SIC 5421

MEAT AND FISH (SEAFOOD) MARKETS, INCLUDING FREEZER PROVISIONERS

This category includes establishments primarily engaged in the retail sale of fresh, frozen, or cured meats, fish, shellfish, and other seafood. Also included are establishments primarily engaged in the retail sale, on a bulk basis, of meat for freezer storage and in providing home freezer plans. Meat markets may butcher animals on their own account, or they may buy from others. Food locker plants primarily engaged in renting locker space for the storage of food products for individual households are classified in SIC 4222: Refrigerated Warehouse and Storage. Establishments primarily engaged in the retail sale of poultry are classified in SIC 5499: Miscellaneous Food Stores.

NAICS Code(s)

454390 (Other Direct Selling Establishments)

445210 (Meat Markets)

445220 (Fish and Seafood Markets)

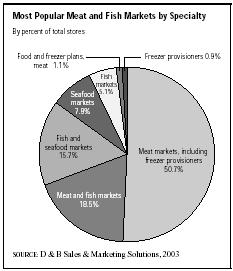

Meat markets, including freezer provisioners, are the dominant types of retail establishments found in this classification, with 5,665 retail outlets. Meat and fish markets consisted of 2,070 establishments, followed by fish and seafood with 1,752 establishments. Combined, they generated approximately $3.8 billion in sales, and controlled about 85 percent of the overall market. States with the highest number of establishments were New York with 1,564, California with 1,305, and Texas with 759.

According to the U.S. Census Bureau, the majority of these establishments were small—employing fewer than five people. In 2001, 1,940 markets had fewer than five employees; 350 had between five and nine; 142 had

between 10 and 19; 86 had between 20 and 99; 2 had between 100 and 499; and 2 markets had more than 500. There were 8,990 employees. The total number of employees climbed to 56,827 in 2003. Total sales for the industry totaled approximately $4.77 billion in 2003. The average sales of individual markets were about $500,000.

While most industry leaders post sales in the billions, individual companies in this industry generated much lower sales than most of its brethren industries. According to the most recent results on Infotrac databases, Murry's Inc. of Upper Malboro, Maryland led the industry in 1997 with sales of $180 million, and Detroit-based Cattleman's Inc. followed with sales of more than $125 million for its fiscal year ended April 1996. Performance Northwest of Portland, Oregon generated sales of $78 million for its fiscal year ended June 1998. American Frozen Foods Inc. of Stratford, Connecticut rounded out the top five industry leaders with sales of $70 million for its fiscal year ended April 1998.

The retail meat and fish market industry, like other retail food markets, experienced a steady downsizing throughout the early to mid-1990s, due in large part to competition from supermarkets, superstores, and wholesale clubs that catered to consumers' desire for one-stop shopping and low prices. Total sales for this industry fell from $6.05 billion in 1993 to $5.97 billion in 1996, and sales dropped 6 percent from December 1995 to December 1996.

According to Dun's Census of American Business, the number of retail meat and fish markets shrunk steadily throughout the 1990s. There were 27,788 markets in 1993; by 1996 that number dropped to 20,811. The majority of these establishments employed fewer than five people. In 1996 about 17,000 markets had nine or fewer employees; about 3,000 employed between 10 and 50; and roughly 450 markets had more than 50 employees.

In the early to mid-1990s, the majority of meat and fish markets had sales between $100,000 and $500,000. In 1996, 223 establishments had sales between $1,000 and $49,000; 1,572 establishments had sales of $50,000 to $99,000; 6,191 stores had sales between $100,000 and $249,000; 5,123 had sales between $250,000 and $499,000; 2,761 had sales between $500,000 and $999,000; and 3,000 stores had sales above $1 million.

Independent meat and fish markets face continued competition from supermarket chains and superstores. The 1994 Industrial Outlook interpreted the shift in some consumer segments from one-stop shopping to more of "buy as you go" attitude as beneficial to independent retailers. New retail strategies, combined with these consumer changes, could help stores hold on to and increase their market share in this industry.

Further Reading

D&B Sales & Marketing Solutions, 2003. Available from http://www.zapdata.com .

Dun's Census of American Business, Parsippany, NJ: Dun & Bradstreet, 1996.

Hoover's Company Profiles, April 2004. Available from http://www.hoovers.com .

Infotrac Company Profiles, 18 February 2000. Available from http://web4.infotrac.galegroup.com .

Monthly Retail Sales and Inventories Report, Washington DC, 2004. Available from http://www.census.gov/econ/www/retmenu.html .

Comment about this article, ask questions, or add new information about this topic: