SIC 5083

FARM AND GARDEN MACHINERY AND EQUIPMENT

This industry is primarily engaged in the wholesale distribution of agricultural machinery and equipment, including devices used to prepare and maintain soil and to plant, protect, irrigate, and harvest crops. The industry also supplies equipment and machinery to dairy and livestock operations.

NAICS Code(s)

421820 (Farm and Garden Machinery and Equipment Wholesalers)

444210 (Outdoor Power Equipment Stores)

Industry Snapshot

In 2001, according to the U.S. Census Bureau, the farm and garden machinery and equipment industry totaled 9,086 establishments. Combined sales totaled slightly more than $12 billion in 2002. In 2003, the annual sales had grown to more than $24 billion. Subcategories include farm dealers, wholesale distributors to nonfarm accounts, including exports, and lawn and garden machinery and equipment.

Background and Development

The trade journal Appliance Manufacturer projected growth in the market for consumer lawn and garden products in 1998 of 2.9 percent to almost 8 million units. The Outdoor Power Equipment Institute (OPEI) predicted increases in shipments of walk-behind power mowers in 1998 of 2.5 percent; decreases in riding mowers of 10 percent; growth for lawn and garden tractors of 6.3 percent; and increases in tiller shipments of 3.6 percent. Overall, shipments rose 5 percent to 7.7 million units for 1998.

Sales of tractors and combines were up significantly in 1996, according to the Equipment Manufacturers Institute. The strength of the farm economy, rising net farm income and a decline in the ratio of debt to assets, contributed to farmers' willingness to buy agricultural equipment. However, depressed grain and livestock prices led to a decrease in North American retail demand for farm equipment in 1999. Hans Becherer, chairman and CEO of Deere & Co. expected a reduction of 25 percent or more. Since the early 1970s, the number of

U.S. farms has decreased by one-third, from 3 million to 2 million.

Current Conditions

According to the Freedonia Group, sales of U.S. power lawn and garden equipment were expected to rise 4.2 percent per year through 2002 to nearly $9 billion. This market included lawn mowers, turf and grounds equipment, garden tractors and tillers, trimmers and edgers, and show throwers. U.S. exports of lawn and garden equipment are two-thirds the value of imports, according to the U.S. Department of Commerce. The biggest markets for exports were Canada, France, Germany, the United Kingdom and Australia.

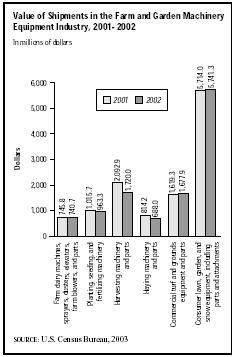

Farm and garden machinery represented the largest segment of the industry, with 2,396 establishments, and their combined sales totaled about $2.7 million. Agricultural machinery and equipment numbered 2,206 establishments, with more than $8 million in sales, and lawn and garden machinery and equipment numbered 1,237 establishments with combined sales of $254.4 million. Farm dairy machines, as well as sprayers, dusters, elevators, farm blowers, and parts generated $740.7 million; planting, seeding, and fertilizing machinery totaled $963.3 million; harvesting machinery and parts contributed $1.72 million; and haying machinery and parts generated $688 million. Average sales per establishment totaled approximately $2.4 million.

Industry Leaders

AGCO Corp., Deere & Co., Caterpillar Inc., and Case Corp. were important agricultural machinery manufacturers with extensive distribution networks. Consolidation continued as companies acquired other equipment makers. In 1998, Case Corp. bought Tyler Industries, a manufacturer of agricultural sprayers. Major wholesalers included RDO Equipment Co., IIC Industries Inc. Former industry leader, Richton International Corp., was acquired by Deere & Co. in 2001.

Workforce

The industry employed approximately 87,642 people in 2003. Its annual payroll was about $3.3 million. The average number of employees per establishment totaled about 7. States with the highest number of establishments were Texas with 1,016, California with 812, Minnesota with 576, Florida with 567, Iowa with 542, and Nebraska with 415.

Further Reading

D&B Sales & Marketing Solutions, 2003. Available from http://www.zapdata.com .

"Lawn & Garden Equipment to Near $9 Billion in 2002." ApplianceManufacturer, February 1999.

U.S. Census Bureau. Statistics of U.S. Businesses 2001. Available from http://www.census.gov/epcd/susb/2001/us/US421420.HTM .

U.S. Census Bureau. Current Industrial Reports 2003. Available from http://www.census.gov/cir/www/alpha.html .

Ward's Business Directory of U.S. Private and Public Companies, 2000: Companies Ranked by Sales within 4-Digit SIC. Farmington Hills, MI: Gale Group, 2000.

Comment about this article, ask questions, or add new information about this topic: