SIC 5065

ELECTRONIC PARTS AND EQUIPMENT, NOT ELSEWHERE CLASSIFIED

This industry consists of companies that wholesale electronic parts and electronic communications equipment not classified elsewhere. Industry products include semiconductors, modems, telephone equipment, amateur radio communications equipment, recording, cassettes, diskettes, and public address equipment.

NAICS Code(s)

421690 (Other Electronic Parts and Equipment Wholesalers)

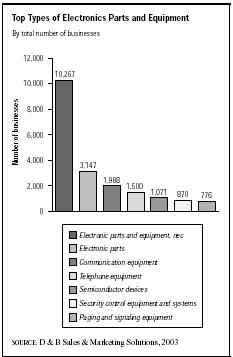

According to the U.S. Census Bureau, there were nearly 20,397 establishments employing approximately 338,488 in the electronic parts and equipment industry in 2001. By 2003, the total number of establishments increased to 23,601, with about 276,822 employees. The industry generated $119.2 billion in annual sales. The average sales per establishment was about $6.70 million. States with the highest number of establishments were California with 4,673, Florida with 1,975, Texas with 1,956, and New York with 1,811.

The electronic parts and equipment industry began in the late nineteenth century, when it primarily served the telegraph industry. After Alexander Graham Bell invented the telephone (1875), and Thomas Edison invented the light bulb (1879), the United States used more electricity. And, as manufacturers offered new electric inventions, wholesale distribution systems were developed to deliver these products to market.

The industry fell into a recession during the 1980s but rebounded by 1987, only to experience a second setback in industry growth—to less than 2 percent—in 1991. Conditions improved slightly in late 1992, as delivery lead times increased; the number of electronic parts distribution companies totaled 15,329 by the end of that year, and combined industry sales totaled $106 billion. Yet, just as industry forecasters predicted that U.S. exporters would sell more to developing markets in Asia, Western Europe, Canada, and Mexico, the industry suffered a recurrence of depressed conditions. A renewed slump in the distribution industry began in 1995 and lasted for three years.

During the remainder of the 1990s, industry players moved toward consolidation; and, due in part to instability in Latin America and an economic crisis in the Far East, U.S. exports slowed dramatically. Distributors rushed to synchronize supply with demand during this decline, which, unfortunately, lasted into the third quarter of 1998. Finally, near the end of the fiscal year, stock prices in the industry hit bottom—a four-year low that was broken by a subtle climb in prices at the beginning of 1999. Distribution margins, however, remained low, as key consumers such as computer manufacturers continued to drive prices down with bulk purchases. Observers reiterated that success in the distribution channels hinged on the ability to sustain growth in the existing high-volume transaction environment.

In early 1999, guardedly optimistic forecasters predicted a turnaround for the electronic component distribution industry, and analysts pressed firms to merge and consolidate in apprehension of a continually temperamental economic climate. Analysts further concluded that the continued growth of distribution channels necessitated the conscientious implementation of dynamic efficiency controls to coordinate supply with demand within a fluctuating marketplace.

Due to the sluggish economy that followed the September 11, 2001 attacks on the World Trade Center, the financial impact was felt throughout the industry. Annual sales of electrical distributors dropped 24 percent in 2001 and 22 percent in 2002. According to the Electrical Wholesalers, the "top 250" electrical distributors, based on annual sales, fell by 8.4 percent to about $36.9 billion in 2001. As a result, there was a decrease of 78,781 employees during that same time period.

Consolidation continued throughout 2001 and 2002 with approximately forty companies reported to have been acquired. For example, Graybar Electric Co. acquired Commonwealth Controls Corp., located in Richmond, Virginia; and WESCO International Corp. acquired both Control Corporation of America, located in Richmond, Virginia, and Heming Enterprises Inc., located in Hayward, California. Some former leaders in the industry were acquired over the past year, which include Kennedy Electrical Supply Corp., Missouri Valley Electric Co., Warren Electric, Eoff Electric, and Fromm Electric. In 2003, sales continued to decline as reported in Purchasing magazine. In fact, for the leading 75 electrical distributors, sales had fallen some seven percent. Nevertheless, Pembroke Consulting Firm, located in Philadelphia, predicted wholesalers and distributors would rebound in technology spending and surpass $80 billion in 2008.

During the early 1990s, the nation's largest independent electrical and telecommunications distributor was Graybar Electric Company, Incorporated. The diversified Graybar, headquartered in St. Louis, Missouri, operated 275 U.S. locations throughout North and Central America, and the Pacific Rim.

Dominance of the industry shifted to Arrow Electronics, Inc. of Melville, New York, in the mid-1990s, although Graybar continued its activity. Arrow, primarily a supplier of passive components, inter connect products,

and computer peripherals, boasted key clients including Intel and Texas Instruments. Arrow moved to acquire a number of smaller distributors throughout the remainder of the decade, and by 1998 the distributor employed 9,700 workers. Arrow reported $8.345 billion in annual sales that year, of which an estimated 65 percent were from semiconductors.

Second to Arrow in the distribution industry, Avnet, Inc. of Phoenix, Arizona, derived approximately 50 percent of its business from the distribution of semiconductors to major producers including National Semiconductor, Intel, and Advanced Micro Devices. Avnet reported $6.35 billion annual sales during fiscal 1999 and increased its employee count by 5.7 percent to achieve a workforce of 8,200. In January of 1999, when Arrow announced a merger with Bell Industries' Electronics Distribution Group, Avnet rebounded with the acquisition of Marshall Industries in mid-year. Arrow Electronics and Avnet thereby commanded over 45 percent of the market, according to a report in Electronic Buyer News. Forecasters predicted continued single-digit growth as the industry moved into the third millennium.

In 2003, Arrow, Avnet, and Grabar remained the leaders in the industry. That year, Arrow posted annual sales of $8.68 billion, while Avnet surpassed Graybar with $9.05 billion to Grabar's $3.97 billion.

Further Reading

"Can Electronics Distributors Rebound in 2003?" Purchasing, 15 May 2003. Available from http://www.keepmedia.com/pubs/Purchasing/2003/05/15/177160 .

D&B Sales & Marketing Solutions, 2003. Available from http://www.zapdata.com .

"Distributors Toughed It Out in 2003; See Growth in 2004." Purchasing, 15 April 2004. Available from http://www.keepmedia.com/pubs/Purchasing/2004/04/15/452883 .

"Distributor Tech Spending to Exceed $80 Billion by 2008." Electrical Wholesaling, 1 February 2004. Available from http://eeweb.com/ar/electric_distributor_tech_spending/index.htm .

Dolash, Sarah, and Jim Lucy."The 250 Biggest." Electrical Wholesaling, June 2002. Available from http://eeweb.com/ar/electric_biggest_3/index.htm .

Hoover's Company Profiles. April 2004. Available from http://www.hoovers.com .

"The Top 200.". Electrical Wholesaling, 1 June 2003. Available from http://eeweb.com/top_200/index.htm .

Comment about this article, ask questions, or add new information about this topic: