SIC 4212

LOCAL TRUCKING WITHOUT STORAGE

This category covers establishments primarily engaged in furnishing trucking or transfer services without storage for freight generally weighing more than 100 pounds, in a single municipality, contiguous municipalities, or a municipality and its suburban areas. Establishments primarily engaged in furnishing local courier services for letters, parcels, and packages generally weighing less than 100 pounds are classified in SIC 4215: Courier Services Except Air; those engaged in collecting and disposing of refuse by processing and destruction of materials are classified in SIC 4953: Refuse Systems. Those establishments involved in removing overburden from mines or quarries are classified in various mining industries, while establishments such as construction contractors engaged in hauling dirt and rock as part of their construction activity are classified in various construction industries.

NAICS Code(s)

562111 (Solid Waste Collection)

562112 (Hazardous Waste Collection)

562119 (Other Waste Collection)

484110 (General Freight Trucking, Local)

484210 (Used Household and Office Goods Moving)

484220 (Specialized Freight (except Used Goods) Trucking, Local)

Trucks represent virtually the sole means of transporting freight in intracity and local markets—operating zones of 50 miles or less. Such diverse products as bakery goods, dry cleaning, auto products, fuel for service station pumps, and vending machine supplies are only a few of the enormous variety of goods delivered by local trucking firms.

Although over-the-road intercity truckers are the most visible segment of the industry as a whole, the trucking industry itself grew out of local, short-haul trucking in the early years of the twentieth century, when automobiles began to be converted into trucks to haul the freight traditionally transported by horse-drawn wagons.

The industry is divided into two types of establishments: private carriers who own or lease trucks to transport their products to customers, and for-hire carriers who contract with shippers to transport their goods for them. All companies in this industry are divided roughly in half between corporations and individual proprietorships or partnerships.

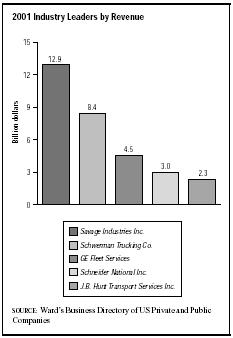

In 2001, the overall industry leader was Savage Industries Inc. of Salt Lake City, with revenues of $12.9 billion and 1,000 employees. Savage handled a diverse array of products, such as coal, chemicals, combustion byproducts, petroleum coke, and sulfur. In second place was Milwaukee-based Schwerman Trucking Co., with $8.4 billion in revenue and 700 employees. Next was GE Fleet Services of Eden Prairie, Minnesota, with $4.5 billion in revenue and 1,700 employees. Rounding out the top five were Schneider National Inc. of Green Bay, Wisconsin, with more than $3.0 billion in revenue and 16,000 employees, and J.B. Hunt Transport Services Inc. of Lowell, Arkansas, with $2.3 billion in revenue and 16,300 employees.

For the industry segment involving mail, package, and freight delivery, the 2002 leader was United Parcel Service Inc., with revenues of $31.3 billion. In 2003, the company reported sales of $33.5 billion and 355,000 employees. Named the "World's Most Admired" company in the industry in 2004 for the sixth year in a row, UPS handled approximately 13 million packages each day. UPS joined the Environmental Protection Agency in 2004 in working to reduce harmful gas emissions from delivery vehicles. In second place was FedEx Corp., with $20.6 billion in revenue.

For the industry segment involving trucking and truck leasing, Ryder System Inc. was the 2002 industry leader, with $4.8 billion in revenue. With a fleet of 135,000, Ryder employed 26,700 workers in 2003. Other leaders in this segment were CNF Inc., Yellow Corp., and Roadway Express Inc.

The industry's largest segment, in terms of number of establishments, is comprised of local delivery firms transporting packages weighing more than 100 pounds. Almost one-third of these firms reported annual revenues of less than $1 million. Although major intercity ground transport firms and air cargo companies also operated local large-package delivery establishments, by far the most common local large-package delivery establishments were smaller firms with names like Susie's Speedy Service or Lickety Split Couriers. The package delivery segment also included messenger services, grocery and food product transporters, newspaper distribution truckers, legal and medical delivery services, and the large-package delivery departments of taxicab companies.

Another important segment of the local non-storage trucking industry is comprised of light haulage and cart-age truckers including warehouse goods transporters, freight forwarders (see SIC 4731: Arrangement of Transportation of Freight and Cargo ), and distributors and goods transfer services. The industry also includes significant numbers of dump truck hauling firms, local log and timber transporters, bulk mail contract carriers, and "star route" carriers, which transport goods between transportation modes, such as from a port to a railhead.

In the late 1990s, a smaller segment of the local nonstorage trucking industry consisted of highly specialized carriers such as hazardous materials transporters, like Enviroguard Technologies and Omega Environmental Control; local animal, livestock, and horse transporters, such as Ft. Worth Cattle Express and Hickory Hill Horse Transport; and local pet transporters, such as Pet' in on the Ritz and Happy Tails to You. The industry also included a variety of local household goods movers who did not offer storage services, ranging from the local divisions of large intercity movers like Bekins, to smaller firms like Starving Scholars Movers; Shleppers Movers; and Load, Lock, and Roll Moving.

By the late 1990s, many local non-storage-trucking firms were unionized. Overall, the local general freight trucking industry reported nearly $15.0 billion in revenue in 2001, down from about $15.2 billion in 2000. The local specialized freight trucking industry reported revenues of $25.4 billion in 2001, a slight gain over $25.3 billion in 2000. According to the Occupational Outlook Handbook, some drivers in this industry also have sales duties. There were 431,000 employed in this capacity in 2002. The overall employment expectation was for steady growth into 2012.

In 2004, the Transportation Security Administration was looking into the viability of requiring locks on all truck cargo areas. Companies were concerned about the cost of such a standard, and trucking companies that make frequent stops, such as UPS, were concerned about delivery delays such locks would create.

Further Reading

Baker, Deborah J., ed. Ward's Business Directory of US Private and Public Companies. Detroit, MI: Thomson Gale, 2003.

Draper, Deborah J., ed. Business Rankings Annual. Detroit, MI: Thomson Gale, 2004.

Hoover's Company Fact Sheet. "Ryder System, Inc." 8 March 2004. Available from http://www.hoovers.com .

Hoover's Company Fact Sheet. "United Parcel Service, Inc." 8 March 2004. Available from http://www.hoovers.com .

"Lock It Up." Fleet Owner, 1 January 2003.

"Products Handled." The Savage Companies, 2003. Available from http://www.savageind.com .

"UPS Extends Environmental Commitment by Joining EPA's 'SmartWay Transport' Program." UPS Pressroom, 9 February 2004. Available from http://pressroom.ups.com .

"UPS Once Again 'World's Most Admired' Program." UPS Pressroom, 27 February 2004. Available from http://pressroom.ups.com .

U.S. Census Bureau. Transportation Annual Survey. 8 March 2004. Available from http://www.census.gov .

U.S. Department of Labor, Bureau of Labor Statistics. 2000 National Industry-Specific Occupational Employment and Wage Estimates. 15 November 2001. Available from http://www.bls.gov/oes/2000/oesi3_414.htm .

U.S. Department of Labor, Bureau of Labor Statistics. Economic and Employment Projections. 11 February 2004. Available from http://www.bls.gov/news.release/ecopro.toc.htm .

U.S. Department of Labor, Bureau of Labor Statistics. Occupational Outlook Handbook 2004-05 Edition. Available from http://www.bls.gov .

US Industry and Trade Outlook. New York: McGraw Hill, 2000.

Comment about this article, ask questions, or add new information about this topic: