SIC 1061

FERROALLOY ORES, EXCEPT VANADIUM

This category covers establishments primarily engaged in mining, milling, or otherwise preparing ferroalloy ores, except vanadium. The mining of manganiferous ores valued chiefly for their iron content is classified in SIC 1011: Iron Ores. Establishments primarily engaged in mining vanadium ore are classified in SIC 1094: Uranium-Radium-Vanadium Ores, and those mining titanium ore are classified in SIC 1099: Miscellaneous Metal Ores, Not Elsewhere Classified. The ferroalloy classification includes the following ores: chromite, chromium, cobalt, columbite, ferberite, huebnerite, manganese, manganite, molybdenite, molybdenum, molybdite, nickel, psilomelane, pyrolusite, rhodochrosite, scheelite, tantalite, tantalum, tungsten, wolframite, and wulfenite. While production and consumption of particular ores can vary as much as their names, industry-wide trends tend to influence ferroalloys as an overall group of ores serving related applications responding to similar market forces.

NAICS Code(s)

212234 (Copper Ore and Nickel Ore Mining)

212299 (Other Metal Ore Mining)

Industry Snapshot

The ferroalloy industry is serviced by dozens of international mining companies, often with special subsidiaries responsible for specific alloys. As ferroalloys are primarily used in the production of steel, the state of worldwide steel production impacts that of the ferroalloy industry. Ferroalloys serve three main functions in steel: they help eliminate undesired elements such as oxygen and sulfur; they impart special characteristics, such as heat- and corrosion-resistance and strength; and they neutralize undesirable elements in the steel. The leading ferroalloy producers are China, South Africa, Ukraine, Kazakhstan, Russia, and Norway.

Starting in 1995, steel production began a decline that has affected prices and demand for many ferroalloys. By 1997 the steel market appeared to have settled down and prices were on the verge of rising, which in turn could have had a domino effect on the ferroalloys industries. However, the U.S. economic recession of the early 2000s pushed both specialty steel and stainless steel consumption down 17 percent in 2001, according to the Specialty Steel Industry of North America. U.S. ferroalloy production declined 10 percent in 2002. Exports declined 18 percent and imports increased 11 percent, according to the U.S. Geological Survey.

From 1989 onward, ferroalloys underwent substantial market decline, largely spurred by a decline in steel production in the United States and other Western nations. Several economic factors placed continued strain on steel—repercussions from the oversupply and price boom of the late 1980s, a flood of exports from Commonwealth of Independent States (CIS) and China, and the lingering effects of worldwide economic recession in the early 1990s. A glut of low-priced imports forced many ferroalloy companies, including world giants, to drastically reduce production and contend with losses and severely reduced profits. Moving into 1993, established market economy countries (EMEC) did not compensate for these factors with sufficient reduction of output, resulting in growing inventories and uncomfortably low commodity prices. From 1993 onward, stainless steel producers in the Western World experienced an annual growth of about 10 percent per year, forcing many to operate at full capacity. However, ferroalloy production forged ahead in anticipation of future demand a little too soon, causing a market flooded by ferroalloys.

By the mid-1990s, industry analysts anticipated a turnaround in the nonfuels minerals industry, particularly in metals. With modernized plants, lower operating costs, and more efficient workforces, producers were poised to capitalize on moderate economic expansion. Although forecasts for the late 1990s indicated increases in commercial building construction, infrastructure projects, and the motor vehicle industry, demand for many types of steel and, consequently, for ferroalloys remained low due to an unanticipated economic recession in the United States, which was worsened by the terrorist attacks of September 11, 2001.

Organization and Structure

The Market. Like mining in general, the ferroalloy industry is organized along the complex lines of worldwide consumption and supply, with different countries consuming different metals—in varying quantities—according to the demands of their industrial bases and capital goods markets. The London Metal Exchange (LME) served as the general barometer of price fluctuation in metals trading, reflecting the ever-shifting balance between world demand and supply of those commodities.

Ferroalloys and the Former Soviet Union. Due to the complexity of international forces governing consumption and supply, however, the industry's organization seemed anything but organized, as evidenced by the turmoil following the collapse of the Soviet Union in the early 1990s. Before that event, the metal mining industry was still coping with the adverse effects of a recession taxing the Anglo-Saxon economies and eventually Japan and Germany as well. For the most part, metal mining companies weathered the storm by repairing their balance sheets with high metals prices in the late 1980s. Industry stocks were cautiously maintained at low levels, while the rapid growth of newly-developing countries translated into new demand for most metals minerals and ferroalloys.

The collapse of the Soviet Union, however, placed tremendous strain on the supply side of the metals industry with no apparent let-up in sight. Seeking hard currency to prop up its staggering economy, the Commonwealth of Independent States (CIS) began aggressively exporting any commodities of immediate value, with LME-traded metals and precious metals at the top of the list. The former Soviet Union had been a leading customer for ores as well as the world's leading producer of iron ore, lead, manganese, nickel, and potash. The crisis prompted convulsions in the economies of Russia and other republics and caused severe industrial production problems, effecting a virtual halt to imports of minerals and metals. Consequently, Western stocks soared and prices plummeted, forcing Western mining companies to slash capital spending and exploration expenditure to a minimum and absorb serious short-term losses.

While the CIS may lessen supply of metals exports, Chinese producers fill in the holes, resulting in an abundance of metal on the market. Many analysts predicted that the CIS would not only develop substantial new markets for metals, but that it would become net importers as well. China's ore grades are lower than in Western countries, and mine output is falling, while production costs rise. For example, the worldwide market continues to rely on China and the CIS for most of its tungsten. Still, unknown stockpile levels have left questions in the minds of analysts as to how much and how long an oversupply situation will last for ferroalloys. In mid-1996, it became apparent that production of at least tungsten, and quite possibly other metals, in the CIS, which had declined between 1990 and 1994, was experiencing an increase in global demand. That higher demand is expected to spur additional production. Tungsten production in the CIS totaled 9,500 metric tons in 1995, a 9 percent increase from the 8,800 metric tons of 1994. Any shortfall in Chinese production was expected to be taken care of by CIS producers.

Background and Development

The mid-nineteenth century saw an explosion in U.S. mining, with the discovery of great mineral deposits, the development of transcontinental railroads, and a rapidly growing population. Responding to such growth, the American Institute of Mining and Metallurgical Engineers (AIME) was founded in 1871 (it was eventually renamed the American Institute of Mining, Metallurgical and Petroleum Engineers in 1956). Since that time, the ferroalloy industry became fundamentally international in scope, depending on worldwide producers to stabilize the delicate balance between consumption and supply and thereby stabilize prices.

From the mid-1980s onward, several new factors further influenced the industry. Roughly 100 years after the beginning of the industrial revolution that proved so bountiful for ferroalloys, many western countries, particularly the United States, began a trend of deindustrialization, with employment in industrial areas shifting toward service-oriented sectors. In 1986, the U.S. Department of Labor included ferroalloy ores mining on a list of industries that were expected to experience more than a 20 percent decline in output over a 15-year period.

With diminished threat of war with the former Soviet Union, attention shifted to management of the so-called "peace dividend," which included some funds that would have been formerly allotted to ferroalloys in the defense industry. In 1992, the U.S. Department of Defense announced an ambitious plan to sell many of its stockpiles of ferroalloys, including cobalt, nickel, manganese metal and ore, ferromanganese, derrochrome, chrome ore, and silicon carbide. Debate continued over the wisdom of the sales, however, spurring mixed reactions from legislators and ferroalloy industry groups. The government stockpiles have been severely depleted since that 1992 decision, and sales now have little effect on the market.

Environmental Issues. As world attention shifted increasingly toward environmental issues, the ferroalloy industry responded on numerous fronts. Issues such as waste water, waste disposal, and land reclamation placed additional planning and economic pressures on mining companies, prompting many to seek development in other countries with less stringent regulations. The minerals industry was primarily controlled by three environmental acts: The Resource Conservation and Recovery Act of 1976 (RCRA), regulating both hazardous and non-hazardous solid waste; The Clean Water Act (CWA), regulating surface water discharges; and The Clean Air Act (CAA), regulating air emissions. Many clauses included in these and other environmental acts met with industry resistance due to increased costs of doing business or even prohibition of some practices deemed standard in the past. In 1990, for example, the EPA required mine owners to comply with terms of the National Pollutant Discharge Elimination System, which called for the monitoring and testing of storm water runoff. The American Mining Congress challenged the rule but was overridden in a 1992 court decision. The result of such proposed legislation has been to force companies to take extra environmental precautions, incurring an added expense over the cost of producing the same metals in other countries. The effect has been to put American companies at a slight disadvantage, at least.

Federal Lands. Another factor affecting the development of the ferroalloy mining industry—and, indeed, mining in general—was the availability of federal lands, which traditionally accounted for about 75 percent of U.S. metals mining. As minerals exploration and mining were dependent on access to these lands, growing efforts to limit or restrict access to federal lands for mining have understandably captured the industry's attention. Natural resource development prescriptions stipulated by the U.S. Forest Service and the Bureau of Land Management grew in scope. From the mid-1960s to mid-1990s, more than 96 million acres of federal lands were withdrawn from mineral entry and placed in the National Wilderness Preservation System. Compounding these debates about mining on federal land were ongoing reinterpretations of key elements in the 1872 Mining Law that determined issues of self-initiation, free access, and security of tenure for mining operations on federal lands.

Current Conditions

The early 2000s saw a deterioration of the domestic ferroalloy industry performance, reflecting a fall in Western world steel production, a sustained flood of exports from the CIS and China, and a backlash from oversupply dating back to the late 1980s. A total of 33 U.S. steel companies declared bankruptcy between 1998 and 2002. Stainless steel production in 2002 declined 18 percent to 1.01 million metric tons. Surveying the specific performances of key metals—nickel, chromium, molybdenum, cobalt, manganese, niobium, and tungsten—yields a clearer picture of the ferroalloy industry in general.

Nickel. A highly ductile and heat- and corrosion-resistant metal, nickel is used primarily in stainless and specialty steel production, plating, and high-temperature superalloys. Global production in the early 1990s was headed by Russia and Canada, followed by Australia, New Caledonia, and Indonesia. When the only U.S. producer, Cominco Resources International Ltd.'s Glen-brook Nickel in Riddle, Oregon, was forced to curtail operations to cope with low metal prices in the late 1990s, the U.S. effectively exited the nickel mining industry. As of 2003, no active nickel mines existed in the United States. U.S. nickel consumption declined from 231,000 tons in 2000 to 218,000 tons in 2003.

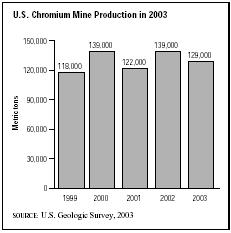

Chromium. Resistant to tarnish and corrosion, Chromium—which derives its name from chrome, the

Greek word for color, due to the lustrous nature of its compounds—is primarily used to produce stainless steel and to harden steel alloys. It is also used as corrosion-resistant decorative plating and as a pigment in glass. It is found primarily in chromite, a combination of iron, chromium, and oxygen. Increased demand for chromium in China pushed prices to historic highs in the early 2000s. As a result, both China and India began to export ferrochromium. Domestically, production of chromium declined from 139,000 metric tons to 129,000 metric tons between 2002 and 2003 as imports increased from 263,000 metric tons to 344,000 metric tons.

Molybdenum. First used widely in World War I to toughen armor plating, molybdenum is commonly used as an alloy to strengthen steel and inhibit rust and corrosion. Accounting for approximately 90 percent of world output, the United States, Chile, and Canada were the world's leading producers in the 1990s. The three major molybdenum mines in the United States were the Henderson Mine located in Colorado, the Thompson Creek Mine located in Idaho, and the Questa Mine located in New Mexico. Between 2002 and 2003, molybdenum production in the United States rose from 32,600 metric tons to 34,100 metric tons; however, production remained well below the 1999 total of 42,400 metric tons. The United States exported 32,300 metric tons of Molybdenum in 2003, up from 23,600 metric tons in 2002. Imports over this time period increased from 11,500 metric tons to 11,800 metric tons.

Cobalt. In use since at least 2250 B.C. as a colorant in Persian glass, cobalt is mainly used in high-temperature alloys, magnetic alloys, and hard-facing alloys resistant to abrasion. The largest producers of cobalt are Zaire, Zambia, and Canada, which sold primarily to the United States because of economic shipping arrangements. Cuba is also a large cobalt producer—one market research firm estimates its holdings at 29 percent of world reserves—but remained unable to sell its materials in the United States. Although a major consumer of cobalt, the United States stopped producing the metal in 1971.

Manganese. In addition to its critical role in steel production, manganese is used in dry-cell batteries, pig iron, animal feed, fertilizers, and other chemicals. South Africa and Russia held more than 80 percent of world resources in the early 1990s. In the early 2000s, the United States, which had no significant manganese mine production of its own, imported supplies primarily from Gabon, Brazil, Australia, and Mexico. Prices for manganese rose in 2003 after France-based Erament SA announced plants to close down its ferromanganese plant in Boulogne.

Niobium. Commonly known as columbium, niobium is one of the refractory metals primarily used as a microalloying element in high-strength and stainless steels. It is also a common ingredient in superalloys, popular in the aerospace industry, and carbide cutting tools. Three mines are almost exclusively responsible for world niobium production: the Araxa mine and smelter of Companhia Brasileira de Metalurgia e Mineralcao (CBMM) and the Catalao mine operated by a subsidiary of the Anglo American Group, both in Brazil, and the Niobec, Quebec, mine in Quebec, Canada.

Tungsten. Also called wolfram, tungsten is found in wolframite and scheelite ores and is primarily used as a carbide to harden metal-cutting tools and as a alloying agent in steel making. Its good thermal and electric conductivity also make it very suitable for electric contact points and lamp filaments. In the 1990s, China led in world tungsten production, followed by Australia, Austria, Bolivia, Brazil, Burma, Canada, North and South Korea, Peru, Portugal, Spain, and Thailand. The United States played a relatively small role in the tungsten industry, with two plants for the production of tungsten concentrated in California and a handful of processors elsewhere. China is the world's largest tungsten exporting country, with a current mine output at almost 80 percent of the world's supply.

Research and Technology

Many employment opportunities in the ferroalloy industry involve implementation or operation of new tools and technologies designed for greater efficiency, safety, and environmental benefit. In addition to innovative mine environments to maximize safety, transportation, communication, and yield of large mine operations, companies and specialty metal mining services drew on new computer technology to assist in all phases of industry activity. In the 1990s, for example, Australia's Mount Isa mine used an Integrated Mine Planning system (IMPS)—a computer-aided drafting (CAD) system for geological interpretation and modeling. The system enabled engineers to integrate information from various departments (geology, mine design, and survey) and evaluate complex criteria—such as test clearances, drivers' lines of sight, and mobile equipment specs and compatibility all at once. Other mining companies began using a new system designed to rapidly determine ore contacts and grades in underground metal mining. By measuring differences in the physical characteristics of relatively small mineral samples culled from drill holes, the system vastly reduced the amount of expensive core drilling sampling and assaying required for mine planning. Sandvik Rock Tools made further developments in drilling systems, developing a computer program to simulate drilling conditions through all types of percussive drilling conditions. Graphically displayed results and data are then used to develop optimum rock drilling tools and to maximize drilling energy efficiency in a wide range of tools.

Further Reading

Fenton, Michael D. Ferroalloys. Washington, DC: U.S. Geological Survey, 2002. Available from http://www.usgs.gov .

Guerriere, Alison. "Tight Supplies Boost Ferromanganese Prices." American Metal Market, 3 December 2003.

Kuck, Peter H. Nickel. Washington, DC: U.S. Geological Survey, 2002. Available from http://www.usgs.gov .

Magyar, Michael J. Molybdenum. Washington, DC: U.S. Geological Survey, 2002. Available from http://www.usgs.gov .

Papp, John F. Chromium. Washington, DC: U.S. Geological Survey, 2002. Available from http://www.usgs.gov .

Robertson, Scott. "Imports Decline But Still Capturing Big Share of US Market." American Metal Market, 8 April 2002.

Comment about this article, ask questions, or add new information about this topic: