SIC 5094

JEWELRY, WATCHES, PRECIOUS STONES, AND PRECIOUS METALS

This industry classification comprises establishments involved in the wholesale distribution of jewelry, watches, precious stones, and precious metals. Products of the industry include clocks, coins, gem stones, pearls, precious metals bullion, silverware, and trophies. Establishments primarily engaged in the wholesale distribution of precious metal ores are included in SIC 5052: Coal and Other Minerals and Ores.

NAICS Code(s)

421940 (Jewelry, Watch, Precious Stone, and Precious Metal Wholesalers)

Industry Snapshot

According to the U.S. Census Bureau, the jewelry, watch, precious stone, and precious metal wholesalers represented approximately 8,215 establishments. Combined, these employed some 54,408 people with an annual payroll of $2 billion. In 2003, the total number of establishments climbed to 12,936. The industry generated approximately $13.8 billion in annual sales. The total number of employees reached 61,411. The average sales per establishment were $1.10 million. The majority of the establishments were small—employing fewer than five people. There were a total of 9,939 establishments with fewer than five employees.

Jewelry, the largest sector of the industry, numbered 4,872 establishments and dominated more than 37 percent of the market. Together, this group accounted for $4.8 billion in sales. The jewelry and precious stones sector numbered 3,435 establishments and controlled more than 26 percent of the market. Combined, this group generated $2.5 billion in sales. Diamonds represented 1,327 establishments and controlled about ten percent of the market, with $1.7 billion in sales. States with the majority of establishments include New York with 2,981, California with 2,685, and Texas with 1,143.

Background and Development

Jewelry is as universal and ancient a form of adornment as clothing. It has been made of a variety of materials from human hair to precious metals and gems, and has been used to signify social status, wealth, official or political rank, holidays and celebrations, and fad and fashion. Its forms have included items for the head (hairpins, headbands, crowns, earrings, and lip and nose rings); neck (pendants and necklaces); chest (brooches, cloak clasps, buttons); waist (belts and girdles); and arms and legs (bracelets, anklets, and rings). As an industry, jewelry has been represented in all the major civilizations by goldsmiths, metalworkers, gem cutters, and many others. The Byzantine Empire (approximately the 6th to 13th centuries) with its profusion of gold and enamel and the European Renaissance (the 15th to 17th centuries) characterized by the use of gemstone-emblazoned fabrics and chains, ropes, pendants, and girdles were perhaps the greatest moments in the history of jewelry.

Watches were developed around 1450-1500 when the coiled spring made the invention of the pocket watch possible. By the 17th century, crystal faces to protect the workings, bearings, hairsprings, and balance wheels were standard. Watches were handcrafted by skilled artisans until about 1800 when machine-made parts led to mass production. Electric and electronic watches were introduced in the 1950s and 1960s.

During the first few years of the 1990s, conditions within the jewelry, watches, precious stones, and precious metals industry were unstable. In 1993, the number of establishments was about 6,800 and sales were about $45 billion, which was up from a 1990-91 low of about 6,000 establishments and $40 billion in sales. High numbers of retailer bankruptcies, fluctuations in international currency exchange rates, and the recession in the United States and abroad led to reduced profitability for wholesale dealers.

In January 1994, however, Jewelers' Circular-Key-stone reported that conditions appeared to be improving. Some diamond dealers attributed the turn-around to the repeal of the federal luxury tax in 1993. During 1994, the heaviest projected demand was for diamond jewelry, loose diamonds, and karat gold jewelry.

Gem stones were also experiencing an upswing. Industry forecasters expected growth in ruby, sapphire, emerald, tourmaline, and tanzanite sales. The highest projected demand was for stones in earth tones, such as orange and peach.

Pearl dealers also anticipated improving conditions. Although high-quality Japanese pearls remained expensive

and in short supply, forecasters predicted that increased supplies of Chinese freshwater pearls and South Sea pearls would help bring prices down in the lower-quality sector of the pearl market. This, coupled with increased demand, was expected to yield higher net profits.

Watch suppliers also expected sales to increase slightly during 1994. Annual U.S. watch sales were pegged at 65 million units with women's and jewelry watches, sport watches, upscale watches, two-tone watches, stainless steel watches, and watches with lighted dials remaining popular.

In the mid-1990s, jewelers were trying to lower their business costs, increase productivity, and tighten their customer base to increase profitability. The diamond trade was having especially low confidence due to foreign competition.

The industry employed more than 50,000 and generated sales of about $44 billion in 1998. Sales in jewelry stores increased about 8.5 percent from 1997 to 1998 to $22 billion, and about 40 percent of sales occurred in the fourth quarter of 1998, in keeping with traditional holiday sales trends. Other than jewelry stores, gemstones, jewelry, precious metals, and watches are sold by department stores, warehouse stores, home shopping television, catalogs and showrooms, and over the Internet.

Over 28,000 jewelry stores across America accounted for approximately half of the nation's jewelry sales in 1998. Consolidation occurred as large chains purchased others, and growth took place as these same chains expanded their number of outlets in shopping malls. Zale Corporation acquired Peoples Jewelers of Canada in June 1999, but Service Merchandise (a major catalog showroom) filed for bankruptcy, also in 1999; these events show that this industry is both highly competitive and risky. Retailers have sought new ways of improving product value. As a result, jewelry imports have increased from 26 percent in 1983 to 52 percent in 1997. With economic declines in Asia, Asian wholesalers have turned to the United States and Europe with increased volumes of exports.

Jewelers improved their prospects substantially in the late 1990s by better marketing and improved tracking of supplies, demand, and sales; they also were able to capitalize on simple demographics as the United States emerged from the recession earlier in the decade with baby boomers reaching their maximum earnings years and investing their income in jewelry. The large jewelry chains were continuing to consolidate into the 2000s, and retailers were optimistic about trends and fashions in jewelry and watches and growth of markets at a range of income levels.

Current Conditions

Jewelers credit the bridal business with 30 to 50 percent of their revenue. Holidays and gift-giving opportunities, are also major factors in sales of watches and jewelry. Year-round spending and the growth of purchases among women of jewelry for themselves have made jewelers less dependent on December holiday sales, despite cyclic sales related to the economy and, to a lesser degree, the seasons.

Jewelry sales also depend heavily on fashion trends. Colored gemstones, designs from natures, diamonds in virtually any form, yellow gold, white metals, princess-cut gemstones, Tahitian pearls, and invisible necklaces are expected to be among the most popular.

In precious metals, gold commodity prices have continued to drop, but jewelry manufacturers and retailers have yet to pass savings along in lower prices because, given the metal's volatile price, they are protecting their ability to pay higher prices for gold over the coming years. Forecasters expected sales of silver jewelry and other white metals to remain strong, with platinum is the strongest of the precious metals in sales. China and Japan lead the world in consumption of platinum jewelry.

Industry Leaders

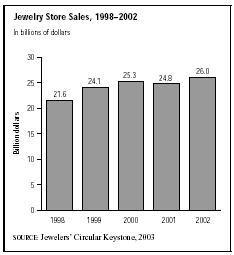

The top 20 firms in jewelry sales consisted of about 50 percent jewelery specialists. Tiffany & Co., Whitehall Jewelers, and the Piercing Pagoda were the only three companies with both unit growth and sales that exceeded 20 percent. For the industry as a whole, 1998 sales growth was 7 percent (compared to 8.7 percent in 1997) and unit growth was 2.3 percent (3.8 percent in 1997). The two major television shopping networks generated about 3 percent of industry-wide sales in 1996 through 1998. Of the three corporate leaders, Tiffany & Co. epitomized quality and name recognition worldwide; in the second quarter of 1999, Tiffany's earnings increased 63 percent. Whitehall Jewellers, Inc., has 276 stores in 31 states and has projected earnings growth rates of 30 percent and 22 percent for fiscal 1999 and 2000, respectively. Following a massive reorganization in the late 1980s, Zale Corporation is the largest specialty retailer (per 1999 statistics) with 1,300 stores in the United States, Canada, and Puerto Rico under several firm names; they also have considerable direct mail and online sales. The specialty jewelry market posted positive results from 1998 through 2002, according to Jewelers' Circular Keystone. Overall sales increased about 20 percent over the five year period, falling only in 2001 to 2.2 percent.

Internet sales of jewelry and watches are anticipated to rise to $56 million in 2000 and $140 million by 2001. Polygon Network, Inc., maintains Web sites for approximately 3,000 retailers and suppliers on six continents as well as providing online information resources. The Network experiences daily transactions of about $3 million and, as of 2000, holds a loose diamond inventory valued at about $100 million.

Research and Technology

Sellers of diamonds are increasingly threatened by sales of cubic zirconium and other, less expensive "diamond look-alikes". The largest diamond marketer worldwide, De Beers, is experimenting with "diamond branding" to mark the firm's name and identification numbers on diamonds. Development of this technique includes reader machines to detect the tiny, laser-cut inscriptions. Production of synthetic gemstones continues to be a strong research field.

De Beer's who had been in control of the synthetic diamond market, had new rivals. Newly formed Apollo Diamond Inc. located in Boston, Massachusetts, and Gemesis Corp. of Sarasota, Florida had come up with a new technology for producing manufactured synthetic diamonds within a lab. De Beer's never dreamed the Russian technology would ever be mastered. The actual manmade diamonds are created in only a few days versus the natural diamonds that are mined from under the earth. Appolo used a process known as Chemical Vapor Deposition (CVD), while Gemesis used a high—pressure, high temperature technique that imitates the geologic conditions under which natural diamonds are formed. The diamonds were expected to be sold about 30 percent less than the price of a natural diamond. Gemesis had sold its yellow synthetic diamonds through retail jewelers at about 10 to 50 percent less than the manmade diamonds. Gemesis was working on producing various other colors, specifically blue, by late 2004.

Further Reading

Appolo Diamond, Inc., 2004. Available from http://www.appolodiamond.com/gemstones.html .

D&B Sales & Marketing Solutions, 2003. Available from http://www.zapdata.com .

Davis, Joshua. "The New Diamond Age." September 2003. Available from http://www.wired.com/wired/archive/11.09/diamond_pr.html .

Heebner, Jennifer. "Jewelry—Only Sales Post Five-Year Gain." Jewelers' Circular Keystone, 1 May 2003. Available from http://www.keepmedia.com/pubs/JCK/2003/05/01/268818 .

U.S. Census Bureau. Statistics of U.S. Businesses 2001. Available from http://www.census.gov/epcd/susb/2001/US421420.HTM .

Weldon, Robert G. "Gemesis Diamonds at Retailers." Professional Jeweler, 21 November 2003. Available from http://www.professionaljeweler.com/archives/news/2003/112203story.html .

Comment about this article, ask questions, or add new information about this topic: