SIC 5021

FURNITURE

This classification comprises establishments primarily engaged in the wholesale distribution of furniture, including bedsprings, mattresses, and other household furniture; office furniture; and furniture for public parks and buildings. Establishments primarily involved in the wholesale distribution of partitions, shelving, lockers, and other store fixtures are classified in SIC 5046: Commercial Equipment, Not Elsewhere Classified.

NAICS Code(s)

442110 (Furniture Stores)

421210 (Furniture Wholesalers)

Industry Snapshot

The wholesale distribution of furniture industry is subdivided into two categories: establishments engaged primarily in the sale of household and lawn furniture, and establishments primarily engaged in the sale of office and business furniture. According to statistics compiled by the U.S. Census Bureau, 29,920 establishments were listed in this classification in 2001. Combined sales totaled $23.1 billion in 2003. There were 278,231 people employed within this industry, with an annual payroll of $7.5 million. The average establishment generated $2.7 million in sales. California, Florida, and New York controlled 32 percent of the market.

Background and Development

This industry is affected by interest rates and the housing market. When these economic indicators are stable and strong, the furniture industry generally has higher retail sales. Barrons reported that the furniture industry experienced a slump from 1988 until mid-1992 when a "stop-and-start" recovery process began. Conditions within the furniture industry reflected the nation's general economy as consumers postponed purchases. As a result, when the economy began to improve, there was a pent-up demand for industry products, and the American Furniture Manufacturers Association (AFMA) predicted an increase in furniture shipments.

Following a slump in the early 1990s, the International Wholesale Furniture Association found more than 90 percent of survey respondents reported sales increases in 1993. Sales continued to climb in 1994 and 1995. Throughout 1995, monthly sales for furniture and home furnishings were between $3.1 and $3.4 million. AFMA also predicted an increase in the value of shipments of 7.6 percent in 1999, and a smaller increase of 2.1 percent for 2000. Consumer demand was expected to increase by 5.5 percent and 4.5 percent for 1999 and 2000, respectively.

Housing starts were forecast to increase by 2.9 percent in 1999, followed by only 0.3 percent in 2000. In the late 1990s, much of this industry's strength has come from the industrial (offices, hotels, restaurants) side of the market. The office furniture market estimated at $12 billion, dropped to $8 billion annually in. The office furniture market is estimated at $12 billion. Some analysts predicted that 50 million families were to occupy a home office.

Current Conditions

The largest type of customer, furniture stores, represented 69.4 percent of sales. Other types of customers included rental dealers (19.2 percent of sales), manufactured homes (4.9 percent),specialty stores (2.5 percent), interior designers (1.4 percent) and institutional buyers (0.5 percent). The two largest product categories, living room/upholstered and bedroom, accounted for half of the sales.

Customary distribution channels within the industry, however, have changed. To reduce costs and improve efficiency, many manufacturers have increased their direct sales to retailers and rental dealers. As a result, wholesalers faced a shrinking number of traditional customers, and innovative wholesale concepts, such as warehouse clubs and electronic shopping networks, emerged. Wholesalers are also being threatened by large discount department stores such as Wal-Mart.

The Business and Institutional Furniture Manufacturers Association (BIFMA) International announced that furniture shipments would climb 5.6 percent for 2004, up from a 4.7 percent drop in 2003. Office furniture also declined 20 percent nationally in 2002. However, according to Furniture Today, furniture spending would increase 23 percent by 2011.

Industry Leaders

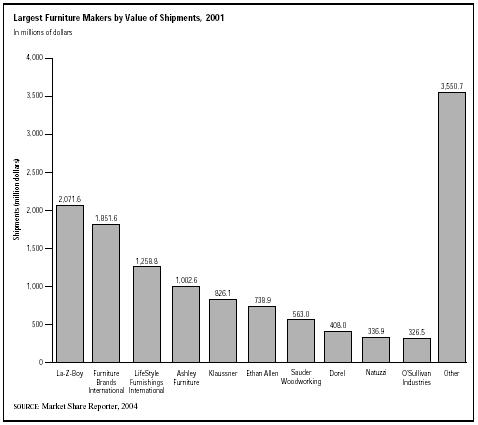

In the late 1990s, industry leaders included Value City Furniture Division of Ohio, Office Depot Incorporated Business Services Division of California, and TAB Products Company, also of California. In 2003, industry leaders were Furniture Brands International Inc. of St. Louis, Missouri, La—Z—Boy Inc. of Monroe, MI., and Hon Industries, Inc. In the second half of 2003, demand for commercial furniture began to stabilize and in December, both shipments and orders grew for the first time in three years.

Workforce

The wholesale trade work force is expected to show an overall increase by 2005. Jobs with the highest increases are expected to be traffic, shipping, and receiving clerks, with 41 percent; general managers and top executives, with 36 percent; blue collar worker supervisors, with 28 percent; and truck drivers, with 28 percent.

America and the World

Global competition has remained a key component for the decline of the domestic furniture industry. Imports were on the rise in 2003, with Brazil commanding 16 percent, Malaysia 12 percent, and China 28 percent. The United States imported about 48 percent of its furniture in 2003. AFMA predicted an increase in furniture shipments of 5.4 percent for 2004. AFMA also predicted an increase on the value of imports to generate some $66.7 billion in sales, compared to $67.6 billion in 2003.

Further Reading

Avery, Susan."Ample Supply, Competitive Prices Spell Buyer's Market." Purchasing, 18 September 2003. Available from http://www.keepmedia.com/pubs/Purchasing/2003/09/18/277744 .

D&B Sales & Marketing Solutions, May 2004. Available from http://www.zapdata.com .

Flaherty, Michael."Feature—US Office Furniture business Shows Signs of Life." Reuters, 16 February 2004. Available from http://www.forbes.com/business/newswire/2004/02/16/rtr1262400.html .

"Furniture Brands International Increases Guidance for the First Quarter of 2004." Business Wire, 27 February 2004. Available from http://www.businesswire.com/ .

Hoover's Company Profiles, May 2004. Available from http://www.hoovers.com

Lazich, Robert S. Market Share Reporter. Farmington Hills, MI: Gale Group, 2004.

Marshall, Fran. "Aktrin: Furniture Spending to Rise to 23% by 2011." Furniture Today, 9 December 2002. Available from http://web4.infotrac.galegroup.com/itw/infomark/703/653/47787634w4/purl=rel_1_ITOF_0_ .

Quarterly Economic Forecast American Furniture Manufacturers Association, July 1999.

U.S. Census Bureau. Statistics of U.S. Businesses 2001. Available from http://www.census.gov/epcd/susb/2001/US421420.HTM .

Ward's Business Directory of U.S. Private and Public Companies. Detroit: Gale Group, 2000.

Comment about this article, ask questions, or add new information about this topic: