SIC 5142

WHOLESALE PACKAGED FROZEN FOODS

Included in this category are establishments primarily engaged in the wholesale distribution of packaged quick-frozen vegetables, juices, meats, fish, poultry, pastries, and other "deep freeze" products. Establishments primarily engaged in the wholesale distribution of frozen dairy products are classified in SIC 5143: Dairy Products, Except Dried or Canned, and those distributing frozen poultry, fish, and meat that are not packaged are classified in SIC 5144: Poultry and Poultry Products, SIC 5146: Fish and Seafoods, and SIC 5147: Meats and Meat Products, respectively.

NAICS Code(s)

422420 (Packaged Frozen Food Wholesalers)

Industry Snapshot

Total frozen foods sales exceeded $30 billion in 2001, according to Frozen Food Age, up from $24 billion in 1997. The category remained healthy due to robust product innovation and lifestyle demographics favoring convenience foods, particularly those with a healthy image. Still, like wholesalers in general, those distributing frozen packaged foods were increasingly squeezed by the intensifying demands of manufacturers and retailers alike. Wholesalers in this environment faced increasing pressure to bolster their operations with value-added services.

Organization and Structure

Some packaged frozen food wholesalers are specialty wholesalers offering just a few products—premium frozen novelties or frozen diet foods, for example. Besides selling frozen food, these wholesalers generally provide point-of-sale merchandising material, display suggestions, and offer product servicing such as stock rotation and product display monitoring.

For the most part, however, frozen foods were provided to retailers by full-service wholesalers, businesses that offer complete lines of grocery and non-grocery products and help the retailers with advertising, merchandising, and getting products they did not warehouse. Competition increased in this sector during the 1990s, and many large companies introduced sophisticated computer programs to track orders and deliveries.

Some frozen foods are distributed through the wholesale/retail chain by retailer-owned wholesalers, retailers who operate their own warehouses and shipping lines. The cooperative effort makes it possible for retailers to obtain merchandise at the lowest possible cost. The retailer-owned wholesaler also supplies group advertising, merchandising, and other services.

Background and Development

The father of the frozen food industry, Clarence Birdseye, began experimenting with frozen food products in 1915; by 1930, General Foods Corp. began marketing a line of frozen poultry, meat, fish, fruit, and vegetables in retail grocery stores under the Birdseye name.

After World War II, the industry began to reach a mass market and quickly began to diversify and segment to boost profits. By the 1950s, frozen foods were the fastest-growing sector of the food business, according to Business History Review. The distribution network caught up with the mass market's pace in the mid-1950s, as technology was developed to mechanically keep rail car contents frozen across long distances, linked together with strategically located centralized automated cold-storage warehouses.

In the industry's infancy, frozen food processors marketed their wares through company-owned branches or regional wholesale distributors. This distribution pattern was expanded in 1945 when the Snow Crop Marketers Co. (New York City) introduced a direct sales program to chain stores, voluntary groups, and retail cooperatives. Frozen food products were then distributed through public warehouses or private distribution centers.

Frozen foods were profitable for both manufacturers and wholesalers. They became the primary players in a category supermarket industry analysts call "meal replacement"—that is, food for people who are too busy to cook. From 1996 to 1997, frozen food sales increased 3.2

percent. According to a 1997 survey conducted by Frozen Food Age , a family with teenagers spent an average $58 a week on frozen foods. The Great Lakes and the Plains had the greatest growth in frozen food sales for the time period covered by the survey.

Current Conditions

Dun & Bradstreet reported about 1,590 establishments operating in this industry in 2003, employing over 41,100 workers and generating revenues of $24 billion. An increasingly health-conscious yet extremely time-pressed U.S. public looked to frozen foods to provide quickly prepared yet delicious and wholesome meals. Though boasting convenience, the industry was traditionally beset by a reputation for product that was generally of lower quality than fresh alternatives. By the late 1990s and early 2000s, the industry spawned a niche specializing in gourmet, restaurant-quality foods that could be prepared quickly at home. Leading brands such as Con-Agra's Healthy Choice and Stouffer's Lean Cuisine marked the trend by pouring money into major marketing campaigns positioning their products to capitalize on the growing consumer hunger for nutritious, and even exotic, frozen foods. This trend bled into the rise of ethnic categories, including French, Italian, and Asian. Asian-style packaged frozen foods, riding the wave of health-conscious consuming, led the segment, increasing 7.8 percent in 2002, according to ACNielsen.

However, the industry faced marketing problems in its very display, as shoppers routinely rated the frozen-food aisle the most uninviting section of the supermarket, forcing retailers to use price promotions as a primary means by which to draw customers, thus impeding profit margins. Meanwhile, frozen packaged foods faced emerging competition from refrigerated foods, especially meat and produce, that copy frozen foods in their claims to convenience. While the refrigerated segment remained a minor threat to frozen foods in 2004, the industry was growing rapidly, with sales expected to hit $12.2 billion by 2005, according to the New Jersey market-research firm Food Spectrum.

Industry Leaders

SYSCO Corp. continued its reign as the largest food-service marketer and distributor in North America in the mid-2000s. Based in Houston, Texas, SYSCO was chiefly a supplier to the food service industry, specializing in the wholesale distribution of more than 275,000 types of prepared frozen meals, condiments, and deli meats. SYSCO employed about 26,200 workers in more than 160 facilities throughout North America in 2003 and distributed to over 420,000 foodservice customers, including restaurants, hospitals, schools, and other business and industry foodservice operations. Value-added services SYSCO regularly supplies to customers include product usage reports and other data, menu-planning advice, food safety training, and inventory-management assistance. The firm expanded rapidly via strategic acquisitions through the late 1990s and early 2000s, edging into the market for frozen Asian cuisine with its purchase of Asian Foods Inc., North America's largest Asian food service distribution company. SYSCO's revenues jumped from $21.8 billion in 2001 to $26.1 billion in 2003.

Trailing SYSCO was U.S. Foodservice Inc., the second-leading food service distributor. With a customer base of over 300,000 and particular strength among schools, the Columbia, Maryland-based firm was a subsidiary of the world's largest food distributor, Royal Ahold, which purchased the company in 2000 and placed it under its Ahold USA operation. Like SYSCO, U.S. Foodservice was on an acquisition spree after being acquired itself, purchasing a number of regional distributors in addition to market rival Alliant Exchange.

The number-three distributor was Performance Food Group Company, of Richmond, Virginia. The firm employed 1,250 in 2003 and distributed to a client base of some 48,000 schools, healthcare facilities, restaurants, and fast-food chains. Like was the case with its rivals, the acquisition of key regional players was among Performance Food Group's key growth strategies in the early 2000s, leading to a jump in sales from $3.24 billion in 2001 to $5.52 billion in 2003.

Ben E. Keith Company, based in Fort Worth, Texas, employed 2,618 and garnered revenues of $1.34 billion in 2003, up 12.7 percent from the year before. In addition to frozen food, Ben E. Keith distributed produce, dry groceries, and beer to restaurants, hospitals, schools, and other institutions.

Further Reading

Dun & Bradstreet. "Industry Reports." Waltham, MA: Dun & Bradstreet, 2004. Available from http://www.zapdata.com .

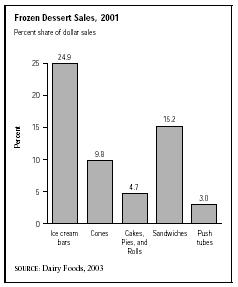

"Freezer Dynamics." Dairy Foods, 2003.

Hamilton, Shane. "The Economies and Conveniences of Modern-Day Living: Frozen Foods and Mass Marketing, 1945–1965." Business History Review, Spring 2003.

"Healthy Meals Embrace Larger Trends." DSN Retailing Today, 5 May 2003.

Lukas, Paul. "Mr. Freeze." Fortune Small Business, March 2003.

"Unilever Lights a Fire in the Frozen Sector." Marketing Week, 18 September 2003.

Comment about this article, ask questions, or add new information about this topic: