SIC 5031

LUMBER, PLYWOOD, MILLWORK, AND WOOD PANELS

This classification is comprised of wholesale distributors of rough, dressed, and finished lumber (other than timber). Establishments operate with or without yards. Principal products include plywood, reconstituted wood fiber products, doors and doorframes, windows and window frames (all materials), wood fencing, and other wood or metal millwork.

NAICS Code(s)

444190 (Other Building Material Dealers)

421310 (Lumber, Plywood, Millwork, and Wood Panel Wholesalers)

Industry Snapshot

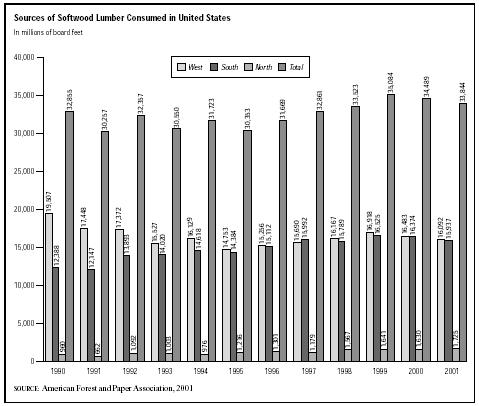

According to the U.S. Department of Commerce, 40 percent of U.S. consumption of "softwood lumber" represents the construction for new construction of homes, and 30 percent for their maintenance and refurbishing. In 2001, the U.S. Census Bureau reported 7,220 lumber, plywood, millwork, and wood panel wholesalers. That number had increased to 15,614 by 2003, and industry sales were valued at more than $62 million. The industry employed roughly 204,070. The U.S. states with the highest sales volume included California, Florida, Texas, New York, Pennsylvania, Ohio, which together accounted for more than 36 percent of the industry's output.

Lumber, plywood, and millwork represented the largest sector with 4,384 establishments. These controlled more than 28 percent of the market, with shared sales of more than $19 million. Businesses in the rough dressed and finished lumber segment numbered 2,463, which was about 15 percent of the market. There were 1,890 businesses that were engaged in the wholesale distribution of kitchen cabinets. Combined, they represented approximately 12 percent of the market. Exterior building materials had 1,520 establishments and represented almost 10 percent of the market. The majority of lumber consumed in the U.S. was imported from Canada.

Background and Development

During the early 1990s, establishments involved in the wholesale distribution of lumber and other wood products faced a number of challenges stemming from depressed economic conditions and an uncertain political climate. As the nation's economy stagnated, many large retail outlets began bypassing wholesalers in favor of direct purchasing channels. Some smaller retail outlets were forced to close, leaving a diminished number of traditional customers for wholesalers. In addition, uncertainty about the nation's timber policy led to fluctuating prices and concerns about product availability. In the late 1990s, however, the booming U.S. housing market led to an increase in new construction, reducing inventories and increasing the price of lumber.

According to figures compiled by the U.S. Department of Commerce, 8,364 establishments participated in this industry in 1992, having combined sales of more than $56 billion. Sales of plywood, millwork, and wood panels represented $28.9 billion of that amount. Lumber sales, totaling $27 billion, were divided between establishments with yards, $14.6 billion, and without yards, $12.4 billion. By 1995, 8,584 firms were in operation, having 122,769 employees, a payroll of $3,794,600 and estimated sales of almost $70 billion. Of the firms reporting, 78 percent had less than 20 employees. Employment was expected to remain relatively flat through the close of the century, with total sales reaching almost $76 billion.

The do-it-yourself (DIY) market represented approximately $117 million in retail sales in 1993. Sales made by DIY retailers rose 12 percent between 1988 and 1993, and industry watchers anticipated that 150 new warehouse-style stores would begin operating in 1994. By 1995, however, the DIY market had flattened considerably and, in 1997, it was declining. In contrast, the professional builders' market continued to increase, beefing up sales for building supply giants such as Home Depot—which controlled 42.8 percent of retail building supply sales in 1996—and the North Carolina-based Lowe's Companies. In 2001, home improvement generated about $190 billion. Some analysts predict home improvement total sales would reach $200 billion in 2004. Together, Home Depot, and Lowe's continued to dominate some 30 percent of the DIY market for 2001. Home Depot generated annual sales of $38.4 billion.

According to Business Trend Analysts, manufacturers' sales of millwork were forecast to increase 3.2 percent in 1999 from a 1998 market that totaled $12 billion,. Market segments that showed significant increases included flush-type, solid-core doors with hardboard faces (up 7.8 percent), hardwood stairwork (up

7.7 percent), and wood patio doors (up 6.7 percent). In 1999, the U.S. paneling market was dominated by furniture and molding/millwork at 44 and 21 percent, respectively. Doors and wall paneling each had nine percent.

Current Conditions

A standard "wood—framed home" demands some 15,000 board feet of lumber. North American lumber production totaled 41 billion board feet during the first seven months of 2003. The residential housing market was expected to continue to fuel the market. David Lereah, chief economist of the National Association of Realtors (NAR) agreed, and stated "new home sales this year should finish at around 1.05 million units," more than an eight percent increase over 2002. Although lumber demand had been on the increase, it has been a "buyers&rsdqou; market in most lumber items, a market shaped by prevalent discounting and widespread declining prices," according to the North American Wholesale Lumber Association (NAWLA).

According to Wholesale and Retail Trade USA, the top five companies in this industry by total annual sales were Nissho Iwai America Corp., later known as Solitz Corporation of America, with $12 billion; HomeBase Inc. with $4.4 billion, Universal Corp. with $4.1 billion, Crane Co. with $1.8 billion, and 84 Lumber Co. with $1.6 billion. Other significant companies in the industry included Carter Lumber Co., North Pacific Group Inc., Hardware Wholesalers Inc., and Boise Cascade Corporation's Building Materials Distribution Division.

Former home improvement wholesaler, HomeBase, opted to convert its existing warehouse stores into House2Homes, which would venture into the home decorating arena. Ginger Silverman of HomeBase, commented on the reasoning behind the newly formed company, and stated that "Home decorating, a $125 billion industry with no one player commanding more than five percent share, is seen as a safe harbor compared to the cut—throat home—improvement category ruled by Home Depot and Lowe's."

According to the U.S. Bureau of Labor Statistics, the total employment within the industry will continue to decline because of the restraints placed on lumber harvests. There were a about 207,000 producers of cabinets, trusses, and windows in 2001. The wholesale and retail dealers accounted for some 818,000 workers. The contractors and subcontractors of residential building represented more than 5 million workers. There are the self—employed contractors that account for an additional million that are construct homes as well.

Further Reading

"Background on Lumber." U.S. Department of Commerce, 31 May 2004. Available from: http://homeservices—directory.com/providers/tips/tech/lumber.pdf .

Business Trend Analysts. "News Release," 9 July 1999. Available from: http://www.businesstrendanalysts.com/PRMWK.shtml .

Darnay, Arsen J., and Joyce Piwowarski, eds. Wholesale and Retail Trade USA, 2nd Edition. The Gale Group, 1998.

D&B Sales & Marketing Solutions, May 2004. Available from http://www.zapdata.com

Dolbow, Sandra. "Humbled HomeBase Bets the House; $30M Effort Launches House2Home." Brandweek, 14 May 2001. Available from http://articles.findarticles.com/p/articles/mi_m0BDW/is_20_42/ai_74699189 .

"Home Improvement Industry Profile." Yahoo Finance, 31 May 2004. Available from: http://biz.yahoo.com/ic/prof/25.html .

Hoover's Company Profiles, May 2004. Available from http://www.hoovers.com .

NAWLA Bulletin, North American Wholesale Association (NAWLA), 20 October 2003. Available from www.lumber.org/bulletin/oct03.pdf .

Sojitz Corporation of America, May 2004. Available from http://www.sojitz.com

U.S. Census Bureau. Statistics of U.S. Businesses 2001. Available from http://www.census.gov/epcd/susb/2001/us/US421420.HTM

Comment about this article, ask questions, or add new information about this topic: