SIC 5043

PHOTOGRAPHIC EQUIPMENT AND SUPPLIES

This industry classification comprises establishments primarily engaged in the wholesale distribution of photographic equipment and supplies, including cameras, darkroom apparatus, and photographic film. Establishments primarily engaged in the wholesale distribution of items such as photocopy, microfilm, and similar equipment are classified in SIC 5044: Office Equipment.

NAICS Code(s)

421410 (Photographic Equipment and Supplies Wholesalers)

Industry Snapshot

In 2001, there were an estimated 1,293 establishments in this industry, down from 1,350 the previous year. The number of establishments had been steadily dropping since a high of 1,556 in 1987, but had remained rather steady from 1993-96 with an estimated 0.3 percent change. States with the largest number of establishments in 2001 were California with 260 and New York with 174—combined, these states together accounted for just under a third of all establishments. In 2003, the number of establishments increased slightly to 1,382. The industry generated $5 billion in sales for 2003, and the average sales per establishment were $4.7 million. There were a total of 18,179 employees.

The largest industry segment was photographic equipment and supplies which controlled more than 48 percent of the industry. Average sales added up to approximately $6.6 million. Cameras and photographic equipment accounted for over ten percent of the market, with total sales of $2.4 million. Photographic cameras, projectors, equipment and supplies dominated more than 14 percent of the market, with $4.5 million in sales.

Background and Development

In 1997, 32.4 percent of American households had film processed. Of these households, 28.3 percent processed 35mm film, 1.2 percent processed advanced photo system (APS) film, 5.8 percent processed disposable-camera film, and 2.9 percent processed other types of films. Of all rolls processed that year, 80 percent were 35mm print film, excluding disposable cameras. Also in 1997, 12.8 percent of American households obtained at least one camera or camcorder, and 11.5 percent bought at least one camera or camcorder.

Unit share was lost by the popular 35mm format in 1997 because of the growing popularity of APS and digital cameras. In 1998, the unit share by camera type purchases, according to Photo Marketing Association International (PMA), was: 35mm lens shutter with 46.5 percent; camcorder with 22.4 percent; APS with 8 percent; 110 with 7.6 percent; instant with 5.5 percent; 35mm SLR with 4.1 percent; digital still camera with 3 percent; and professional medium and large format with 2.9 percent. The 1997 unit shares by outlet type for camera and camcorder purchases were: discount stores with 39.8 percent; electronic/video stores with 15.1 percent; camera stores with 11.1 percent; unclassified types of stores with 8 percent; department stores (not discount) with 7.4 percent; mail order with 6 percent; catalog showroom with 5.4 percent; warehouse clubs with 3.8 percent; and drugstores with 3.3 percent.

Overall demand for photographic equipment and supplies was generally flat throughout the early 1990s. The 1999 value of shipments was expected to be $24.7 billion. Photographic industry shipments through 2003 are expected to show modest growth reaching $26.7 billion. The United States ranks as the world's second largest exporter of photographic equipment and supplies after Japan. In 1997, U.S. exports were worth $4.7 billion, 4 percent more than 1996.

The 1990s saw the introduction of two products that continue to have a profound effect on the photographic equipment and supplies industry. APS, a new kind of camera and film and photo finishing option, first appeared in 1996. Using a 24mm format the APS film cassettes and cameras were developed by five major camera and imaging companies—Kodak, Fuji, Canon, Minolta, and Nikon.

One advantage of the APS format is its simple film loading procedure. Loading a standard 35mm film canister can be tedious since it has to be manually wound around a spool, the leader cannot be used for photographic images, and once in the camera it is not practical to remove the film unless it is rewound into its canister. APS cassettes are dropped into the camera. The "smart" cassette then tells the camera to move the film to the first unused frame. The cassette can be removed at any time and reloaded. In this sequence the APS cassette will instruct the camera to advance the film to the next available frame. APS systems and their cameras also allow the user to choose from three formats for every frame shot. The "classic" format is similar to the standard 35mm format, the "HDTV" format is slightly wider, and the "panoramic" format approximates 3:10 ratio framing. In 1997, 11.2 percent of cameras bought in the United States were APS format, up from 6.4 percent in 1995.

Another innovation came in the late 1990s with the introduction of the film less digital camera. Generally selling for between $200 and $1,000 (prices vary depending on quality and options) in 1999, these cameras record and store images in a digital format. As soon as a picture is taken it can be viewed on a small screen on the back of the camera and the user has the option of storing the imaging or deleting it. The camera is then plugged into a personal computer via a cable and the digitized images can be brought up on the computer's monitor and printed or stored for future use. Kiplinger's predicts that 1999 will see the sale of 1.6 million digital cameras. In 1998, according to the PMA, 3 percent of all cameras and camcorders sold were digital.

In an article for PTN Lorraine DarConte interviewed industry insiders who saw changes in the way distributors relate to digital cameras which are "as close to the computer/electronic industry as to the photo industry," according to Michael Hess, vice president of marketing for Tiffen/Saunders. Martin Lipton, national sales manager for Argraph Corp., also saw changes ahead for distributors of photo equipment and supplies. "Distributors that involve themselves in digital photography have to make themselves aware of a vast new body of information. They have to be the teachers and fonts-of-knowledge for many of their dealers." Josh Blank of Mardel Photo Supply agreed. "Digital photography brings with it a new set of challenges for the traditional photographic distributor. Digital imaging and printing require product knowledge, new inventory stocking requirements for the showroom and constant updates on competitive products." Bob Rose, vice president of Bogen saw electronic induced changes in the way dealers and distributors interact. "Probably one of the biggest changes for distributors," Rose said, "is dealing with more computer-literate dealers. People are constantly asking us for more information via e-mail and fax machines." Bogen's sales representatives also access the Internet to check inventory and expedite orders while in the field. Liz Kleider, president of Kleider Inc. expected profound changes in consumers because of electronic innovations. Kleider said, "I see two distinct camps emerging in our industry: those who believe in 'pictures' and those who call them 'images,"' Kleider said. "The traditional photographic picture is to hold in your hand, to mail, to exhibit, and store. Besides, it can be produced cheaply. The electronic image is exciting in its versatility and mobility. But it is more fleeting, and capture into a more stable medium is still quite expensive." Writing for Photo Marketing Alfred DeBrat suggested that retailers align themselves with photo equipment distributors who grew into digital imaging from the photographic rather than the electronic side of the business. Digital imaging products can thus be discussed using a 'common language' as opposed to distributors of electronic products "who may speak an unfamiliar language of bits, bytes, and megapixels."

Current Conditions

According to Photo Marketing magazine the total number of film rolls decreased by two percent over 2002. Film processing also declined about 6.2 percent, with 756 rolls being processed. The traditional method for consumers to develop their film decreased by 3.5 percent in 2002. Markets hit the hardest were mail—order and specialty retailers. These markets have seen double the decline in film processing over the past few years. The mass retailers were making a big hit with consumers because of their lower prices, and also convenience. The drug stores continued to thrive also, and did not experience the strain from the newest methods of film developing.

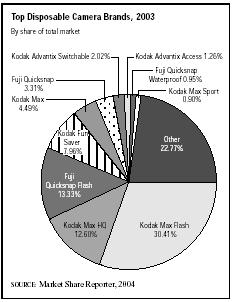

The market leader remained the onetime—use camera. Sales increased nine percent over 2001 to 197 million units sold. This was largely due to the continued advancement of technology. Photo Marketing reported that "10 percent to 11 percent of households use single—use cameras exclusively for their photo needs." However, Fuji predicted the single—use camera to max out in 2006. The Kodak Max Flash single—use camera was the market leader for 2003, which represented 30.41 percent of the market. The Fuji Quicksnap accounted for 13.60 percent of the market. Combined, consumers purchased more than 306 million.

Industry Leaders

One of the largest wholesale distributors of photographic equipment and supplies in the United States was Minolta Corporation, of Ramsey, New Jersey. Minolta was incorporated in 1959 to market products created by the Minolta Camera Co., Ltd., a Japanese manufacturer of cameras and accessories. Minolta offers products including cameras, and computer-based digital information and imaging systems. Minolta employed nearly 4,000 people in the United States and had 1998 sales of about $1.1 billion.

Another major wholesale distributor was Olympus America, Inc., a subsidiary of Japan's Olympus Optical

Co. Ltd. Olympus America was established in 1968 in Melville, New York, as a division of the Olympus Corporation. The company employed 1,500 people and had 1998 sales of about $223 million. It distributed photographic supplies not only to retailers, but to hospitals and government organizations as well, and marketed Olympus scientific products.

The Tiffen Manufacturing Corp. of Hauppauge, New York, was a major manufacturer of photographic equipment and supplies, especially glass filters for still, video, and motion picture/television photography. Tiffen also offered filters and accessories for the digital camera market. In 1998, Tiffen had sales of $27 million and employed 270 people. Tiffen has also entered into an agreement with photo giant Eastman Kodak, of Rochester, New York, to market, sell, and distribute Kodak filters, step tablets, control devices, and darkroom accessories. Tiffen planned to introduce consumer and professional photographic accessories to be sold as Kodak Gear and Kodak ProGear. Tiffen reported $144.1 million in sales for 2003.

Workforce

In 1996, the photographic equipment and supply industry employed 32,615 workers and had an annual payroll of $1.3 billion. Photographic equipment wholesalers averaged 19 employees per establishment, while all of wholesaling averaged only 12. Payroll per employee was also higher in the photographic equipment wholesale trade when compared to the wholesale industry average. Photographic wholesalers' average payroll per employee was $36,519, whereas the entire wholesale industry averaged $29,919.

Further Reading

D&B Sales & Marketing Solutions, 2003. Available from http://www.zapdata.com .

"How Olympus is Scaling the Heights." Business Week Online, 14 July 2003. Available from http://www.businessweek.com:/print/magazine/content/03_28/b3841019_mz047.htm?bw.htm .

Lazich, Robert S. Market Share Reporter. Farmington Hills, MI: Gale Group, 2004.

Longheier, Brian. "Processing Volume Down 3 Percent in 2002." Photo Marketing, April 2004. Available from http://www.photomarketing.com/0404_Process.htm .

Photo Marketing Association (PMA). May 2004. Available from http://www.pmai.org .

"Two Recent Studies by Jackson, Mich.—based Photo." Food Industry Research Center, 1 May 2004. Available from http://www.progressivegrocer.com/progressivegrocer/firc_new/article_display.jsp?vnu_content_id=1000501839 .

U.S. Census Bureau. Statistics of U.S. Businesses 2001. Available from http://www.census.gov/epcd/susb/2001/US421420.HTM .

Comment about this article, ask questions, or add new information about this topic: