SIC 5599

AUTOMOTIVE DEALERS, NOT ELSEWHERE CLASSIFIED

Establishments in this industry are primarily engaged in the retail sale of new and used automotive vehicles, equipment, and supplies, not elsewhere classified, such as snowmobiles, go-karts, dune buggies, utility trailers, and golf carts. Also included in this industry are establishments primarily engaged in the retail sale of aircraft. Not included in this classification are automobiles, light trucks, recreational vehicles, motorcycles, boats, motor scooters, all-terrain vehicles, and personal watercraft.

NAICS Code(s)

441229 (All Other Motor Vehicle Dealers)

In 2001, the U.S. Census Bureau reported 2,216 establishments engaged in the retail sale of new and used automotive vehicles, equipment, and supplies, not elsewhere classified. The total number of retailers climbed to 5,683 in 2003, with annual sales of approximately $4.8 billion, and there were 24,785 employees. The average establishment had sales of about $900,000. States with the highest number of stores within this industry were Texas with 536, California with 530, Florida with 499, New York with 258, and Michigan with 203. Together, they enjoyed more than 35 percent of the U.S. market.

Businesses within this industry sell a wide range of products at the retail level. Products as different as snowmobile helmets and single-piston aircraft are sold by retail establishments that vary greatly in size and scope of business.

Automotive dealers, (not elsewhere classified) represented 1,271 establishments, or 22 percent of the market. Dealers of utility trailers numbered 1,176 and 20 percent of the market. Snowmobile dealers numbered 776, and powered golf cart dealers numbered 726. Aircraft dealers had 611, and self—propelled aircraft numbered 444.

An estimated 1,678 establishments in the automotive dealers, not elsewhere classified, industry employing approximately 9,100 workers were in operation in 1997. These establishments brought in sales of an estimated $2.5 billion in 1997.

Snowmobile retailers sell new and used snowmobiles, parts, and equipment and are involved in the servicing of the vehicles. Dealers contract to carry the product lines supplied by the four snowmobile manufacturers worldwide. Because business depends on snow, retailers are located in the states in which winters are marked by snow accumulation that stays on the ground long enough for a respectable snowmobiling season. Dealers also often carry other types of recreational vehicles, such as all-terrain vehicles and personal watercraft, to balance out the seasonal swings in business.

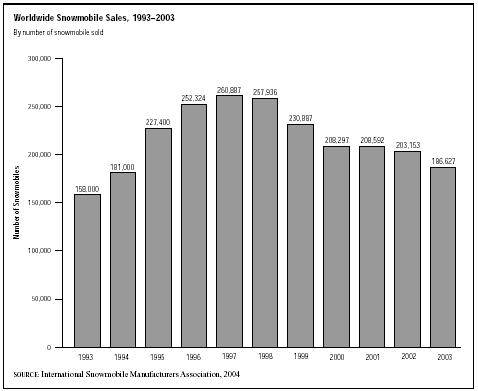

The sport of snowmobiling is relatively new; the first snowmobile was mass produced about 50 years ago by Bombardier, Inc., a Canadian company. Forbes estimated that the market peaked in 1971 when dealers sold approximately 500,000 units. The International Snowmobile Manufacturers Association (ISMA) estimated that in the late 1990s, dealers were selling more than 147,000 units a year in the United States at an average unit price of $5,780. The Statistical Abstract of the United States estimated that, by the late 1990s, the United States purchased approximately $930 million worth of snowmobiles and related equipment.

ISMA reported 114,927 snowmobiles purchased in the United States in 2003, with an additional 50,209 sold in Canada. The average retail price was about $6,380. In all, there were 2.7 million registered snowmobiles, 1.6 million in the U.S. alone. The total number of licensed snowmobile dealers were 1,560 in the United States, 1,060 in Canada, and 403 in Scandinavia. The leading manufacturers are Artic Cat, Bombardier Inc., Polaris Industries, and Yamaha Motor Corporation.

Most of the business in the aircraft sector of this category is done in the buying and selling of used aircraft and parts. An article in Business and Commercial Aircraft magazine suggested that used aircraft has historically outsold new aircraft at a margin of three to one. The

same article maintains that 95 percent of turbine equipment is sold to existing users of business aircraft. The National Aircraft Resale Association reported that 1,525 used jet and 1,312 turboprop sales transactions were completed in 1997. For 2000, the figures changed to 1,567 used jet and 1,358 turboprop sales, respectively. The figures were compiled by NARA's associate member, AMSTAT Corporation, a research organization that compiles statistics for the aviation business industry.

According to the Kart Marketing Group, Inc., publisher of Kart Marketing International magazine, gokarts generated approximately $500 million in business per year in North America in the late 1990s. There are two different types of go-karts and two types of retailers to sell them. "Fun" karts built for general usage and priced between $700 and $900 are sold through lawn and garden stores and hardware stores. "Racing" karts built especially for high-speed track usage and priced from $3,000 to $5,000 are sold through outlets dedicated to kart sales. Approximately 200,000 fun karts were sold at the retail level in the late 1990s, compared to sales of

Further Reading

D&B Sales & Marketing Solutions, May 2004. Available from http://www.zapdata.com

International Snowmobile Manufacturers Association (ISMA). Snowmobiling Fact Book, 2000. Available from http//www.snowmobile.org .

——. "Facts and Statistics about Snowmobiling." May 2004. Available from http//www.snowmobile.org .

National Aircraft Resale Association (NARA), May 2004. Available from http//www.nara—dealers.com.org .

U.S. Census Bureau. Statistics of U.S. Businesses 2001. Available from http://www.census.gov/epcd/susb/2001/us/US421420.HTM

U.S. Department of Commerce. 1997 Census of Service Industries & Geographic Area Series. Washington, D.C.: Bureau of the Census, 2000. Available from http://www.census.gov .

Comment about this article, ask questions, or add new information about this topic: