SIC 5171

PETROLEUM BULK STATIONS AND TERMINALS

This industry consists of companies that wholesale crude petroleum and petroleum products from bulk liquid storage facilities. Distributors of liquefied petroleum gas from bulk liquid storage facilities are also included.

NAICS Code(s)

454311 (Heating Oil Dealers)

454312 (Liquefied Petroleum Gas (Bottled Gas) Dealers)

422710 (Petroleum Bulk Stations and Terminals)

In 2001, U.S. Census Bureau reported 7,020 petroleum bulk stations and terminals companies. Combined, these companies employed approximately 94,034 workers. The annual payroll totaled $3.7 billion. In 2003, the total number of establishments dropped substantially to only 4,603. The employee number almost dropped in half to 45,419 workers. Total sales were $33.1 billion, with the average sales per establishment at about $10.9 million. Texas, Minnesota, and California reported the highest number of establishments.

Analysts subdivided the industry into three categories: petroleum bulk stations, petroleum bulk terminals, and liquefied petroleum (LP) gas bulk stations and terminals. Petroleum bulk stations were defined as businesses with bulk storage capacity from 10,000 to 100,000 gallons for stations getting supplies by tanker, barge, or pipeline, and those with capacity from 100,000 to 2,100,000 for stations getting supplies from other sources. Petroleum bulk terminals were those businesses whose bulk storage capacity exceeded 100,000 gallons in facilities getting supplies by tanker, barge, or pipeline, and those whose capacity exceeded 2,100,000 gallons for facilities getting supplies from other sources. LP gas bulk stations and terminals were plants selling liquefied petroleum gas to dealers, wholesale distributors, industrial users, commercial users, and government and military units.

Petroleum bulk stations were the largest sector of the industry, with 2,860 companies that controlled more than 62 percent of the overall market, with combined sales of more than $24 million. Petroleum bulk stations and terminals accounted for 1,504 companies, more than 32 percent of the market value. Petroleum terminals numbered 239 companies.

The 1997 Economic Census-Wholesale Trade reported 69 petroleum bulk stations and terminals companies. Sales in 1997 totaled $331.4 million, based on the NAICS code. The mid-1990s sales breakdowns for industry products were reported as: motor gasoline, $49.2 billion; no. 2 distillate fuel oil, $11.8 billion; liquefied petroleum gas, $1.8 billion; residual fuel oil, $1.9 billion; all other distillate fuel oil, $1.9 billion; jet fuel, $3.9 billion; lubricating oil and grease, $1.6 billion; crude oil, $19.7 billion; aviation gasoline, $208.0 million; and special naphtha, $94.0 million.

Industry watchers predicted that petroleum demand would rise as the U.S. economy improved after a slowdown in the early 1990s, and world crude oil supplies met demand. But even as forecasters predicted stable prices, this theory was disproved in the late 1990s. Further improvements in fuel-consumption efficiencies, however, could slow growth within the industry.

The petroleum industry climbed 4.1 percent in March of 2004, according to the American Petroleum Institute (API). For the first quarter of 2004, imports of distillate fuel, liquefied petroleum, and residual fuel remained the same, while jet fuel declined.

One of the largest companies classified in this industry was Coastal Oil New England, Inc., a petroleum products marketing subsidiary of the Coastal Corporation with 1999 sales totaling $8.2 billion. The Coastal Corporation, founded in 1955, was one of the nation's largest energy Companies; Coastal has the capacity for 468,000 barrels per day. In the early 2000s, the company agreed to be acquired by El Paso Energy, a natural gas leader. Another industry leader was EOTT Energy Partners, L.P. of Houston, Texas, with 1999 sales of $8.7 billion. EOTT gathered and marketed crude oil and also used third-party

pipelines to deliver jet fuel, fuel oil, and unleaded gasoline. The company gathers and markets approximately 430,000 barrels of crude oil each day.

In the propane segment, one leader was a UGI Corp. subsidiary, AmeriGas Partners, LP of King of Prussia, Pennsylvania, with 1999 sales of $1.4 billion and more than 5,000 employees. Ferrellgas Partners is another propane leader, with 1999 sales of $624.1 million and 4,463 employees.

The top propane companies held their positions in 2003. UGI Corp. posted sales of $3 billion, AmeriGas Partners with 1.6 billion, and Ferrellgas Partners, L.P. had $1.1 billion in sales. In December of 2002, Ferrellgas acquired ProAm, one of the top twenty propane companies. Ferrellgas sells about 900 million gallons of propane per year.

EOTT Energy Partners, L.P. filed for Chapter 11 bankruptcy protection in 2002, followed by the separation of their affiliation with the Enron Corp. Enron Corp., an energy trader, went bankrupt in late 2002. EOTT has since emerged from Chapter 11 with a new identity, and a new name. As of March 1, 2003, the former EOTT, now separated from Enron, conducts business as EOTT Energy LLC. The released statement also included that EOTT should return to its past performance.

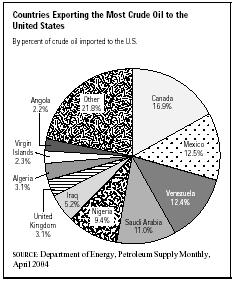

The leading suppliers of imports included Canada, Mexico, Venezuela, Saudi Arabia, Nigeria, Iraq, United Kingdom, Algeria, Virgin Islands, and Angola. In April of 2004, the petroleum imports totaled 12,195,000 barrels per day. That was a decrease of 4.1 percent over April of 2003. The average price for a barrel of OPEC crude oil on May 7, 2004 was $33.72.

Further Reading

American Petroleum Institute. "Monthly Statistical Report," 14 April 2004. Available from http://www.api-ec.api.org/printerformat.cfm?ContentID=CCEOOOOD-7572-11D5-BCAOOBODOE15BFL .

——. "Monthly Statistical Report," 19 May 2004. Available from http://www.api-ec.api.org/printerformat.cfm?ContentID=DAC33528-7704-11D5-BC6AOObODOE15BFC .

"Bobtail Upgrade." Modern Bulk Transporter, 8 January 2003. Available from http://www.keepmedia.com./pubs/ModernBulkTransporter/2003/08/01/274692 .

D&B Sales & Marketing Solutions, 2003. Available from http://www.zapdata.com .

"EOTT Energy Files Bankruptcy." Houston Business Journal, 9 October 2002. Available from http://www.bizjournals.com/houston/stories/2002/10/07/daily27.html .

"EOTT Energy Emerges as a New Company from Chapter 11; With Lower Debt, Restructured Finances, and Complete Separation from Enron." PRNewswire, 3 March 2003. Available from http://www.forrelease.com/D20030303/dam040.PI.03032003143009.08261.html .

Hoover's Company Profiles, May 2004. Available from http://www.hoovers.com .

U.S. Census Bureau. Statistics of U.S. Businesses 2001. Available from http://www.census.gov/epcd/susb/2001/US421420.HTM .

Comment about this article, ask questions, or add new information about this topic: