EMPLOYEE BENEFITS

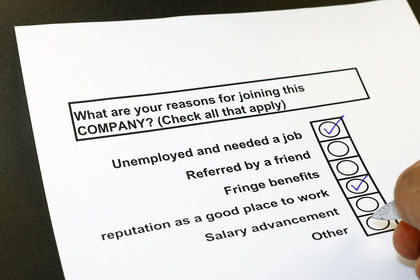

Employee benefits, sometimes called fringe benefits, are indirect forms of compensation provided to employees as part of an employment relationship. To compete for quality employees in today's marketplace, employers must do more than offer a "fair day's pay." Workers also want a good benefits package. In fact, employees have grown accustomed to generous benefits programs, and have come to expect them.

Employee benefits exist in companies worldwide, but the types and levels of benefits vary greatly from country to country. Generally speaking, companies in industrialized countries in Europe and North America offer employees the most generous benefit packages. Even within the industrialized world, however, employee benefits can vary significantly. For example, employees in Germany and other European countries receive more vacation days than the average U.S. employee. Conversely, most employers in the U.S. offer some form of medical/health insurance to employees. But most companies in European countries don't offer this employee benefit, because it is provided through government-sponsored socialized medicine programs.

HISTORICAL OVERVIEW

Employee benefits were not a significant part of most employees' compensation packages until the mid-twentieth century. In the U.S., for example, benefits comprised only about 3 percent of total payroll costs for companies in 1929. According to U.S. Chamber of Commerce, however, employee benefits in the U.S. now comprise approximately 42 percent of total payroll costs. Several things account for the tremendous increase in the importance of employee benefits in the U.S. In the 1930s, the Wagner Act significantly increased the ability of labor unions to organize workers and bargain for better wages, benefits, and working conditions. Labor unions from the 1930s to 1950s took advantage of the favorable legal climate and negotiated for new employee benefits that have since become common in both unionized and non-union companies. Federal and state legislation requires companies to offer certain benefits to employees. Finally, employers may find themselves at a disadvantage in the labor market if they do not offer competitive benefit packages.

LEGALLY REQUIRED BENEFITS

In the U.S., legislation requires almost all employers to offer the social security benefit, unemployment insurance, and workers' compensation insurance. Larger companies (those with 50 or more employees) are also required to offer employees an unpaid family and medical leave benefit. Each of these legally required benefits is discussed briefly below.

SOCIAL SECURITY.

The Social Security Act of 1935, as amended, provides monthly benefits to retired workers who are at least 62 years of age, disabled workers, and their eligible spouses and dependents. Social Security is financed by contributions made by the employee and matched by the employer, computed as a percentage of the employee's earnings. As of 2005, the combined contribution of employer and employee for retirement, survivors', and disability benefits was 12.4 percent of the first $90,000 of employee income. Monthly benefits are based on a worker's earnings, which are adjusted to account for wage inflation. The Social Security Act also provides Medicare health insurance coverage for anyone who is entitled to retirement benefits. Medicare is funded by a tax paid by the employer and employee. The tax rate for Medicare is a combined 2.9 percent of the employee's total wage or salary income.

UNEMPLOYMENT INSURANCE.

Unemployment compensation provides income to unemployed individuals who lose a job through no fault of their own. Eligible workers receive weekly stipends for 26 weeks. The specific amount of the stipend is determined by the wages the claimant was paid during the previous year. Unemployment compensation laws in most states disqualify workers from receiving benefits under the following conditions:

- Quitting one's job without good cause. Workers who voluntarily quit their jobs are not eligible for unemployment compensation unless they can show good cause for quitting. Good cause exists only when the worker is faced with circumstances so compelling as to leave no reasonable alternative.

- Being discharged for misconduct connected with work. If employees are discharged for misconduct, they are not eligible for unemployment, unless they can show that the discharge was unfair. To ensure fair discharges, employers should make employees aware of work rules through employee handbooks, posting of rules, and job descriptions. Employers must also provide workers with adequate warnings prior to discharge (unless a serious violation, such as stealing, has occurred).

- Refusing suitable work while unemployed. Eligibility for unemployment compensation is revoked if an employee refuses suitable work while unemployed. Individuals must actively seek work and make the required number of search contacts each week. Benefits are terminated if the claimant refuses a bona fide job offer or job referral.

WORKERS' COMPENSATION INSURANCE.

Millions of workers are hurt or become sick for job-related reasons each year. All 50 states have workers compensation insurance laws that are designed to provide financial protection for such individuals. Specifically, these laws require the creation of a no-fault insurance system, paid for by employers. When workers suffer job-related injuries or illnesses, the insurance system provides compensation for medical expenses; lost wages from the time of injury until their return to the job (employees are given a percentage of their income, the size of which varies from state to state); and death (paid to family members), dismemberment, or permanent disability resulting from job-related injuries.

Nationwide, payouts for workers' compensation are relatively high and curbing costs is a priority for many U.S. companies. The increase in costs is primarily due to rising medical costs that now account for as much as 60 percent of total workers' compensation costs in some states. Fraudulent claims also increase costs.

OPTIONAL EMPLOYEE BENEFITS

Other employee benefits are quite common, but are not required by federal law in the U.S. Some of the more significant optional benefits are summarized below.

HEALTH INSURANCE.

Basic health-care plans cover hospitalization, physician care, and surgery. Traditional fee-for-service health care coverage became increasingly expensive in the late twentieth century. As a result, many U.S. companies adopted "managed care" health care plans. In general, managed care plans cut health care costs for employers by requiring them to contract with health care providers to perform medical services for their employees at an agreed upon fee schedule, in exchange for the employer encouraging (sometimes requiring) the employees to receive their medical care within the approved network of health care providers.

Health Maintenance Organizations (HMOs) are one type of managed care plan. HMOs are organizations of physicians and other health-care professionals who provide a wide range of services for a fixed fee. When participants need medical services, they pay a nominal per-visit charge of $5 or $10. Because members visit their health care facility more frequently, potential problems can be discovered and eliminated before they can become major health threats. Thus, HMOs can save money through preventative medicine. However, employees have a limited number of doctors from which to choose and must get approval from a primary care physician for specialized treatment.

Preferred Provider Organizations (PPOs) provide services at a discounted fee in return for the company's participation, which creates increased business for the health facility. Employees may choose any member facility of their choice. PPOs are somewhat less restrictive of patient choice than HMOs, since they allow employees to receive health care outside the approved network if the employee is willing to shoulder a higher percentage of their health care expenses.

Employers are not legally required to offer health insurance to employees. If they do, however, the Consolidated Omnibus Budget Reconciliation Act (COBRA) provides for a continuation of health insurance coverage for a period of up to three years for employees who leave a company through no fault of their own. Such employees are required to pay the premiums themselves, but at the company's group rate.

LONG-TERM DISABILITY (LTD) INSURANCE.

This benefit provides replacement income for an employee who cannot return to work for an extended period of time due to illness or injury. An LTD program may be temporary or permanent. The benefits paid to employees are customarily set between 50 and 67 percent of that person's income.

PENSIONS.

Pensions, or retirement incomes, may be the largest single benefit most employees receive. In most instances, employees become eligible to participate in company pension plans when they reach 21 years of age and have completed one year of service. After they have satisfied certain age and time requirements, employees become vested, meaning that the pension benefits they have earned are theirs and cannot be revoked. If they leave their jobs after vesting, but before retirement, employees may receive these benefits immediately or may have to wait until retirement age to collect them, depending on the provisions of their specific pension plan.

Employers may choose from two types of pension plans-defined benefit plans or defined contribution plans. Defined benefit plans specify the amount of pension a worker will receive on retirement. Defined contribution plans specify the rate of employer and employee contributions, but not the ultimate pension benefit received by the employee. If a defined benefit plan is chosen, an employer is committing itself to an unknown cost that can be affected by rates of return on investments, changes in regulations, and future pay levels. Consequently, most employers have adopted defined contribution plans.

Companies establish pension plans voluntarily, but once established, the Employee Retirement Income Security Act of 1974 (ERISA) requires that employers follow certain rules. ERISA ensures that employees will receive the pension benefits due them, even if the company goes bankrupt or merges with another firm. Employers must pay annual insurance premiums to a government agency in order to provide funds from which guaranteed pensions can be paid. Additionally, ERISA requires that employers inform workers what their pension-related benefits include.

LIFE INSURANCE PLANS.

These employee benefits are very common. The premiums for basic life insurance plans are usually paid by the employer. Employee contributions, if required, are typically a set amount per $1,000 in coverage based on age. Employees are often given the opportunity to expand their coverage by purchasing additional insurance.

PERQUISITES AND SERVICES.

A host of possible perquisites and services may be offered to employees as benefits, such as pay for time not worked (e.g., vacation, holidays, sick days, personal leave), reimbursement for educational expenses, discount on company products or services, automobile and homeowner insurance, employee savings plans, tax-sheltered annuities, employer-sponsored child day care and sick child care, stock options, and so forth. Executives are frequently offered a variety of perquisites not offered to other employees. The logic is to attract and keep good managers and to motivate them to work hard in the organization's interest.

BENEFITS ADMINISTRATION

Two issues that are crucial to the management of employee benefits are flexible benefit plans and cost containment. Many employers now offer flexible benefit plans, also known as cafeteria plans. These plans allow employees to choose among various benefits and levels of coverage. Under a cafeteria plan, employees may choose to receive cash or purchase benefits from among the options provided under the plan. Flexible benefit plans present a number of advantages:

- Such plans enable employees to choose options that best fit their own needs. New workers, for example, may prefer cash; parents may prefer to invest their benefit dollars in employer-sponsored childcare programs; and older workers may decide to increase their pension and health care coverage.

- Deciding among the various options makes employees more aware of the cost of the benefits, giving them a real sense of the value of the benefits their employers provide.

- Flexible benefit plans can lower compensation costs because employers no longer have to pay for unwanted benefits.

- Employers and employees can save on taxes. Many of the premiums may be paid with pretax dollars, thus lowering the amount of taxes to be paid by both the employee and the employer.

Because of these advantages, flexible benefit plans have become quite popular: such plans are now being offered by many U.S. companies. However, some companies are shying away from cafeteria plans because they create such an administrative burden. Moreover, the use of such plans can lead to increased insurance premiums because of adverse selection. Adverse selection means that people at high risk are more inclined than others to choose a particular insurance option. For instance, a dental plan option would be chosen primarily by employees with a history of dental problems. Consequently, insurance rates would increase because the number of low-risk individuals enrolled in the programs would be insufficient to offset the claims of high-risk individuals.

Companies can contain costs in several ways. Because an employer's workers' compensation premiums increase with each payout, firms can prevent unnecessary costs by scrutinizing the validity of each claim. Some employers cut costs by deleting or reducing some of the benefits they offer employees. This approach, however, can negatively affect both recruitment and retention. A more viable approach is to offer benefits that are less costly, but equally desirable. Companies can continue to offer attractive benefits by implementing some of the cost containment strategies discussed next.

Many companies implement utilization review programs in order to cut health care costs by ensuring that each medical treatment is necessary before authorizing payment, and ensuring that the medical services have been rendered appropriately at a reasonable cost. These programs require hospital pre-admission certification, continued stay review, hospital discharge planning, and comprehensive medical case management for catastrophic injuries or illnesses.

Employers also closely examine their firm's health insurance carriers in order to address the following questions:

- Is the program tailored to company needs?

- Are the prices competitive?

- Will there be a good provider/vendor relationship?

- Will payouts be accurate (e.g., will the correct amount be paid to the right person)?

- How good is the customer service?

- Is the insurance carrier financially secure?

Some employers have been able to increase the attractiveness of their benefit programs while holding costs constant, allowing an organization to get more of a "bang for its buck" from these programs.

Lawrence S. Kleiman

Revised by Tim Barnett

FURTHER READING:

Cornell Law School. Legal Information Institute. U.S. Workers Compensation Law. Ithaca, NY: 1999. Available from http://www.law.cornell.edu/topics/workers_compensation.html.

Kleiman, L.S. Human Resource Management: A Tool for Competitive Advantage. Cincinnati: South-Western College Publishing, 2000.

Newman, J.M. Compensation. 2nd ed. Boston: Irwin, 1999.

Social Security Administration. Available from < http://www.ssa.gov >.

U.S. Chamber of Commerce. Available from < http://www.uschamber.com >.

Comment about this article, ask questions, or add new information about this topic: