SIC 1446

INDUSTRIAL SAND

This category covers establishments primarily engaged in operating sand pits and dredges, and in washing, screening, and otherwise preparing sand for uses other than construction, such as glass making, molding, and abrasives.

NAICS Code(s)

212322 (Industrial Sand Mining)

Industry Snapshot

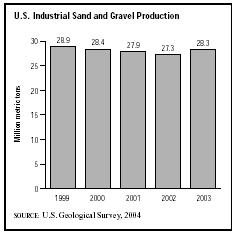

In 2003, 67 U.S. companies in 34 states produced an estimated 28.3 million metric tons of industrial sand and gravel with a total value of $566 million. Illinois, Michigan, California, North Carolina, Texas, Wisconsin, New Jersey, and Oklahoma accounted for 59 percent of the national industrial sand and gravel total that year. U.S. consumption of industrial sand and gravel grew from 26.1 million metric tons in 2002 to 27.2 million metric tons in 2003.

Organization and Structure

Glass Sand. The single most common use of industrial sand (38 percent of total tonnage in 2003) is in glass making, where glass or quartz sand constitutes 52 to 65 percent of the weight of finished glass. Glass sand requires a high percentage of silica—the principal ingredient of sand—because the presence of other elements such as iron oxide and clay introduces visible impurities that mar the glass's transparency. Few sandstones or natural sands (such as beach or dune sand) are pure enough to yield glass without "beneficiation," or the removal of impurities through processing. Glass sands are graded according to average grain size, which can be determined by passing them through sieves of varying calibers.

The container glass industry was one of the largest consumers of silica-based glass sand in the United States in the late 1990s, but the trend toward glass recycling, as well as increased plastic bottle and aluminum can packaging, weakened demand for silica sand. Some states require that 35 percent of container glass be comprised of recycled glass, with the potential for increases of as high as 65 percent recycled glass content by 2005. This trend was partly offset in the late 1990s, however, by heightened demand for flat glass, special-purpose glass, glass microwave packages, and glass containers for sparkling and flavored waters.

Molding Sand. Molding or foundry sand is traditionally the second most common use (20 percent in 2003) of industrial sand. Sand is used in these applications to make molds into which molten metal is poured in metal casting and as the "core" sand used in such molds to produce hollow areas in the final casted product. Sand needs to contain several properties to be used in foundry or molding applications. Internal cohesiveness and heat resistance—or refractoriness—enable the mold to withstand the high temperatures of the metal casting process (in steel applications, temperatures of 1340 to 1500 degrees Fahrenheit). Second, the sand's moisture content, and the type and amount of bonding agent (such as clay) within it, govern its ability to withstand the pressure exerted by the cast metal during heating. A third requirement is the sand's permeability, or its ability to allow water vapor and gases from the molten metal to escape during the casting process for cooling. Finally, the sand's composition and texture determine whether it will react chemically with the casted metal and whether it will create a smooth surface on the metal when it cooled.

While so-called naturally bonded molding sand contains enough clay and other bonding material to be used in metal casting without the addition of other bonding ingredients, synthetic molding sand consists of silica sand to which a specific amount (about 5 to 10 percent) of fire clay, bentonite, or other bonding material is added artificially. The trend toward greater use of these synthetic molding sands continues. Spurred by government regulations governing the disposal of used industrial sand, the use of recycled or reclaimed foundry sand is also increasing.

Fracturing Sand. Fracturing or hydraulic "frac" sand, also known as "proppant" sand, accounted for 5 percent of U.S. industrial sand production in 2003. It is comprised of washed and graded high silica-content quartz sand with a grain size of between 0.84 and 0.42 millimeters and is used in high-pressure fluids pumped into oil and gas wells to enlarge or scour out openings in oil-or gas-bearing rock or to create new fractures from which oil or gas can be recovered. Traditionally, the "fracture treatment" at an average well uses 26,000 pounds of fracture sand, and annual demand for fracture sand increases or decreases with the level of activity in the oil and gas industry.

Abrasive Sand. Abrasive sand and blast sand, which accounted for 5 percent of total industrial sand tonnage in 2003, include quartz-based silica sand used in sandpaper, glass grinding, stone sawing (as in dimension stone manufacturing), metal polishing and metal casting cleaning, and in sandblasting to remove paint, stain, and rust. While sands with angular-shaped grains are often used because they cut faster, sands with rounded grains last longer and yield a smoother finish.

Other Uses. Other traditional applications of industrial sand include engine sand, fire or furnace sand, and filtration sand, which together comprised 32 percent of the industry's total tonnage in 2003. Engine sand is laid on railroad tracks to provide traction for train engines in wet or slippery conditions. Fire or furnace sand is generally coarser than the sand used in metal molding. It is used in building floors for acid open-hearth furnaces and in lining the cupolas and ladles that contain molten metal in the foundry industries.

Filtration sand is used by municipal water departments to remove bacteria and sediment from water supplies. Although filtration sand is generally mined from the same quarries as molding and glass sands, it has to be free of clay, lime, and organic matter as well as insoluble in hydrochloric acid. Other industrial uses include enamel manufacture, various metallurgical applications, and the production of phosphoric acid for the fertilizer industry.

Producing Regions. The sand used in industrial applications is mined from silica sand and sandstone deposits in 35 states. Approximately 75 percent of the sand derived from dunes and glacial lake beds is sandstone. Silica sand is composed almost exclusively of grains of quartz and includes between 95 and 99 percent (or more) silicate.

Industry firms in New Jersey traditionally supply special-purpose industrial sand (abrasives, fire sand, etc.), while silica miners in Pennsylvania provide sand for refractory bricks. Deposits in eastern Ohio are a source of sandstone sand that, when finished and sized, is used for clay-free molding sand and high-purity glass sand. Sandstone pebbles from the same region are often crushed and used in the production of ferrosilicon and silica brick. Industry mines in northwestern Ohio and southeastern Michigan historically produce very pure quartz sandstone for high-quality glass sand, and industrial sand mines in California have provided materials for superduty silica brick and glass-making applications since the mid-1950s.

Background and Development

Mining Methods. The method by which industrial sand deposits are mined depends on the solidity or degree of "cementation" of the mineral. Natural sand deposits such as dunes and coastal beaches can be worked simply by using loading and hauling equipment. However, in deposits where the "overburden" or covering deposits are unusually deep—as in some locations in Missouri—underground mining uses the traditional "room-and-pillar" method, in which sections of the deposit are mined around supporting "pillars" of the mineral.

By far the most common means of extraction, however, is the mining of open pits or quarries. The term quarry is traditionally assigned to hard mineral deposits—such as the harder varieties of sandstone—requiring blasting or crushing, while pit technically refers to softer mineral deposits that can be mined using digging techniques.

Firms involved in quarrying operations use drills to make "shotholes" spaced at calculated intervals parallel to the rock face and with a diameter, depth, and angle sufficient to dislodge a specific volume of rock when explosive charges are detonated in them. The explosives are of a quantity and type needed to shatter the rock face and break the sand deposit into sizes convenient for loading.

Firms mine deep sand deposits in dry pits in progressive steps or terraces connected by ramps. They use light blasting, mechanical excavators, or high-pressure jets of water to dislodge the lighter earthy material and expose the heavy sand rock for mining. In some low-lying sand deposits, water naturally seeps into the pit as material is removed, so sand can be extracted as in riverbeds using "drag lines," chain buckets, "grab dredgers," or suction pumps. In pits with sufficiently deep water levels, floating grab dredgers and drag lines can be used to haul the sand to the surface.

Processing. While molding or foundry sand may be marketed without preparation other than crushing, glass sand is washed, dried, and screened, and may also be treated by electromagnetic, electrostatic, flotation, or other techniques to remove heavy mineral impurities like clay. Blast sand may be processed by breaking large sand grains into marketable grades using a high-speed rotary impact mill. Quartzite sandstone used to make silica bricks is crushed and screened into particle sizes of about 0.132 inches.

Developments in the late 1990s. In 1995 the U.S. industrial sand industry experienced several facility closures as well as a few major mergers and acquisitions, including Fairmount Minerals' purchase of two Ohio companies to fortify its third-place position in the industry. The biggest corporate news, however, was the announcement by U.S. Borax, the parent company of the industry's largest producer, U.S. Silica, that it planned to divest its subsidiary from its corporate stable.

Major changes in the end uses for industrial sand continued to affect the demand for the industrial sand mining industry's products. The greatest new product advances in 1995 occurred in the silica chemicals and glass and advanced materials industries. Rhône-Poulenc Basic Chemicals and PPG Industries announced new precipitated silica plants in Illinois and Louisiana, respectively; Dow Corning launched a new line of "resin modifiers" based on silicone powder for use in flame-retardant thermoplastics; and Ford Motor Company announced the development of an all-fiber, glass-reinforced composite car body design that if adopted by the auto industry would increase the demand for the industrial sand industry's glass sand products. By using silica as an ingredient in the ceramic portion of such aluminum-and-ceramic composites, manufacturers could produce industrial materials with the strength of steel but with a fraction of its weight and cost. The growing importance of the semiconductor industry also promised to expand the silica sand industry's sales, and Samsung Electronics and Intel Corporation announced major new plants in Texas and Arizona, respectively.

Current Conditions

In 2004 the United States remained the world's largest producer and consumer of industrial sand and gravel due to the wide range and high quality of its deposits and the advanced processing techniques used to mine them. After the United States, which accounted for 28.3 million metric tons of the 94 million metric tons of industrial sand and gravel produced worldwide, the leading producers in 2003 were Germany, Austria, France, and Spain.

After increasing for several consecutive years to meet growing demand, production of industrial sand declined 3.7 percent between 2001 and 2002. Analysts pointed to recessionary economic conditions in the United States as the reason behind slowing demand. Production of industrial sand and gravel combined grew from 27.3 million metric tons in 2002 to 28.3 million metric tons in 2003; however, production levels remained below those of the late 1990s.

The United States exported 1.4 million metric tons of industrial sand and gravel in 2003, primarily to Canada and Mexico. Exports had declined steadily since their 1999 total of 1.4 million metric tons, despite increased demand from Mexico. U.S. industrial sand imports were much smaller than exports, totaling 250,000 metric tons in 2003, with Canada accounting for 48 percent of this total and Mexico accounting for 47 percent.

Health and environmental issues continued to have a major impact on the industrial sand mining industry in 2004. In 1992 the International Agency for Research on Cancer had identified crystalline silica as a probable human carcinogen, and the U.S. Occupational Safety and Health Administration (OSHA) therefore required that industrial sites using or receiving more than 0.1 percent of crystalline silica notify workers of its potential health dangers. Industry firms began labeling bags and filing Material Safety Data Sheets to comply with federal, state, and local regulations regarding crystalline silica content, and garnet and granular slag were investigated as alternative sources of blasting and filtration sand. Establishments were expected to continue moving into lower-population zones in the early 2000s.

Industry Leaders

The largest producer of industrial sand in the United States in the early 2000s was J.M. Huber Corporation of Edison, New Jersey, which posted 2002 sales of $1.23 billion and 3,278 employees. Second was Unimin Corporation of Connecticut, which produced the broadest range of ceramic grade silica, nepheline syenite (SIC 1459: Clay, Ceramic, and Refractory Minerals, Not Elsewhere Classified) , feldspar (SIC 1459: Clay, Ceramic, and Refractory Minerals, Not Elsewhere Classified) , and micron-sized silica. Its trademarked "QIP" quality assurance program enabled it to offer minerals of the highest grades of chemical purity and uniformity. In 2002, Unimin garnered sales of $550 million. Other leaders included U.S. Silica of West Virginia, which was sold by its corporate parent U.S. Borax and Chemical Corporation of California to D. George Harris and Associates, a New York industrial management and advisory firm, in late 1995. By 2003, U.S. Silica operated processing plants in 14 states.

Further Reading

Dolley, Thomas P. "Silica." U.S. Geological Survey Minerals Yearbook. Washington, DC: U.S. Geological Survey, 2002. Available from http://minerals.er.usgs.gov/minerals .

Economic Census, 1997. Bureau of the Census, 2000. Available from http://www.census.gov .

"Sand and Gravel (Industrial)." Mineral Commodity Summaries. Washington, DC: United States Geological Survey, January 2004. Available from http://minerals.er.usgs.gov/minerals .

Comment about this article, ask questions, or add new information about this topic: