SIC 1459

CLAY, CERAMIC, AND REFRACTORY MINERALS, NOT ELSEWHERE CLASSIFIED

This category covers establishments primarily engaged in mining, milling, or otherwise preparing clay, ceramic, or refractory (heat-resistant) minerals, not elsewhere classified. Establishments producing clay in conjunction with the manufacture of refractory or structural clay and pottery products are classified in manufacturing in the major group for stone, clay, glass, and concrete products.

NAICS Code(s)

212325 (Clay and Ceramic and Refractory Minerals Mining)

Industry Snapshot

Firms in this industry extract raw minerals used in a wide variety of industrial and consumer applications with the most common end use being refractory materials for the manufacture of glass, ceramics, and industrial uses.

Organization and Structure

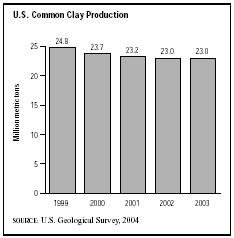

Common Clay and Shale. Industry firms produced 39.3 million metric tons of common clay and shale in 2003. In 2003, common clay and shale accounted for 58.5 percent of the total output of all clay minerals (including those produced by firms not classified in this industry) sold or used in the United States.

Common clay alone was used to manufacture bricks (56 percent of output), cement (17 percent), and in lightweight aggregate (17 percent). Other uses for common clay alone include such heavy clay products as building brick, flue linings, sewer pipe, drain tile, structural tile, terra cotta, and portland cement clinker (slag). In descending order of output, the leading producers of common clay in 2002 were North Carolina, Texas, Alabama, Georgia, Ohio, Missouri, Oklahoma, California, South Carolina, Kentucky, Arkansas, Virginia, and Pennsylvania.

Shale is one of the most common sedimentary rocks and thus usually has a lower unit price than rarer clays such as kaolin and ball clay. Shale's industrial applications include heavy ceramic ware, portland cement manufacture, and lightweight construction aggregate. The choice of shale as an ingredient in these applications is governed by such factors as its suitability compared with other industrial minerals, the presence of other useful minerals in the market for which it is to be produced (i.e., pumice, sand and gravel, slag, or crushed stone in the lightweight aggregate industry), and its economic viability with respect to other competing minerals such as clay.

Bentonite. The United States was the world leader in the production of bentonite throughout the early 2000s, and the 21 industry companies operating as of 2002 produced an estimated 3.97 million metric tons, valued at $180 million, in 12 states. In 2002, bentonite's specific end uses were as a foundry sand-bonding agent (25.4 percent), as a clumping agent in pet waste litter (22.7 percent), as a drilling mud (20.6 percent), and in iron ore pelletizing (15.1 percent). Bentonite's other uses included the manufacture of decolorizing oils; catalysts for the production of polymers, plastics, and resins in the petrochemical industry; absorbent materials for industrial plants; cattle feeds; and a thickening agent for the production of paints, hand lotions, and pencil lead.

As ingredients in the drilling mud used in the oil-well drilling industry, bentonite-based products aid in the removal of drill cuttings, thicken drilling fluids, stabilize well walls, and reduce friction. Bentonite is also used as an ingredient and preblend in the production of metal casting products for automobiles, kitchen appliances, and other products; as a binding agent in iron ore pelletizing processes in the steel industry; and as a water-absorbing sealant or liner in underground or waterproofed structures.

Fuller's Earth. The United States was the world leader in fuller's earth production throughout the 1990s and early 2000s with 16 companies producing a total of 2.73 million metric tons. Fuller's earth derived its name from the ancient practice of using earth to clean wool—a process known as "fulling." Fuller's earth became a generic name for clay-and earth-based minerals that had the property of chemically colorizing vegetable oils and minerals. The product is used to decolorize soy oils, petroleum products, tallow, and cottonseed oil, as well as in such applications as insecticide production, oil well drilling, mud, manufacture, and as a filler. Fuller's earth is also used in the manufacture of traditional or nonclumping cat litter products. In 2002, the majority of all fuller's earth mined in the United States was for use as an absorbent; a minor amount of total output served as a dispersant in insecticide.

Feldspar. Feldspar is the most common igneous rock mineral and the most plentiful mineral in the earth's crust. In the early 2000s, roughly 70 percent of all feldspar (including aplite) sold or consumed in the United States is in the glass-making industry, including the manufacture of glass fibers and glass containers in which it enhances glass's durability, hardness, and resistance to erosion. Feldspar is also commonly used as a flux in the manufacture of ceramics and its other end uses include the manufacture of pottery, plumbing fixtures, electrical porcelain, ceramic wall and floor tiles, glass, dinnerware, television picture tubes, and glass fiber insulation.

Nepheline syenite is a feldspathic mineral that provides alumina and alkali used in glass making and serves as a flux in ceramic product manufacturing to lower melting temperature. Pegmatites are the minerals from which feldspar is mined; feldspar is the most plentiful mineral present in pegmatites.

Fire Clay. In 2002, a total of seven businesses produced 446,000 metric tons of fire clay, the majority of which was used in refractory products such as calcines (metal oxides produced by roasting or calcination), firebrick, grogs (crushed material used to make refractory products, such as crucibles, to limit shrinkage), high-alumina brick, saggers (fireclay boxes for firing more delicate ceramics), refractory mortars and mixes, and ramming and gunning mixes. Other uses include lightweight aggregates, portland cement, and pottery. Roughly 12 percent of fire clay production is used as a dispersant in insecticides. In 2002, Missouri produced the most fire clay for the United States, followed by South Carolina, Ohio, and California.

Magnesite. The United States has been the world's biggest producer of metallic magnesium since World War II. Magnesium is the third most abundant element in seawater and the eighth most abundant element in the Earth's crust. Magnesium and its compounds are recovered from seawater and from mineral deposits of magnesite, dolomite, and olivine. Magnesium is employed primarily as an alloy in the aluminum used to make everything from beverage cans, aircraft, automobiles, and machinery. It has also found uses in the desulfurization of iron and steel and in the chemical, agricultural, and construction industries. In 2002, more than half of U.S. magnesium compounds were used in refractories, as for example, in the linings of iron and steel furnaces; thus, the magnesite mining segment of the industry is strongly affected by economic trends in the iron and steel industry. Magnesium compounds are also used in agricultural, chemical, environmental, and industrial capacities.

Kyanite. Kyanite and its two related minerals, andalusite and sillimanite, are used primarily in the glass-making, metallurgy, refractory, and ceramic industries. With most mines located in Georgia, Virginia, and North and South Carolina, the American kyanite mining segment is the world's second largest producer. South Africa ranks first with more than half of the world total. Andalusite is mined from deposits in California and used in the manufacture of spark plugs and other porcelain requiring high heat-resistant properties in electrical and chemical applications.

Kaolin. Kaolin is a clay mineral that is used as a pigment in the production of paint, paper, plastic, ink, polish, ceramics, cement, fiberglass, adhesives, and rubber. Kaolin is distinguished from other clay minerals like illite, montmorillonite, vermiculite, and several other groups by chemistry, particle shape and structure, and properties like conductivity and light refraction. All clays are very fine in structure, and their differences require techniques like electron microscopy or X-ray diffraction to measure. These same differences, however, greatly affect the behavior of kaolin (or any of the other clays) in product applications. Kaolin is also used as a paper coating (100,000 tons) and in refractories (210,000 tons).

In 2002, 24 firms in 10 states produced 8.01 million metric tons valued at $951 million. This was a slight decrease from the 8.11 million metric tons produced the previous year. Georgia is the leading state in kaolin production, followed by Alabama, South Carolina, and California.

Current Conditions

Common Clay and Shale. In 2002, the 162 firms in the common clay and shale segment of the industry mined these minerals for use in the manufacture of their own products, and only about 10 percent of the estimated 23 million metric tons of common clay and shale produced in 2002 was sold to other firms. A significant trend in this portion of the industry was the consolidation of industry firms in reaction to the prohibitive costs of transporting mined clay and shale. Thus, many smaller industry firms operated through local ownership companies, while larger firms contained transportation costs by owning and operating a number of strategically located pits and fabricating facilities.

In 2002, 23 million metric tons of common clay and shale was sold by the United States. More than 55 percent is used as brick, with 17 percent being used as cement, and 17 percent being used as lightweight aggregate.

Bentonite. A total of 21 companies produced bentonite in 12 states in 2002. While production of swelling bentonite increased to 3.62 million metric tons valued at $166 million, production of nonswelling bentonite decreased to 354,000 metric tons, valued at $14 million. Alabama was the leading producer of nonswelling bentonite; Wyoming led the nation in swelling bentonite production.

Fuller's Earth. Sixteen companies operating 31 quarries in 10 states produced 2.7 million metric tons of fuller's earth in 2002. World production of fuller's earth, 3.9 million tons in 2003, was led by the United States and Germany.

Feldspar. In 2003, nine U.S. firms produced an estimated 800,000 metric tons of feldspar and aplite with a value of $44 million. The three largest producers supplied nearly 70 percent of this total. In the mid-1990s industry leader Feldspar Corporation had expanded its North Carolina production capacity by 120,000 tons and opened a new mine in Georgia. In 2003, the United States only imported 9,000 metric tons for consumption, 96 percent of which was supplied by Mexico. Glass was the largest end use for feldspar in the United States as of the early 2000s; as a result, the booming U.S. housing market, which bolstered the U.S. glass market, impacted the feldspar industry favorably.

Fire Clay. In 2002, seven U.S. firms operating 44 quarries in 4 states produced 446,000 metric tons valued at $10.5 million, up from 383,000 metric tons in 2001, but considerably lower than the 583,000 metric tons produced in 1995. Most producers were refractory manufacturers that used the clay in the fabrication of firebrick and other refractory materials.

Magnesite. In 2003, two companies in Delaware and Florida extracted magnesium compounds from seawater; three companies in Michigan extracted magnesium compounds from brine wells; and two companies in Utah recovered magnesium compounds from lake brine. U.S. production of magnesium compounds fell to 285,000 metric tons in 2003, down from 395,000 metric tons in 1999. Domestic production wasn't enough to satisfy demand, as 350,000 metric tons were imported, 66 percent of which came from China. In 2003, the Ludington, Michigan-based brine producer shuttered its magnesium hydroxide plant, which resulted in the eventual shutdown of a dead-burned magnesia plant located nearby, which had relied on the Ludington plant for magnesium hydroxide. As a result, only one dead-burned magnesia producer continues to operate in the United States.

Kyanite. In the mid-1990s the kyanite industry was positively affected by new developments in the refractory market. So-called monolithic refractories, that is, refractories that are made of a single piece, found expanded uses in new high-temperature manufacturing processes being adopted in the iron and steel, cement, glass, and other refractories industries. In particular, industry firms like Kyanite Mining Corporation of Virginia, C-E Minerals of Georgia, and North American Refractories are expected to benefit from the emergence of new refractory materials that help the steel industry in its quest to produce ever purer grades of steel. In 2003, U.S. consumption of kyanite reached 102,000 metric tons. Refractories accounted for 90 percent of use. The U.S. exported 35,000 metric tons of kyanite and imported 7,000 metric tons, all from South Africa.

Industry Leaders

Leading the clay, ceramic, and refractory minerals industry in the early 2000s was Amcol International (formerly American Colloid) of Illinois, which posted sales of $364 million in 2003. Minerals accounted for more than half of total revenues for Amcol, which is the leader in the manufacture of such clay-based products as scoopable cat litter. Other top players include Oil-Dri Corp., which posted 2003 sales of $173 million, and Martin Marietta Magnesia of Michigan.

In 1999 Utah Clay Technology (UCT), a firm that makes high-quality kaolin, had leased 7,000 acres of land in southern Utah from Utah Kaolin Corporation. UCT's kaolin reserves are estimated to have increased by over 200 million tons through this mining lease. Hecla Mining Company of Coeur d'Alene, Idaho, was also a key supplier of kaolin and other clay mineral from mines in Mexico, Venezuela, and the United States as of 1999. However, in 2003, Hecla divested the last of its industrial minerals operations, effectively exiting the industry.

Further Reading

"AMCOL International Corporate Report," 18 April 2000. Available from http://www.amcol.com .

"Clays." Mineral Commodity Summaries. Washington, DC: United States Geological Survey, January 2004. Available from http://minerals.er.usgs.gov/minerals .

"Feldspar." Mineral Commodity Summaries. Washington, DC: United States Geological Survey, January 2004. Available from http://minerals.er.usgs.gov/minerals .

Hoover's Online Company Profiles. "AMCOL International Corporation," 18 April 2000. Available from http://www.hoovers.com .

"Kyanite and Related Materials." Mineral Commodity Summaries. Washington, DC: United States Geological Survey, January 2004. Available from http://minerals.er.usgs.gov/minerals .

"Magnesium Compounds." Mineral Commodity Summaries. Washington, DC: United States Geological Survey, January 2004. Available from http://minerals.er.usgs.gov/minerals .

Virta, Robert L. "Clay and Shale." U.S. Geological Survey Minerals Yearbook. Washington, DC: U.S. Geological Survey, 2002. Available from http://minerals.er.usgs.gov/minerals .

Comment about this article, ask questions, or add new information about this topic: