacture of opaque glass and colored cathedral glass, and steel production (a single ton of steel requires approximately seven pounds of fluorspar). Lithium compounds have historically been used in roughly 20 industrial applications, including the production of synthetic vitamins, the manufacture of special-purpose alloys, use in aluminum lithium composite alloys for commercial and military aircraft, and in nuclear energy applications, among other uses. Spodumene, lepidolite, and amblygonite were mined by industry firms primarily for their lithium content. Almost 70 percent of strontium consumed in the United States was used in the manufacture of X-ray-blocking faceplate glass for television picture tubes. Celestite and strontiate were strontium-based minerals also mined by this segment of the industry. Other minerals mined in comparatively small quantities by industry firms included arsenic, brimstone, alunite, guano, marcasite, mineral pigment, ocher, pyrrhotite, and umber.

Industry Leaders

The leader in the chemical and fertilizer minerals industry in the 2000s was Freeport-McMoran Inc., of Louisiana, with close to 15,000 employees and $2.2 billion in 2003 sales. In addition to producing, distributing, and selling phosphate fertilizers—in which it was the leading U.S. firm—the company also explored for, mined, developed, produced, processed, transported, and marketed sulfur and other minerals, owned and operated laboratory and pilot plant facilities for analyzing minerals, performed metallurgical work, and conducted testing and research activities. Freeport-McMoran was founded in 1981 through the merger of Freeport Minerals Co. and McMoran Oil & Gas. To strengthen its mineral assets while lessening its dependence on the fertilizer market, in the 1980s CEO James Moffet had begun diversifying and expanding, investing more than $1 billion in new sulfur reserves, adding geothermal properties and oil and gas assets, and opening phosphate mines in Florida. In 1988, however, two major mineral discoveries—a gold, silver, and copper mine in New Guinea and the world's second-largest sulfur discovery in history in the Gulf of Mexico—compelled Moffet to change course. To pay for the development of these sites, it sold its geothermal properties and part of its oil and gas, fertilizer, and gold properties, betting that the two discoveries were worth the risk in company capital. Moffet's bold move depended for its success on a resurgence in mineral prices, however, that, by 1996, had not yet arrived, and a lawsuit filed by New Guinea tribesmen claiming Freeport-McMoran had violated their land and culture put a crimp in Moffet's strategy. One investment firm had downgraded Freeport-McMoran to a "neutral" rating over the company's "high-risk" strategy, and Rene L. Latiolais had replaced Moffet as the company's CEO. In 1997 Freeport-McMoran was acquired by IMC Global Inc. at a value of $748 million. The companies had collaborated in a prior partnership (IMC-Agrico) which made phosphate fertilizers. By the late 1990s, IMC Global was the third largest world producer of salt, behind Morgan Salt and Cargill. However, IMC Global, which posted 2003 sales of $2.2 billion, agreed to merge with Cargill in early 2004.

Further Reading

"Barite." Mineral Commodity Summaries. Washington, DC: United States Geological Survey, January 2004. Available from http://minerals.er.usgs.gov/minerals .

"IMC Global, Inc." Hoover's Online, 2004. Available from http://www.hoovers.com .

Ober, Joyce A. "Sulfur." U.S. Geological Survey Minerals Yearbook. Washington, DC: U.S. Geological Survey, 2002. Available from http://minerals.er.usgs.gov/minerals .

"Salt." Mineral Commodity Summaries. Washington, DC: United States Geological Survey, January 2004. Available from http://minerals.er.usgs.gov/minerals .

"Sulfur." Mineral Commodity Summaries. Washington, DC: United States Geological Survey, January 2004. Available from http://minerals.er.usgs.gov/minerals .

Comment about this article, ask questions, or add new information about this topic: