SIC 5169

CHEMICALS AND ALLIED PRODUCTS, NOT ELSEWHERE CLASSIFIED

This industry consists of wholesale distributors of chemicals and allied products not included in another classification. Industry products include acids, industrial and heavy chemicals, dyestuffs, industrial salts, rosin, and turpentine.

Companies primarily engaged in the wholesale distribution of agricultural chemicals and pesticides are in SIC 5191: Farm Supplies. Companies involved in the wholesale distribution of drugs are in SIC 5122: Drugs, Drug Proprietaries, and Druggists' Sundries. Companies that distribute pigments, paints, and varnishes are in SIC 5198: Paints, Varnishes, and Supplies.

NAICS Code(s)

422690 (Other Chemical and Allied Products Wholesalers)

In 2001, the U.S. Census Bureau reported there were approximately 11,911 wholesale distributors of chemicals and allied products. Combined, they employed some 121,143 workers with an annual payroll of $6.3 billion. In 2003, the total number of establishments increased to 13,457. Together they generated $43.7 billion in sales. The average sales per establishment was about $4.5 million. The employee count rose to 13,457 with approximately ten employees per establishment.

California and Texas represented the highest concentration with 2,801 establishments controlling more than 20 percent of the market. Michigan only accounted for 417 establishments; however, companies in this state generated the highest annual sales, valued at $5.8 billion.

Chemicals and allied products not elsewhere classified accounted for 5,726 establishments and more than 42 percent of the overall market. The total sales combined were $14.6 billion. Industrial chemicals numbered 1,370 establishments and more than ten percent of the market.

Analysts subdivide industry products into two categories: industrial gases (except liquefied petroleum) and other chemicals and allied products. During the mid 1990s, wholesalers of industrial gases represented 15.3 percent of the total number of industry firms and accounted for 3.9 percent of the dollar-value of industry sales.

According to "The Business of Chemistry in the USA: Performance and Outlook," a Chemical Manufacturers Association survey released in November 1999, the value of overall domestic shipments of chemicals and allied products climbed to a record $412 billion in 1999, an increase of more than 5 percent. CMA director of economics T. Kevin Swift attributed these gains to new-product innovations in the biosciences and in specialty chemicals, as 16 percent of revenues to industrial chemical companies from 1994 through 1999 derived from new products.

Chemical exports remained flat at $68 billion through 1999, continuing a trend since 1992, when exports rose only one percent to reach $42 billion. However, the U.S. chemical industry enjoyed a $526 million trade surplus with China (1998 U.S. exports to China amounted to $1.97 billion while imports from China reached only $1.44 billion).

The leading chemical distributors were positioned for growth and were able to acquire smaller distributors. For example, Brentag, Inc. acquired Holland Chemical International, and Vopak acquired Ellis & Everard. However, the most significant acquisitions for 2002 include, Univar's spin off from Royal Vopak. The company then took on its new name of Univar N.V. That same year, Univar acquired Stochem of Toronto, Canada. Positioned for growth, Univar planned to expand throughout the United States, as well as into Western Europe.

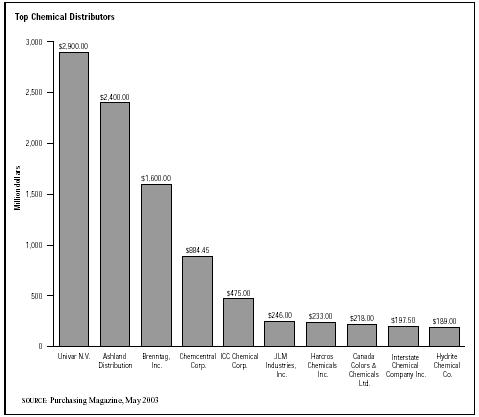

Univar N.V. (formerly Vopak) was the top chemical distributor according to Purchasing, with $2.9 billion in sales for 2002, up from $2.4 billion in 2001. Second place Ashland Chemical Company of Dublin, Ohio, had sales of $2.4 billion for 2002. The Industrial Chemicals and Solvents division of Ashland distributed more than 7,000 chemicals, solvents, additives and raw materials to industries as diverse as printing inks and industrial cleaning products.

Other industry leaders were Brenntag, Inc. with $1.6 billion, Chemcentral Corp. with $884.45 million, ICC Chemical Corp. with $475 million, JLM Industries, Inc. with $246 million, Harcros Chemicals Inc. with $233 million, Canada Colors & Chemicals Ltd. with $218 million, Interstate Chemical Company Inc. with $197.5 million, and Hydrite Chemical Co. had sales of $189 million. The leading 100 chemical distributors reported $139.8 million of overall sales for 2002, a decrease of 3.7 percent or $145.3 million for 2001.

Further Reading

Avery, Susan. "The Top 100 Face Uncertainty." Purchasing, 1 May 2003. Available from http://www.keepmedia.com/pubs/Purchasing/2003/05/01/269972 .

D&B Sales & Marketing Solutions, 2003. Available from http://www.zapdata.com .

"Hoover's Company Capsules," 2004. Available from http://www.hoovers.com .

"Top 100 Chemical Distributors." Purchasing, 1 May 2003. Available from http://www.keepmedia.com/pubs/Purchasing/2003/05/01/269987 .

U.S. Census Bureau. Statistics of U.S. Businesses 2001. Available from http://www.census.gov/epcd/susb/2001/US421420.HTM .

Comment about this article, ask questions, or add new information about this topic: